Depot review March 2024 - And on, and on, and on,...

March picks up where February left off. And before that, January, December, November,...

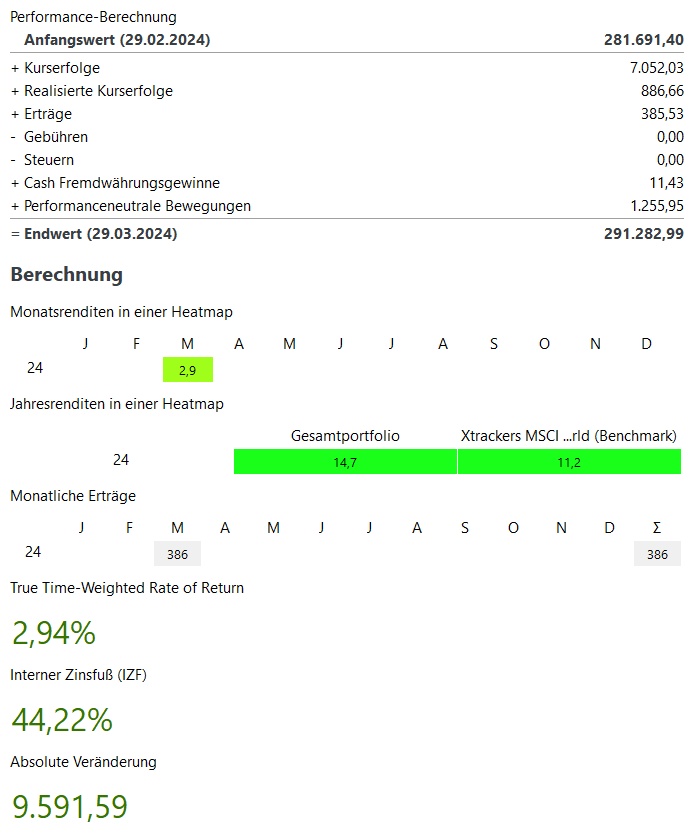

In total, March was +2,9%! This was less than in January and February and was mainly driven by the first half of March. In total, this corresponded to price gains of ~8.000€.

Winners & losers:

On the winners' side is getting really boring. In 1st place, of course: NVIDIA

$NVDA (+1,56%) with share price gains of ~€2,100. 2nd place goes to Alphabet

$GOOG (+0,31%) with €1,000. But also Bitcoin $BTC (+4,28%) also showed a strong performance with price gains of €800. The top 5 is then rounded off by two securities that I would rarely expect to see in the top 5: The MSCI World ETF $XDWD (+0,4%) and the German Bank $DBK (+0%)

On the losers' side there is a lot of tech. With Palo Alto Networks $PANW (+0,62%) and MercadoLibre $MELI (+0,62%)

two high growth tech stocks that were already at the bottom in February.

In addition Apple $AAPL (-0,23%)

Nike $NKE (-0,23%)

and Starbucks $SBUX (-0,57%) were weaker.

The performance-neutral movements in March amounted to € 1,300. As in January and February, a larger proportion is currently being spent on private expenses. Nevertheless, I was able to invest significantly more net in March than in January and February. I bought just over €2,000 in March. However, the net figure for the pure securities portfolio is a minus, as I sold my Encavis

$ECV shares after the takeover offer from KKR. As a result, ~€2,600 flowed out of my securities account, which is now in the clearing account for 4%.

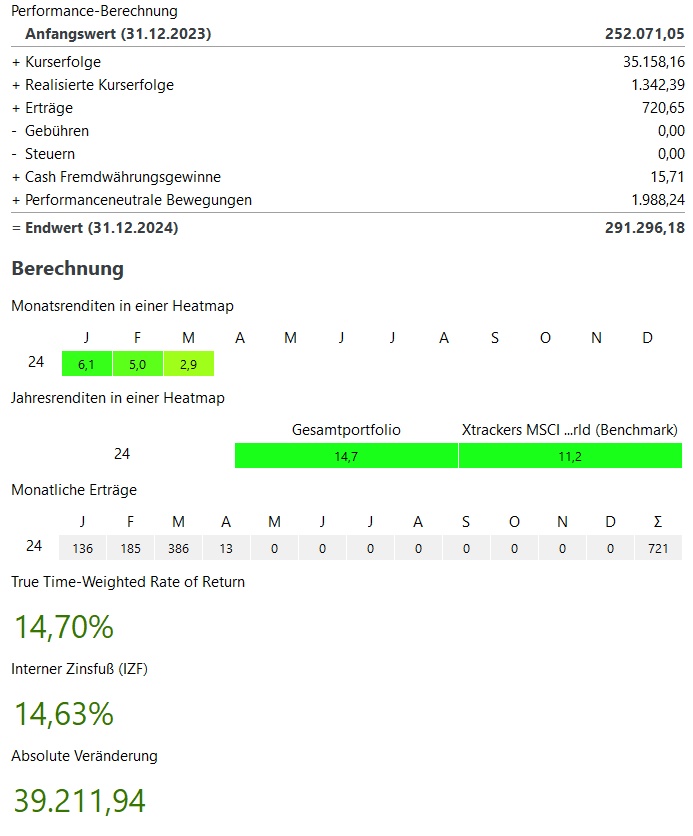

My performance for the current year is +14,7% and thus well above my benchmark, the MSCI World with 11.2%.

In total, my portfolio currently stands at ~291.000€. This corresponds to an absolute growth of ~€39,000 in the current year 2023. ~36.000€ of this comes from price gains, ~720€ from dividends / interest and ~2.000€ from additional investments.

Dividend:

- Dividends in March were +30% above the previous year at ~€350

- In the current year, the dividends after 3 months are also +30% over the first three months of 2023 at ~630€.

- In March, there was also a dividend for the first time from Meta $META (+0,44%)

Buys & Sells:

- I bought in March for approx. 2.000€

- Of which 500€ each in Hermes $RMS (+0%) and Constellation Software $CSU (+8,56%) as a first purchase

- In addition, the first few euros saveback from the Trade Republic card were also invested

- As always, my savings plans were executed:

- Blue ChipsNorthrop Grumman $NOC (+0%) MasterCard $MA (-0,17%) Salesforce $CRM (+1,22%) Deere $DE (+0,11%) Lockheed Martin $LMT (-0,46%) ASML $ASML (+2,29%) Thermo Fisher $TMO (-0,02%) Itochu $8001 (+3,69%) Republic Services $RSG (+0,63%) Hermes $RMS (+0%) Constellation Software $CSU (+8,56%)

- Growth: -

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the WisdomTree Global Quality Dividend Growth $GGRP

- CryptoBitcoin $BTC and Ethereum $ETH

- Sales there was the (involuntary) sale of Encavis in March $ECV

Even though I was only able to add €2,000 net to my portfolio in the first quarter, the snowball had a very clear effect. Nevertheless, I will of course be investing more again in the medium term.

Target 2024:

My goal for this year is to reach 300.000€ in the portfolio. Now that my portfolio is already at €291,000, I have almost reached my target as of March.

However, I am still of the opinion that the markets will soon enter a sideways trend. In my opinion, this was already slightly indicated in the second half of March.