$KSPI (+0,16%)

$NCLH (-0,04%)

$STNE (+4,1%)

$BEI (-1,17%)

$SE (-0,92%)

$ONON (-1,46%)

$TGT (+3,33%)

$GTLB (-4,77%)

$CRWD (-1,02%)

$BAYN (-3,48%)

$WIX (+8,2%)

$ADS (-6,51%)

$AVGO (+0,29%)

$DHL (+1,14%)

$R3NK (+3,12%)

$JD (-1,25%)

$BILI (+2,41%)

$1913 (-0,49%)

$MRK (+0,97%)

$MRVL (+1,28%)

$GPS (+2,89%)

$COST (-0,02%)

$IOT

$LHA (-0,08%)

Merck

Price

Discussione su MRK

Messaggi

35Quarterly figures 02.03-06.03.26

There is always something to leverage

After I made a mistake with $MRK (+0,97%) last year and no longer expect to see a 25% increase in a short period of time, I quickly regrouped and made up the loss more than twice over.

Amazon's share price was literally crying out for a small jump.

A little risk is definitely fun.

Now - after triggering the stop - I hope that the price corrects a little again👀

No trading day without Drama👉🏻👈🏻🥹

Partnership for AI and data-driven drug development

Hello, my dears,

Siemens is a must-have for me, so I'm staying invested.

Siemens and Merck have deepened their strategic partnership through a new Memorandum of Understanding to accelerate the digital transformation in the life science industry.

The Memorandum of Understanding (MoU) focuses on the development of integrated software solutions based on automation, data and artificial intelligence (AI). The aim is to network research, development and production of new active ingredients more closely and thus accelerate them. The partnership marks the first use of the technology that Siemens acquired as part of the Dotmatics takeover in July 2025.

As part of the partnership, digital solutions will be developed to close existing gaps in drug discovery and biotech manufacturing workflows. To this end, Software-as-a-Service (SaaS) products from Merck will be linked with the Siemens digital ecosystem. As part of an initial pilot project, Merck's AI tools and digital applications will be made available in Luma. Luma is an AI-supported software (Scientific Intelligence Platform) from Siemens that was acquired with the Dotmatics takeover. It will enable scientists to order products in a single environment while accessing the digital tools and relevant information they need to make faster, data-driven decisions.

Building on this pilot project, Siemens and Merck are planning further joint projects and aiming for even closer integration in the long term, such as intelligent data management tools and user-friendly interfaces that make it easier for scientists to use complex procedures. In addition, both partners are exploring the development of digital marketplaces through which customers can access complementary technologies and services.

S&P 500 - catch-up potential?

In the S&P 500, 224 out of 500 shares are in the red this year. "Welt" has analyzed which stocks have the potential to catch up.

The criteria:

The stocks must have lost at least 20 percent in price since the beginning of the year, have at least double-digit price potential according to analysts' estimates and also be recommended as a buy by at least 50 percent of augurs.

The candidates (selection):

$UNH (+0%) - United Health

$DECK (-0,76%) - Deckers Outdoor

$UPS (+1,11%) - UPS

$HAL (-1,02%) - Halliburton

$MRK (+0,97%) - Merck

$NCLH (-0,04%) - Norwegian Cruise Line

$IQV (+0,43%) - IQVIA Holdings

Source: Welt, 14.05.25 (excerpt) | Image: ChatGPT

Dates week 15

As every Sunday, the most important news from the past week, as well as the dates for the coming week.

Also as a video:

https://youtube.com/shorts/dPPeUQiYKaA?si=J8OBGoP_bVjrvo4T

Monday:

The Darmstadt-based pharmaceutical company $MRK (+0,97%) Merck buys a biotech cancer specialist from the USA. The acquisition is Springworks. A total of 3 billion euros is said to have been invested.

As expected $RHM (+3,08%) Rheinmetall was able to significantly increase its profit. Expectations were even exceeded, with operating profit increasing by 49% to 199 million euros.

Tuesday:

The logistics group $DHL (+1,14%) DHL can perform better than expected. EBIT rose by 4.5% to 1.37 billion euros in the first quarter. Earnings also increased from 63 (previous year) cents per share to 68 cents.

Wednesday:

Inflation in Germany is falling almost to the ECB target. In April, the inflation rate was probably 2.1% compared to the same month last year. The inflation rate is recorded by Destatis. However, experts had even expected a fall to 2.0%.

Donald Trump's tariff policy is having a full impact on the US economy. While experts expected growth, the US economy is shrinking unexpectedly. GDP shrank by 0.3% (annualized in the USA) in the 1st quarter. In the 4th quarter of 2024, the growth rate was still 2.4 %.

https://www.theguardian.com/business/2025/apr/30/economy-gdp-q1-trump-tariffs

Thursday:

The Bank of Japan leaves the key interest rate at 0.5%. It justifies this with the tariffs imposed by the USA and a lower growth forecast.

https://www.reuters.com/business/boj-keep-rates-steady-cut-growth-forecasts-2025-04-30/

Friday:

A surprisingly strong labor market lifts stock markets worldwide on Friday afternoon. Despite Donald Trump's tariff announcements, many new jobs were created in the USA and the unemployment rate remained constant.

These are the most important dates for the coming week:

Tuesday: 11:00 Producer prices (EUR)

Wednesday: 20:00 Interest rate decision (USA)

Thursday: 13:00 Interest rate decision (UK)

Can you think of any other dates? Write it in the comments 👇

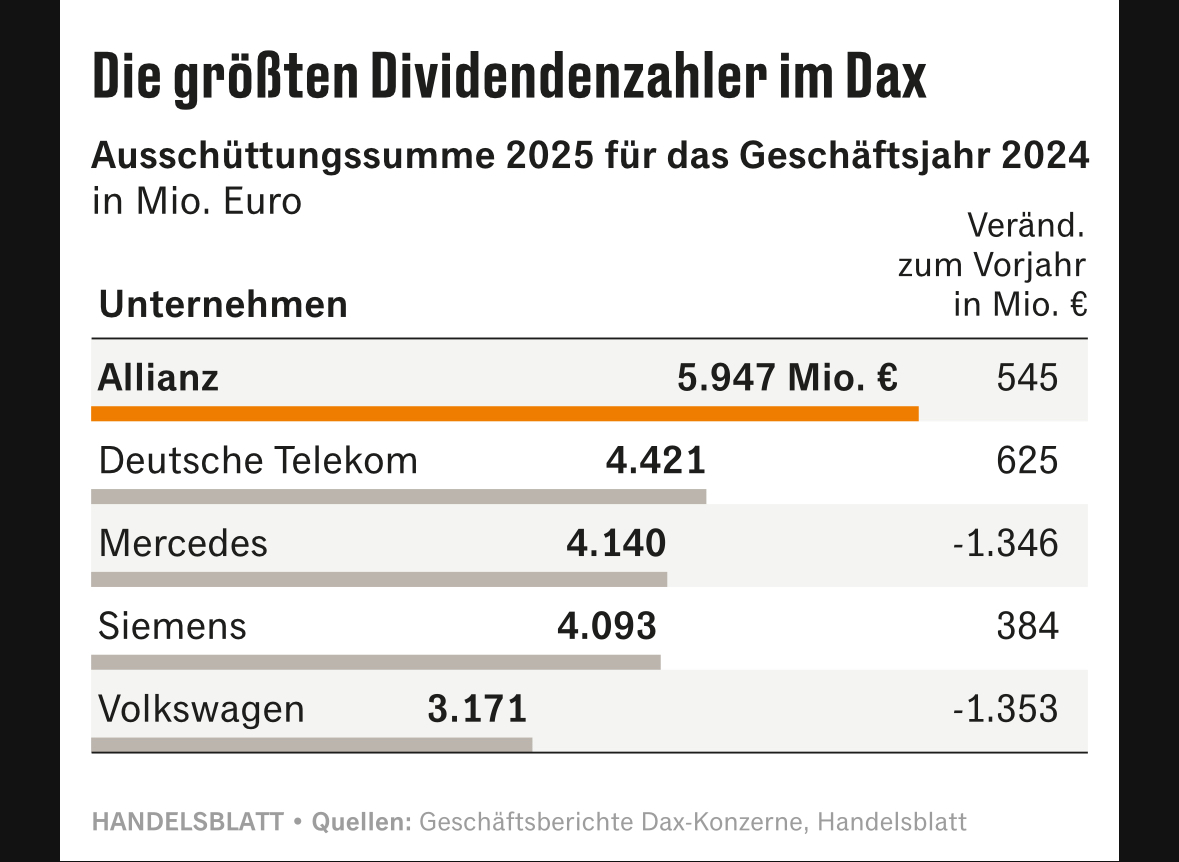

DAX companies' dividends - record high in sight

At 53 billion euros, the 40 DAX companies are likely to pay out almost one billion euros more this year than a year ago - more than ever before.

The reason for the strong development is high consolidated profits and unexpectedly rising dividends at a good dozen companies, including $ALV (-0,22%) Allianz, $MUV2 (+0,85%) Munich Re and $RHM (+3,08%) Rheinmetall.

At 109 billion euros net profit, the DAX companies are likely to have earned as much in 2024 as in the previous year, according to Handelsblatt calculations. Slump in earnings for the three car manufacturers $BMW (+0,08%) BMW, $MBG (+0,74%) Mercedes and $VOW (+0,45%) VW will be offset by companies in other sectors, in particular the major insurers Allianz, Munich Re and $HNR1 (+0,4%) Hannover Re, but also $DTE (+0,17%) Deutsche Telekom, $HEN (+0,21%) Henkel and $EOAN (+1%) Eon.

More than a dozen DAX companies have announced higher dividends than the market had previously expected. For example $ALV (-0,22%) 15.40 euros per share after 13.80 euros in the previous year. Analysts had forecast just under 15 euros. The insurer is thus distributing just under six billion euros. This is a record in the German corporate landscape.

The biggest jump is at $MUV2 (+0,85%) Munich Re: The reinsurer is increasing its dividend by five euros per share to 20 euros.

The two healthcare specialists $FRE (+0,25%) Fresenius and $FME (-1,02%) Fresenius Medical Care, the brand manufacturer $HEN (+0,21%) Henkel, the automotive supplier $BTR Continental, the $CBK (+0,93%) Commerzbank, $RHM (+3,08%) Rheinmetall and $HNR1 (+0,4%) Hannover Re have raised their dividends, in some cases significantly more than expected. This is also due to rising profits, which justify a higher profit share for shareholders.

The largest dividend payers in the DAX are

Like the car manufacturers, a number of companies in the DAX remain below the usual international payout ratios, including the family-run groups $BEI (-1,17%) Beiersdorf and $MRK (+0,97%) Merck. They pass on less than 30 percent of their profits. This leaves enough of a buffer so that dividends do not have to be reduced immediately in more difficult times.

Germany's most valuable group, $SAP (-1,31%) SAP, with a payout ratio of 85%, is pushing the limit: net profit of 3.1 billion euros in the past year compares with a total dividend payout of 2.7 billion euros. However, the profit was burdened by a one-off effect.

So far, a total of 20 companies have increased their dividends, with only $BAS (+0,36%) BASF and the three car manufacturers. Four companies have yet to do so: $RWE (+0,58%) RWE, $SY1 (-2,81%) Symrise and $VNA (-1,56%) Vonovia are likely to increase their dividends, while analysts expect $PAH3 (-0,07%) analysts expect a reduction at Porsche Holding.

Source (excerpt) & chart: Handelsblatt, 15.03.25

Day 3 | WEF 2025

The CEO of $MRK (+0,97%)Belén Garijo, expressed her optimism at the #wef2025 optimistic that Europe can strengthen its global competitiveness. Despite growing competition from the USA and China, the pharmaceutical company is continuing to invest in its own region.

"We have invested heavily in Europe because we are convinced that the ship can be turned"

The comments come after Donald Trump voiced plans to punish the EU & China with tariffs to counter what he sees as "unfair trade practices".

Garijo said Merck is prepared for such developments by expanding its presence in the US and pursuing local strategies pursuing local strategiesto counteract potential trade restrictions.

"We have diversified our supply chain to be closer to our customers and better able to respond to potential trade restrictions"

Boeing and 6 More Contrarian Stocks for 2025

Boeing $BA (-0,29%)

Merck $MRK (+0,97%)

Nike $NKE (-0,81%)

Ulta Beauty $ULTA (+1,42%)

Roku $ROKU (+0,32%)

Wayfair $W (+2,48%)

Peloton $PTON (+0,09%)

Titoli di tendenza

I migliori creatori della settimana