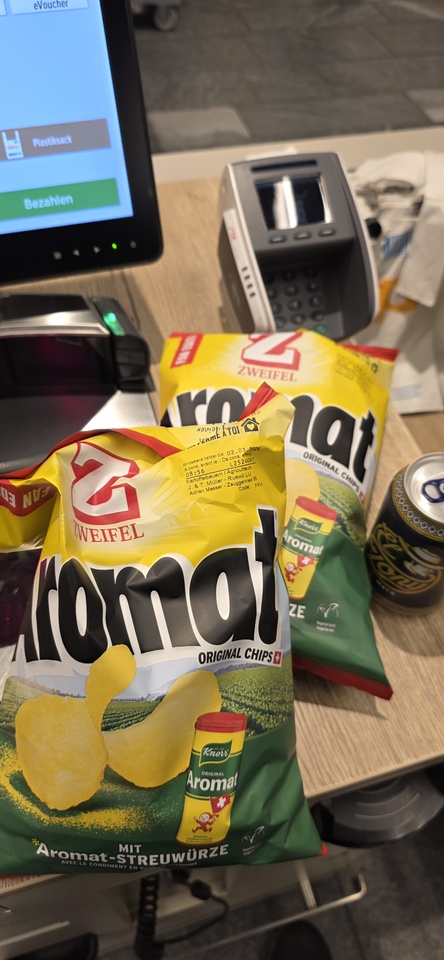

As a Swiss, this is my best investment this year. Limited fan edition by Zweifel in cooperation with $ULVR (+0,39 %) 😍😍

Unilever

Price

Discussion sur ULVR

Postes

333Spin Off Unilever -> Magnum Ice Cream Company. What are your thoughts?

$ULVR (+0,39 %) has announced that it will spin off its global ice cream division, including brands such as Magnum, Ben & Jerry's, Langnese and Cornetto, into an independent company called The Magnum Ice Cream Company (TMICC).

The reasons for this:

- Unilever sees the ice cream business as having a strong seasonal component, high capital commitment and complex supply chains - these are very different from its core beauty, personal care and food businesses.

- The spin-off is intended to release value: TMICC should grow independently, with a targeted focus on brands, realize economies of scale and offer investors a pure "ice cream playground".

Key data of the spin-off

- TMICC will be headquartered in the Netherlands and plans to be listed on the stock exchanges in Amsterdam, London and New York.

- Unilever will retain a minority stake of less than 20% after the spin-off and will reduce this over time.

- Employment conditions for around 6,000 Eiskrem employees in Europe/UK have been secured in advance for at least three years to ensure stability during the transition phase.

Opportunities & risks

Opportunities:

- TMICC can fully specialize in ice cream, allowing it to operate more flexibly and potentially achieve higher margins.

- Investors gain a clearer investment vehicle for the global ice cream market - potential for valuation premium.

Risks:

- Seasonal and weather-dependent business, cold transportation chains, competitive pressure and fluctuations in raw material and energy prices remain challenges.

- Brands such as Ben & Jerry's are also struggling with strategic tensions: e.g. conflicts over the social mission vis-à-vis TMICC/Unilever.

Question for the forum:

What do you think of the spin-off of Unilever's ice cream business into the Magnum Ice Cream Company? Do you think that TMICC really is really better positioned to increase growth and margins - or is there a risk that the spin-off will bring more risk than benefit?

Disclaimer:

I am invested and Unilever is a SWAN (sleep well at night) stock for me in my dividend portfolio, in fact one of my largest positions.

analyzed on Monday the impact of the upcoming share consolidation in the course of the spin-off of the ice cream business. Following the transaction, the consumer goods group's net profit is likely to decline by around ten percent, excluding any costs of the spin-off of the business and synergy effects for the 2026 financial year.

Review of October 2025

My review of October 2025. Many thoughts and yet no solution.

There's also a question at the end of the article.

📈 Performance:

S&P500: +4.73%

MSCI World: +4.25%

DAX: +0.32%

Dividend portfolio: +1.13%

My high and low performers in October were (top/flop 3):

🟢 ($LLY (-2,31 %) ) Eli Lilly +20.29%

🟢 ($MC (+1,64 %) ) LVMH +17.59%

🟢 ($STAG (-0,37 %) ) STAG Industrial +11.02%

🔴 ($CTAS (+0,71 %) ) Cintas -8.41%

🔴 ($TXN (+1,84 %) ) Texas Insturments -11.09%

🔴 ($RACE (+0,7 %) ) Ferrari -15.71%

Dividends:

October 2025: €126.83

October 2024: € 147.55

Change: -14.04%

Sales:

🟥 None

Purchases:

🟩 ($ULVR (+0,39 %) ) Unilever (8 pcs.)

🟩 ($WM (-0,46 %) ) Waste Management (2 pcs.)

Savings plans:

($CTAS (+0,71 %) ) Cintas (50€)

($MC (+1,64 %) ) LVMH (50€)

($MSFT (+0,76 %) ) Microsoft (25€)

What else has happened?

October was very quiet. Apart from a week's vacation and my birthday, nothing much happened. I used the quiet (and free) time to continue thinking about my nest egg. When do I fill it up and how much? Does it really have to be €10,000? How quickly should this happen or can I just save up slowly? What would be my safe-sleeping amount? Questions upon questions. I have also found many answers. However, I haven't really got any further because I can't make up my mind.

The current situation is as follows: The savings rate on shares will be reduced, and the special payment will not be included in the $XEON (+0,01 %) (i.e. for loan repayments), but will also go into the nest egg. I have set the amount I want to save to €5,000. That would then be done. I'll be rebuilding again from January. Until then, I'm still working out how I can present it well and what I feel comfortable with. I can still save the amount for the loan, as long as I plan a monthly savings amount at some point and don't just use the special payments.

🥅 Goals for 2025:

Deposit of €10,000 and thus a custody account volume in the share portfolio of ~€73,000

Target achievement at the end of October 2025: 77.94%

If everything remains/becomes as planned, I will not reach my personal target. But if I don't change my mind again (which would result in a lower nest egg) or get a windfall for Christmas, then I don't see any more options at the moment.

How would you solve my "problem" with the nest egg? How would you decide?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.

From reverse splits & spin-offs (now it's getting wild)

As you have probably noticed, Unilever has been considering the idea of separating and spinning off its ice cream division in the past.

The next clear steps in this plan have now been taken with the last shareholders' meeting. I am copying the information here for you, which every shareholder will receive in one form or another via their bank.

The Annual General Meeting of Unilever PLC resolved on 21.10.2025 to carry out a reverse stock split.

(a "reverse split") and to spin off its ice cream division and list it on the stock exchange under the name The Magnum Ice Cream Company ("TMICC") (a "spin-off").

What does this mean for you now?

If you have shares in Unilever PLC in your securities account at the end of November 7, 2025, you will also receive shares in TMICC (ISIN not yet known).

The new shares are expected to be booked in at a ratio of 5:1, i.e. for every 5 shares in Unilever PLC you will receive one additional share in TMICC.

one share in TMICC.

If you have shares in Unilever PLC in your securities account at the end of 10.11.2025, these will be combined. The consolidation ratio is not yet known. Your shares will be converted into the

new ISIN GB00BVZK7T90 / WKN A41NM1. The market value of your shares will increase at the same time in line with the merger ratio.

You will therefore not suffer a loss in value, but

you will only have a smaller number of shares in your securities account.

We will automatically credit or exchange the shares for you - so you don't have to worry about anything. However, we cannot say exactly when we will credit the shares to you. That depends on when we receive them from our depositary. We currently have no further information on this.

Please also note that due to the current "government shutdown" in the

the issue of TMICC shares will be delayed due to the current government shutdown in the USA, as further approvals from the US authorities are required, which cannot be obtained at present.

What tax implications does this have for you?

The spin-off will be tax-neutral under German tax law. In this case, this means that the acquisition costs of your Unilever PLC shares will be reduced by around 16.67%. This discount will be transferred to the new shares of TMICC and represents

and represents their acquisition cost. This division of the acquisition costs means that no capital gains tax is incurred.

The reverse split is also tax-neutral. This means that you do not have to pay capital gains tax on the exchange into the new shares and the acquisition costs of your previous shares are transferred in full to the new shares.

According to the information available to us from our depositary, the issue of the new shares will be subject to UK Stamp Duty Reserve Tax of up to 1.5% of the consideration. As soon as we receive this charge, we will pass it on to you and debit your custody account. However, we are currently unable to inform you when or in what amount the charge will be made.

debit will be made. We have no information on this.

Please note: This information is provisional and may change at any time. It is therefore possible that capital gains tax may still be payable on the spin-off or reverse split.

What do I do with the information?

As I only hold around 1.86 shares at the time of this information, as my standing order has only been running since January, I have decided to set the standing order so that I have just over 2 shares as of November 1.

In addition, I have just bought 18 additional shares with the aim of reaching just over 20 shares after November 1st.

This gives the existing 1.86 shares the opportunity to make their contribution to the spin-off.

After the reverse split, I will try to sell the money from the 18 old shares again at a slight profit and then continue my standing savings order on the new Unilever at the usual slow pace.

Whether I see the ice cream division as another share in my portfolio and then add to it or sell it will depend on the further development (dividend strategy etc.) of the new company.

How are you dealing with this issue and your shares?

What are your opinions on the future of the two companies?

The new Nestle boss reorganizes

The new Nestlé $NESN (+0,72 %) Group CEO Philipp Navratil wants to make savings and is cutting 16,000 jobs. The manager has increased the savings target from CHF 2.5 billion to CHF 3.0 billion by the end of 2027.

In his first major public appearance, Navratil explained that volume growth was his top priority. "To this end, we have increased our investments in a targeted manner and have already achieved initial results. Now we need to do even more, act faster and accelerate our growth momentum."

A lot of work is needed to get Nestlé back on track. Because when it comes to key indicators such as sales growth and share price performance, the food giant, whose products range from ready meals and frozen products to confectionery, coffee, Vittel water and pet food, is now lagging behind rivals such as Danone $BN (+0,03 %) and Unilever $ULVR (+0,39 %) are lagging behind.

Source text (excerpt) & graphic: Handelsblatt, 16.10.2025

From my point of view, the quality of the price development corresponds to that of many products.

Inspiration needed

Hello everyone,

I have cleaned up my portfolio a bit and trimmed it to 30 positions (please ignore the very small positions, it is more expensive to sell them than to keep them). The different ETFs on msci, msci em, dax and NASDAQ are due to historical reasons (sub. Deposits, change from synth. To physical replication, too many taxes with complete change). At the end of the year I will sell the 2 DWS old funds and then have the tax refunded promptly --> grandfathering. I just don't know where to switch to.

I am currently saving:

$TDIV (+0,32 %) 250/m

$IWDA (+0,36 %) 600/m

$IEMA (+0,54 %) 250/m

$EQAC (+0,45 %) 250/m

$ALV (+0,27 %) 50/w

$KO (+0,06 %) 50/w

$PEP (+0,23 %) 50/w

$UNH (-0,52 %) 50/w

$V (+0,49 %) 50/w

$ULVR (+0,39 %) 50/w

And I reinvest the dividends from $O (+0,34 %) and $MAIN (+0,74 %) monthly

I try to have all positions that I want to hold long-term at 2-4 percent (exceptions: ETFs, $EWG2 (+1,35 %) and $BRK.B (+0,29 %) )

At the moment semiconductors ($AMD (+2,06 %)

$PLTR (+2,32 %)

$MU (+2,44 %) and $MPWR (+0,23 %) ) are my "yield positions", which I would like to sell if the price continues to rise.

But at the moment I'm lacking inspiration. What is my portfolio missing in the long term? Which themes could I "play" to achieve short-term returns. Or just leave everything as it is.

I would be grateful for any opinions.

Greetings 👋

📦🍦 A long love affair: Unilever 💍

Unilever is not sexy like Tesla, not loud like Nvidia, but has been my faithful companion in the portfolio for over 10 years - the classic "marriage for life". 🥂

👉 Brands that everyone knows: Ben & Jerry's and Magnum (unfortunately the change is coming to ice cream, I'm a customer) Dove, Lipton, Knorr - basically your entire fridge and half your bathroom.

👉 Dividends? It's on! Paid without interruption for over 50 years. No mega growth, but a solid cash cow. 🐄💸

👉 Share price? More like a leisurely Sunday afternoon in the park - not much action, but no heart attacks. 🚶♂️🌳

Unilever is the type of stock you don't stare at all the time - but when the market crashes, you realize how pleasant this "boring" stability is.

BuyFriday

Bought 10 $ULVR (+0,39 %) and 13 $VPK (+0,85 %) , what should give me now > €2.000 total dividend/year. 🥳

New dividend portfolio

I would like to start a completely new portfolio that will primarily revolve around dividends.

As a core I was thinking of $TDIV (+0,32 %)

Would you say this is a good core?

If not I would add $VHYL (+0,47 %) add.

Additionally I would like to have a CC ETF as a kind of support, probably $JEGP (+0,24 %) and or $SXYD (+0,24 %)

I would like to represent the NASDAQ with $EQQQ (+0,43 %) but I will represent it with $ASML (+1,18 %) and $2330 will be added.

Allianz $ALV (+0,27 %) and Munich Re $MUV2 (+0,06 %) I definitely want to include, but they are too expensive for me financially, so I was thinking of the $EXH5 (-0,23 %)

Oil shares are represented by $VAR (+0,46 %) and one more.

Do you have any recommendations?

I am thinking about $CVX (+0,56 %)

$EQNR (+0,72 %) and $PETR4 (-2,22 %)

I would also like renewable energies, but I'm not familiar with them.

Do you have any suggestions?

Becoming a defensive company $ULVR (+0,39 %)

$D05 (-0,55 %)

$O (+0,34 %) and of course $NOVO B (+2,24 %) Being.

$BATS (+1,77 %) I already have in a portfolio, would it be too much of a lump to add $MO (-0,08 %) to add to it?

I still have $KHC (-1,61 %) on the watchlist but the split is not going so well, would it be wise to start with a savings plan?

Apart from that $RIO (+0,47 %)

$NKE (+1,01 %)

$1211 (+0,98 %)

$SOFI (+3,96 %) and $HAUTO (+0,56 %) will be represented with smaller positions.

What is your opinion?

Would you improve anything?

What else would you add, especially in EE and defensive stocks?

Feedback is very important to me here, so far I have just been wandering aimlessly around the stock market without a fixed plan and strategy.

This is my first attempt to build something serious.

Greetings to all Getquins out there!

Defensive phase

As I mentioned a while ago, I am looking for positions to make my portfolio more price stable. Therefore, today I took position in:

- $AD (-0,18 %) (20 pieces)

- $ULVR (+0,39 %) (2 pieces purchased)

In the more risky corner I find $TWEKA (+0,63 %) a company that has plenty of potential despite disappointing quarters. Picked up at €34 each.

Titres populaires

Meilleurs créateurs cette semaine