At 53 billion euros, the 40 DAX companies are likely to pay out almost one billion euros more this year than a year ago - more than ever before.

The reason for the strong development is high consolidated profits and unexpectedly rising dividends at a good dozen companies, including $ALV (-1%) Allianz, $MUV2 (-1,26%) Munich Re and $RHM (+1,13%) Rheinmetall.

At 109 billion euros net profit, the DAX companies are likely to have earned as much in 2024 as in the previous year, according to Handelsblatt calculations. Slump in earnings for the three car manufacturers $BMW (-2,17%) BMW, $MBG (-1,25%) Mercedes and $VOW (-3,38%) VW will be offset by companies in other sectors, in particular the major insurers Allianz, Munich Re and $HNR1 (-0,79%) Hannover Re, but also $DTE (-0,64%) Deutsche Telekom, $HEN (-0,96%) Henkel and $EOAN (-1,11%) Eon.

More than a dozen DAX companies have announced higher dividends than the market had previously expected. For example $ALV (-1%) 15.40 euros per share after 13.80 euros in the previous year. Analysts had forecast just under 15 euros. The insurer is thus distributing just under six billion euros. This is a record in the German corporate landscape.

The biggest jump is at $MUV2 (-1,26%) Munich Re: The reinsurer is increasing its dividend by five euros per share to 20 euros.

The two healthcare specialists $FRE (+0,25%) Fresenius and $FME (-0,8%) Fresenius Medical Care, the brand manufacturer $HEN (-0,96%) Henkel, the automotive supplier $BTR Continental, the $CBK (-2,79%) Commerzbank, $RHM (+1,13%) Rheinmetall and $HNR1 (-0,79%) Hannover Re have raised their dividends, in some cases significantly more than expected. This is also due to rising profits, which justify a higher profit share for shareholders.

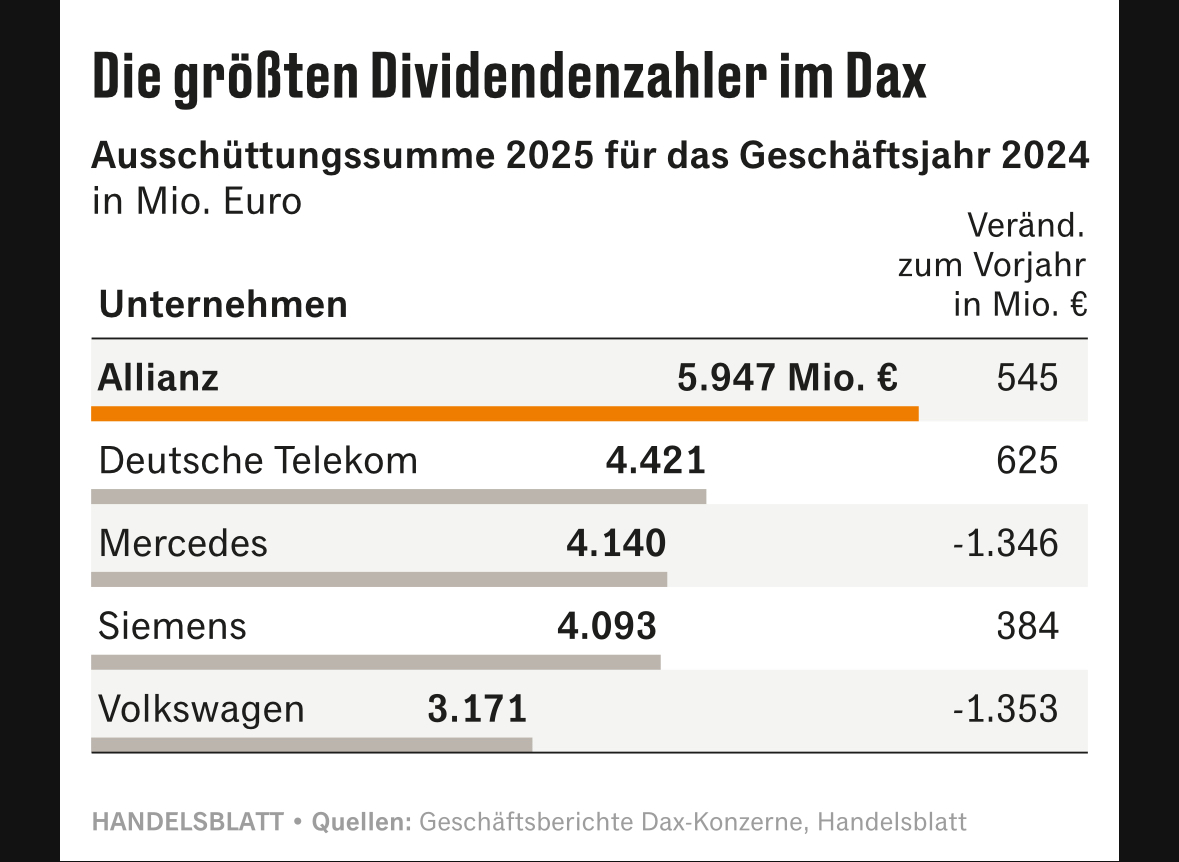

The largest dividend payers in the DAX are

Like the car manufacturers, a number of companies in the DAX remain below the usual international payout ratios, including the family-run groups $BEI (+2,28%) Beiersdorf and $MRK (-2,54%) Merck. They pass on less than 30 percent of their profits. This leaves enough of a buffer so that dividends do not have to be reduced immediately in more difficult times.

Germany's most valuable group, $SAP (+0,58%) SAP, with a payout ratio of 85%, is pushing the limit: net profit of 3.1 billion euros in the past year compares with a total dividend payout of 2.7 billion euros. However, the profit was burdened by a one-off effect.

So far, a total of 20 companies have increased their dividends, with only $BAS (-2,28%) BASF and the three car manufacturers. Four companies have yet to do so: $RWE (+0,32%) RWE, $SY1 (-0,03%) Symrise and $VNA (-0,63%) Vonovia are likely to increase their dividends, while analysts expect $PAH3 (-0,88%) analysts expect a reduction at Porsche Holding.

Source (excerpt) & chart: Handelsblatt, 15.03.25