First purchase from $WRBY

Had been on the watchlist for some time, but unfortunately hesitated to buy in...

Briefly: While $META (+1,59%) with $EL (+1,82%) gets stuck in demo breakdowns & meta-binding and $AAPL (+1,51%) comes too late, positions itself $WRBY with $GOOG (+3,65%) as a smart underdog through Gemini + Android XR

In my estimation, the monopolists have positioned themselves quite poorly strategically:

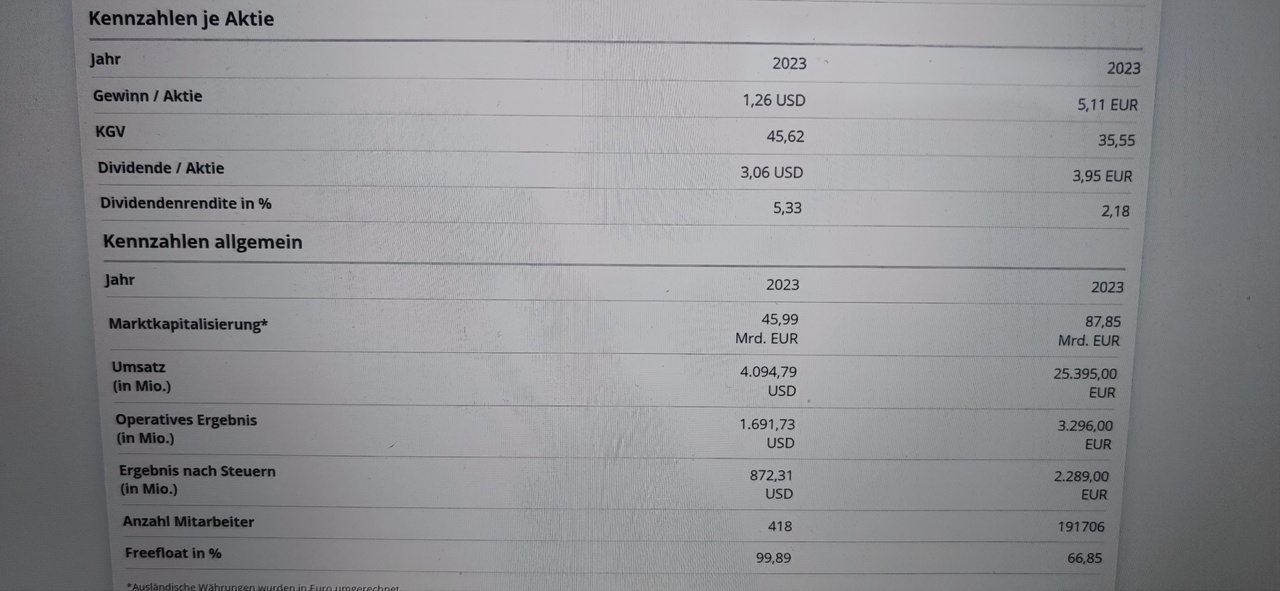

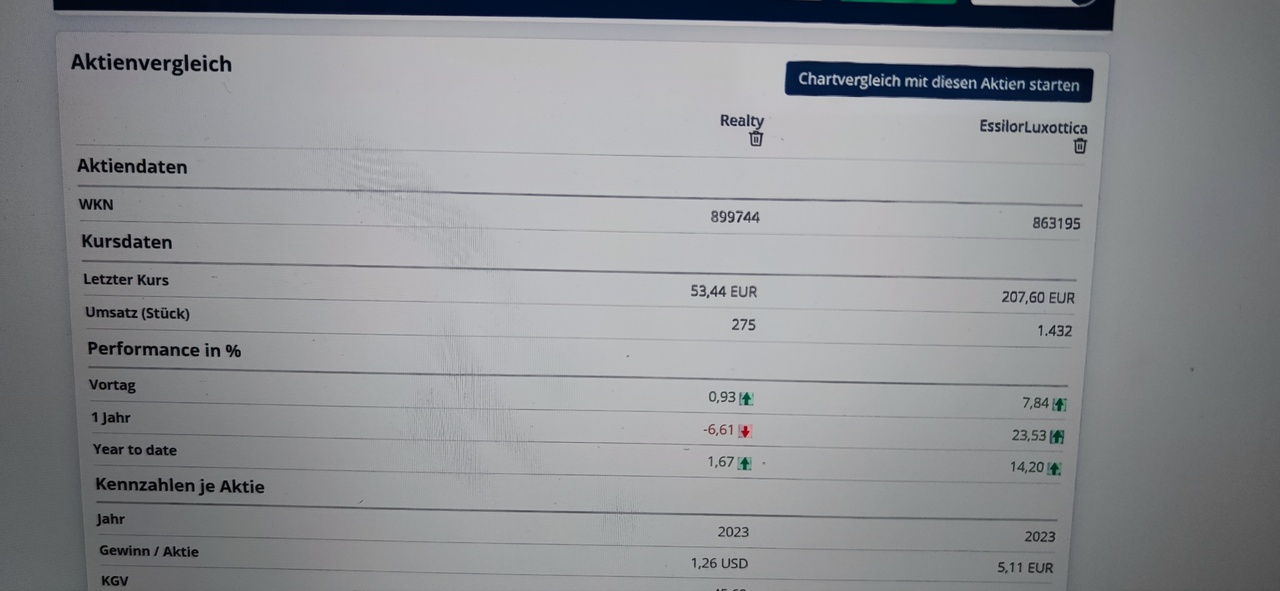

- EssilorLuxottica ($EL (+1,82%)) the absolute monopolist in the classic eyewear market, is the first mover in the $META (+1,59%) as the first mover in the XR/AR glasses sector. We all saw Mark Zuckerberg make two really big demo mistakes at Meta Connect 2025: In the live AI (cooking demo), the AI totally hangs, doesn't respond properly and jumps around - allegedly due to overload/WiFi in the room (not just normal WiFi problem). Then the video call crash: Incoming WhatsApp call comes in, display falls asleep, race condition bug prevents acceptance → Zuckerberg tries several times in vain, finally gives up. Source: The viral video (e.g. https://www.youtube.com/shorts/UcycakgOdEU). => Strategic bonding: EssilorLuxottica is now firmly tied to Meta for the next few years in order to further expand and launch the Oakley and Ray-Ban series. Which means that they cannot collaborate with $GOOG (+3,65%) and Gemini and have backed the wrong horse in the case of the poorer AI

- $AAPL (+1,51%) is currently only active in the VR sector with the expensive Apple Vision Pro and has so far missed the entry into lightweight AR/AI glasses as well as generative AI. The recently announced cooperation with Gemini for an upgraded Siri (confirmed on January 12, 2026) is more of a stopgap and only confirms for me that Apple is lagging behind here - my decision to back Warby feels even more right as a result. In the long term, I think Apple could hold its own in the market due to IOS dependencies, but in the short to medium term they will be left out as there are no known ambitions.

New wind in the eyewear market?

In the past, pure design was decisive - and $EL (+1,82%) was great at dominating the market via licenses and proprietary brands. But now, a change similar to the watch market could come about through smartwatches, and Essilor's business model in the eyewear market could come under pressure if the eyewear market transforms from a purely design-driven market to a technology-driven market.

Will brand or technology be decisive in the future?

Bull-Case:

$GOOGL (+3,81%) as a strong second mover for AR/AI glasses can therefore only work with Warby Parker (partnership since 2025, launch 2026 confirmed, $150m commitment), as $EL (+1,82%) blocked by $META (+1,59%) is blocked.

This means that $WRBY benefits massively from the Android XR ecosystem and has direct compatibility with one of the best smart device APIs via Gemini.

In addition, Google clearly dominates Meta in this respect, as it has its own TPUs - which gives it massive price advantages (efficiency, power-per-watt, scaling) over the current Meta hardware.

Soft Reasons:

Warby Parker is an American company Founded in New York, with typical US DTC spirit and branding, but with efficient production and supply chains mainly in Asia. This enables good margins and scalability, but there is a certain risk of tariff and trade wars.- "Buy a Pair, Give a Pair" program For every pair of glasses sold, one pair is donated free of charge to someone in need. By the end of 2024, over 20 million pairs of glasses had already been distributed (source: Warby Parker Impact Report 2024). This not only shows social responsibility, but above all a very well-organized and scalable supply chain - the company supplies significantly more glasses than it sells to paying customers alone.

- Meta pushes the market Meta and EssilorLuxottica are planning to massively ramp up production of Ray-Ban Meta Smart Glasses - the target is 20 million units per year or more by the end of 2026 (source: Bloomberg, January 2026). This proves: The entire AI/smart glasses market is really picking up speed and creating a tailwind for all players, including Warby Parker.

- Meta massively expands compute Meta is currently investing heavily in its own data centers ("Meta Compute" initiative) in order to improve the AI performance in its devices such as the Ray-Ban Meta. In the long term, they are talking about hundreds of gigawatts of capacity (source: Meta Q4 2025 Earnings Call). This shows how serious the competition in the wearables sector is becoming.

- Google is excellently positioned with TPUs Google can operate its Gemini AI particularly efficiently and cost-effectively thanks to TPUs (Tensor Processing Units) developed in-house. This gives it a clear advantage over Meta, which relies on other hardware. Another indication of the trend towards efficient edge AI: NVIDIA acquired Groq's assets and team for around 20 billion dollars in December 2025 (source: Reuters, December 2025). Jonathan Ross, the inventor of the original Google TPU (v1/v2), founded Groq → there is philosophical DNA at TPU too. (deterministic, efficient tensor processing).