$WYFI (+1,4%) the next Arista or Nebius? Let’s see. Added small position to my portfolio.

WhiteFiber, Inc.

Price

Discussione su WYFI

Messaggi

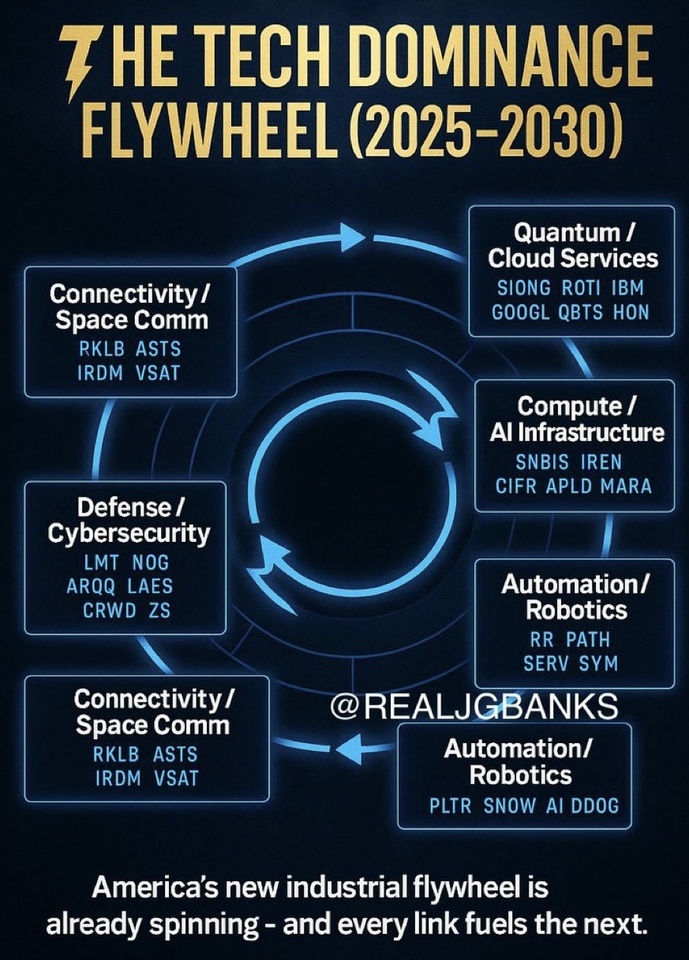

4A selection of possible TEN BAGGER 🚀

For all those interested, here is a list of possible upcoming TEN BAGGER or half or similar or future bankruptcies 🔮 📣🔊

🔸 Hims & Hers $HIMS (-6,11%)

🔸 Palantir $PLTR (-0,02%)

🔸 ExlService Holdings $EXLS (+0,48%)

🔸 IES Holdings $IESC (+0,35%)

🔸 Jabil $JBL (+0,11%)

🔸 RadNet $RDNT (+0%)

🔸 Robinhood $HOOD (-0,54%)

🔸 RocketLab $RKLB (+0,42%)

🔸 Toast $TOST (+0,06%)

🔸 Whitefiber $WYFI (+1,4%)

🔸 Figure Technology $FIGR

🔸 Circus SE $CA1 (-0,13%)

🔸 Voyager Technologies $VYGR (+0,13%)

🔸 Perpetua Resources $PPTA (+0%)

🔸 Lightbridge Corp. $LTBR (+2,92%)

🔸 Oklo $OKLO

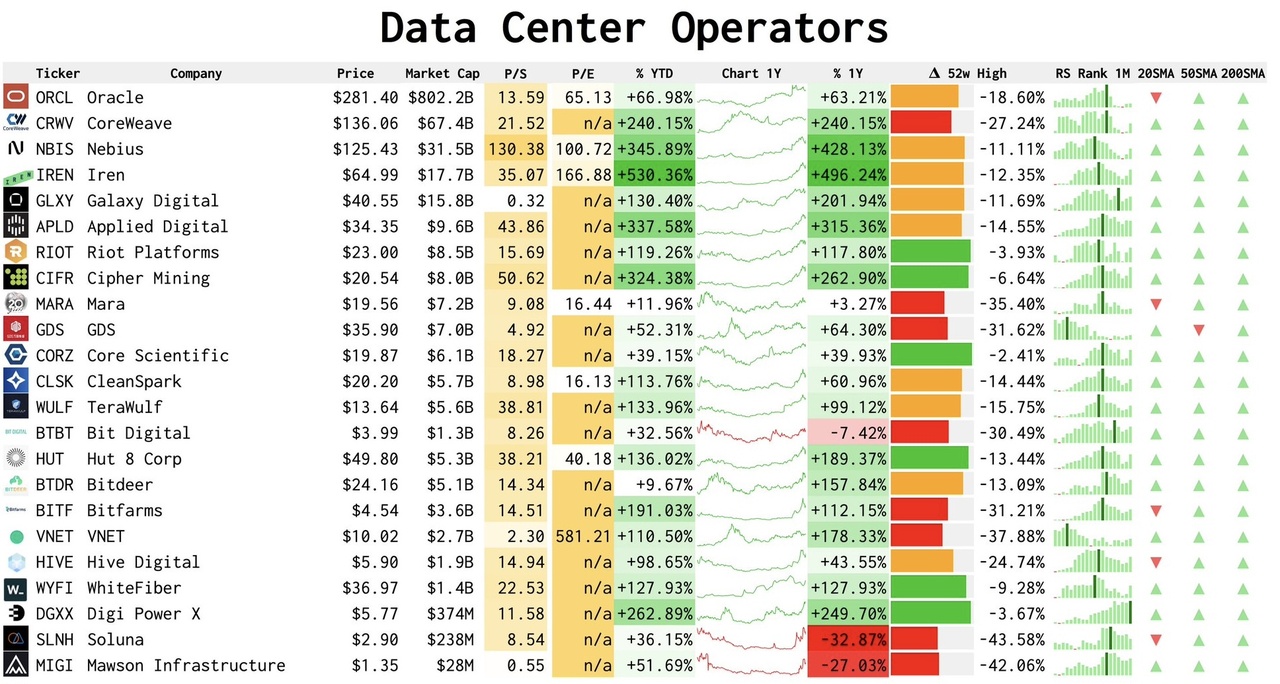

List of data center operators 🫡

$IREN (-0,97%)

$CIFR (-2,13%)

$NBIS (+0,59%)

Maybe one or the other exciting value for you?

I am in $IREN (-0,97%) , $CIFR (-2,13%) but $NBIS (+0,59%) I also find it exciting in the long term. 👌

$ORCL (+0,48%) Oracle

$CRWV (+0,39%) CoreWeave

$NBIS (+0,59%) Nebius

$IREN (-0,97%) Irish

$GLXY (-0,58%) Galaxy Digital

$APLD (+1,37%) Applied Digital

$RIOT (-1,1%) Riot Platforms

$CIFR (-2,13%) Cipher Mining

$MARA (-1,39%) Mara

$GDS (+2,74%) GDS

$CORZ (-1,92%) Core Scientific

$CLSK (-1,77%) CleanSpark

$WULF (+0%) TeraWulf

$BTBT (-0,53%) Bit Digital

$HUT (+0,38%) Hat 8

$BTDR (-1,62%) Bitdeer

$BITF (-2,33%) Bitfarms

$VNET (+1,05%) VNET

$HIVE (-0,95%) Hive Digital

$WYFI (+1,4%) WhiteFiber

$DGX (+0%) Digi Power X

$SLNH Soluna

$MIGI Mawson Infrastructure

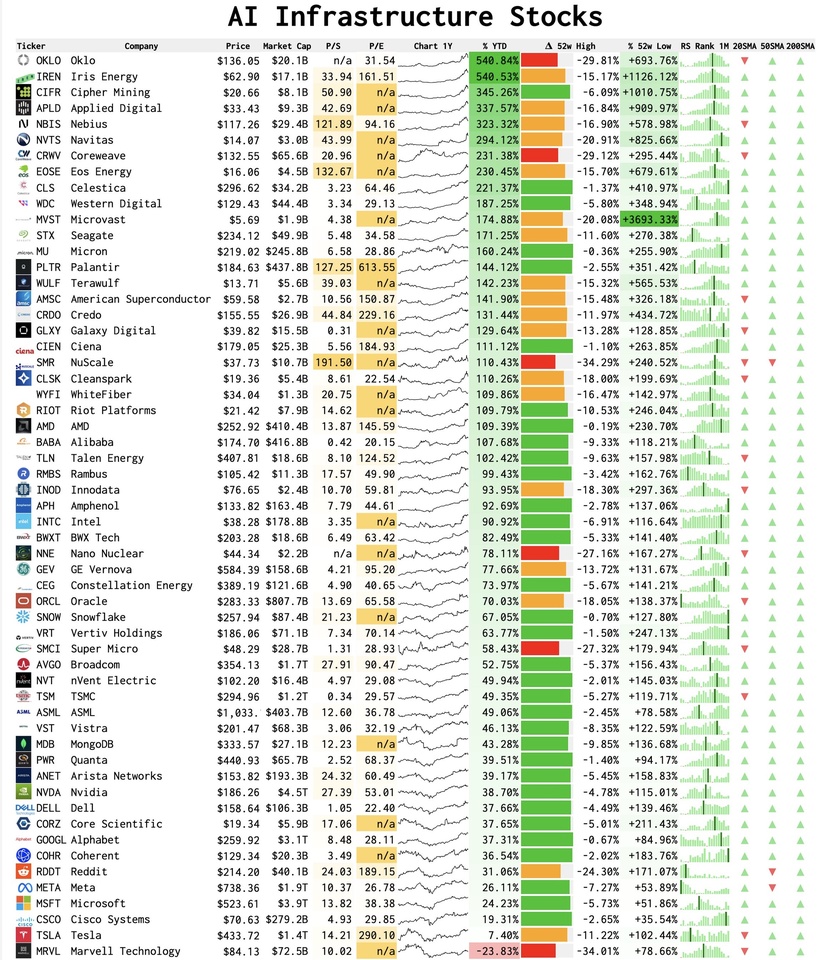

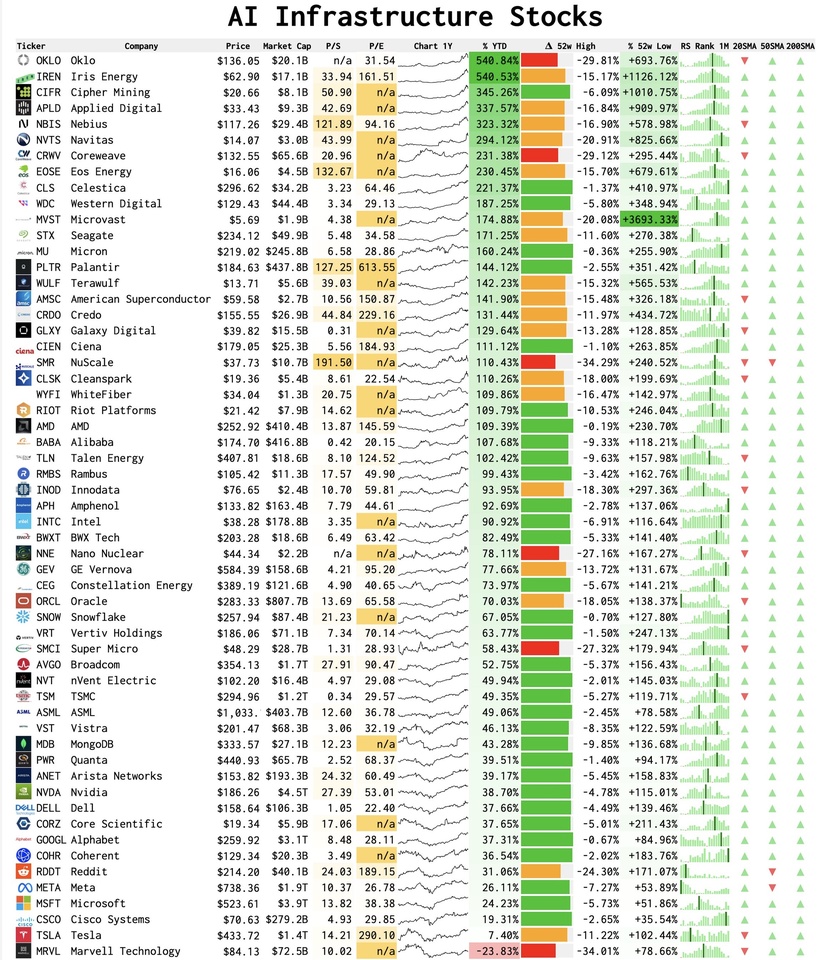

AI infrastructure continues to be one of the most exciting investment themes

$IREN (-0,97%)

$CIFR (-2,13%)

$BTC (-2,49%)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (-0,97%) and $CIFR (-2,13%) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (-2,13%) probably add a little more and perhaps pick up one or two other companies.

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+0,21%)

$MSFT (+0,49%)

$AMZN (+0,51%)

$ORCL (+0,48%)

$BABA (-0,85%)

Neocloud: $NBIS (+0,59%)

$IREN (-0,97%)

$CRWV (+0,39%)

$APLD (+1,37%)

$GLXY (-0,58%)

$WYFI (+1,4%)

Memory: $SNDK

$STX (+0,82%)

$MU (+1,09%)

$WDC (+0,66%)

$PSTG (+0,78%)

Semiconductor: $NVDA (+0,71%)

$AVGO (+0,63%)

$AMD (+0,33%)

$TSM (+1,43%)

$ASML (+0,59%)

$ARM (+0%)

$KLAC (+0,62%)

$INTC (+0,53%)

Networking: $CIEN (+0,2%)

$CLS (+0%)

$CRDO

$RMBS (+1,45%)

$ANET (+1,18%)

$APH (+0,71%)

$COHR (-0,24%)

Servers: $VRT (+1,08%)

$DELL (+0,23%)

$HPE (+0,15%)

Data: $INOD (-0,13%)

$PLTR (-0,02%)

$SNOW (+1,12%)

$DDOG (+0,86%)

$MDB (+0,6%)

Energy: $LEU (-0,15%)

$CEG

$OKLO

$TLNE

$GEV (+0,42%)

$NXT (+0%)

Batteries: $EOSE

$QS (+0,86%)

$TSLA (+0,3%)

$MVST (+1,28%)

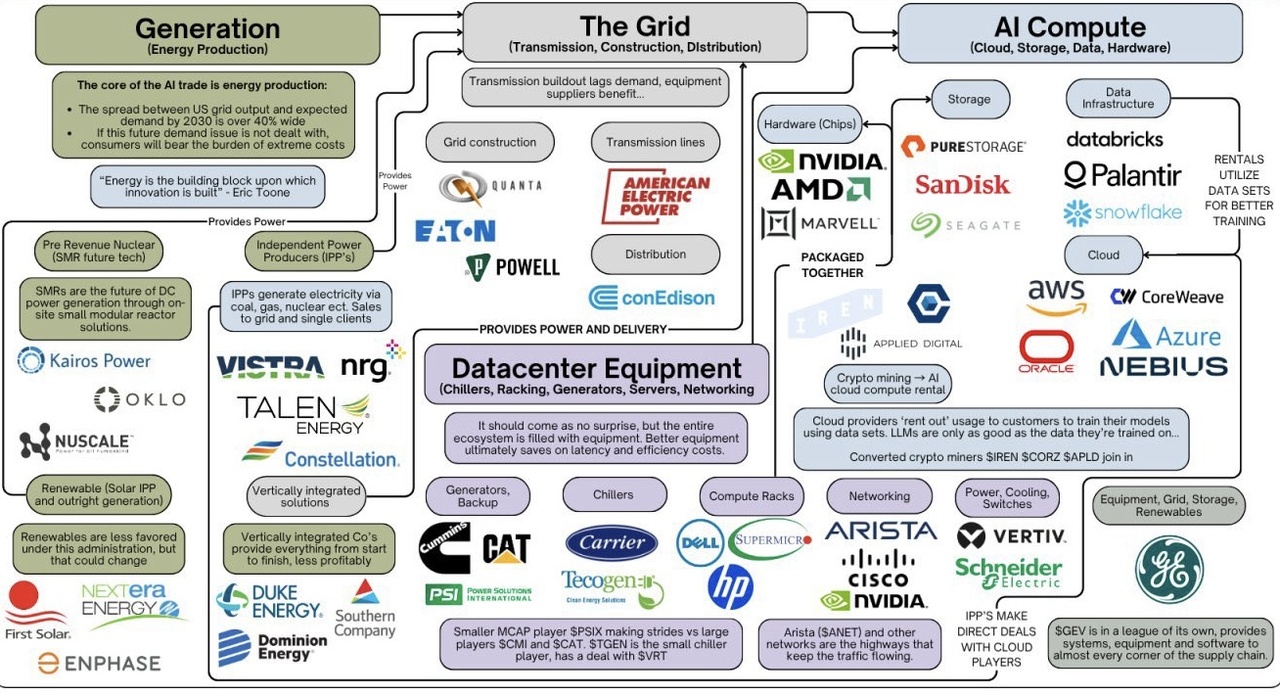

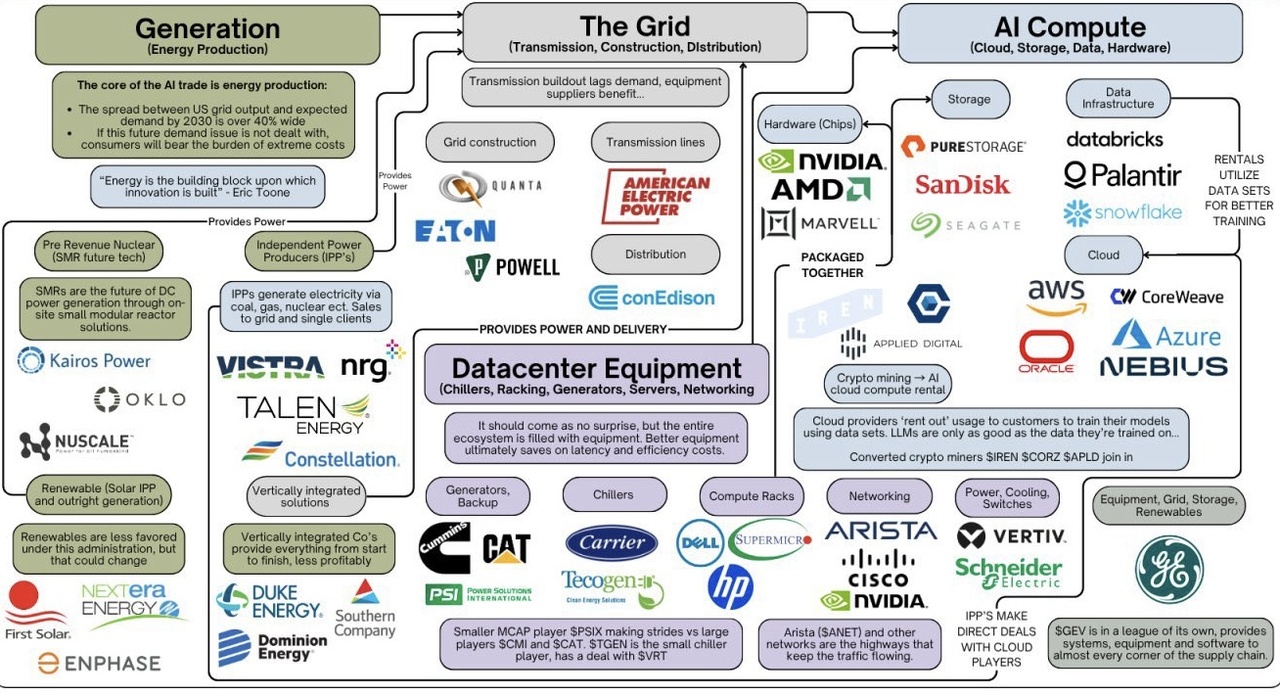

Every AI Value Chain explained:

AI infrastructure continues to be one of the most exciting investment themes

$IREN (-0,97%)

$CIFR (-2,13%)

$BTC (-2,49%)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (-0,97%) and $CIFR (-2,13%) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (-2,13%) probably add a little more and perhaps pick up one or two other companies.

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+0,21%)

$MSFT (+0,49%)

$AMZN (+0,51%)

$ORCL (+0,48%)

$BABA (-0,85%)

Neocloud: $NBIS (+0,59%)

$IREN (-0,97%)

$CRWV (+0,39%)

$APLD (+1,37%)

$GLXY (-0,58%)

$WYFI (+1,4%)

Memory: $SNDK

$STX (+0,82%)

$MU (+1,09%)

$WDC (+0,66%)

$PSTG (+0,78%)

Semiconductor: $NVDA (+0,71%)

$AVGO (+0,63%)

$AMD (+0,33%)

$TSM (+1,43%)

$ASML (+0,59%)

$ARM (+0%)

$KLAC (+0,62%)

$INTC (+0,53%)

Networking: $CIEN (+0,2%)

$CLS (+0%)

$CRDO

$RMBS (+1,45%)

$ANET (+1,18%)

$APH (+0,71%)

$COHR (-0,24%)

Servers: $VRT (+1,08%)

$DELL (+0,23%)

$HPE (+0,15%)

Data: $INOD (-0,13%)

$PLTR (-0,02%)

$SNOW (+1,12%)

$DDOG (+0,86%)

$MDB (+0,6%)

Energy: $LEU (-0,15%)

$CEG

$OKLO

$TLNE

$GEV (+0,42%)

$NXT (+0%)

Batteries: $EOSE

$QS (+0,86%)

$TSLA (+0,3%)

$MVST (+1,28%)

Every AI Value Chain explained:

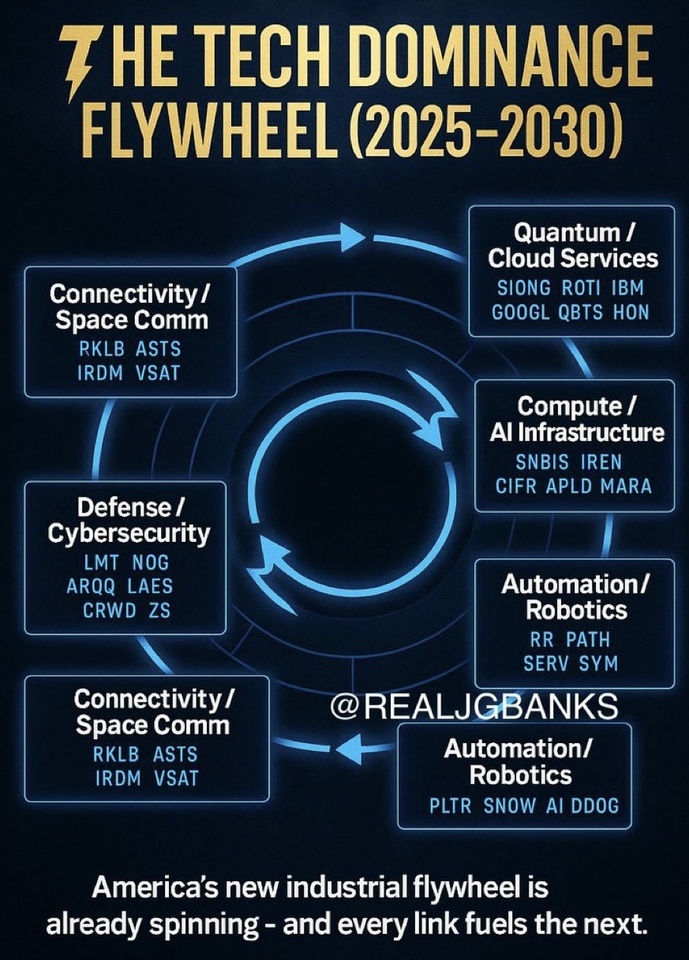

In addition to $IREN and $CIFR also $GLXY, $INOD, $NVDA and $DDOG.

Plus $GOOGL, $AMZN and $BABA

So I'm pretty broadly positioned in this area when I look at it like this 😉😎

Others would say there is a cluster risk. However, the strategy of focusing on the highest possible returns means investing in the booming sectors, which at the moment are AI and commodities.

Titoli di tendenza

I migliori creatori della settimana