A good buying opportunity for some Swiss stocks at the end of the month? What do you think?

$SIKA (-0.35%)

$LOGN (+2.67%)

$CFR (-0.81%)

$BARN (-1.29%)

$EMMN (+0.23%)

$UHR (+0.07%)

Posts

13A good buying opportunity for some Swiss stocks at the end of the month? What do you think?

$SIKA (-0.35%)

$LOGN (+2.67%)

$CFR (-0.81%)

$BARN (-1.29%)

$EMMN (+0.23%)

$UHR (+0.07%)

Subscribe to the podcast for part 2 of the listener questions.

Spotify

https://open.spotify.com/episode/1Mre4nxG5Rj3jaGLM4haPC

YouTube

Apple Podcast

Since the beginning of the year, analysts have lowered their profit estimates for the 50 largest listed companies in Europe by almost four percent. This is according to data from the financial specialist Bloomberg.

One of the main reasons for this is the tariffs imposed by US President Donald Trump Trump and the associated uncertainty. Tariffs make products more expensive, making them less affordable for end customers. In addition, the recent euro exchange rate against the dollar is affecting companies. This makes products sold in the dollar zone more expensive and less competitive. In addition, turnover and profits are reduced as soon as companies convert their dollar earnings into euros and report them on their balance sheets.

But there are exceptions. For five companies in the European Stoxx 50 share index, analysts have increased their profit forecasts for the current financial year by at least five percent since the beginning of the year. by at least five percent - for one group by as much as 15 percent.

Handelsblatt profiles the shares of these companies with a view to their business prospects, their stock market valuation and their share price potential.

The candidates are:

$PRX (-0.58%) - Prosus | 20 analysts per buy / 4 hold

$CFR (-0.81%) - Richemont | 17 buy / 16 hold / 1 sell

$NOVN (+1.7%) - Novartis | 9 buy / 15 hold / 5 sell

$SAP (+0%) - SAP | 25 buy / 6 hold / 3 sell

$IBE (+1.17%) - Iberdrola | 12 buy / 19 hold / 2 sell

The detailed analysis is available here (€):

https://hbapp.handelsblatt.com/cmsid/100124777.html

Source: Handelsblatt, 09.05.25

Subscribe to the podcast to prevent China from taking Taiwan.

00:00:00 Weekend trading stocks

00:03:40 Market environment

00:16:00 Delta Air Lines

00:20:00 LVMH, Grok AI

00:43:30 Hermès, Richemont, Kering

01:03:20 TSMC, ASML

01:26:50 Coalition agreement

Spotify

https://open.spotify.com/episode/36OedAqU7ZcTYd3PpnHRFQ?si=99nQieH0Qh6Hy1QhQ5hQzA

YouTube

Apple Podcast

$MC (-1.33%)

$RMS (-0.51%)

$KER (+1.7%)

$DAL (-1.02%)

$2330

$ASML (-1.17%)

$GOOG (-1.03%)

$GOOGL (-1.03%)

$SPOT (+2.56%)

$AAPL (-2.33%)

$CFR (-0.81%)

Not a good day for LVMH $MC (-1.33%).

The champagne has been left in the fridge again (didn't expect to get it out either)

LVMH currently 5th largest position in my portfolio, according to the getquin Deepdive -> 3.8% portfolio share.

-40% from the all-time high and the benchmarks don't look good. I'm convinced in the long term and want to hold the position, but I'm still wondering whether it wouldn't make more sense to reallocate and enter later. Should I stay in the luxury sector or is the alternative a basic investment? I don't need the money at the moment and am thinking of holding on to it.

I'll answer this question for myself at the end of the post.

For now, here is an overview of the figures and classification. Sources: Earnings call and report presentation

(I know, dozens of others have already posted today, perhaps the classification and explanation will provide more clarity).

Overall view: Solid, but the shine is fading slightly

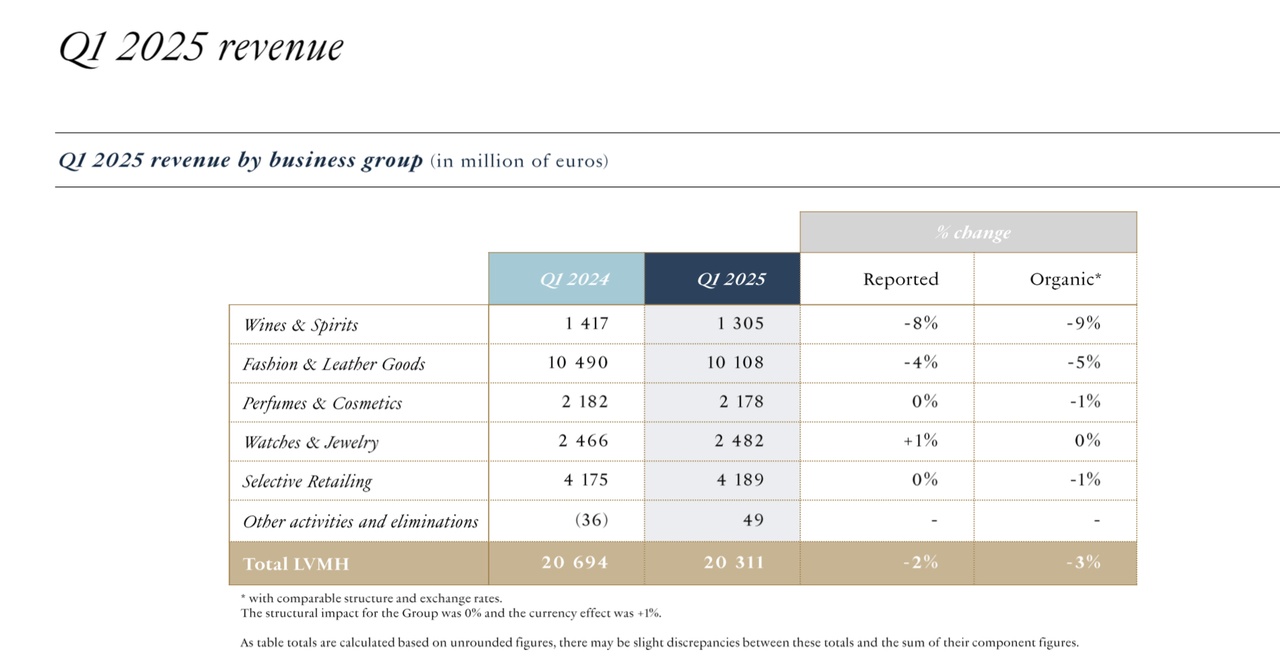

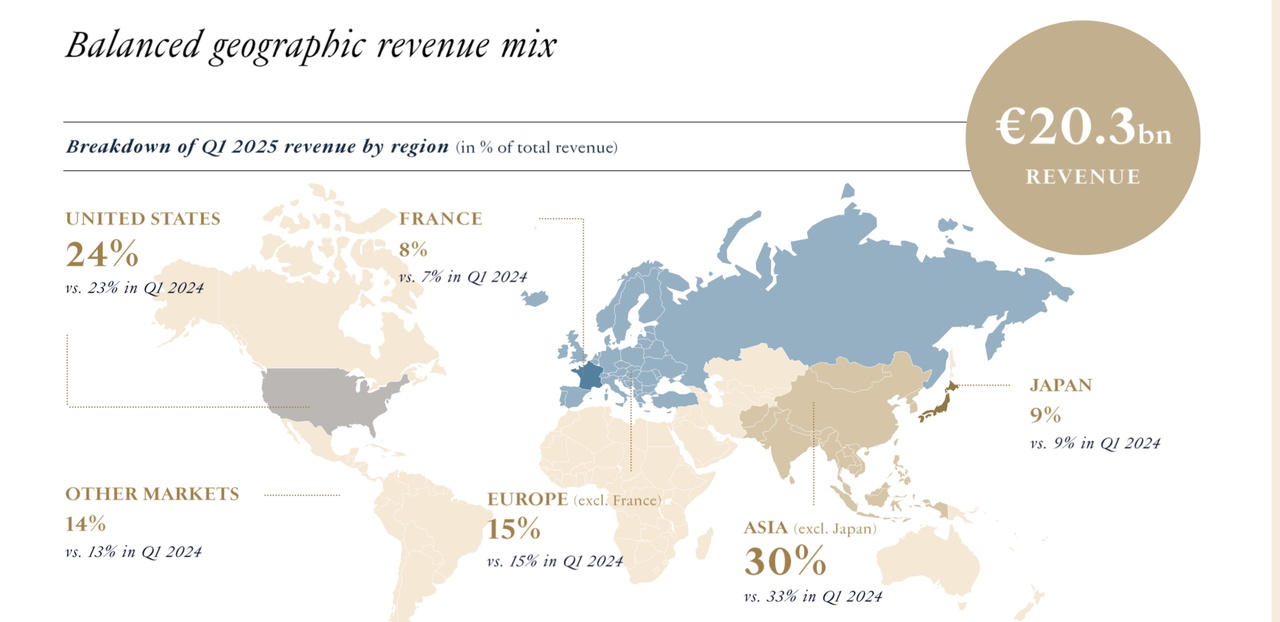

Turnover20.31 billion €

Explanation:

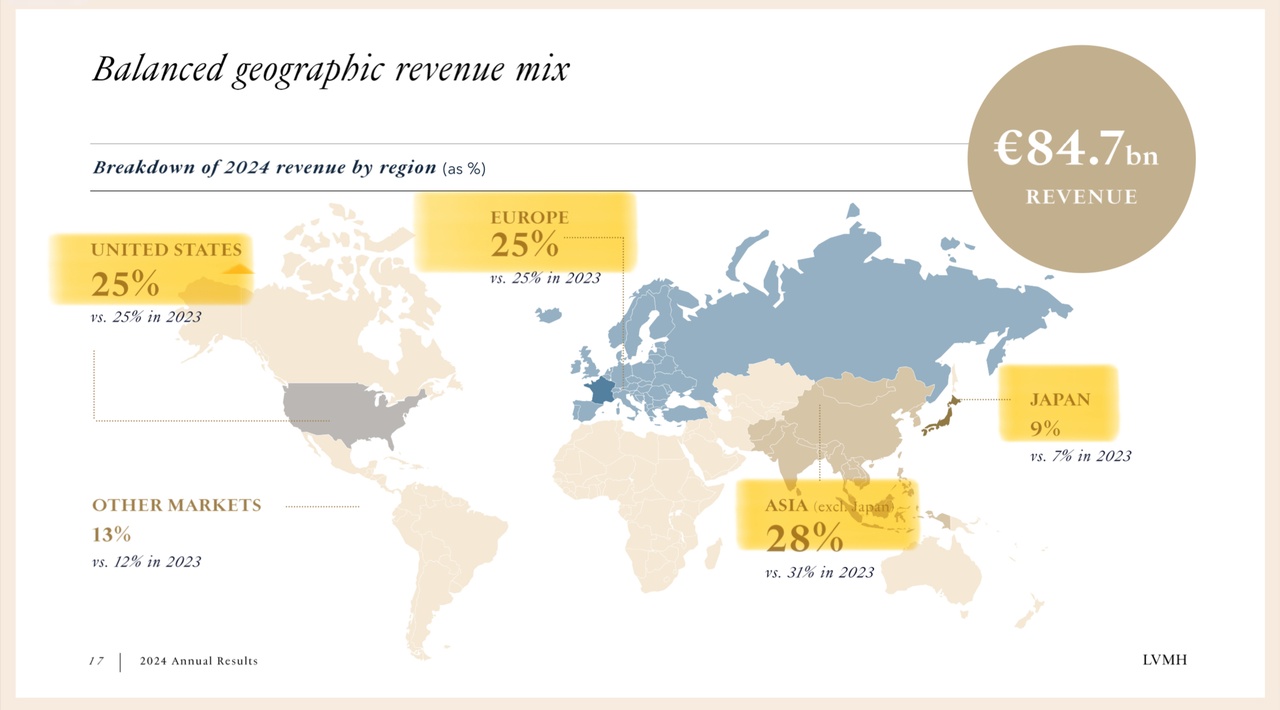

Weak euro at the beginning of the year lifted US sales, weak yen depressed Japan, but overall it was enough for a better reporting result. Summarized at the end of the post for those interested.

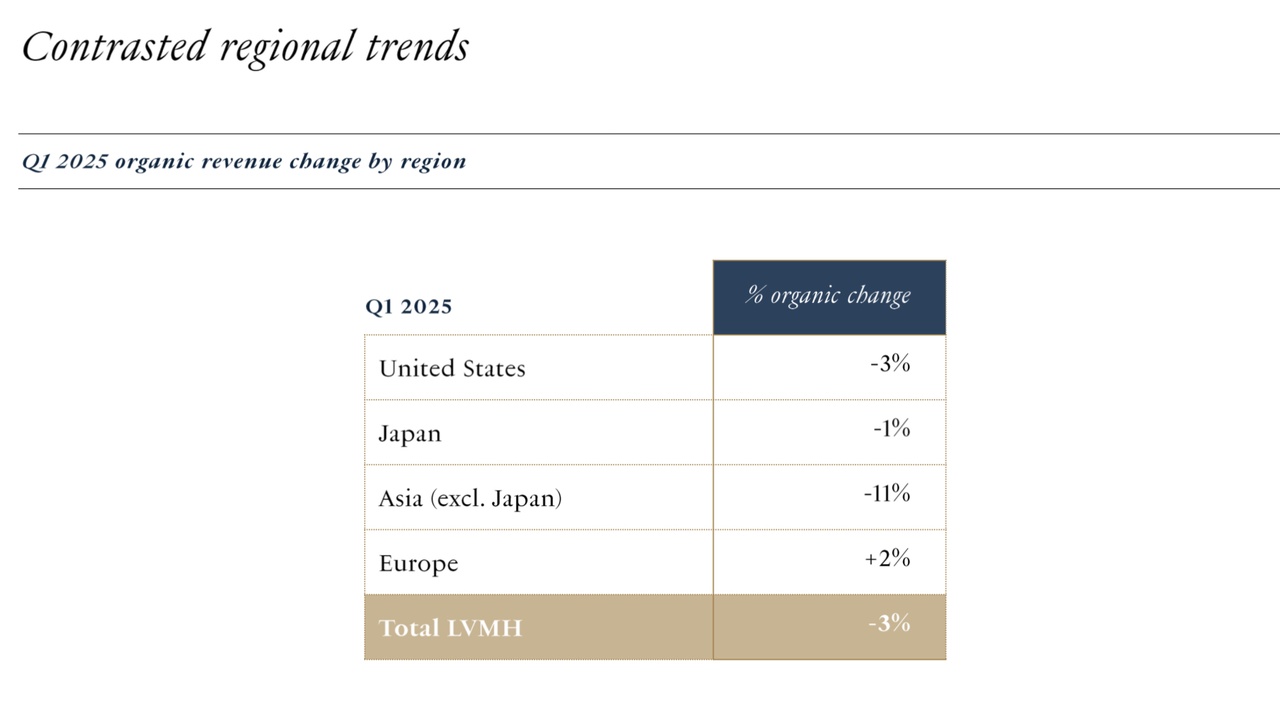

Regional trends:

Explanation:

The decline in Asia is partly due to a "base effect": 2024 was extremely strong (especially in Japan due to Chinese tourists). This strong basis for comparison makes 2025 look much weaker, although the absolute level remains high.

2nd segment analysis: strengths and weaknesses at a glance

Fashion & Leather Goods (cash cow)

Turnover10.10 billion € (-5% organic)

Highlights:

Classification:

Mix = higher-quality product mix, e.g. selling more €4,000 bags instead of €1,500 bags -> more sales per item and supports the margin without using official price increases.

Wines & Spirits (problem child)

Turnover1.30 billion € (-9 % organic)

Watches & Jewelry

Turnover2.48 bn € (0% organic, sales stable)

Perfumes & Cosmetics

Turnover2.17 billion € (-1% organic)

Selective Retailing (Sephora, DFS, Le Bon Marché)

Turnover4.18 billion € (-1 % organic)

3. challenges in the market environment

Geopolitics & economy

Interpretation:

Buyer behavior

4. LVMH strategy & positioning

+ Strengths:

- Weaknesses / risks:

5. bottom line, stay invested or reallocate?

LVMH remains a giant that invests selectively in weak cycles instead of cutting back.

Those who take a long-term view will benefit from the structural brand value.

In the short term, the share has no clear price driver in an environment of high interest rates, geopolitical uncertainty and weakening demand in Asia and the USA.

My conclusion: (not investment advice, of course 👀)

>>> Hold position. <<<

______________

What can investors who want to get in on LVMH do?

Stay patient, buy in tranches if necessary

Why?

Strategy tip:

Enter in partial tranches (e.g. x% now, x% on setbacks) + watch out for signals (e.g. stabilization in Asia, tariffs specified, Q2 sales trend)

What should investors who are currently in the red do?

Do not sell out of panic

Why?

What to do instead of selling?

______________

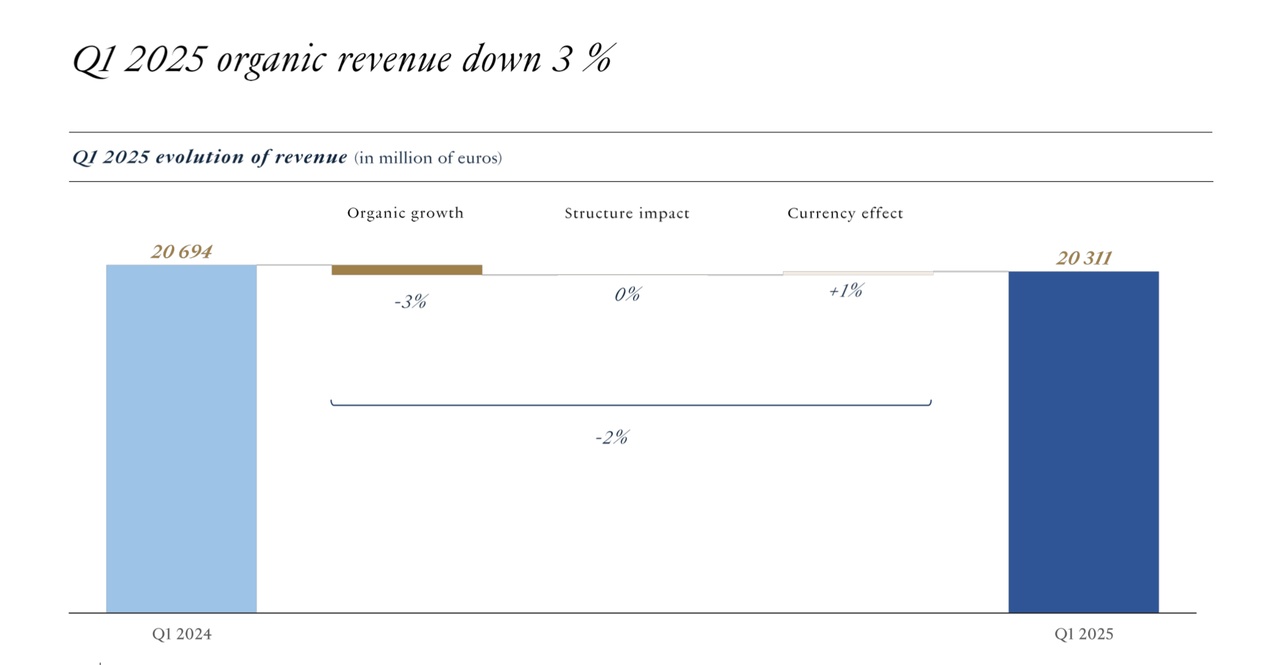

Exchange rate effect explains why -2 % instead of -3 %?

In the first quarter of 2025, LVMH reported organic sales growth of -3%, but the reported growth was only -2%. The difference is due to positive exchange rate effects, mainly from the US dollar.

At the beginning of the year, the euro was weak against the US dollar, which means

Sales in the USA (e.g. with Louis Vuitton or Sephora) were converted into euros at a more advantageous exchange rate -> this lifts reported sales.

At the same time, the Japanese yen was significantly weaker against the euro. Sales in Japan (e.g. with Dior or Bvlgari) bring in fewer euros when converted, although sales in yen have not changed → this has a negative effect.

Bottom line:

The positive effect from the weak euro against the dollar was stronger than the negative effect from the weak yen. This is why the reported growth of -2% is better than the operating loss of -3%.

______________

Thanks for reading! 🤝

______________

Sources:

Audio Webcast Q1 2025 Revenue:

https://voda.akamaized.net/lvmh/2083769_67e55782ce10a/

Presentation:

https://lvmh-com.cdn.prismic.io/lvmh-com/Z_0pc-vxEdbNPBim_LVMHQ12025.pdf

$CFR (-0.81%) currently has an important factor that clearly sets it apart from competitors such as LVMH and Hermes!

Not least for this reason and the attractive chart picture should make you sit up and take notice.

Click here for a brief analysis:

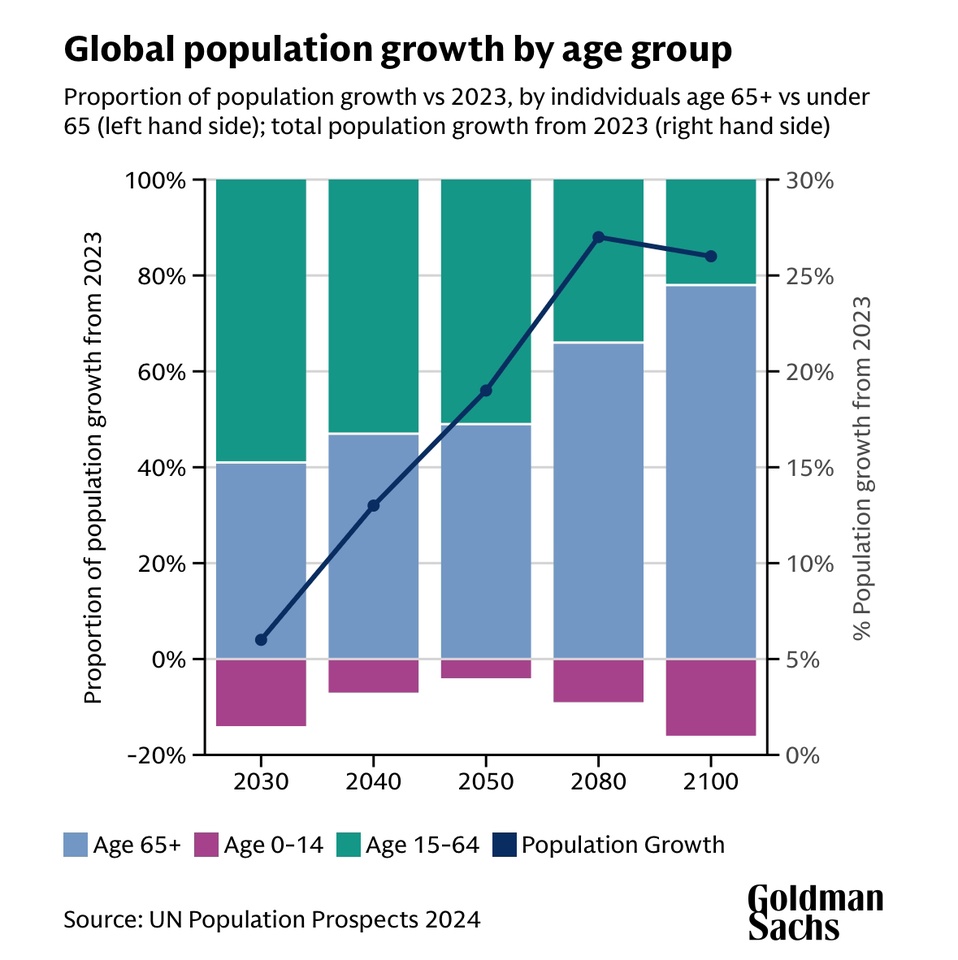

The world's population is getting older and older, an irreversible demographic change with considerable economic consequences.

This article is intended to provide investment ideas and impetus. The stocks mentioned do not, of course, constitute investment advice, but merely serve as examples of potential beneficiaries of demographic change. Historical developments are no guarantee of future returns.

The main source is the short analysis "How to invest as the global population ages" by Goldman Sachs [1], which, however, does not name any specific stocks.

I have also added additional sources and charts.

__________

🌍 Demographic change: growth and ageing of the world's population

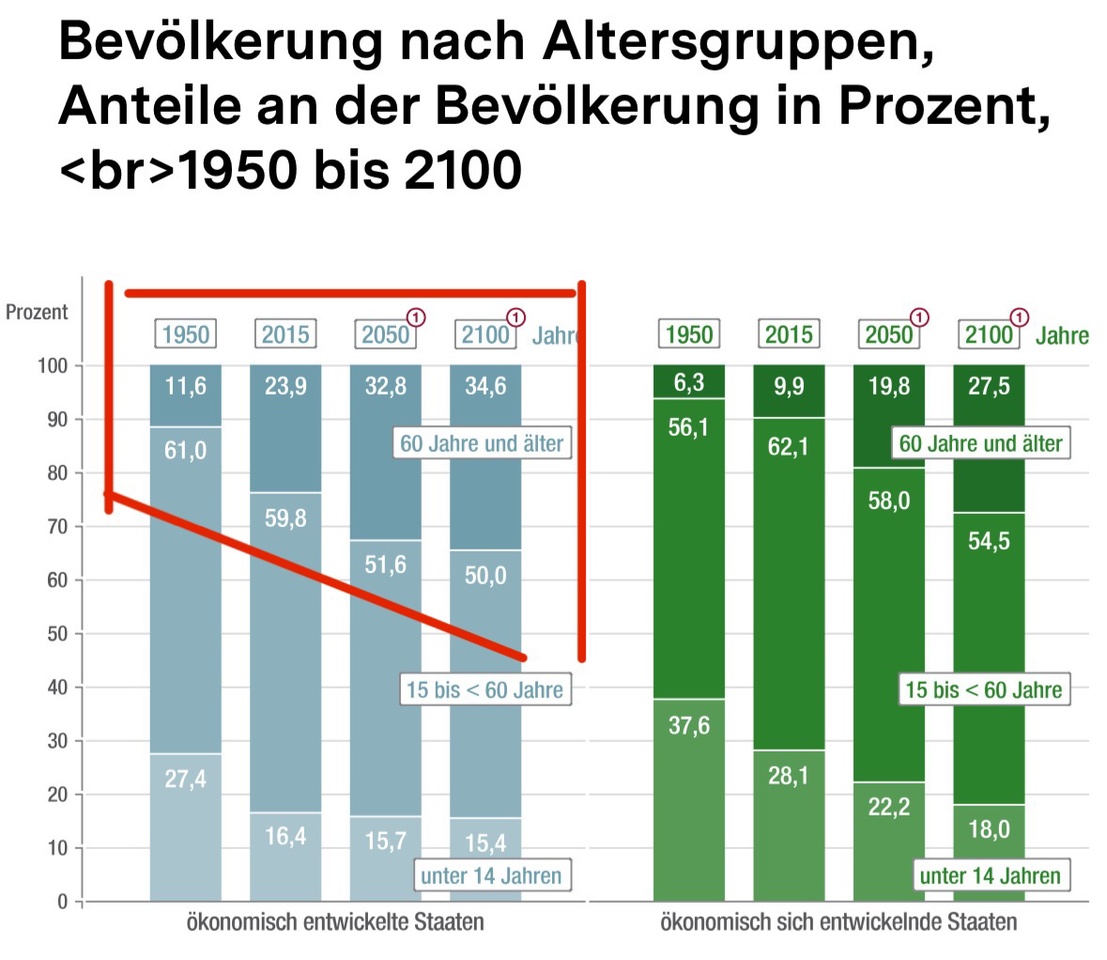

The world's population will grow to almost 10 billion people by 2050. But it is not just the number of people that is increasing, their age structure is also changing dramatically. [2]

Increase in the older population:

Source: [2]

Regional differences:

Europe & North America have the oldest populations & remain the most affected demographically.

Latin America, the Caribbean & Asia: The proportion of over-60s will more than double between 2015 and 2050, reaching around 25 %.

Africa remains the youngest region: in 2015, there were 21 countries worldwide with a birth rate of 5 children per woman, 19 of which were in Africa. However, it should be noted that current statistics from 2024 show that the birth rate per woman in Africa was already just 4.07 in 2023 and could fall to 2.79 by 2050. [3]

While industrialized countries are struggling with an ageing society, Africa remains the most dynamic and youngest region in the world. This development can also have an economic impact and open up new investment opportunities. [2]

Goldman Sachs also comments in the article with similar figures, according to which the global population is expected to increase by around 20% by 2050 and senior citizens will make up a disproportionate share. The number of people over the age of 65 is expected to double from 800 million to 1.6 billion during this period. [1]

In view of this demographic development, there are opportunities to benefit from precisely this trend. Opportunities lie in targeted investments in sectors that could benefit from the growing proportion of older people.

🚑 Healthcare: A growing market worth billions

Facts:

Possible profiteers:

Medical technology

Pharmaceuticals

🏡 Senior Living & Care: Bottlenecks in nursing homes worldwide

Facts:

The UK has a shortfall of over 30,000 senior units by 2028. [1]

In Germany, France and Italy there is a shortage of nursing home places due to the ageing population. [1]

In the US, only 2% of people over 65 live in nursing homes, leading to an increasing demand for home care and telemedicine. [1]

Potential beneficiaries:

Care providers

Homecare

Telemedicine

Anti-Aging

🚢 Leisure & consumption: The new "silver economy"

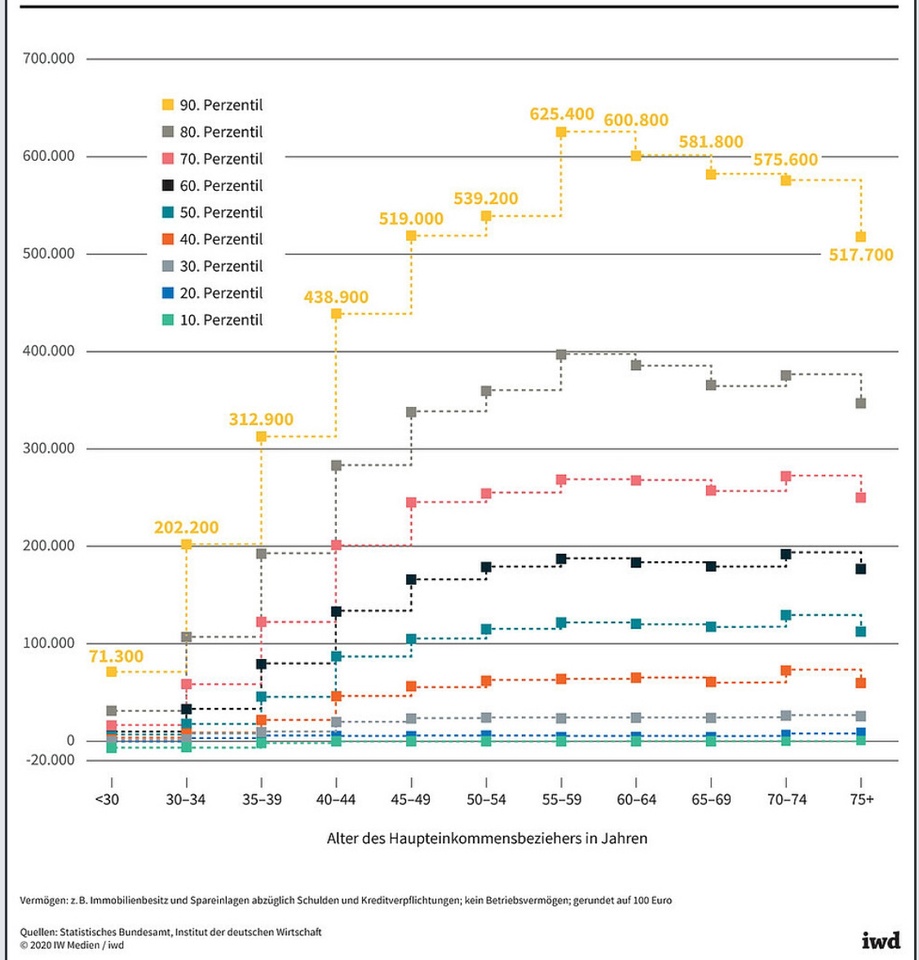

The following chart shows the distribution of wealth in Germany depending on the age of the main income earner. [4]

It is clear that older people tend to have higher wealth than younger age groups. This is reflected in the significantly higher values for the percentiles for age groups aged 50 and over. In particular, the groups aged between 50 and 74 have the highest assets.

The trends are also similar internationally:

This observation underlines the economic importance of the older generations and their central role in wealth distribution and consumer spending.

Possible beneficiaries:

Luxury

Cruise (Over 60s book a third of all cruises worldwide [1])

Motorhome manufacturers/ recreational vehicles (47% of motorhome users are over 55 years old, In the UK, two thirds of over 55s have a motorcycle license, which may indicate a growing market for motorcycles and accessories. [1])

🤖 Technology & automation: solution to the labor shortage

Facts:

The labor shortage caused by an aging society is becoming a global challenge. Automation, AI and robotics could help close the skills gap. [1]

Profiteers:

🧠 Conclusion:

Demographic change offers long-term investment opportunities. Early investment in the right sectors can benefit from rising spending on health, care, leisure and technology.

I myself am still looking for one or two individual investments and am a little annoyed that I didn't get into Hims & Hers earlier, although I have been on the verge of doing so several times. Apart from the luxury segment with LVMH, the portfolio also includes Siemens as a conglomerate in the field of automation.

Do you explicitly take demographic change into account in your investments, e.g. in the form of individual shares?

Which shares do you have in your portfolio or do you still see them as an opportunity?

Thanks for reading!

_________

Sources:

[1] https://www.goldmansachs.com/insights/articles/how-to-invest-as-the-global-population-ages

[2] https://www.bpb.de/kurz-knapp/zahlen-und-fakten/globalisierung/52811/demografischer-wandel/

[4]

https://www.iwd.de/artikel/mit-dem-alter-waechst-das-vermoegen-489710/

I was able to leave the champagne in the fridge yesterday after LVMH $MC (-1.33%) fell short of expectations in terms of profit and net income, losing up to -5% at times. The share recovered slightly later in trading. Things don't look so rosy today either. In the long term, however, I am not worried, even if the jump above €800 may take a little longer.

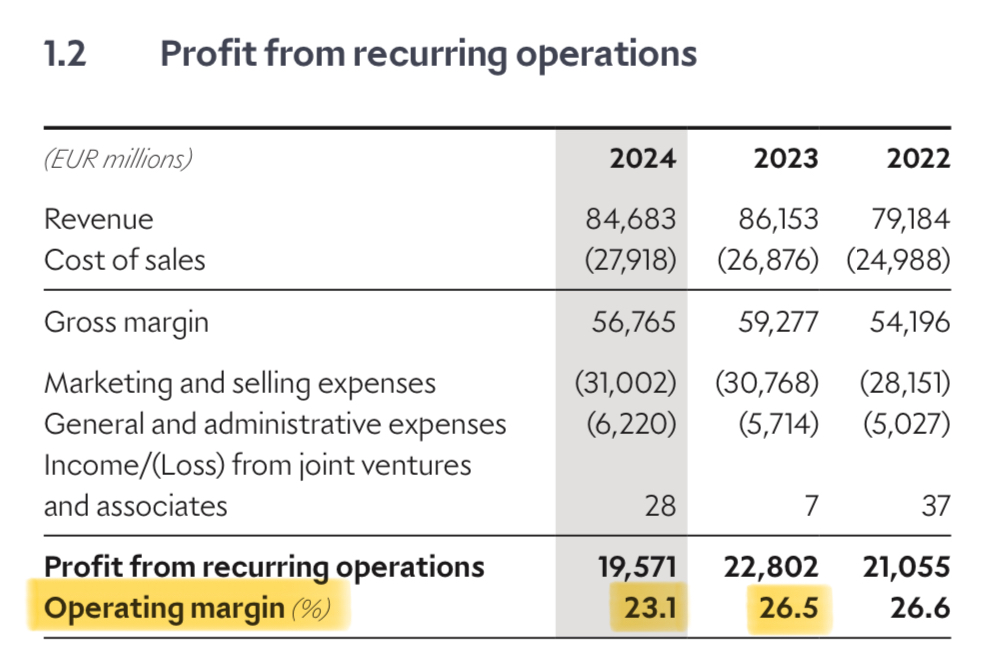

Let's start with the facts:

I have taken the time and trouble to read through the annual reports and listen to the earnings call:

Summary and classification from the published annual reports of LVMH "Presentation

2024

Annual Results" [1] and "Financial Domcuments" [2]. Page references in the source reference refer to the reports mentioned separately in [Source 1 & 2].

First of all, a brief overview of how the % figures in the annual report are to be understood, as this is important in my opinion.

📈 Percentage figures: "Published" vs. "Organic"

Two types of growth figures are given in the LVMH reports:

1 . Published development (Published)

2 . Organic development (Organic)

Why the difference is important:

Published change gives a complete picture of external factors. Organic change, on the other hand, shows operational performance and is a better indicator of a company's long-term stability.

📊 Business figures 2024: overview

Regional performance: [1, p. 17-18]

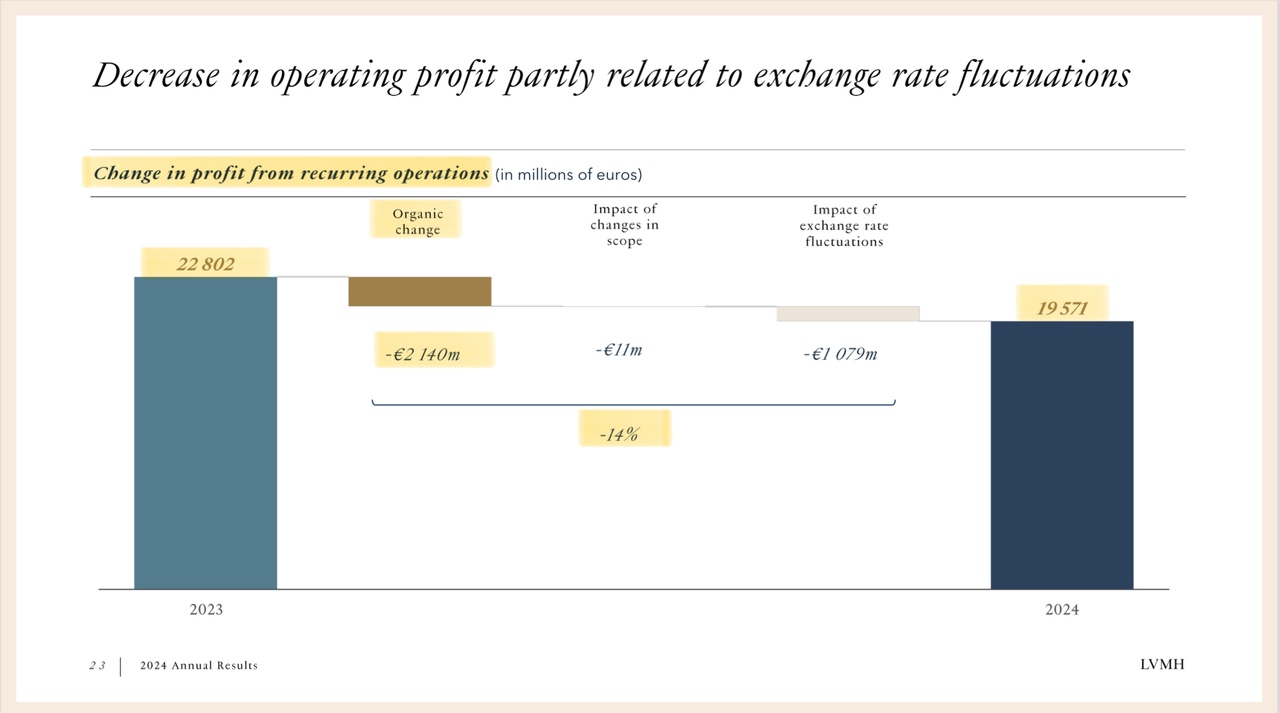

Main factors for profit decline explained: (Transcript Earnings Call, CFO: Jean-Jacques Guiony)

LVMH reports a 17% drop in profits to 12.5 billion euros compared to the record previous year. This is mainly due to several factors:

1 . Increase in costs:

2 . Currency and price fluctuations:

3 . losses in certain areas:

4 . Higher expenses:

Additional management decision:

Summarized so far: LVMH's profit decline resulted from an imbalance between cost increases and sales growth, as well as specific challenges in some business units.

👜 Products & segments: Highlights 2024

1 . Fashion & leather goods

2 . Perfumes & Cosmetics

3 . Wines & Spirits

4 . Watches & Jewelry

5 . Selective Retailing (Sephora & DFS)

🌎 Sustainability in case anyone is itching:

💰 Financial strength and key figures

Cash and debt

Inventories

📈 Classification in the stock market environment

LVMH shares have been under pressure in recent months, despite strong fundamentals:

LVMH has reported a 17% drop in profits, not a good sign at first glance. But when you look at the details, it becomes clear:

The problems are largely temporary.

⚡ Why I remain optimistic in the long term:

📉 It may remain bumpy in the short term, but LVMH is a quality company with a strong capacity for innovation, which will remain in demand even in difficult times. I am looking forward to the future plans of the industry leader, which remains on course for success with a strongly growing brand presence. For long-term investors, the "price slide" could therefore be more of an opportunity than a risk. (Of course, my personal opinion does not constitute investment advice or a recommendation to buy or sell. 🙂)

Finally, Bernard Arnault was also optimistic about the future:

"LVMH will continue to focus on creativity, excellence and agility to extend its leadership in the luxury market. Despite global uncertainties, the Group sees further potential for sustainable growth and long-term success."

🎉 Thanks for reading! From here on there are attachments, examples & original slides

_______________

*Exchange rate fluctuations explained (example)

When a company like LVMH sells products in the USA, sales are generated in US dollars (USD). However, since LVMH publishes its financial report in euros (EUR), these sales must be converted into euros.

What happens if the US dollar depreciates against the euro?

1 . Before the devaluation: 1 USD = 0.95 EUR

2 . After the devaluation: 1 USD = 0.90 EUR

➡️ Although LVMH sold exactly the same amount in the USA, sales in euros appear lower.

At the beginning of 2024: 1 USD = 0.9060 EUR.

Low on August 23: 1 USD = 0.8927 EUR.

Increase until December 31: 1 USD = 0.9662 EUR.

_______________

Sources:

[1] LVMH: "Presentation" to " 2024 Annual Results"

https://lvmh-com.cdn.prismic.io/lvmh-com/Z5j825bqstJ998qD_LVMH-2024FullYearresults.pdf

[2] LVMH: "Financial Domcuments"

https://lvmh-com.cdn.prismic.io/lvmh-com/Z5kVBpbqstJ999KR_Financialdocuments-December31%2C2024.pdf

[3] Expected results 2024

https://stock3.com/news/lvmh-aktie-nach-zahlen-deutlich-unter-druck-2-16085679

If you've made it this far, you can still see the original slides from the presentation of my favorite products, or rather those of my wife 😵💫.

+ 5

Tonight presents LVMH

$MC (-1.33%) presents its results for the 2024 financial year and Q4.

https://www.lvmh.com/en/financial-calendar/2024-full-year-results

Analysts expect sales for the fourth quarter of 23.2 billion euros and earnings per share (EPS) of 17.44 euros [1].

For the full year 2024, turnover of 84.2 billion euros and EBITDA of 25.97 billion euros is forecast [2].

Morgan Stanley raised its rating for LVMH to "overweight" yesterday and set the target price at 820 euros (+14%). As a result, the share price rose by 3% and is moving back towards the 800 euro mark [1].

Market development:

The luxury sector recently experienced an upswing after Richemont $CFR (-0.81%) the parent company of Cartier, presented impressive figures.

In the third quarter, which ended in December 2024, turnover rose by 10% to 6.15 billion euroswhich exceeded analysts' expectations [3].

The positive results also boosted other luxury brands such as LVMH, Kering $KER (+1.7%) and Hermes $RMS (-0.51%) [4].

The US market is expected to be a key driver of LVMH's growth, especially given the continued weakness of the Chinese market [5].

USA: A sustained recovery in demand is boosting sales.

China: The recovery is slower than expected, but competitors such as Burberry $BRBY (-1.06%) are reporting stabilized sales.

Fashion & Leather Goods: Louis Vuitton and brands such as Loewe and Rimowa continue to perform strongly.

Risks in brief:

Morgan Stanley warns of potential burdens from tariffs on luxury goods or consumer restraint, particularly in China.

Should growth at Louis Vuitton stagnate, this could have a negative impact on the entire Group.

Portfolio:

LVMH is the second-largest single position in my portfolio after getquin Deepdive with just under 5%, consisting of direct and indirect investments, behind Bitcoin $BTC (+1.57%) .

I am therefore looking forward to the results tonight and am betting on a strong Q4.

The battle for Europe's most valuable company continues... can LVMH still surprise and make the leap over the €800 mark or are expectations already priced in?

___________________

Sources:

[1]

http://de.investing.com/equities/l.v.m.h.?

[2]

https://de.marketscreener.com/kurs/aktie/LVMH-4669/termine/

[3]

https://www.richemont.com/investors/results-reports-presentations/

[4]

https://www.investopedia.com/european-luxury-stocks-jump-on-richemont-record-quarterly-sales-8775521

[5]

Top creators this week