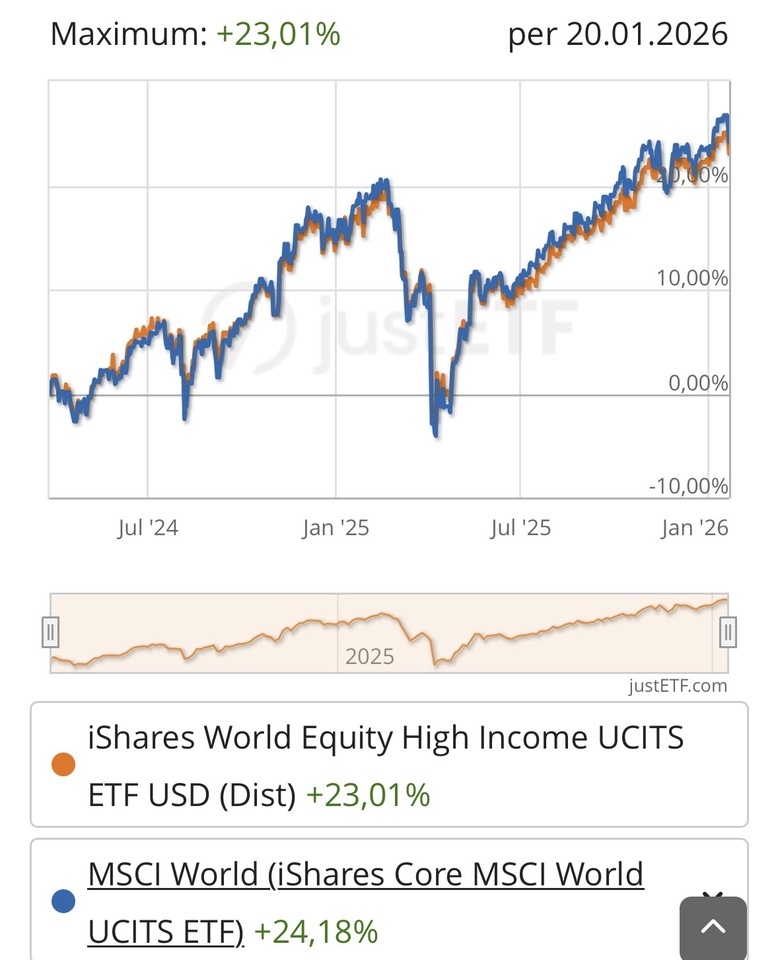

$JEGP (+0,54 %) Regardless of the dividend, this ETF is on a strong rise in 2026.

Do you have it in your portfolio?

Postes

189$JEGP (+0,54 %) Regardless of the dividend, this ETF is on a strong rise in 2026.

Do you have it in your portfolio?

Are the dividend payments from $JEPQ (-1,1 %) and $JEGP (+0,54 %) not included in the overall performance?

New monthly update with new investments. Updated version (contained a small playback error)

#etf

#etfs

#youtube

#dividend

#dividends

#dividende

#invest

#pokemon

New monthly update and New investments

A brief question to understand how the $WINC (-0,61 %)

Unlike the $JEGP (+0,54 %) the ETF works with futures in order to capture the upside in strongly rising markets. In itself a very nice idea, which works well compared to other covered call ETFs, if you look at it in comparison to the benchmark MSCI World.

Now to the actual question:

if you assume a long-term average return of approx. 7% for the MSCI World and the $WINC (-0,61 %) 9.5%, then there should be a negative price trend in the long term with the dividend or payout discount (-2.5%). Am I right or have I missed something?

Im a dividend seeker and and a little bit growth seeker I’m wondering if to increase some positions already present in my portfolio or wait a little more … or diversify more ..

i got to invest a decent amount because a bond expired past week and im searching ideas ..

my favourite positions in this moment are :

any thoughts or different ideas ?

**Summary:**

I plan to draw down a building society loan of **€16,800** **without residential use** and invest specifically in **3 income-distributing ETFs**.

The aim is **cashflow-based repayment within approx. 24 months**, not buy & hold for 10 years.

---

## 🏦 Financing (fixed)

* Loan amount: **16.800 €**

* Debit interest rate: **2,15 %**

* Term (formal): **10 years**

* Special repayment: **possible monthly at any time**

* Monthly interest charge: **≈ 30 €**

* Strategy: **Dividend income + special repayment**

*My goal repaid after 24 months loan

📊 Planned investment (debt capital)

**Equalized distribution: € 5,600 each**

1️⃣ **iShares World Equity High Income Active UCITS ETF**

ISIN: IE000KJPDY61 $WINC (-0,61 %)

→ Global equity income, high distribution (mainly quarterly)

2️⃣ **JPM Nasdaq Equity Premium Income Active UCITS ETF**

ISIN: IE000U9J8HX9 $JEPQ (-1,1 %)

→ Nasdaq exposure + option premiums, **monthly distribution**

3️⃣ **JPM Global Equity Premium Income Active UCITS ETF**

ISIN: IE0003UVYC20 $JEGP (+0,54 %)

→ Globally diversified + option strategy, **monthly distribution**

---

💸 Expected cash flow (conservative)

* Total net dividends: **≈ 90-108€ / month**

* Interest covered: **yes**

* Pure repayment portion from distributions: **≈ 60-78€ / month**

* Additional repayment planned from own funds (dividends from the existing portfolio are diverted to repayment)

➡️ **Target:** Full repayment in **~24 months**, then cash flow free.

🧠 Risk classification (deliberately chosen)

* No margin, no Lombard

* Fixed interest rate < expected cash flow

* Income ETFs → limited upside, but predictable return

* Main risks:

* Reduction in distributions

* Sideways/downwards markets

* Option strategies limit price gains

💸 Cash flow side (income ETFs)

Conservative net distribution yield of the ETF basket:

≈ 6.5-7.0% net p. a.

corresponds to 650-700 basis points

➡️ Spread (yield - interest rate):

+435 to +485 basis points

🧠 Interpretation (for the community)

No classic growth lever

No price momentum required

Leverage based purely on carry

Comparable with:

conservative credit spread

structured income overlay

Yes, a savings plan on the Msci world could be in the portfolio after 2 years with a higher book value, but after 2 years I have one the shares in the 3 ETFs and monthly cash flow free

---

## ❓ Open questions for the community

* How do you see the project?

* Is the **2.15% fixed interest rate** a justifiable "leverage" from your point of view?

* Would you set the weighting of the three ETFs differently?

* Am I overlooking a structural risk?

I am very happy to receive critical opinions.

The goal is not "get rich quick", but controlled cash flow with a quick payback

In addition to $JEGP (+0,54 %)

$TDIV (+0,34 %) and $VWRL (-0,29 %) i started a position in $WINC (-0,61 %)

As I had already planned this morning, I have parted with the $QYLE (-0,28 %) and bought the $WINC (-0,61 %) and bought the I also took the opportunity to get rid of the $JEGP (+0,54 %) which performed even worse than the Global x for me. Overall, I came out of both with a red zero.

In addition to the ishares, 50 of the proceeds from the $ASWM (-1,1 %) went into the portfolio, of which I now have 100.

In the high yield area, I then added the $TDIV (+0,34 %) as the largest position and the $YYYY (-0,3 %) the $JEPQ (-1,1 %) and the $SXYD (-0,05 %) .

That's how it's going to stay for now; in total, that's around 8-9% of the total portfolio in this area.

As I bought the Winc before the ex-date, but sold the global x afterwards, I can still take the dividends from both this month. As a result, I even have a small gain on the global x overall.

I just want to use the first day of the year to set out my financial cornerstones for 2026. In a way, it's a little public self-talk so that I don't lose focus and have a guideline to follow throughout the year.

Initial situation: Due to my professional background, I have always been very real estate-oriented in my investments. This was no different in 2025, with over 90% of my assets being real estate and less than 10% "other" - including my regular securities portfolio. In principle, I feel quite comfortable with an overweighting in "stones", but I would like to shift the ratio slightly in order to have a larger proportion of assets that can be liquidated quickly. It is also desirable to have less exposure due to possible additional government regulations in the area of tenancy and real estate law (energy-related renovation obligations, rent regulations, etc.).

My portfolio is clearly geared towards distributions, as I am already over 50 years old and no longer fully employed. So I need something I can live from. My portfolio therefore mainly contains 'boring dividend stocks and ETFs'. It would be nice to generate an average of 2tsd euros net per month in dividends by the end of 2026.

Measure 1: A small apartment is for sale - the notary appointment is in the second week of January. Proceeds after deduction of brokerage and transaction costs approx. 200tsd, which will flow directly into the portfolio. I will sell my existing positions $TDIV (+0,34 %) and $WINC (-0,61 %) as well as my individual shares $BATS (-0,19 %) , $RIO (-2,36 %) and $PETR4 (+0,64 %) increase them.

Measure 2: Sale of a small building plot - it is not yet possible to predict when this will be completed, as the plot is somewhat special. However, I think a sale in 2026 is realistic - proceeds approx. 160,000 euros. I would like to use the money to add a few more individual shares to the portfolio. Depending on how the prices have gone by then, I'm thinking of $PZU (-3,04 %) , $PFE (+0,35 %) and $CA (-0,57 %). Maybe I will also $JEGP (+0,54 %) further.

Measure 3: In February/March I will probably get my money back, which I spent on various building materials for a joint project. About 12tsd Euro. This will also go into the depot. There may also be the first returns from my first house subdivision project. But how much will come out of it is speculation, and the money will be returned at GmbH level, so that doesn't "count" for the time being.

Measure 4: This is the biggest board. I don't know yet whether it will work - at the moment I give it a realistic 25-50% chance of being implemented. I would like to take over a package of three houses with two business partners. We have a provisional commitment from the seller, but we have to manage to arrange financing. We need around EUR 3.5 million from the bank, so it won't be easy, especially as we only have until the end of February and the houses have a significant commercial component, which is generally viewed negatively by banks. If anything comes of it, I'll report back. It would be my last big deal in this area. We would split up and sell two houses and keep the third.

(Image generated with Lovart.ai, modified in Photoshop)

Meilleurs créateurs cette semaine