$WINC (+0,77 %) is running in my custody account on a savings plan. Now an additional debit has been logged in and the detail says reinvestment from distribution. This is new to me and I have only received dividends so far. Has this happened to anyone else? My broker is ING.

iShares World Equity High Income ETF

Price

Debate sobre WINC

Puestos

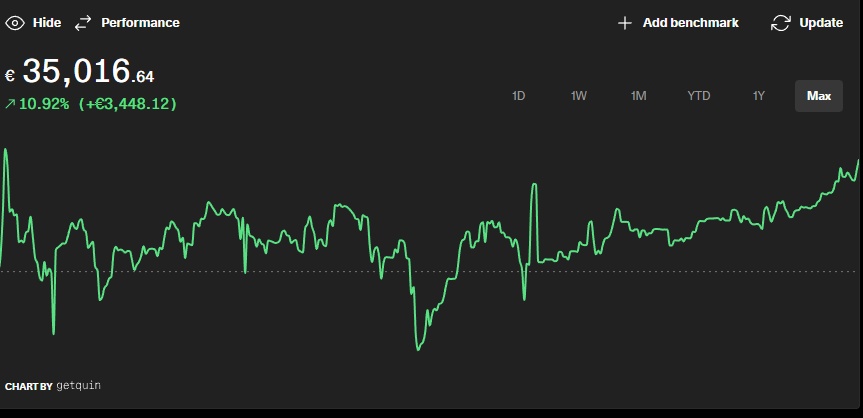

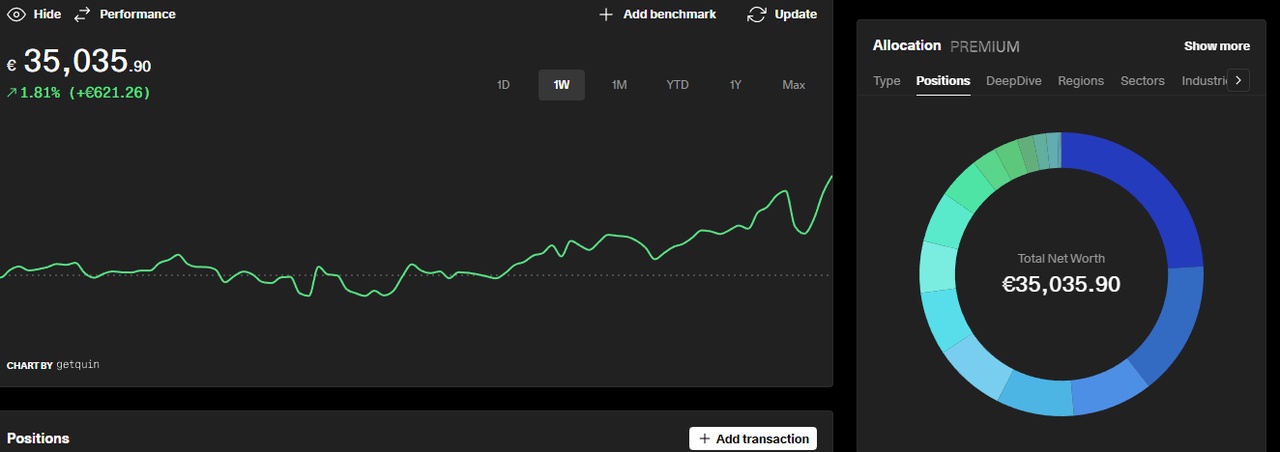

34All time high 35k

Impressed by my performance in these turbulent times.

Which dividend stock do you think is a bargain right now? Long term.

$TDIV (+0,23 %)

$PG

$O (+1,13 %)

$ASRNL (+1,04 %)

$JNJ (-0,5 %)

$JEGP$AD (+0,69 %)

$VPK (-2,19 %)

$NOVO B (-2,32 %)

$ULVR (+1,38 %)

$WINC (+0,77 %)

$VHYL (+0,81 %)

What are you thinking about, for your next purchase?

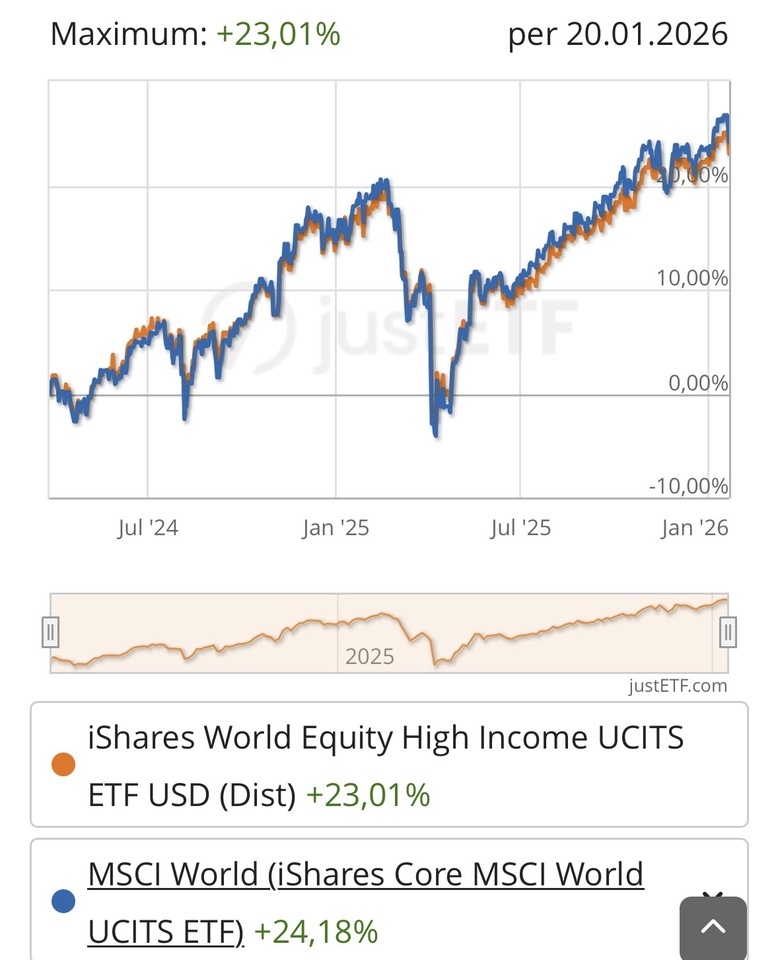

Total Return WINC

A brief question to understand how the $WINC (+0,77 %)

Unlike the $JEGP (+0,2 %) the ETF works with futures in order to capture the upside in strongly rising markets. In itself a very nice idea, which works well compared to other covered call ETFs, if you look at it in comparison to the benchmark MSCI World.

Now to the actual question:

if you assume a long-term average return of approx. 7% for the MSCI World and the $WINC (+0,77 %) 9.5%, then there should be a negative price trend in the long term with the dividend or payout discount (-2.5%). Am I right or have I missed something?

Let's see what 2026 will bring, to be honest i think i expect a lot from this ETF this year !

Reallocation

Due to some partial profit-taking in the (US) tech/AI sector ($NBIS (-9,32 %) / $AVGO (-0,41 %) / $MPWR (+1,59 %) / $AMD (-1,53 %)) and OS selling ($RKLB (-6,56 %) / $AMD (-1,53 %)), the portfolio will be rebalanced and restructured. $RKLB (-6,56 %) , $LMND (-7,45 %) , $GOOG (+3,65 %) and $9988 (-0,62 %) but I'm not touching them (yet) 😀

Unfortunately, the entry prices for GQ have been completely messed up due to the recent transfer from TR to SC.

- After almost a year of watching, I dare to re-enter at $GRAB (-0,84 %) - further increase to 500 shares would be considered

- at $HIMS (-0,67 %) a limit buy at €25 is lying in wait, increase from 40 to 60 shares planned

- $NOW (-2,85 %) increased to 13 shares

- $WKL (+0,53 %) increased to 18 shares

- $AJG (+1,14 %) Position filled, 7 shares

- $DXCM (+0,57 %) Position filled, 26 shares

- Doubling of the small speculative position at $ONWD (-0,72 %) planned to 120 shares, limit buy @ € 4.30

- 10 shares $TEM (-2,07 %) collected, savings plan continues

- $RSG (-1,05 %) , $CCEP (+0,9 %) and $DDOG (-4,15 %) also continue to run in the savings plan alongside the ETFs $UBU7 (+0,57 %) , $WINC (+0,77 %) , $SCWX (+0,82 %) and $EXH5 (+1,19 %)

I am still undecided about the potential increase in $UBER (+0,99 %) , $NU (+1,09 %) , $ZTS (+1,27 %) and $TTD (+0,14 %) - and would be happy to hear a few opinions! I feel Nu and Uber are the most likely at the moment - although Waymo is accelerating well.

💡 Building society loan (2.15 %) as moderate debt leverage for income ETFs - opinion poll*

**Summary:**

I plan to draw down a building society loan of **€16,800** **without residential use** and invest specifically in **3 income-distributing ETFs**.

The aim is **cashflow-based repayment within approx. 24 months**, not buy & hold for 10 years.

---

## 🏦 Financing (fixed)

* Loan amount: **16.800 €**

* Debit interest rate: **2,15 %**

* Term (formal): **10 years**

* Special repayment: **possible monthly at any time**

* Monthly interest charge: **≈ 30 €**

* Strategy: **Dividend income + special repayment**

*My goal repaid after 24 months loan

📊 Planned investment (debt capital)

**Equalized distribution: € 5,600 each**

1️⃣ **iShares World Equity High Income Active UCITS ETF**

ISIN: IE000KJPDY61 $WINC (+0,77 %)

→ Global equity income, high distribution (mainly quarterly)

2️⃣ **JPM Nasdaq Equity Premium Income Active UCITS ETF**

ISIN: IE000U9J8HX9 $JEPQ (+0,65 %)

→ Nasdaq exposure + option premiums, **monthly distribution**

3️⃣ **JPM Global Equity Premium Income Active UCITS ETF**

ISIN: IE0003UVYC20 $JEGP (+0,2 %)

→ Globally diversified + option strategy, **monthly distribution**

---

💸 Expected cash flow (conservative)

* Total net dividends: **≈ 90-108€ / month**

* Interest covered: **yes**

* Pure repayment portion from distributions: **≈ 60-78€ / month**

* Additional repayment planned from own funds (dividends from the existing portfolio are diverted to repayment)

➡️ **Target:** Full repayment in **~24 months**, then cash flow free.

🧠 Risk classification (deliberately chosen)

* No margin, no Lombard

* Fixed interest rate < expected cash flow

* Income ETFs → limited upside, but predictable return

* Main risks:

* Reduction in distributions

* Sideways/downwards markets

* Option strategies limit price gains

💸 Cash flow side (income ETFs)

Conservative net distribution yield of the ETF basket:

≈ 6.5-7.0% net p. a.

corresponds to 650-700 basis points

➡️ Spread (yield - interest rate):

+435 to +485 basis points

🧠 Interpretation (for the community)

No classic growth lever

No price momentum required

Leverage based purely on carry

Comparable with:

conservative credit spread

structured income overlay

Yes, a savings plan on the Msci world could be in the portfolio after 2 years with a higher book value, but after 2 years I have one the shares in the 3 ETFs and monthly cash flow free

---

## ❓ Open questions for the community

* How do you see the project?

* Is the **2.15% fixed interest rate** a justifiable "leverage" from your point of view?

* Would you set the weighting of the three ETFs differently?

* Am I overlooking a structural risk?

I am very happy to receive critical opinions.

The goal is not "get rich quick", but controlled cash flow with a quick payback

"Can I also pay the loan from my earned income should the planned cash flow fail to materialize?"

If that's the case, I don't think you're overleveraging yourself.

Etf portfolio with trading212

New addition to my ETF experiment:

Already had my eyes on this ETF, made my entry after ex-div date.

Current distribution:

- 50% All-world

- 26% EM

- 12% TDIV

- 12% WINC

Added a new ETF

In addition to $JEGP (+0,2 %)

$TDIV (+0,23 %) and $VWRL (+0,63 %) i started a position in $WINC (+0,77 %)

Welcome to the club

Valores en tendencia

Principales creadores de la semana