$MICC (-1,75 %) I bought Magnum a couple of days ago and now its 4% up$

Magnum Ice Cream Co. N.V.

Price

Debate sobre MICC

Puestos

15Magnum Ice Cream

What do you do with $MICC (-1,75 %) through the spin-off, is that what it's called?

Sell and take the loss or is it all booked incorrectly?

Quiet days, turbulent markets: my December review

While the world outside was drifting into the Christmas hustle and bustle and I was consciously spending more time with my parents, little dramas were unfolding at the markets. My class leader $AVGO (+0,37 %) lost value, as did the main share portfolio. But honestly? I only really noticed this at the end of the year. The second half of December had long since cast its spell over me, especially Christmas and the time between the years when everything slows down a little. Instead of rushing around, I reflected and did some soul-searching. Meanwhile, the automated systems continued to do their job. Savings plans were running and dividends were flowing.

At the end of the year $LTC (-1,84 %) Properties was the last buy of the year. Alongside $O (+0,76 %) and $MAIN (-2,93 %) this monthly payer should continue to grow. The business model has a future and I am building something here step by step.

And now enough of the quiet, time for a review.

Overall performance

It was business as usual as I enjoyed the end of the year. Negative effects passed me by, that's just part of it.

My key performance indicators for my overall portfolio at a glance:

- TTWROR (month under review): -0.46% (previous month: +1.40%)

- TTWROR (since inception): +79,52%

- IZF (month under review): -5.23% (previous month: +18.54%)

- IZF (since inception): +10,81%

- Delta: -401.91€

- Absolute change: +616.54€

Performance & volume

$AVGO (+0,37 %) gives up 15% and also pulls ahead of other tech stocks such as $NFLX (+13,31 %) and $GOOGL (+0,91 %) my main stock portfolio down. The other portfolios rise, but cannot compensate for this. That's part of investing. When I look at the top 5, I notice that defensive stocks such as $BAC (-3,46 %) and $WMT (+2,6 %) are rising slightly again. I like that, it's a stinking boring business model, which isn't sexy at all, but provides me with steady share price growth and a nice cash flow.

The five red lanterns naturally go to the same weakening candidates (by performance). Well, if something is going well, something must be going badly.

Size of individual stock positions by volume in the overall portfolio:

Share of equities (%) in the total portfolio (and associated securities account):

$AVGO (+0,37 %) 3.06% (main share portfolio)

$WMT (+2,6 %) 1.76% (main share portfolio)

$GOOGL (+0,91 %) 1.51% (main share portfolio)

$BAC (-3,46 %) 1.50% (main share portfolio)

$NFLX (+13,31 %) 1.38% (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$NOVO B (-0,91 %) 0.48% (main share portfolio)

$BATS (-0,28 %) 0.54% (main share portfolio)

$GIS (+0,16 %) 0.55% (crypto follow-on deposit)

$MDLZ (+1,88 %) 0.56% (main share portfolio)

$CPB (+0,04 %) 0.58% (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$AVGO (+0,37 %) : +328% (main stock portfolio)

$NFLX (+13,31 %) +101% (main share portfolio)

$GOOGL (+0,91 %) +115% (main share portfolio)

$WMT (+2,6 %) +91% (main share portfolio)

$BAC (-3,46 %) + 81% (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$NKE (-2,79 %) : -35% (main stock portfolio)

$GIS (+0,16 %) -34% (main share portfolio)

$TGT (-1,24 %) : -33% (main share portfolio)

$CPB (+0,04 %) : -30% (main share portfolio)

$NOVO B (-0,91 %) -24% (main share portfolio)

Asset allocation

Equities and ETFs currently determine my asset allocation.

ETFs: 41.7%

Equities: 58.2%

Crypto: 0.0%

P2P: less than 0.01%

Investments and subsequent purchases

In December, I slightly increased the savings plans from my net salary and reinvestment. I invested the following amounts in savings plans:

Planned savings plan amount from the fixed net salary: €1,040 [previously: €1,030]

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: €1,060 [previously: € 1,040]

Savings ratio of the savings plans to the fixed net salary: 50.24% [49,75%]

In addition, there were the following additional investments from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: €40.00

Subsequent purchases/one-off savings plans as a cashback annuity from bonuses: € 0.00

Subsequent purchases from other surpluses: € 108.23

Automatically reinvested dividends by the broker: €7.03 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

Unscheduled purchases were made on various securities accounts outside the regular savings plans:

Number of unscheduled purchases: 9

40.00€ for $FGEQ (-0,71 %)

56.94€ for $ULVR (+0,74 %)

88.72€ for $LTC (-1,84 %)

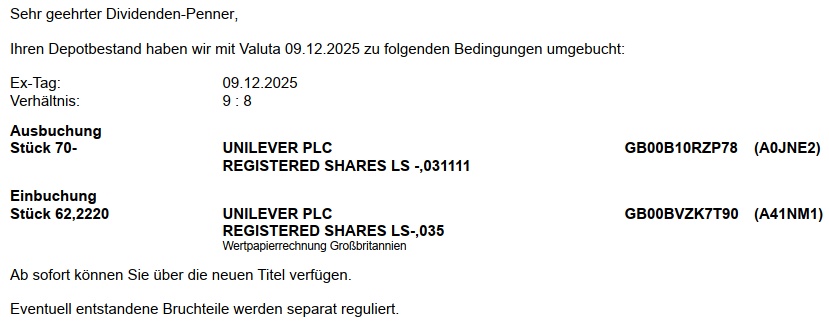

After the Magnum spinoff at Unilever, I sold the booked position a few days too late in order to shift it into Unilever with some cash. It was sold:

37,43€ from $MICC (-1,75 %)

Magnum Ice Cream is neither in my freezer nor in my portfolio.

Passive income from dividends

I received € 132.75 in dividends (€ 152.20 in the same month last year). This corresponds to a change of -12.78% compared to the same month last year. The reason for the decline is that distributions from my three large Vanguard ETFs no longer arrived on time. Further key figures:

Number of dividend payments: 32

Number of payment days: 16 days

Average dividend per payment: €4.15

average dividend per payday: €8.30

The top three payers in the month under review were:

My passive income from dividends (and some interest) mathematically covered 7.94% of my expenses for the month under review. Acceptable for a weak month with medium-high expenses (by my standards).

Crypto performance

I am currently completely on the sidelines here. It will be a while before I get back in.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows the TTWROR in the current month (and since the beginning):

My portfolio: -0.46% (since I started: +79.52%)

$VWRL (+0,1 %) +0.06% (since my start: 66.12%)

$VUSA (-0,59 %) +1.00% (since my start: 63.76%)

After outperforming the ETFs last month, I am underperforming this time. 2026 will catch up. 🤗

Key risk figures

Here are my risk figures for the month under review:

Maximum drawdown: YTD: 17.17% (month under review: 1.56%)

Maximum drawdown duration: 702 days [since inception] (reporting month: 26 days)

Volatility: YTD: 12.00% (in the month under review: 1.33%)

Sharpe Ratio: YTD: 0.48 (in the month under review: -3.92)

Semi-volatility: YTD: 9.35% (in the month under review: 0.98%)

The maximum drawdown of 702 days since the beginning is still reminiscent of the tough phase 2022-2023, before the year-end rally started at the end of 2023. In December itself, the decline of 1.56% was marginal and a sign that the major turbulence of the year was over.

My Sharpe Ratio has improved to 0.48 YTD, showing that for every unit of risk, I get almost half a unit of return above the risk-free rate. Volatility has fallen from a wild 28% over the course of the year to a reassuring 12% YTD, while semi-volatility is down to just 9.35%. That shows: My portfolio does fluctuate, but the risk of loss is lower than the overall volatility would suggest. December was particularly quiet with a semivolatility of 0.98%.

What remains? Confirmation of my strategy: think long-term, keep calm and buy when things get cheap. 2025 ends solidly despite weakness.

Outlook

Back in the November review, I announced my investment of the Christmas bonus. Of course, I wasn't talking about money from my employer, but simply what I received for Christmas plus a few pennies I had lying around at home. I posted the reinvestment on the same day in the week between the years.

I also donated a few dividends, the fourth and final donation was made in December. You can read more about this in the Instagram Story. I think donations are important, because those who have should also give something.

I'll end this review with another personal point, which I already covered in the August and November reviews.

Loyal readers of my reviews will know that in the summer I was diagnosed with an aneurysm of the ascending aorta near my heart as a result of a bicuspid and insufficient aortic valve. It was an accidental finding that took some of the danger out of this ticking time bomb thanks to close monitoring, but it is still ticking. When I look back on the year 2025, I realize how this thing has permanently changed my thinking and my approach. Of course, it's an ongoing process, but I'm less likely to fall back into old patterns. Even though the cardiology appointment in December found that the thing hasn't grown any further, which will give me a little more time before surgery, I know the day will come. It's unclear when, but like a meteoroid hurtling towards the earth, there is something on the horizon. You just don't know when it's going to hit. The fact that the 43-44mm has remained stable (and no more) is a gain of time for me that I want to use. I have a lot of plans to develop new sources of income, significantly expand my social media presence, implement new habits, continue to work on my fitness and focus on life and the positive. Despite the diagnosis, 2025 will be a great year for me. And I'm going to go one better in 2026.

Thank you for reading. I wish you all the best for 2026!

👉 You can also read my portfolio review for December on Instagram from January 8, 2026 (and budget review from 9.1.26).

📲 In addition to the portfolio and budget review, there are currently three posts a week: @frugalfreisein

!!! Please pay close attention to the spelling of my alias. Unfortunately, there are too many fake and phishing accounts on social media. I have already been "copied" several times. !!!

👉 How was your month in the portfolio? Do you have any tops & flops to report? Leave your thoughts in the comments!

Review of December 2025

Here is my review of December 2025. I will probably also write a review of the year, where I will also go into more detail about the dividends. But that will probably take a few more days.

📈 Performance:

S&P500: -0.33%

MSCI World: +0.32%

DAX: +2.74%

Dividend portfolio: -1.55%

My high and low performers in November were (top/flop 3):

🟢 ($2318 (+0,18 %) ) Ping An +15.65%

🟢 ($RIO (-0,45 %) ) Rio Tinto +11.61%

🟢 ($2768 (+2,71 %) ) Sojitz +7.15%

🔴 ($MMM (-1,76 %) ) 3M -6,81%%

🔴 ($TSCO (+1,25 %) ) Tractor Supply -8.45%

🔴 ($7974 (-0,34 %) ) Nintendo -21.09%

Dividends:

December 2025: € 208.88

December 2024: € 185.64

Change: +12.52%

Sales:

🟥 ($MICC (-1,75 %) ) The Magnum Ice Cream Company

Purchases:

🟩 ($HD (+1,1 %) ) Home Depot (2 pcs.)

Savings plans:

($CTAS (+1,28 %) ) Cintas (50€)

($MC (-3,08 %) ) LVMH (50€)

($MSFT (+0,04 %) ) Microsoft (25€)

What else has happened?

As is often the case in December, there are those who rush from one Christmas party to the next, constantly have appointments and can't find any peace and quiet even at Christmas.

Then there are those who take December very easy, have relaxed TV evenings, make the most of the nice weather during the day (if possible) and at least try to keep things quiet at Christmas. I belong to the latter and only belong to the former at Christmas. As a result, my December was pretty quiet except for the Christmas rush, where you're rushing from one meal to the next and from one relative to the next. With various birthdays around Christmas and between the years, the stress continues. Fortunately, I've been reserving Boxing Day for me and my wife for a few years now. We don't visit anyone there and don't want anyone with us. We just spend the whole day doing whatever we feel like doing. Apart from that, we have a quiet New Year's Eve and that's it for 2025.

🥅 Goals for 2025:

Deposit of €10,000 and thus a custody account volume in the share portfolio of ~€73,000

Target achievement at the end of October 2025: 91.56%

So I actually didn't quite reach my target, although the total investment I was aiming for (incl. pension portfolio & Oskar) of €20,000 was achieved.

Overall, I am quite satisfied with the year. In the annual review, as mentioned above, I will go into more detail about the dividends and the overall performance.

Anyone who enjoyed the report and would like to read more is welcome to follow me,

If you are not interested, you are welcome to scroll on or use the block function.

Even if the goals were just missed, you have achieved so much more in the meantime that you can look back on 2025 with pride and satisfaction 😉

So off to 2026, spit in your hands and on you go 👋🏻

Courses TR

Hello everyone,

due to the spin-off at $ULVR (+0,74 %) are now $ULVR (+0,74 %) and $MICC (-1,75 %) with the wrong performance.

As a result $MICC (-1,75 %) a performance of -70%.

Do you have any experience of how long TR needs to post the performance correctly?

So if you sell TMICC now, you can offset this against profits.

But maybe I just didn't understand it correctly 😂

$MICC (-1,75 %)

$ULVR (+0,74 %)

An ice cream, an outdoor pool, a false assumption

I thought Magnum was overrated for a long time.

It was a typical thought of a Western investor:

"When I go to the supermarket, the next store brand is already on the frozen food shelf anyway. So why Magnum?"

Case closed. I thought.

But then I observed myself. Not analytically, but honestly.

When do I actually eat ice cream?

At the outdoor pool? Not a store brand. Suddenly it's Cornetto or Magnum.

At the movies? The same ritual for years: Ben & Jerry's. No price comparison, no alternative.

On the beach, on vacation, on the promenade? Again, no no-name products - but brands that you know, that you trust, that you grab spontaneously.

And that's when the penny dropped.

The competition doesn't take place on the supermarket shelf.

Competition takes place at the point of consumption.

Magnum does not primarily compete with private labels.

Magnum occupies buying moments: Heat. Leisure. Vacation. Impulse. Places without alternatives, without time to think, without price sensitivity.

This is exactly where market power is created.

And suddenly the spin-off of the ice cream division no longer seems like a side note in the Group's strategy, but like a strategic liberation.

The strategic core: why the spin-off is a game changer:

With the spin-off from the Unilever Group, the Magnum Ice Cream Company will become an independent company for the first time - with a single focus: growth in the global ice cream business.

What was previously part of a huge consumer goods conglomerate can now:

Allocate capital in a targeted manner,

bundle management energy.

Drive expansion where ice cream really scales: warm countries, fragmented markets, impulse channels.

Especially in regions with weak retail chains (parts of Africa, South East Asia, Latin America), the brand is crucial. It is not the cheapest supplier that wins there, but the best known.

Magnum is perfectly positioned for this.

Market position: dominance instead of interchangeability

Magnum is not a nice ice cream brand.

Magnum is the market leader.

Around 21 % market share in the global ice cream business,

Larger than all competitors individually.

Clear premium positioning with global recognition.

The global ice cream market is estimated to be worth between 80 and over 100 billion US dollars, depending on the source. Growth is moderate but stable - and this is precisely where premium plays to its strengths: Pricing power instead of a volume war.

Magnum does not simply sell ice cream.

Magnum sells pleasure, reward, a little ritual.

Figures that carry the bull case

An investment is not just about the story - it's about the fundamentals.

Implied valuation of the spin-off: around 8 billion euros.

Ice cream is capital-intensive (cold chains, logistics), but highly profitable for premium brands.

Under the Unilever umbrella, the division was cash flow positive

Magnum recently generated around € 650 million in free cash flow - an indication of the financial quality of the spun-off activities.

Growth

Volume growth recently positive again,

Price increases were accepted by the market,

Premium and impulse channels are growing faster than traditional supermarket sales.

In short:

👉 Stable sales + rising margins + focus = free cash flow leverage

The real moat: Location beats price

Perhaps the most important point is often overlooked:

Magnum is not winning on the shelf.

Magnum is winning in the moment.

Outdoor pools

Cinemas

Beaches

Petrol stations

Street vending

Vacation regions

There are:

no price comparison

no private label

no alternatives

Whoever is present here owns the customer.

And this is exactly where Magnum is strong.

Opportunities for the future

Geographic expansion

Growth in warm, densely populated regions with increasing purchasing power

Premiumization

New varieties, limited editions, better ingredients → higher prices enforceable

Focused capital allocation

No more cross-financing for other Group divisions

Brand strength

Built up over decades, almost impossible to copy, emotionally anchored.

Risks - fairly considered

Of course, this is not a risk-free investment:

Seasonality can cause cash flows to fluctuate in the short term

Commodity prices (milk, cocoa, energy) influence margins

Logistics & cold chains are capital-intensive

Valuation after the spin-off must first stabilize

But:

These are known, manageable risks - not structural ones.

Conclusion: An underestimated quality value

Magnum is often viewed through the wrong lens.

Too often people think of supermarket shelves, too rarely of moments of consumption.

As an independent company, Magnum combines

Market leadership

premium margins

global scaling

strong cash flow prospects

The spin-off enables exactly what investors should love: Focus.

For long-term investors who believe in brands, pricing power and global consumer trends, Magnum is no ordinary ice cream business.

It is a high quality consumer goods investment that is just beginning to think for itself - and potentially be valued for itself.

Who wants to sell ice cream with me?

Magnum

Mmmm ice cream in winter .... I dared to try Magnum $MICC (-1,75 %) wife also wanted a share

Dates week 51

As every week, the most important economic news of the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/LcrXtGMbKSk?si=XSygSM2keaWaMyAC

Monday:

$ULVR (+0,74 %) Unilever floated its ice cream business on the Amsterdam stock exchange. The $MICC (-1,75 %) Magnum Ice Cream Company went public on Monday at a price of 12.20 euros. The company is valued at around 10 billion euros. 8 billion euros was the most recent annual turnover. The Ben & Jerry's brand is also part of the group.

Wednesday:

The Fed cuts key interest rates for the third time in a row by 25 basis points to a range of 3.5 - 3.75 %. The Fed currently expects a further cut in 2026. The markets can rise after the decision. Lower interest rates -> more money for companies.

https://edition.cnn.com/business/live-news/federal-reserve-interest-rate-12-10-2025

Friday:

Not only Germany, but also the UK has massive economic problems. New GDP figures show that economic growth has actually fallen unexpectedly.

The mobility company Flix has made a conscious decision to base itself in Germany and is deploying 65! ordered high-speed trains exclusively in Germany. So far, Flix has deployed 15 trains in Germany. From our point of view, this is good news, as we ourselves have already used the Flixtrain on the Stuttgart-Berlin route several times and were satisfied. You can indirectly invest in Flix via EQT ELTIF, which is traded on Trade Republic.

These are the most important dates for the coming week:

Tuesday: 9:30 HCOB Industrial Data (DE)

Thursday: 14:15 Interest rate decision (EUR)

Friday: 04:00 Interest rate decision (Japan)

Splits litter my beautiful depot

Unilever is now my second split (after 3M). And unfortunately this has littered my portfolio with split shares of $MICC (-1,75 %) and $SOLV WI (-5,42 %) which don't even pay dividends. To make matters worse, the 9:8 reverse split also leaves me with crooked numbers of shares in $ULVR (+0,74 %) .

I HATE CROOKED NUMBERS!

DKB writes that the fractions are treated separately. I can already see the sale of 0.222 shares worth €12.25 coming my way for a "small fee" of €10. Unfortunately, DKB is merciless in this respect (I had the same experience with the 3M split of Solventum).

Who suffers with me?

Valores en tendencia

Principales creadores de la semana