This should have been my last purchase in this portfolio for this year; from March onwards, this portfolio will only run with savings plans, financed from the distributions and dividends. Savings are made, $EQQQ (-0,55%) , $WITS (-0,59%) and $IUIT (-0,59%) Let's see what it looks like at the end of the year.

JPM NASDAQ Eqt Prem Actv ETF D

Price

Discussão sobre JEPQ

Postos

72Trade Republic

Are the dividend payments from $JEPQ (-0,06%) and $JEGP (+0,2%) not included in the overall performance?

💡 Building society loan (2.15 %) as moderate debt leverage for income ETFs - opinion poll*

**Summary:**

I plan to draw down a building society loan of **€16,800** **without residential use** and invest specifically in **3 income-distributing ETFs**.

The aim is **cashflow-based repayment within approx. 24 months**, not buy & hold for 10 years.

---

## 🏦 Financing (fixed)

* Loan amount: **16.800 €**

* Debit interest rate: **2,15 %**

* Term (formal): **10 years**

* Special repayment: **possible monthly at any time**

* Monthly interest charge: **≈ 30 €**

* Strategy: **Dividend income + special repayment**

*My goal repaid after 24 months loan

📊 Planned investment (debt capital)

**Equalized distribution: € 5,600 each**

1️⃣ **iShares World Equity High Income Active UCITS ETF**

ISIN: IE000KJPDY61 $WINC (+0,25%)

→ Global equity income, high distribution (mainly quarterly)

2️⃣ **JPM Nasdaq Equity Premium Income Active UCITS ETF**

ISIN: IE000U9J8HX9 $JEPQ (-0,06%)

→ Nasdaq exposure + option premiums, **monthly distribution**

3️⃣ **JPM Global Equity Premium Income Active UCITS ETF**

ISIN: IE0003UVYC20 $JEGP (+0,2%)

→ Globally diversified + option strategy, **monthly distribution**

---

💸 Expected cash flow (conservative)

* Total net dividends: **≈ 90-108€ / month**

* Interest covered: **yes**

* Pure repayment portion from distributions: **≈ 60-78€ / month**

* Additional repayment planned from own funds (dividends from the existing portfolio are diverted to repayment)

➡️ **Target:** Full repayment in **~24 months**, then cash flow free.

🧠 Risk classification (deliberately chosen)

* No margin, no Lombard

* Fixed interest rate < expected cash flow

* Income ETFs → limited upside, but predictable return

* Main risks:

* Reduction in distributions

* Sideways/downwards markets

* Option strategies limit price gains

💸 Cash flow side (income ETFs)

Conservative net distribution yield of the ETF basket:

≈ 6.5-7.0% net p. a.

corresponds to 650-700 basis points

➡️ Spread (yield - interest rate):

+435 to +485 basis points

🧠 Interpretation (for the community)

No classic growth lever

No price momentum required

Leverage based purely on carry

Comparable with:

conservative credit spread

structured income overlay

Yes, a savings plan on the Msci world could be in the portfolio after 2 years with a higher book value, but after 2 years I have one the shares in the 3 ETFs and monthly cash flow free

---

## ❓ Open questions for the community

* How do you see the project?

* Is the **2.15% fixed interest rate** a justifiable "leverage" from your point of view?

* Would you set the weighting of the three ETFs differently?

* Am I overlooking a structural risk?

I am very happy to receive critical opinions.

The goal is not "get rich quick", but controlled cash flow with a quick payback

"Can I also pay the loan from my earned income should the planned cash flow fail to materialize?"

If that's the case, I don't think you're overleveraging yourself.

Regrouping

As I had already planned this morning, I have parted with the $QYLE (-0,31%) and bought the $WINC (+0,25%) and bought the I also took the opportunity to get rid of the $JEGP (+0,2%) which performed even worse than the Global x for me. Overall, I came out of both with a red zero.

In addition to the ishares, 50 of the proceeds from the $ASWM (-2,17%) went into the portfolio, of which I now have 100.

In the high yield area, I then added the $TDIV (-0,21%) as the largest position and the $YYYY (-0,93%) the $JEPQ (-0,06%) and the $SXYD (+0,19%) .

That's how it's going to stay for now; in total, that's around 8-9% of the total portfolio in this area.

As I bought the Winc before the ex-date, but sold the global x afterwards, I can still take the dividends from both this month. As a result, I even have a small gain on the global x overall.

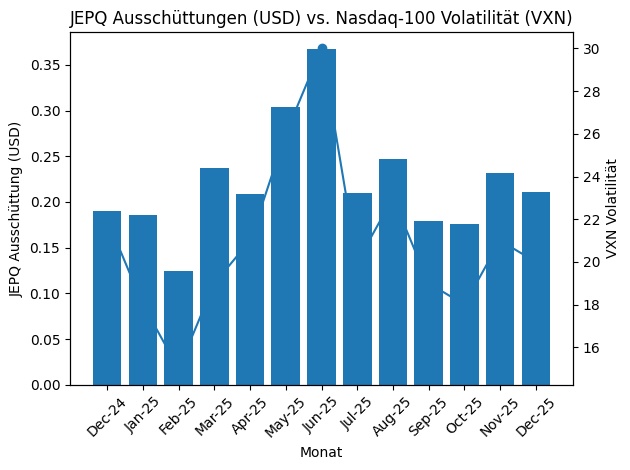

Why I hold JEPQ - VXN, USD & cash flow

📊 Why I $JEPQ (-0,06%) hold - VXN, USD & cash flow

Briefly my thoughts on JEPQ (Nasdaq Equity Premium Income ETF):

1️⃣ VXN = key to distribution

JEPQ does not live from the Nasdaq itself, but from the Nasdaq 100 volatility (VXN).

If the VXN rises, option premiums become more expensive → higher distributions.

Quiet tech phases = weaker months, but no structural problem.

(Insert VXN chart here)

2️⃣ Distribution ≠ Yield

JEPQ is not a classic dividend ETFbut monetizes volatility.

High distributions are mainly made in nervous / sideways markets.

In strong tech bull markets, price gains are capped.

🔵 JEPQ thrives on precisely these movements

- VXN > 22

- → Very good option premiums

- → High distributions (e.g. May/June 2025)

- VXN 18-20 (now!)

- → Decent, but no peak distributions

- VXN < 16

- → weak premiums

- → distributions like Feb 2025

3️⃣ Don't forget the currency (USD / EUR)

JEPQ distributes in USD distributions.

The following applies to us EUR investors:

- weak euro → more € in the account

- strong euro → same USD amount feels smaller

👉 Volatility and exchange rate determine the real cash flow.

Unfortunately, we euro investors are currently in the red, but the currency pair can turn around again. In the base currency, things are going exactly as they should

✅ Why I hold JEPQ

- Income component alternative to bonds :-) not a growth ETF

- Profits from tech volatility

- Complements JEPI (VIX) very well

- No timing, just let it run

At a current price of approx. 23,02 € my 1,866 shares have a market value of around 42.955 €

The result: the "double leverage"

The combination of the higher dividend yield and the tax advantage results in a huge difference:

- The cash flow advantage: per year 1,254.66 more net cash available.

- Monthly effect: That's 104.55 € extra per month that will be reinvested in my portfolio (World/S&P 500) through the tax savings alone.

- Effective tax rate:I pay on the JEPQ distributions only approx. 18,46 % taxes on the JEPQ distributions, while the bond is fully taxed at 26.375%.

Jp's management is extracting a decent premium for us from the vola of the VXN, as a comparison of the VXN with the distribution history shows.

The real victory of this investment lies in the total return and this takes a little time :-)

In any case, the distribution in February rocks again

@Dividendenopi alternative to bonds for you?

But hey, at least not the garbage from GlobalX

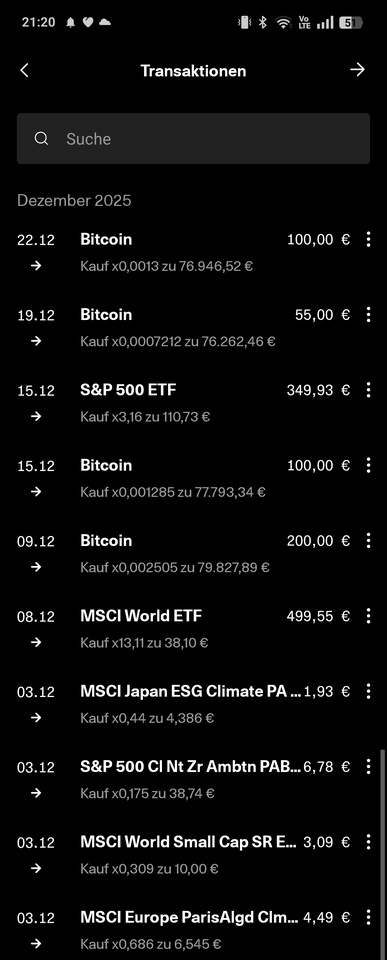

Mail from the midfield

The last purchase for this year is through 😅

Oh man, the yield is just like that:

Info about overnight money

This thing is slumbering in my dormant BAV and has really stepped on the gas after a few bad years:

That's pleasing ✅

But owed to the covered call ETFs

$JEGP (+0,2%) and $JEPQ (-0,06%)

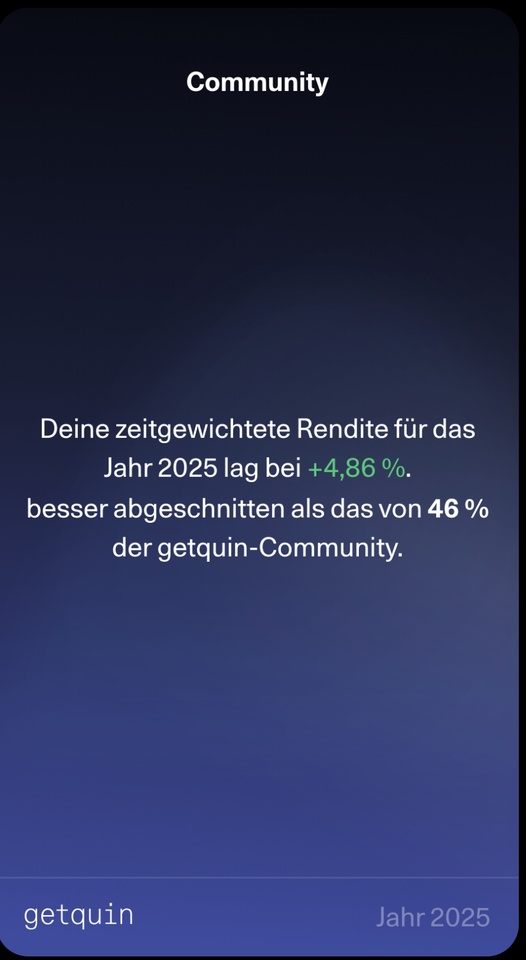

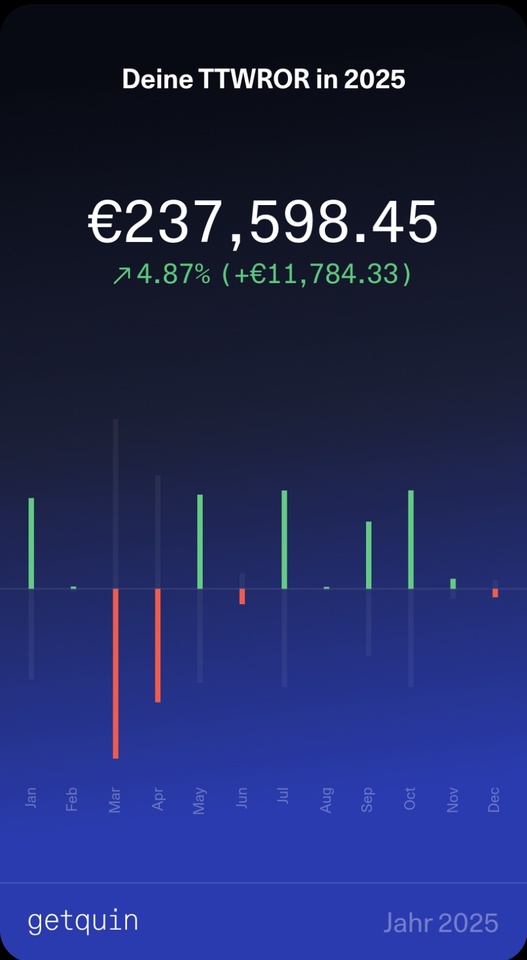

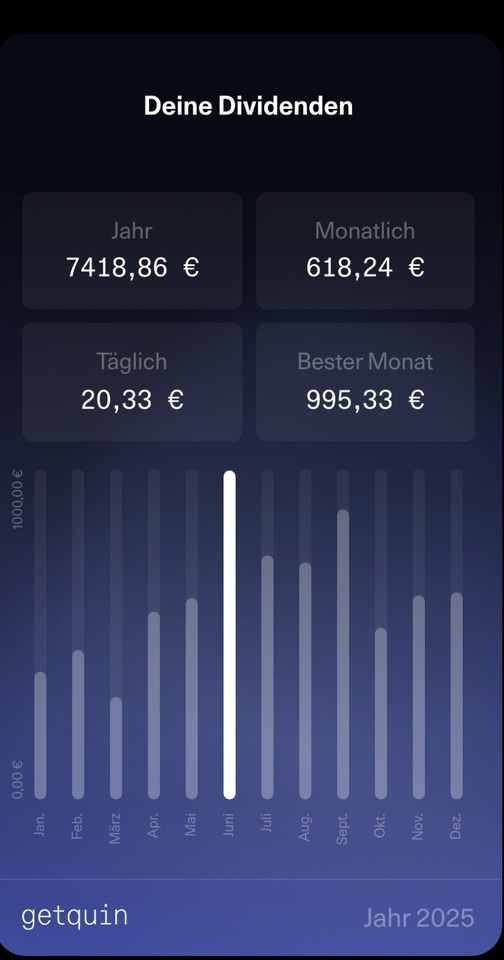

Yes, the goal for next year is clear, the 1/4 mile ✅

After the bad time in March April to reorganize all in all a conciliatory conclusion for me

I'm looking forward to next year.

It could be better, but it could also be worse.

We'll see.

+ 2

50k Broken just before Christmas!

My goal for this year was to reach a portfolio value of €40,000. I more than met that goal. In January, my portfolio was still at €14,000. This year I deliberately deposited a lot and worked hard. Step by step, the amount continued to grow. This eventually resulted in a portfolio value of €50,000. The fact that I was able to achieve this at around age 22 makes it extra special. Secretly I am quite proud of this. On to more highlights!

(For the sourpusses among us, the % on getquin of 3% total profit/loss is not correct, this is +-10%. Still not shockingly much of course, but the honest story 🙂 ).

$BTC (-2,12%)

$VWRL (-0,25%)

$TDIV (-0,21%)

$JEGP (+0,2%)

$JEPQ (-0,06%)

$VUSA (-0,39%)

Why the heck does he have Coverd Call ETFs in his portfolio? TL:tr

🛡️ My "3-pillar portfolio": cash flow as an interest shield before 2028

Hello community,

Since there are controversial discussions under every post about CC ETfs

-> here are my reasons why I have them in my portfolio (and yes I have ki in the conversation)

At the age of 43, I am not only concerned with growth, but above all with risk management - because my real estate interest commitment expires on 30.09.2028, with a remaining debt of € 147,000.

My goal is to set up the portfolio in such a way that I can either offset the refinancing costs or pay off the debt completely.

1. the logic: cash flow meets growth

My investments are divided into three pillars with a clear function:

The cash flow engine

$JEPQ (-0,06%) & $JEGP (+0,2%) /JEPI

Generation of high monthly income (option premiums)

The growth cores

$HMWO (-0,47%) (MSCI World) & $VUSA (-0,39%) (S&P 500)

Long-term build-up of capital and substance

2. the strategy:

Two phases for the JPM cash flow (approx. 450 € net/month)

I use the high monthly net income from JEPQ/JEPI flexibly in two phases to achieve my goals:

🟢 Phase 1: Accumulation (Currently until approx. 2027)

* Measure: The monthly JPM distributions are reinvested directly into the VUSA ETF.

* Purpose: Utilize interest rate arbitrage (pay 1.88% interest, generate 8-10% gross return) to accelerate growth capital. The reinvestments are expected to increase the VUSA portfolio by over € 30,000 by the reporting date!

* In addition: The HMWO will continue to be built up separately with its own savings rate.

🔴 Phase 2: The interest shield (from 2028)

* Measure:

Reinvestment ends. The JPM cash flow is used to offset the increased monthly burden of the follow-up financing.

* Result: Even with a pessimistic 5.0% interest rate, the additional monthly burden of approx. +€227 is more than doubly compensated by the JPM cash flow (approx. €450 net).

Growth in VUSA and HMWO can continue.

3. the ultimate flexibility in October 2028

Thanks to the deposit cushion of an estimated € 259,000 built up over the next few years, I can choose freely on the refinancing date:

* Option A (Further growth): finance € 147,000 at the then applicable interest rates and subsidize the higher rate with the JPM cash flow. The entire growth deposit is retained.

* Option B (debt-free): Partially liquidate the deposit and pay off the €147,000 remaining debt in full. The property would be debt-free and my rental income of €520 would be pure surplus.

4. the tax advantage

Since all my ETFs (JEPQ, JEPG, VUSA, HMWO) receive the 30% partial exemption for equity funds, there is no tax disadvantage for the high-yield JPM funds compared to the growth stocks.

In addition, the rising interest costs of the property can be offset against the total income for tax purposes as income-related expenses from 2028.

Conclusion: I deliberately trade maximum capital growth in strong bull markets for financial security and compensation with a calculable real estate debt risk.

The JPM ETFs are

my active "interest rate buffer". -> we'll see if that works out

@Koenigmidas -> we've already had this conversation on another channel😅

I don't understand the point. Almost every normal ETF yields more. 🤷🏼♂️

Títulos em alta

Principais criadores desta semana