Hello everyone,

I appreciate your feedback on my strategy.

I'm in my mid-50s and we currently put aside €2,900 every month. 1,900 goes into

$B161SX (+0,06%) to build up reserves. Current annual return 1.9%.

The aim here is to reach €50k in the next 20 months in order to be able to make the upcoming investments in the house.

As soon as this is achieved, I will reduce the savings in favor of the ETF's and in the next 5 years we will have paid off all debts and the free amounts will also go into asset accumulation.

Dream goal at the start of retirement 500T€UR. 😉

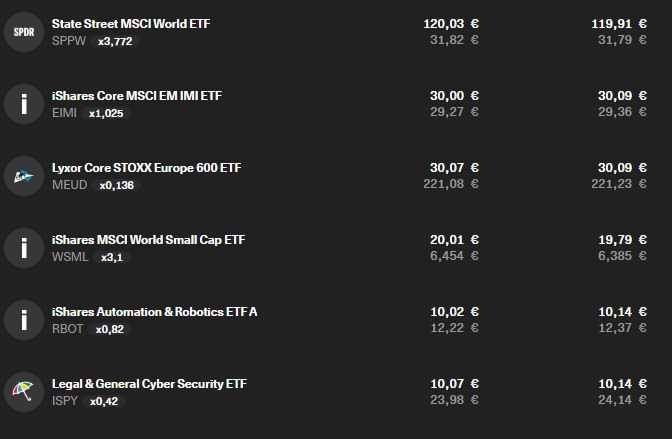

50% of the remaining €1,000 will go into

and 10% each in

$RBOT (+0,64%) and

I want to monitor the performance of the two momentum ETFs to see whether they outperform the MSCI World and the Eurostoxx600. Over the next 12-24 months, I will then switch depending on the results.

I am still holding on to the existing individual stocks in order to sell them at a (larger) profit and have no time pressure here, even with the stocks in the red.

My price target is

$AIR (+0,87%) 240-250€

$CCL (+0,73%) at 28-30€

$LHA (+0,06%) at 9-10€

and the rest should bring 20-30% when I sell them.

This year I have still been working a lot with direct investments (currently +20% in 2025) but will continue to reduce this. The funds released will then go into the above-mentioned ETFs according to the above key.

I'm leaving out crypto, as the topic doesn't appeal to me, and commodities are too volatile for me, and gold is currently too expensive, even though many people are saying that we'll soon be at 5T€UR.

I look forward to your feedback or questions if something is unclear.

BG