A recent W+ article by the "Welt" editorial team presents supposedly lucrative dividend stocks.

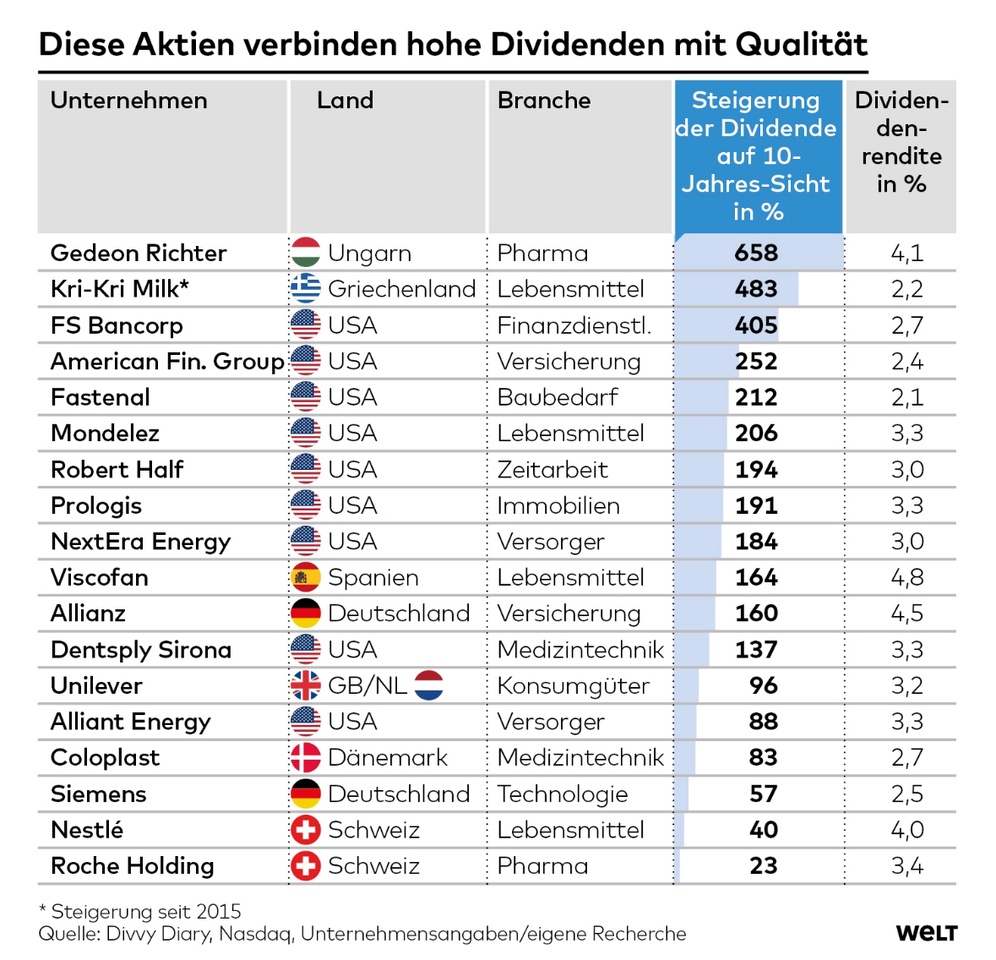

Here is a selection of 18 shares "with high dividends and quality":

Two from Germany also made it onto the list:

Judge for yourself and feel free to comment with your opinions.