Growth, cash, and a booming market

I’ve been looking closely at two of Southeast Asia’s fastest-growing tech champions: Sea and Grab. Both dominate their respective ecosystems, both are profitable or on the verge of it, and both hold strong cash positions. But as much as I like the growth stories, the valuations tell a slightly different story. These are fair businesses right now, not necessarily cheap, also not expensive, just balanced on the edge between quality and risk.

Starting with Sea, the e-commerce and digital powerhouse behind Shopee, Garena, and SeaMoney. Estimates suggest top-line growth between 20–30% for the next three years, driven by Shopee’s expansion, rising monetization, and a rapid fintech ramp-up through SeaMoney. Garena, once the group’s profit engine, is stabilizing and still provides useful cash flow. Sea holds over $8 billion in cash, which gives it breathing room and flexibility. Free cash flow is growing in the mid-double digits, and the FCF yield of roughly 3–4% looks set to expand quickly if growth stays consistent. The business is scaling beautifully, but I can’t call it cheap. At these levels, execution needs to remain flawless to justify the current multiple. In the past, growth has been suppressed and pretty much flat; now it’s reaccelerating, but everything has to go well. That’s why I believe the stock isn’t a bargain right now. However, the story might change at 10–20% cheaper.

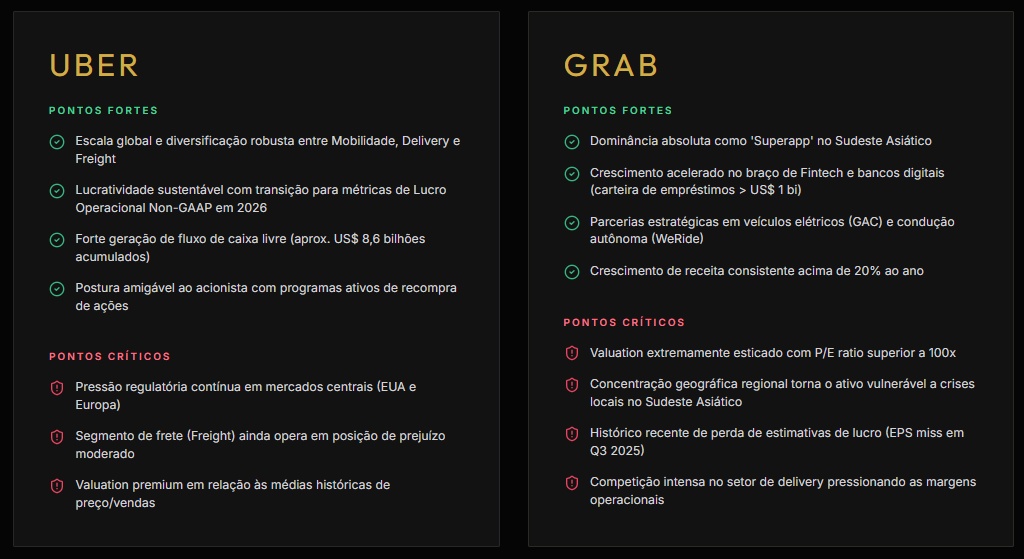

Then there’s Grab, Southeast Asia’s well-known “superapp.” Mobility, deliveries, and financial services are all doing pretty well. The company is what you get when you put Uber and Amazon together, then place it somewhere in Asia. Revenue is growing about 20% year over year, the company has close to $5 billion in cash, and free cash flow has turned positive with improving margins. On paper, it’s a very similar story to Sea: high growth, expanding profitability, and an FCF yield around 3%. The difference is that Grab feels very similar, but less compelling based on financials, even though the story is exciting.

Sea offers more upside thanks to its successful multi-segment business model and faster scaling, outperforming Grab mainly on valuation and financials. Both are fairly valued, not screaming buys, but still worth watching for those occasional deep pullbacks that are common in EM growth names. Just consider that Grab already traded around $3.60, and it can move very fast in those regions.

I’m keeping both on my radar. The fundamentals are very interesting, with strong balance sheets, clear growth, and rapidly improving cash flows, but I’d rather wait for the market to give me a better entry. Growth is fantastic, yes, but fair is not cheap, and patience could be key here.

$SE (-3,65%)

$GRAB (-1,25%)