So, after my lukewarm stumble onto the stage of the community recently, now for real:

Hello everyone (friendly nods to all),

I've been a mostly silent reader for a while now, but I'd like to introduce myself - even if I don't know what I'm up to - in keeping with local custom:

I am 55 & a civil servant in the Federal Civil Service, which puts me in the fortunate position (I hope) of not having to rely on additional income from investments for a materially bearable retirement (in twelve years' time, I would just about reach retirement without deductions after 40 years in the civil service). Investment is therefore essentially a consumption alternative, a safety cushion and - later - intended for my sons (living with their mother, 17 & 13 years old; each with their own portfolios / savings plans). My investment horizon is therefore open ended (or determined biologically or by the legitimate major needs of the offspring).

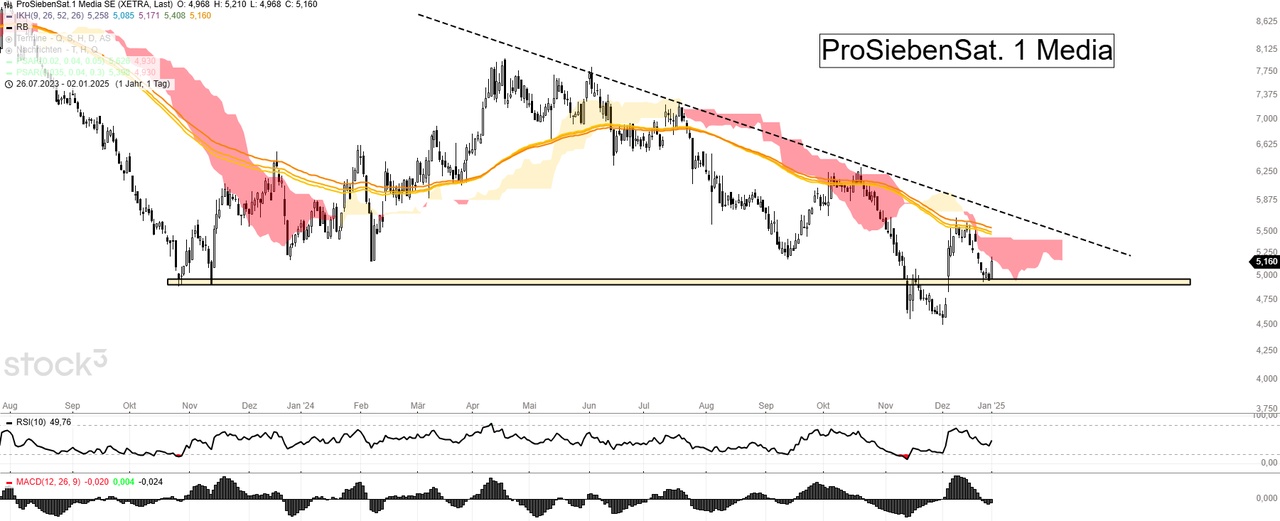

My investment history - still perceptible in the portfolio presented here - begins in 1996/1997 with the first (and later unfortunately also the second) placement of the $DTE (+0,2%) T-share and the IPO of $PSM (-0,29%) ProSieben (which has since more than made up for its initial investment through dividends, good boy). At some point, he inherited the current e.on position from his grandparents $EOAN (+0,26%) e.on position and a position in $VOW3 (-0,71%) Volkswagen, which I sold several years later on the advice of my savings bank at the time (bygones).

Then nothing for a long time (studies/traineeship, career start - I was "investing in my current account" and couldn't even manage to process my business trip expenses on time, tststs).

With a wife and children came the need to make provisions (the little guys simply cost a tidy sum through the cycle), which I initially did through sporadic ad hoc investments:

In particular hubris, at the beginning of the subprime crisis I trusted the investment banks to have everything under control and bought shares in $DBK (-0,83%) Deutsche Bank (close to ATH), Bear Stearns and Merrill Lynch (the relics can be found as a minus at $BAC (-0,88%) Bank of America for Bear Stearns and - invisibly - a tax loss carryforward to offset the now quite respectable $JPM (-0,79%) J.P. Morgan position for Merrill Lynch), $DBK (-0,83%) with additional purchases slowly creeping back into a "perhaps at some point back to zero" zone.

Otherwise, a number of active funds ($n/a LU0557858130, $n/a LU1143163779, $n/a IE00BG7PHW03, $n/a (+0,05%) LU1496713741, $n/a (-0,11%) DE0008474750, $n/a GB0030932676, $n/a (-0,5%) LU1864952335 and predecessors), of which only $n/a (-0,44%) Pictet Water had actually performed noticeably positively on a time-weighted basis.

From around 2015, I then gradually started to populate the current portfolio with various equity and ETF savings plans at ING ($GOOG (-1,07%) Alphabet C, $AAPL (-0,91%) Apple, $KO (-0,34%) Coca-Cola, $NESN (+0,4%) Nestlé, $BAYN (-0,98%) Bayer (ouch!), $SIE (-0,45%) Siemens, $DIS (-0,82%) Walt Disney, $PFE (-0,17%) Pfizer, $PR1J (-0,53%), $FLXC (+1,09%), $FLXK (-1,22%), $EXS1 (-0,45%), $LCUK (-0,29%), $C060, $XMUS (-0,87%), $DBXW (-0,86%), mostly at 50 euros/month), supplemented by a few nicely timed individual purchases in $AAPL (-0,91%) , when it was still trading at around 80 euros before the 3:1 stock split, as well as $MT (-0,36%) AcelorMittal and $BHP (-0,12%) (mini position, but with a nice dividend yield since then).

With supply chain problems and inflation emerging at the end of corona/beginning of Ukraine, I then started to invest in another portfolio, the actually far too expensive $SPAG (-0,61%) iShares Agribusiness and $EXV6 (-0,28%) iShares STOXX Europe 600 Basic Resources as a hedge against the rising cost of living that had gone wrong (had bet on more pronounced sectoral greed-flation).

Since I have since followed the recommendations of $VWCE (-0,74%) resp. $ACWI (Glashaus!) in the meantime, the aggregated lump and the $AAPL (-0,91%) and $GOOG (-1,07%) was getting a bit scary, but I didn't want to touch the corresponding equity savings plans (more on this in a moment), I put my basic trust in the long-term out-performance of the US equity market into practice by investing in two "equal weight" index funds, namely with $WEBA (-1,16%) on the NASDAQ100 (also with a savings plan) and $XDEW (-0,73%) on the S&P500 (one-off investment only).

Some of this, especially the earlier investment history, is foreign to my Getquin portfolio history, as I only entered this after a portfolio reorganization in early 2023.

Over the years, my employer has steadily introduced stricter regulations for private financial transactions, which currently makes it practically impossible for me to invest in individual names or funds with certain predominant industry shares. However, in an exemplary manner under the rule of law, previously existing savings plans were protected in the respective iterations of the tightening, so that I jealously continue the remaining share savings plans (see above lump at $GOOG (-1,07%) and in particular $AAPL (-0,91%)).

I currently save monthly as follows (savings rate): Grandfathering: $GOOG (-1,07%) (100), $AAPL (-0,91%) (50), $DIS (-0,82%) (50), $PFE (-0,17%) (50), $KO (-0,34%) (50); "regular": $VWCE (-0,74%) (currently 520 with annual 4% dynamic), $SPAG (-0,61%) (100), $WEBA (-1,16%) (100), $EXV6 (-0,28%) (100), $10AJ (-0,74%) (100) and - before first-time execution - (100). $SDIP (-0,65%) (100).

In addition, I have reflected certain market assessments at the respective point in time through individual purchases in country ETFs (long-term catch-up potential of the emerging markets through $HMEF (-0,8%), $FLXC (+1,09%), $FLXK (-1,22%) - $FLXI (-0,87%) was now too expensive for me and the Indian economy was not sufficiently represented by companies listed there; the sleeping innovation giant Japan through $PR1J (-0,53%), "luxury always works" even in times of inflation through $DX2G (-0,28%)Europe - especially CH and UK - as a general counterweight to the US through $VEUR (-0,41%) and the sensible Nordics by $XNZN (-0,37%)), so that there is now a colorful bouquet of ETFs. However, I am not fundamentally dissatisfied with this, especially as far as these are distributing & savings plan-capable in my ING portfolio, so that their distributions (from 75 euros) are automatically reinvested ($VEUR (-0,41%) - is so large that this could work for each of the quarterly distributions, $DX2G (-0,28%), $PR1J (-0,53%)).

I think that as long as I am still subject to my employer's investment restrictions, I will only make marginal changes to this. For a "fire and forget" portfolio, however, I could imagine switching to a 70/20/10 portfolio in the medium term. $WEBG (-0,9%), $HMEF (-0,8%), $SDIP (-0,65%) (@ING: please $SDIP (-0,65%) savings plan, thank you!). Let's see what the end of PFOF brings on the cost side, especially for savings plans.

So, that's it; thanks for your patience and perseverance. You're welcome to give me tips, but as I said, my hands are largely tied (and I don't think much of the crypto tulip bulbs until they become an actual means of payment, not just for buying sinister services on the dark web)...

Here's to a successful investment community (&thanks for having me)!