$VIS (+0,52%) After what happened I hope to catch her 10% down 47-48€

Viscofan

Price

Discussão sobre VIS

Postos

7Viscofan +

$VIS (+0,52%) good company - reasonable price .

📈 Viscofan: steady growth and a dividend to love

There are few companies on the Spanish stock market that offer global leadership, financial stability and attractive shareholder remuneration at the same time.

financial stability and attractive shareholder remuneration. One of them is $VIS (+0,52%) a company founded in 1975 in Navarre, Spain, which today is a world leader in the manufacture of packaging for meat products.

Its business may sound unremarkable at first glance, but that is precisely one of its strengths: it produces an essential good, with stable demand and little exposure to passing fads. With a presence in more than 100 countries and factories in Europe, America and Asia, Viscofan is a true hidden champion in the Spanish continuous market.

📊 Recent results: solid growth

In a context marked by inflation and rising energy prices, Viscofan has shown remarkable resilience.

✅ 2024: record net profit of €157 million (+11% vs. 2023).

✅ EBITDA: reached €285 million, growing by 6 %.

✅ Revenues: although slightly down due to the decline in cogeneration, the core business remained strong.

✅ 1Q 2025: revenues of 307 million (+6 %) and EBITDA of 68 million (+11 %).

These numbers show a clear trend: the company knows how to adapt and maintain stable margins even in adverse ⚡ environments.

💶 Dividend: an attraction hard to ignore

If there is one thing investors value about Viscofan, it is its shareholder remuneration policy.

💰 Dividend yield: around 5 %, above the Spanish average.

📉 Payout: between 40-50 %, a healthy range that guarantees sustainability.

📅 Regularity: consistent payments over the years, even with extraordinary payments.

In 2024, the company approved a dividend of €3.10 per share, which included an extra component of €1. This reflects not only its financial strength, but also its willingness to share profits with its shareholders 🔒.

🌐 Strategy and competitive advantages

Viscofan is not just another industrial company. Its competitive advantage (moat) lies in three pillars:

🔹 Technological diversification: it is the only company in the world to master the four main envelope technologies (collagen, cellulose, fibrous and plastic).

🔹 Global scale: operates in more than 100 countries and continues to expand, with a focus on Asia, where demand for proteins continues to grow at a rapid pace.

🔹 Defensive business: the products it manufactures are basic for the food industry, with stable demand even in economic crises.

In addition, it has a solid balance sheet, low debt and high cash generation, factors that allow it to invest in new plants while sustaining growing dividends.

🏆 Conclusion: a safe haven stock with a future

Viscofan combines rare qualities in a single stock:

✨ Global leadership in a stable niche with high barriers to entry.

✨ Steady growth and resilience in the face of crises.

✨ An attractive, generous and sustainable dividend.

Over an 8 to 15 year horizon, the company has everything to continue consolidating itself as a safe haven stock within the Spanish stock market 🛡️. For investors looking for recurring income and stability, Viscofan is a stock that deserves to be on the radar.

📌 In short: discreet, not very media-friendly, but tremendously efficient. One of those companies that represent the heart of a long-term portfolio.

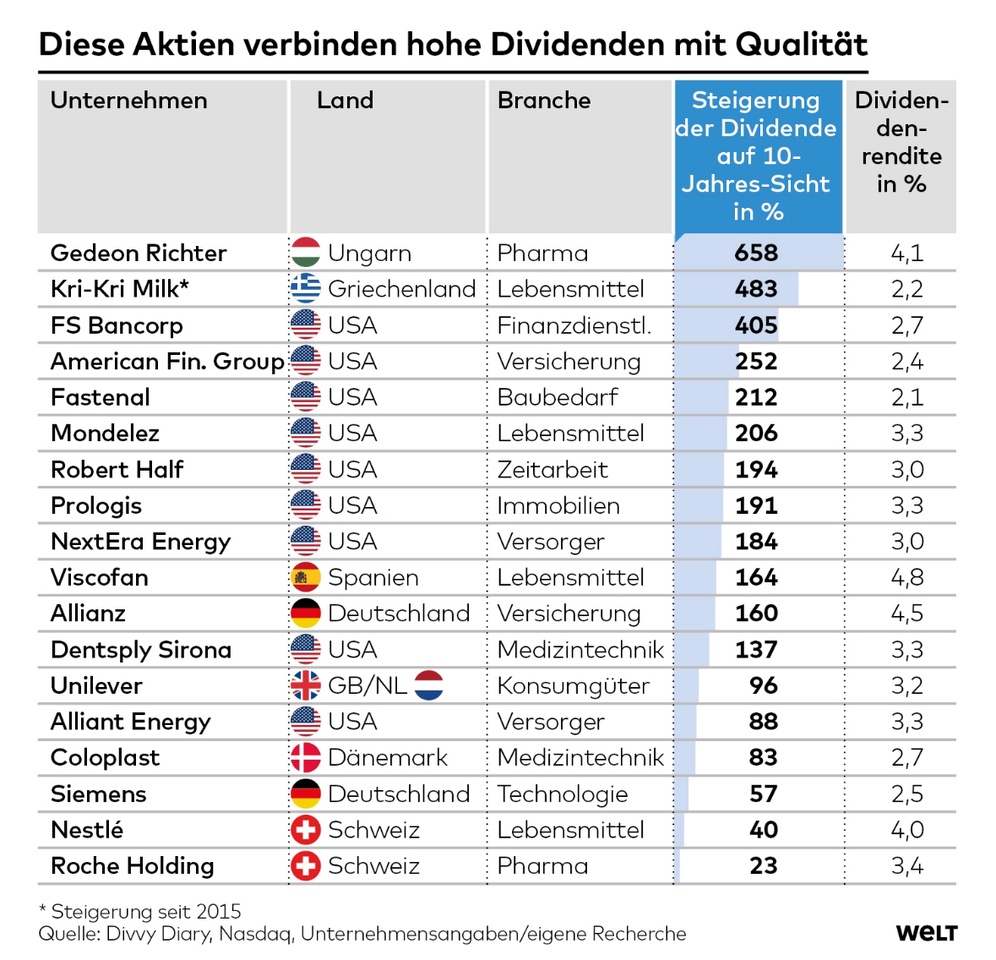

"600 percent increase in 10 years - with these shares" headlines Welt

A recent W+ article by the "Welt" editorial team presents supposedly lucrative dividend stocks.

Here is a selection of 18 shares "with high dividends and quality":

Two from Germany also made it onto the list:

Judge for yourself and feel free to comment with your opinions.

Here is a summary of important events & the Formatting is Getquin's fault!

US MARKET🇺🇸

Monday

Publication of the Empire State Manufacturing Survey of the New York Fed for April.

Publication of the retail sales in the USA for March.

Publication of the business inventories for February.

Publication of the homebuilder confidence for April.

Speeches by Lorie LoganPresident of the FED of Dallasand Mary C. DalyPresident of the FED Bank of San Francisco.

Quarterly reports from Goldman Sachs ($GS (+0,66%) ), Charles Schwab ($SCHW (-0,11%) ) and M&T Bank ($MTB (+1,4%) ).

Tuesday

Publication of the building permits for March.

Publication of the industrial production for March.

Quarterly reports from UnitedHealth Group ($UNH (-0,11%) ) , Johnson & Johnson ($JNJ (-0,5%) ), Bank of America ($BAC (+0,56%) ), Morgan Stanley ($MS (+0,22%) ), BNY Mellon ($BK (+0,18%) ) and PNC Bank ($PNC (+1,02%) ).

Wednesday

Publication of the mortgage applications for the week ending April 12.

Publication of the FED Beige Books.

Quarterly reports from United Airlines ($UAL (+2,33%) ), Abbott Laboratories ($ABT (+0,34%) ), U.S. Bancorp ($USB (+0,98%) ), Travelers Cos. ($TRVC34 ), Citizens Financial ($FCNCA (-1,15%) ), First Horizon ($FHN (+0,94%) ) and Discover Financial Services ($DFS ).

Thursday

Publication of initial jobless claims for the week ending April 13.

Publication of the Philadelphia Fed Manufacturing Survey for April.

Release of existing home sales for March.

Speeches by John C. WilliamsPresident of the FED of New Yorkand Raphael BosticPresident of the FED of Atlanta.

Quarterly reports from Netflix ($NFLX (+1,88%) ), Intuitive Surgical ($ISRG (+1,04%) ) and Infosys ($INFY ).

Friday

Speech by Austan GoolsbeePresident of the FED of Chicago.

Quarterly reports from Procter & Gamble ($PG (+0,98%) ), American Express ($AXP (+0,94%) ), Fifth Third Bancorp ($FITB (+2,41%) ) and Huntington Bancshares ($HBAN (+0,19%) ).

Saturday

Possible events in connection with the Bitcoin halving.

EU MARKET

Monday

Release of industrial production

Speech by Philip Lane, Member of the Executive Board of the ECB

Quarterly reports from Pagegroup ($PAGE (-0%) ) 🇬🇧, Playtech $PTEC (-0,06%) ) 🇬🇧

Tuesday

Trade Balance (Feb)

ZEW Economic Sentiment

Eurogroup Meetings

Publication of the quarterly reports of Ashmore ($ASHM (+0,81%) ) 🇬🇧

Wednesday

Publication of CPI data

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

Quarterly figures from Severstal ($CHMF ) 🇷🇺, Volvo B ($VOLV B (+0,12%) ) 🇸🇪, Viscofan $VIS (+0,52%) ) 🇪🇸, Petershill Partners ($PHLL ) 🇬🇧, Hays ($HAS (+0,95%) ) 🇬🇧

thursday

Speech by Luis de GuindosVice President of the ECB

EU Summit & Eurogroup Meetings

Speech by Isabel Schnabel, Member of the Executive Board of the ECB

- Quarterly figures from EQT AB ($EQT (+0,4%) ) 🇸🇪, EssilorLuxottica ($EL (+1,82%) ) 🇫🇷, Nordea Bank ($NDA FI (+1,06%) ) 🇸🇪, Sartorius Stedim ($DIM (+2,65%) ) 🇩🇪, Nokia Oyj $NOKIA (+2,75%) ) 🇫🇮, Inter Cars SA ($n/a) 🇵🇱, Tauron Polska Energia ($TPE (-2,48%) ) 🇵🇱, Forvia ($FRVIA (-1,34%) ) 🇫🇮, Dunelm ($DNLM (+0,45%) ) 🇬🇧, Adtran Networks SE ($ADV (+0,45%) ) 🇩🇪, Olvi Oyj A ($OLVAS (+1,7%) ) 🇫🇮, Econocom ($ECOM ) 🇧🇪, Talenom Oyj $TNOM (-0,86%) ) 🇫🇮, Alisa Pankki Oyj ($ALISA (+0%) ) 🇫🇮

Friday

Eurogroup Meetings

CFTC EUR speculative net positions

Quarterly figures from Sodexo ($SW (+0,65%) ) 🇫🇷, Linea Directa Aseguradora ($LDA (+1,22%) ) 🇪🇸, Alma Media ($002950 ) 🇫🇮, Gofore ($GOFORE (+1,82%) ) 🇫🇮

Títulos em alta

Principais criadores desta semana