Ping An of China

Price

Debate sobre 2318

Puestos

32Asia increased in risk-off mode

For risk reasons, I have opted for new investments in the Asian region.

First an insurance stock with $PNGAY . I find it very interesting. Doesn't always have to be tech.😂

Review of December 2025

Here is my review of December 2025. I will probably also write a review of the year, where I will also go into more detail about the dividends. But that will probably take a few more days.

📈 Performance:

S&P500: -0.33%

MSCI World: +0.32%

DAX: +2.74%

Dividend portfolio: -1.55%

My high and low performers in November were (top/flop 3):

🟢 ($2318 (-2,54 %) ) Ping An +15.65%

🟢 ($RIO (+0,89 %) ) Rio Tinto +11.61%

🟢 ($2768 (-3,21 %) ) Sojitz +7.15%

🔴 ($MMM (-0,58 %) ) 3M -6,81%%

🔴 ($TSCO (+1,25 %) ) Tractor Supply -8.45%

🔴 ($7974 (+6,72 %) ) Nintendo -21.09%

Dividends:

December 2025: € 208.88

December 2024: € 185.64

Change: +12.52%

Sales:

🟥 ($MICC (-0,13 %) ) The Magnum Ice Cream Company

Purchases:

🟩 ($HD (-0,95 %) ) Home Depot (2 pcs.)

Savings plans:

($CTAS (-1,01 %) ) Cintas (50€)

($MC (-0,53 %) ) LVMH (50€)

($MSFT (+0,01 %) ) Microsoft (25€)

What else has happened?

As is often the case in December, there are those who rush from one Christmas party to the next, constantly have appointments and can't find any peace and quiet even at Christmas.

Then there are those who take December very easy, have relaxed TV evenings, make the most of the nice weather during the day (if possible) and at least try to keep things quiet at Christmas. I belong to the latter and only belong to the former at Christmas. As a result, my December was pretty quiet except for the Christmas rush, where you're rushing from one meal to the next and from one relative to the next. With various birthdays around Christmas and between the years, the stress continues. Fortunately, I've been reserving Boxing Day for me and my wife for a few years now. We don't visit anyone there and don't want anyone with us. We just spend the whole day doing whatever we feel like doing. Apart from that, we have a quiet New Year's Eve and that's it for 2025.

🥅 Goals for 2025:

Deposit of €10,000 and thus a custody account volume in the share portfolio of ~€73,000

Target achievement at the end of October 2025: 91.56%

So I actually didn't quite reach my target, although the total investment I was aiming for (incl. pension portfolio & Oskar) of €20,000 was achieved.

Overall, I am quite satisfied with the year. In the annual review, as mentioned above, I will go into more detail about the dividends and the overall performance.

Anyone who enjoyed the report and would like to read more is welcome to follow me,

If you are not interested, you are welcome to scroll on or use the block function.

Even if the goals were just missed, you have achieved so much more in the meantime that you can look back on 2025 with pride and satisfaction 😉

So off to 2026, spit in your hands and on you go 👋🏻

Review of September 2025

📈 Performance:

S&P500: +2.80%

MSCI World: +2.60%

DAX: -0.09%

Dividend portfolio: +0.74%

My high and low performers in September were (top/flop 3):

🟢 ($TSLA (+0,93 %) ) Tesla +33.20%

🟢 ($UNH (-0,99 %) ) UnitedHealth +14.25%

🟢 ($D05 (-0,9 %) ) DBS +12.94%

🔴 ($DTE (-0,3 %) ) Deutsche Telekom -8.29%

🔴 ($TSCO (+1,25 %) ) Tractor Supply -9.43%

🔴 ($TXN (+2,06 %) ) Texas Instruments -10.30%

Dividends:

September 2025: € 203.56

September 2024: € 140.14

Change: +45.26%

Sales:

🟥 ($T (-3,19 %) ) AT&T (27 shares) +36.05%

Purchases:

🟩 ($2318 (-2,54 %) ) Ping An Insurance (150 pcs.)

🟩 ($UNP (-0,02 %) ) Union Pacific (3 shares)

Savings plans:

- ($CTAS (-1,01 %) ) Cintas (50€)

- ($MC (-0,53 %) ) LVMH (50€)

- ($MSFT (+0,01 %) ) Microsoft (25€)

What else has happened?

As announced, I asked the tax office to recalculate the advance payments. This was done and fortunately I no longer have to pay anything in advance.

If things go well, I'll even get some money back next year.

The bill for the car has also arrived and amounts to €1500. But that really pays for everything.

My nest egg has melted down to €900 and now I have to build it up again. Once again, the target is €10,000.

I was on vacation in Egypt from the end of September until last weekend. As always, it was super nice and just pure relaxation.

🥅 Destinations 2025:

Deposit of €10,000 and thus a custody account volume in the share portfolio of ~€73,000

Target achievement at the end of September 2025: 69.19%

How was your September?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.

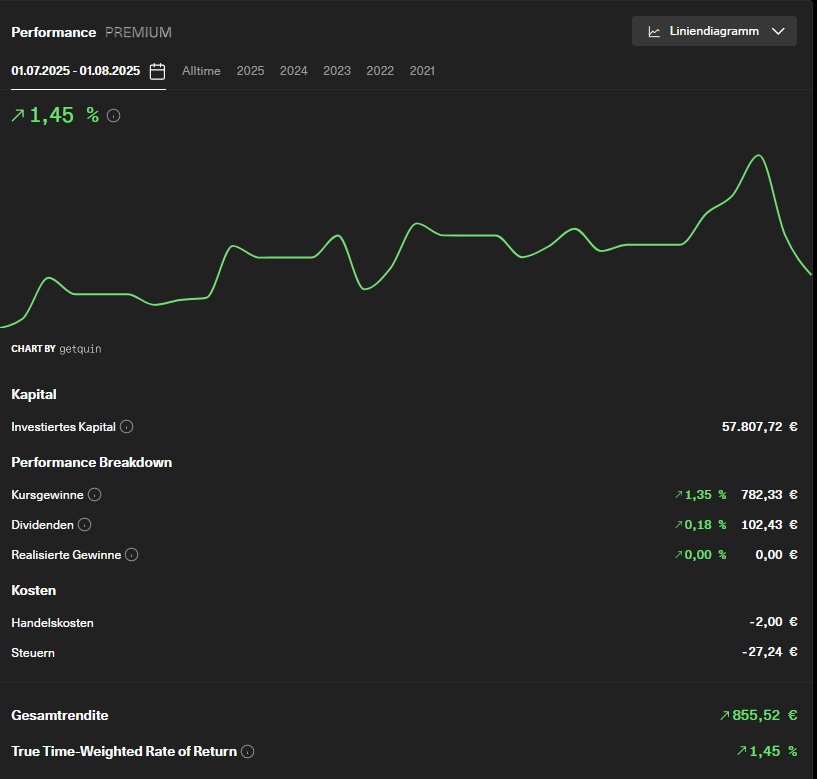

Depot re-sorting and review July 2025

At the end of July, I made the decision to break up my portfolio. This is just a visual change, but it will take me back below 100,000 euros.

What did I do?

I decided to split my portfolio into three parts. Of course, as I said, this is only a visual change. But it allows me to make a somewhat more concrete evaluation.

But first, as usual, let's take a look at the S&P500:

For once, the S&P500 was up almost continuously in July. There was only a dip at the end of August. The main reason for the rise was the regulated tariffs.

In my opinion, the stock market reacts very quickly and very positively to any regulations, which, as we all know, can also be quickly discarded.

In the end, the S&P500 gained +3.97% (USD). In EUR terms, it is even up 6.1%.

Now let's move on to my new portfolio allocation. For the time being, nothing has changed in terms of positions. However, I have turned one portfolio into three or simply sorted things out.

On the one hand, of course, I have my share portfolio, which also serves as a review here.

Secondly, I have taken out my XEON. It's still running, of course, because that's the money that will be used to pay off the loan in five years' time. I don't need to keep that in retrospect.

I have also created a "pension portfolio". This contains my ETFs, which I save a total of €650 per month. This doesn't need to be included in the review either, as the savings plans are running there and there shouldn't be any changes until retirement.

What remains is my share portfolio, which contains the individual shares and gold.

As you can see, my performance is +1.45%.

The S&P500 has massively outperformed me here. At the same time, the MSCI World has also risen by 4.4%. Over the year as a whole, my portfolio is now down -1.7%, while the MSCI World is still down -2.7%. The S&P is even at -4.1%

Only the DAX is still outperforming everyone. Over the year, it is now up +17.7%.

My high and low performers in July were (top 3):

Tractor Supply ($TSCO (+1,25 %) )+15,85%

British American Tobacco ($BATS (+0,7 %) ) +15,59%

Ping An insurance ($2318 (-2,54 %) ) +13,52%

Nestlé ($NESN (+0,3 %) ) -9,32%

Nintendo ($7974 (+6,72 %) ) -11,07%

United Health ($UNH (-0,99 %) ) -16,29%

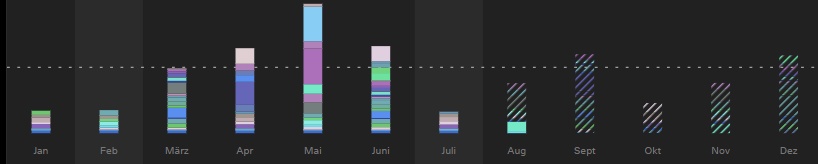

Dividends:

In July, I received €56.87 net from a total of 8 distributions.

Compared to July 2024 (€74.17), this was a reduction of 23.32%.

The difference is due to the fact that Ping An already paid in June this year.

Due to my new portfolio allocation, I have excluded the ETF dividends in each case and therefore the dividend is now of course also visually much lower. The dividends received in the bond portfolio flow 1:1 back into the ETFs.

Investments:

The bill for the car has finally arrived. It amounts to around €1200. Of course, that sets me back enormously. But the worst is yet to come.

The tax was due on 31.07. Well, I was already aware that I had to pay it. However, the sum amounts to €4,000 in arrears. But where does that come from? My old employer paid me a special payment from the old year (i.e. 2023), which was untaxed except for the pension contributions. I got away with it and of course I have to pay an enormous amount as a result. This is also deducted from my nest egg, which makes it worthwhile to have a nest egg.

This means I'm starting almost from scratch again with my nest egg. However, the inspection is due next month at the latest, including an oil change and possibly a brake change.

That would probably use up the nest egg completely. If the brakes don't need to be changed, I can also use the coffee money.

Let's see what August or September at the latest brings.

Buying and selling:

There were no sales in July either.

I added to Gladstone Invest ($GAIN (-0,61 %) ) (150 shares) and Hercules Capital ($HTGC (-1,67 %) ) (14.45 shares)

savings plans (125€ in total):

- Cintas ($CTAS (-1,01 %) )

- LVMH ($MC (-0,53 %) )

- Microsoft ($MSFT (+0,01 %) )

Goals 2025:

I have to change my targets slightly - together with the portfolio. Overall, the €130,000 at the end of the year will remain, but this target will of course be made smaller and the focus will only be on the dividend portfolio.

To be honest, I haven't thought about the target there yet.

Target achievement at the end of July 2025 (in relation to the €130,000): 58.33%

How was your July?

What else would be of interest or what could I do better in the review?

If you liked the report and would like to read more, feel free to follow me,

If you're not interested, you can keep scrolling or use the block function.

Roast my portfolio!

- 23 years old

- Focus on quality companies and diversification

- Would like to significantly increase the ETF share in the long term (to approx. 50%)

- Further investments in Asia are planned because I see a lot of potential there in the coming years and think that these countries will also gain political importance

- Watchlist: $2318 (-2,54 %)

$D05 (-0,9 %)

$S68 (-1,3 %)

$J36 (-2,88 %)

$SIE (-0,08 %)

Ampliación de posiciones

Como cada semana, he realizado nuevas aportaciones a mi cartera siguiendo mi estrategia de Dollar-Cost Averaging (DAC) Dinámico a través del plan de inversión de Trade Republic. Así, continúo aplicando método y disciplina a partes iguales ante un mercado volátil, especialmente en un mes de publicación de resultados trimestrales y fechas de ejecución de dividendos.

Estas han sido mis compras de la semana:

- $2318 (-2,54 %) (5 €): El sector asegurador chino sigue presionado por la incertidumbre macro y la ralentización inmobiliaria en China. Aprovechamos para invertir en la aseguradora más grande de Asia y la más tecnológica.

- $SBRE (-1,3 %) (19 €): Esta semana han publicado resultados. A los analistas no les ha gustado demasiado la previsión anual, pero siguen aumentando volumen de mercado y siendo únicos en su nicho.

- $AMP (+3,99 %) (10 €): sigue en movimientos lateralizados y muy por debajo de su valor objetivo. Este mes hemos conocido de la adjudicación de nuevos contratos internacionales.

- $PLMR (-2,74 %) (20 €): Mantiene el mismo precio de la semana pasada, así que por qué no aumentar en una empresa en la que creo.

- $ALV (+0,09 %) (10 €): está en zona de soporte y la empresa es un bicho. Hay que seguir con el plan.

¡Hasta el 2 de junio!

—-

As every week, I’ve made new contributions to my portfolio following my Dynamic Dollar-Cost Averaging (DCA) strategy through Trade Republic’s investment plan. This way, I continue applying both method and discipline in a volatile market environment, especially during a month filled with quarterly earnings releases and ex-dividend dates.

These have been my buys this week:

- $2318 (-2,54 %) (5 €): The Chinese insurance sector remains under pressure due to macro uncertainty and the ongoing real estate slowdown. A good opportunity to invest in Asia’s largest and most tech-driven insurer.

- $SBRE (-1,3 %) (19 €): Results were out this week. Analysts weren’t too optimistic about the annual guidance, but the company continues to increase market share and stands strong in its niche.

- $AMP (+3,99 %) (10 €): The stock remains sideways and well below its target price. This month, they secured new international contracts, which reinforces the company’s growth potential.

- $PLMR (-2,74 %) (20 €): Price remains unchanged from last week, so why not increase exposure to a company I believe in.

- $ALV (+0,09 %) L (10 €): Trading at a key support area. This company is a beast — no reason to deviate from the plan.

See you on June 2nd!

Plan de inversión 16/05/25

Acabo de finiquitar la configuración de mi plan de inversión semanal y que se ejecutará mañana. Siguiendo mi estrategia de DCA dinámico, las premiadas son:

- $ALV (+0,09 %) con 10€, al entrar de nuevo en precios razonables tras el reparto de dividendos.

$AMP (+3,99 %) con 10€, ya que aún se enfrenta a su resistencia en los 0,16€.- $SBRE (-1,3 %) con 5€, aunque debería dejarla en Stand by.

- $2318 (-2,54 %) con 5€ ya que aún está lejos de su resistencia.

Y entramos en una nueva compañía de seguros que me encanta. Mañana doy más detalles, que hoy se ha hecho tarde.

—-

I have just finalized the setup of my weekly investment plan, which will be executed tomorrow. Following my dynamic DCA strategy, the selected stocks are:

- $ALV (+0,09 %) with €10, as it has re-entered reasonable valuation levels following the dividend payout.

- $AMP (+3,99 %) with €10, as it is still facing resistance around €0.16.

- $SBRE (-1,3 %) with €5, although it should ideally remain on standby.

- $2318 (-2,54 %) with €5, as it remains far from its resistance level.

Additionally, we are adding a new insurance company that I’m very excited about. I’ll share more details tomorrow since it got late today.

Declaración de intenciones

A finales de marzo de 2025 tome la decisión de comenzar mis andaduras por las sinuosas rutas de la inversión. Y como inversor novel, lo hice de la mano de un sector familiar para mi: los seguros.

Por ese motivo, cerca del 75% de mi portfolio pertenece al sector.

Mi apuesta fuerte es a día de hoy $2318 (-2,54 %) , una compañía sólida afectada por circunstancias externas a su actividad. A $MAP (+1,67 %) un especial cariño y junto a $ALV (+0,09 %) , estabilizadores. $G (+0,21 %) apuntala la cartera y la estabiliza. $PHNX (-2,69 %) reparte dividendos generosos sin perjudicar su negocio y $SBRE (-1,3 %) tiene un potencial bestial, con un negocio exclusivo.

En su mayoría son empresas de la Europa Continental, dos Británicas y una China. Las cuatro primeras, de seguros generales muy orientadas a Patrimoniales. Phoenix Group está orientada a seguros de vida y Sabre a seguros premium de circulación con fuerte suscripción de motocicletas.

Fuera de los seguros, un ETF del sector de la defensa y seguridad como es $IVDF (+0,88 %) así como la española $AMP (+3,99 %) , muy ligada también a la defensa y la seguridad y que ha salido de una situación difícil por el buen camino.

¿Mi plan? Invertir en torno a 50€ semanales en estas acciones a través de un plan de inversión dinámico en Trade Republic. Cada semana variaré la porción de inversión que destinó a cada posición según su evolución.

¡Iremos viendo!

Your opinion is needed

I have these two shares, among others, on my watchlist.

What are your opinions on them?

$2318 (-2,54 %) - Ping an Insurance is an insurance group in China with a market capitalization of around EUR 110 billion

$1038 (-1,29 %) - CK Infrastructure Holdings is a Hong Kong company that invests in infrastructure companies worldwide, including in Germany

Both would fit well into my dividend strategy as solid investments

Valores en tendencia

Principales creadores de la semana