📊 Why I $JEPQ (-0,06%) hold - VXN, USD & cash flow

Briefly my thoughts on JEPQ (Nasdaq Equity Premium Income ETF):

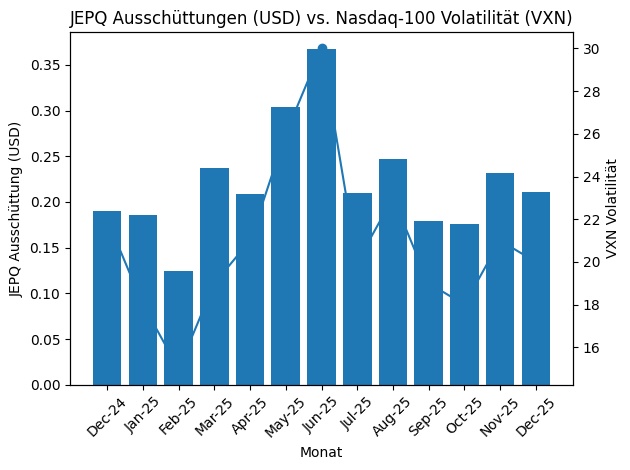

1️⃣ VXN = key to distribution

JEPQ does not live from the Nasdaq itself, but from the Nasdaq 100 volatility (VXN).

If the VXN rises, option premiums become more expensive → higher distributions.

Quiet tech phases = weaker months, but no structural problem.

(Insert VXN chart here)

2️⃣ Distribution ≠ Yield

JEPQ is not a classic dividend ETFbut monetizes volatility.

High distributions are mainly made in nervous / sideways markets.

In strong tech bull markets, price gains are capped.

🔵 JEPQ thrives on precisely these movements

- VXN > 22

- → Very good option premiums

- → High distributions (e.g. May/June 2025)

- VXN 18-20 (now!)

- → Decent, but no peak distributions

- VXN < 16

- → weak premiums

- → distributions like Feb 2025

3️⃣ Don't forget the currency (USD / EUR)

JEPQ distributes in USD distributions.

The following applies to us EUR investors:

- weak euro → more € in the account

- strong euro → same USD amount feels smaller

👉 Volatility and exchange rate determine the real cash flow.

Unfortunately, we euro investors are currently in the red, but the currency pair can turn around again. In the base currency, things are going exactly as they should

✅ Why I hold JEPQ

- Income component alternative to bonds :-) not a growth ETF

- Profits from tech volatility

- Complements JEPI (VIX) very well

- No timing, just let it run

At a current price of approx. 23,02 € my 1,866 shares have a market value of around 42.955 €

The result: the "double leverage"

The combination of the higher dividend yield and the tax advantage results in a huge difference:

- The cash flow advantage: per year 1,254.66 more net cash available.

- Monthly effect: That's 104.55 € extra per month that will be reinvested in my portfolio (World/S&P 500) through the tax savings alone.

- Effective tax rate:I pay on the JEPQ distributions only approx. 18,46 % taxes on the JEPQ distributions, while the bond is fully taxed at 26.375%.

Jp's management is extracting a decent premium for us from the vola of the VXN, as a comparison of the VXN with the distribution history shows.

The real victory of this investment lies in the total return and this takes a little time :-)

In any case, the distribution in February rocks again

@Dividendenopi alternative to bonds for you?