What do you guys think of $HIVE (+6,42%) ?

I’ve read some posts here, some were positive and some were negative, but it always happens.

Do you think its path could be similar to $IREN? (+11,88%)

Messaggi

18What do you guys think of $HIVE (+6,42%) ?

I’ve read some posts here, some were positive and some were negative, but it always happens.

Do you think its path could be similar to $IREN? (+11,88%)

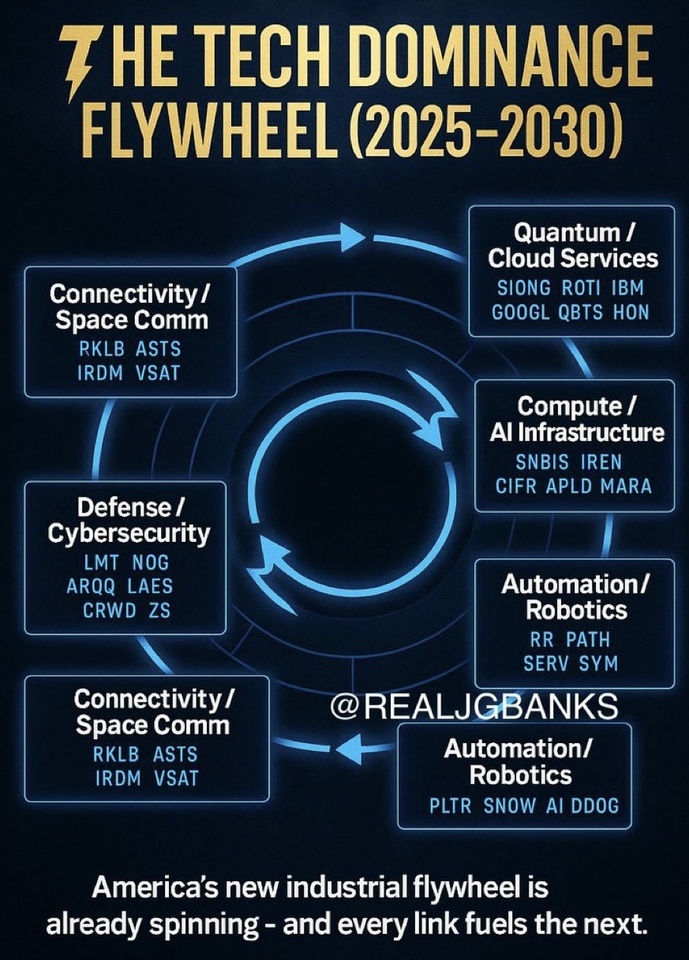

If you're wondering what's going on with the former $BTC (+7,04%) miners who work in data centers today, here is the answer.😉

I'm still waiting for a deal at $BITF (+9,8%) as has already been rumored with $AMZN (+3,45%) 🤑

The shares of Riot Platforms (NASDAQ:RIOT) rose by over 7% on Friday morning after the Bitcoin mining company announced the conclusion of a data center lease agreement with Advanced Micro Devices (NASDAQ:AMD)had announced.

The company announced the signing of a ten-year data center lease and services agreement with AMD at its Rockdale, Texas location. The agreement includes an initial deployment of 25 MW of critical IT load capacity to be delivered in phases from January 2026 through May 2026, with a potential expansion to 200 MW.

Riot expects the agreement to generate approximately $311 million in contract revenue over the initial term. Should AMD exercise all three five-year renewal options, total contract revenue could increase to approximately USD 1 billion.

"This partnership is a validation of our infrastructure, development capabilities, the attractiveness of our sites, our readily available power capacity and our ability to provide innovative solutions to meet the needs of world-class tenants," said Jason Les, CEO of Riot.

In conjunction with the lease, Riot also announced the closing of the unrestricted purchase of 200 acres of land at its Rockdale site for $96 million. The purchase was financed entirely through the sale of approximately 1,080 Bitcoin from the company's balance sheet.

The Rockdale site has a 700 MW grid connection, a dedicated water supply and fiber optic connections. With this acquisition, Riot now owns and manages over 1,100 acres of land and 1.7 GW of power capacity at its two sites in Texas.

Hasmukh Ranjan, CIO of AMD, commented: "At AMD, advancing high-performance computing and AI requires partners that can keep up with our pace and scale. We look forward to working with Riot, whose capabilities, power availability and high-density solutions align with our infrastructure roadmap."

The initial deployment will utilize Riot's existing infrastructure, with the company starting with the retrofit of an existing building at a cost of $89.8 million.

$IREN (+11,88%)

$NBIS (+10,37%)

$BITF (+9,8%)

$CIFR (+8,32%)

$BTC (+7,04%)

$CLSK (+3,35%)

$RIOT (+7,1%)

$MARA (+5,61%)

$HIVE (+6,42%)

Next one.💪🏻

This time, from my point of view, exciting developments regarding my portfolio value $HIVE (+6,42%) which were explained in a press release:

San Antonio, Texas--(Newsfile Corp. - January 13, 2026)

HIVE Digital Technologies Ltd (TSXV: HIVE) (NASDAQ: HIVE) (FWB: YO0) (BVC: HIVECO) (the "Company" or "HIVE"), a diversified global digital infrastructure company headquartered in San Antonio, Texas.

digital infrastructure company headquartered in San Antonio, Texas, today announced its

expansion into Paraguay through a strategic joint venture with Paraguay's

Paraguay's leading telecommunications operator.

As part of this partnership, HIVE is introducing one of the first purpose-built BUZZ artificial intelligence cloud platforms in Paraguay, located in Asunción and hosted in a Tier III data center of the leading telecom operator in Paraguay. The platform is designed to provide high performance computing (HPC) and AI infrastructure for academic and research institutions, enterprises, financial service providers and healthcare providers in Paraguay and the entire South American region.

The first deployment is scheduled to begin in the first quarter of 2026 and will initially

with an enterprise-class GPU cluster that will be used for AI training, inference

inference and data-intensive workloads. The platform will be

scaled over time according to customer demand and subject to capital

availability of capital, with the renewable hydropower of

Paraguay, the national fiber optic network of Paraguay's largest telecommunications provider and enterprise-class data centers.

This expansion builds on HIVE's existing digital infrastructure in Paraguay, where the company develops and operates Tier I data centers and associated substations supported by access to large-scale renewable hydropower electricity. HIVE views Bitcoin mining as a means to build Tier I data center infrastructure and substations that monetize excess or unused electricity.

monetize surplus or unused electricity and convert energy into economic value.

into economic value. In this framework, each bitcoin represents a bundle of energy, a concept also

concept that has also been articulated by technology leaders such as Elon Musk and Jensen Huang in their discussions of Bitcoin as a form of monetized economic labor. The infrastructure required for production can serve as the fundamental basis for more advanced digital computing applications, including AI and high performance computing hosted in Tier III data centers.

HIVE's strategy in Paraguay is based on a long-term, multi-year vision to further develop energy-based digital infrastructure into scalable AI and data center capacity. The company believes that

believes that the growth of the AI-driven digital economy depends on a reliable

depends on a reliable power supply and high-performance dark fiber connectivity that enables secure, low-latency data transmission.

with low latency. While Tier III data centers capable of hosting GPU-intensive workloads require significantly higher capital investments

HIVE believes that its phased approach - starting with Tier I infrastructure - provides a disciplined and economically efficient path to higher-value AI-enabled facilities.

facilities.

Paraguay has experienced periods of strong economic growth in recent quarters

supported by a stable government and an investment-friendly policy environment. HIVE believes that

these conditions, combined with the country's energy profile, provide a

constructive backdrop for long-term investment in digital infrastructure.

infrastructure.

HIVE believes that this development is broadly consistent with the development of

digital infrastructure in Texas, including the San Antonio to West Texas

corridor from San Antonio to West Texas, where development began with Tier I data centers focused on energy-intensive workloads and later expanded to capital-intensive Tier III facilities that can support advanced enterprise and AI workloads.

workloads. The company believes that Paraguay is at a similar early stage in this infrastructure

similar early stage in this infrastructure development cycle, while recognizing that the

recognizing that outcomes will depend on a number of economic and regulatory factors.

and regulatory factors.

The company anticipates that continued investment in AI and HPC infrastructure will

and HPC infrastructure could support downstream economic activity, including potentially

activity, including a potential increase in demand for software

software developers, computer engineers, data scientists,

electrical engineers and other technical professionals, which over time would

would contribute to workforce development over time.

The expansion also reflects Paraguay's continued institutional commitment

Paraguay's ongoing institutional commitment to the United States. On December 15, 2025

U.S. Secretary of State Marco Rubio and Paraguayan Foreign Minister Rubén Ramírez

Foreign Minister Rubén Ramírez Lezcano in Washington, D.C., signed a

Troop Stationing Agreement (SOFA) between the United States and Paraguay.

Paraguay. While SOFAs are a common instrument of US foreign policy with countries such as

countries such as Germany, Italy and Japan, the agreement reflects continued

continued bilateral cooperation in areas such as security, stability

stability and law enforcement, which could contribute to greater institutional

could contribute to greater institutional trust.

The launch of the BUZZ AI cloud platform is designed to support the demand for accelerated computing across South America by providing companies with access to an AI infrastructure that operates in a Tier III environment and is powered by renewable energy.

Tier III environment and powered by renewable energy.

While future expansions will depend on the expansion of infrastructure such as dark fiber

fiber, customer demand, regulatory conditions and the availability of

availability of capital, HIVE believes that the conditions in Paraguay are

conditions in Paraguay are favorable for long-term participation in the development of

development of AI and hyperscale data centers.

Frank Holmes, Executive Chairman of HIVE, said: "Paraguay is an important location for HIVE

important location for HIVE, where we have demonstrated how energy-based digital

infrastructure can support long-term value creation. This

development is consistent with patterns we have observed in Texas, including in the

including in the San Antonio area, where infrastructure development began with Tier I data centers and later expanded to capital-intensive Tier III facilities capable of hosting demanding AI workloads. We are convinced that the

economic stability, the supportive political environment and the institutional

institutional relationships in Paraguay provide a constructive basis for the further

further development of the digital infrastructure."

Aydin Kilic, President and CEO of HIVE, added: "The launch of the AI cloud infrastructure in Asunción is a first step in bringing science

research institutions, companies, financial service providers and healthcare

healthcare organizations access to local high-performance computing capacity.

capacity. This initiative complements the existing operation of HIVE's Tier I data center in Paraguay, which currently uses approximately 300 megawatts

and, subject to market conditions and approvals, will be expanded by a further 100 megawatts in 2026.

could be expanded by a further 100 megawatts."

HIVE believes that Paraguay's combination of renewable energy sources, stable governance, supportive policy framework and growing digital infrastructure make it a potential

political framework and growing digital infrastructure, Paraguay has the

potential to play an important long-term role in South America in the field of AI

and high-performance computing.

$BTC (+7,04%)

$NBIS (+10,37%)

$IREN (+11,88%)

$BITF (+9,8%)

$CIFR (+8,32%)

$CLSK (+3,35%)

Good morning, dear ones,

There has been a lot of positive news flow in the last few days, which I naturally don't want to withhold from you.

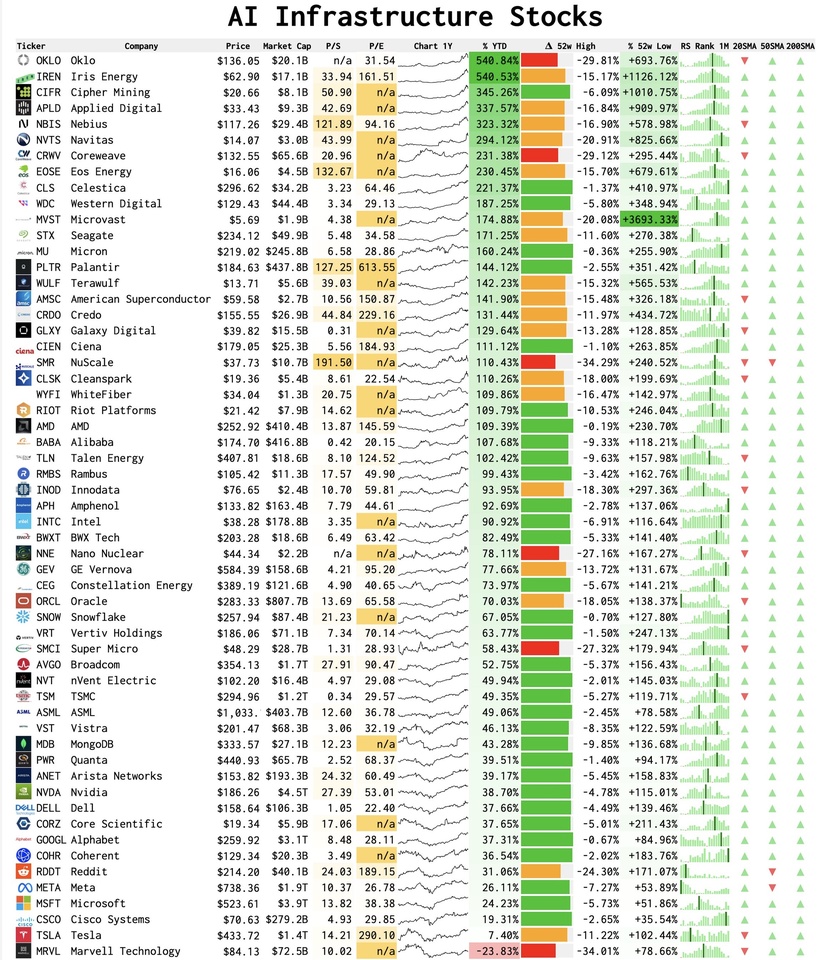

Since you have to start somewhere, let's start with $IREN (+11,88%) .😉

H.C. Wainwright has bought the shares of IREN Ltd. (NASDAQ:IREN) from "Neutral" to "Buy" and set a price target of 80.00 US dollars. The reason given is the company's strong positioning in the AI infrastructure sector. This target implies considerable upside potential compared to the current share price of USD 50.43.

The analyst firm assumes that AI infrastructure will remain a key investment theme in 2026. This will be driven by hyperscalers' investment budgets, growing demand for access to large power capacities and positive investor sentiment. This is in line with IREN's impressive revenue growth of 235% over the last twelve months.

H.C. Wainwright particularly highlighted IREN's five-year, USD 9.7 billion AI cloud contract with Microsoft. This is expected to be fully monetized by the end of 2026 and generate annual recurring revenues of USD 1.94 billion once the entire 200 MW of critical IT power has been deployed at the Childress site. The company also has a solid financial position with a current ratio of 5.52, which indicates that cash and cash equivalents significantly exceed current liabilities.

The analyst firm also referred to IREN's development pipeline, which includes additional capacity of over 2 GW and is expected to be fully operational by 2027. This offers considerable growth potential for the company's AI cloud business. With analysts forecasting revenue growth of 117% for the 2026 financial year, IREN's expansion plans appear well positioned to drive future business development.

IREN shares have corrected by around 35% since their all-time highs in early November 2025, which H.C. Wainwright sees as an attractive entry point. At the same time, it points out that the company recently raised USD 2.3 billion via convertible bonds to finance the expansion of its AI data centers. Despite the recent setback, IREN achieved a remarkable return of 381% last year.

$BTC (+7,04%)

$NBIS (+10,37%)

$CIFR (+8,32%)

$BITF (+9,8%)

$HIVE (+6,42%)

$CLSK (+3,35%)

Hello everyone,

It's crazy what happened on the markets today, isn't it? And that despite (or because of?) the events at the weekend.

As you can see from the header, I don't want to withhold from you what happened in my portfolio today, so:

Daily performance: +3.84%

Top performer (how could it be otherwise, of course defense and AI/data centers, since CES 2026 started today):

$ONDS (+1,92%) +13,45%

$IREN (+11,88%) +12,51%

$CIFR (+8,32%) +11,19%

$BITF (+9,8%) +11,06%

$HIVE (+6,42%) +9,02%

I would also like to make special mention of $ZETA (+3,88%) with a daily gain of 8.18%. I have been really pleased with the share since it found its way into my portfolio (thanks to @MozartTrading who introduced Zeta here and drew my attention to it in the first place). Let's see how things continue here.

And now: cards on the table, @Tenbagger2024

@Multibagger

@Klein-Anleger and everyone else, how did your day go?

Hope your portfolios went up today 🚀

Edit to $ZETA (+3,88%) : Just received an info on OpenAI partnership, share went up again right after the market close with another set.

This or something similar could be my personal headline for 02.01.2026.

In addition to receiving my letter of congratulations on passing my probationary period after changing jobs last summer, it was of course another savings plan day.

In addition to the investments worth the equivalent of €1,375 to be collected there every month (€25 in $ATAI (+0,32%) has not yet gone through due to the relocation to the USA, so I'm curious to see whether the NASDAQ-listed securities are still eligible for the savings plan😅), a further €1,000 has found its way into the market and thus into my portfolio.

In this case, it was not a "quick 1-2 new positions between the holidays" action like a few days ago (the days were really crazy to say the least with the price movements of some stocks with rather thin volumes), but a targeted increase in some of my existing positions, which were of course already provided with a savings plan.

I have done the same thing from time to time over the past few months with the previously smaller savings plan positions in my portfolio, and this time was no exception.

This time, I increased the positions in equal parts:

Overall, I am quite satisfied with my current portfolio structure, but I will sit down from time to time during the course of the year and review existing positions, check my investment theses and probably also simply take profits on stocks that are more "bets" than long-term investments for me ($BITF (+9,8%) , $HIVE (+6,42%) , $REKR (+4,79%) , $FBIO and one or two in the rare earth/critical raw materials sector).

A few new positions may then be added, but the aim here is clearly to liquidate positions first (where appropriate) and only then to open further positions.

How are you doing? How did your first trading day of the year go? Do you also have one or more of the stocks mentioned in your portfolio? How do you feel about them?

Good evening dear community,

I would like to share with you more actively what is happening or has recently happened in my portfolio.

I have used the - in some cases significant - setbacks in growth and AI stocks over the last few days/week to bring more cash into the market. Delayed data and rate cut or not, the well-known saying "Time in the market, beats timing the market" applies to me. Savings plans run mindlessly month after month anyway.

So here is a brief look at what has happened in the portfolio over the last few days:

$RKLB (+4,18%) Initial purchase of 19 shares at €38.40 each

$ZETA (+3,88%) First purchase of 50 shares at €14.55 each

$HIMS (+3,22%) Increase by 8 shares at € 30 each

$DEFI (+5,42%) Increase of 279 shares at € 0.896 each

$CA1 (-2%) Increase by 31 shares at €15.95 each

$HIVE (+6,42%) Increase by 82 shares at € 2.92 each

This means that all my (freely) available cash is in the market for the time being. Let's see where the journey takes us.

How have your portfolios fared over the last few days? I've seen a clear downward trend, primarily due to the significant drop in BTC and the sharp fall in the prices of my AI stocks.

Nevertheless, I remain relaxed and am not selling anything because my investment case is still intact for all my current investments. With this in mind: remain steadfast, above all question whether anything has changed in your investments from a fundamental perspective and if not: just be patient😉.

$IREN (+11,88%)

$CIFR (+8,32%)

$NBIS (+10,37%)

Maybe one or the other exciting value for you?

I am in $IREN (+11,88%) , $CIFR (+8,32%) but $NBIS (+10,37%) I also find it exciting in the long term. 👌

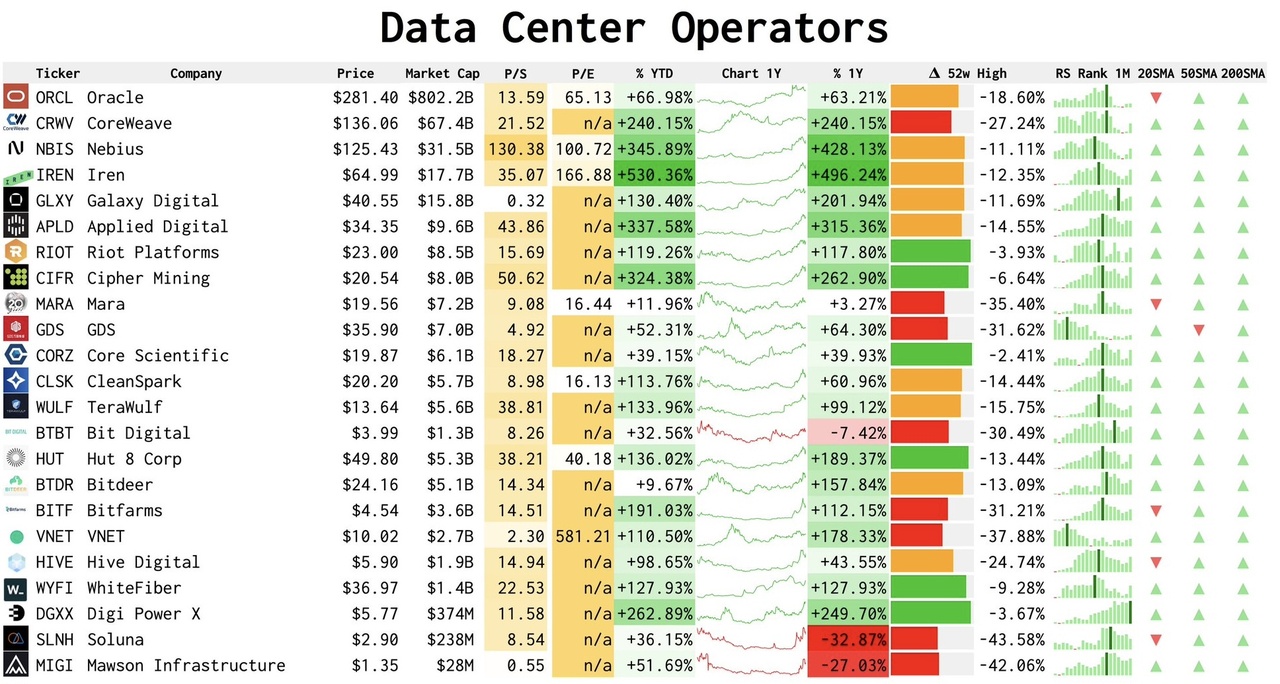

$ORCL (+2,9%) Oracle

$CRWV (+8,07%) CoreWeave

$NBIS (+10,37%) Nebius

$IREN (+11,88%) Irish

$GLXY (+13,24%) Galaxy Digital

$APLD (+8,91%) Applied Digital

$RIOT (+7,1%) Riot Platforms

$CIFR (+8,32%) Cipher Mining

$MARA (+5,61%) Mara

$GDS (+1,83%) GDS

$CORZ (+4,17%) Core Scientific

$CLSK (+3,35%) CleanSpark

$WULF (+6,13%) TeraWulf

$BTBT (+7,99%) Bit Digital

$HUT (+13,2%) Hat 8

$BTDR (+6,78%) Bitdeer

$BITF (+9,8%) Bitfarms

$VNET (+2,32%) VNET

$HIVE (+6,42%) Hive Digital

$WYFI (+6,72%) WhiteFiber

$DGX (+5,81%) Digi Power X

$SLNH Soluna

$MIGI Mawson Infrastructure

$IREN (+11,88%)

$CIFR (+8,32%)

$BTC (+7,04%)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (+11,88%) and $CIFR (+8,32%) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (+8,32%) probably add a little more and perhaps pick up one or two other companies.

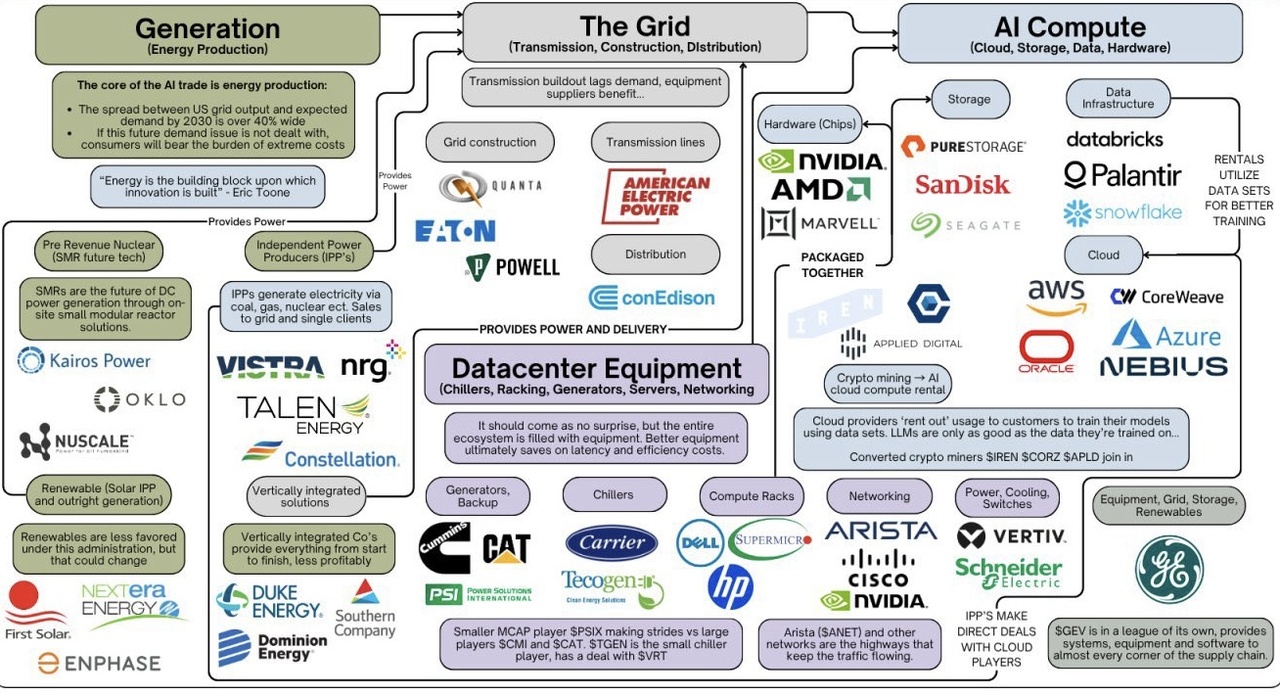

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+0,72%)

$MSFT (+0,55%)

$AMZN (+3,45%)

$ORCL (+2,9%)

$BABA (-1,55%)

Neocloud: $NBIS (+10,37%)

$IREN (+11,88%)

$CRWV (+8,07%)

$APLD (+8,91%)

$GLXY (+13,24%)

$WYFI (+6,72%)

Memory: $SNDK

$STX (+8,7%)

$MU (+6,93%)

$WDC (+9,2%)

$PSTG (+1,67%)

Semiconductor: $NVDA (+1,59%)

$AVGO (+1,69%)

$AMD (+3,63%)

$TSM (+1,48%)

$ASML (+2,56%)

$ARM (+2,3%)

$KLAC (+2,17%)

$INTC (+5,13%)

Networking: $CIEN (+3,61%)

$CLS (+3,85%)

$CRDO

$RMBS (+4,82%)

$ANET (+6,39%)

$APH (+0,73%)

$COHR (-3,76%)

Servers: $VRT (+3,2%)

$DELL (+0,82%)

$HPE (+0,11%)

Data: $INOD (+3,16%)

$PLTR (+3,43%)

$SNOW (+1,76%)

$DDOG (+7,14%)

$MDB (+0,63%)

Energy: $LEU (+2,39%)

$CEG

$OKLO

$TLNE

$GEV (+0,28%)

$NXT (+0%)

Batteries: $EOSE

$QS (+5,33%)

$TSLA (+3,17%)

$MVST (+3,09%)

Every AI Value Chain explained:

I migliori creatori della settimana