My dears, as we look ahead to the new year, I'm already taking a look around.

With the question of which values could be the winners in 2026.

Last year, I read comments from time to time. Which said that the top performers of 2024 will not perform next year or will even lose.

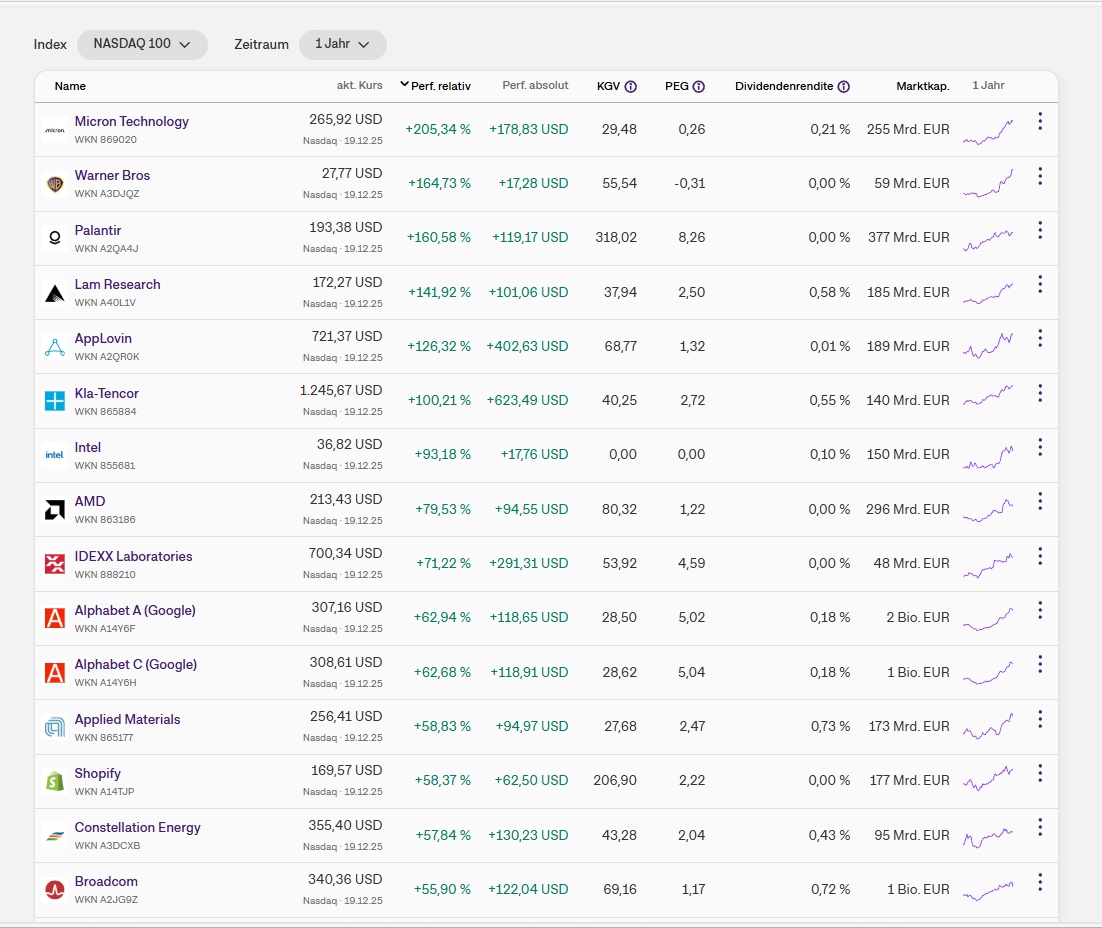

If I had listened to them, I wouldn't have stayed invested in AppLovin. And I would have missed out on the Tenbagger 2025.

Dear ones, how are you dealing with your TOP performers from this year?

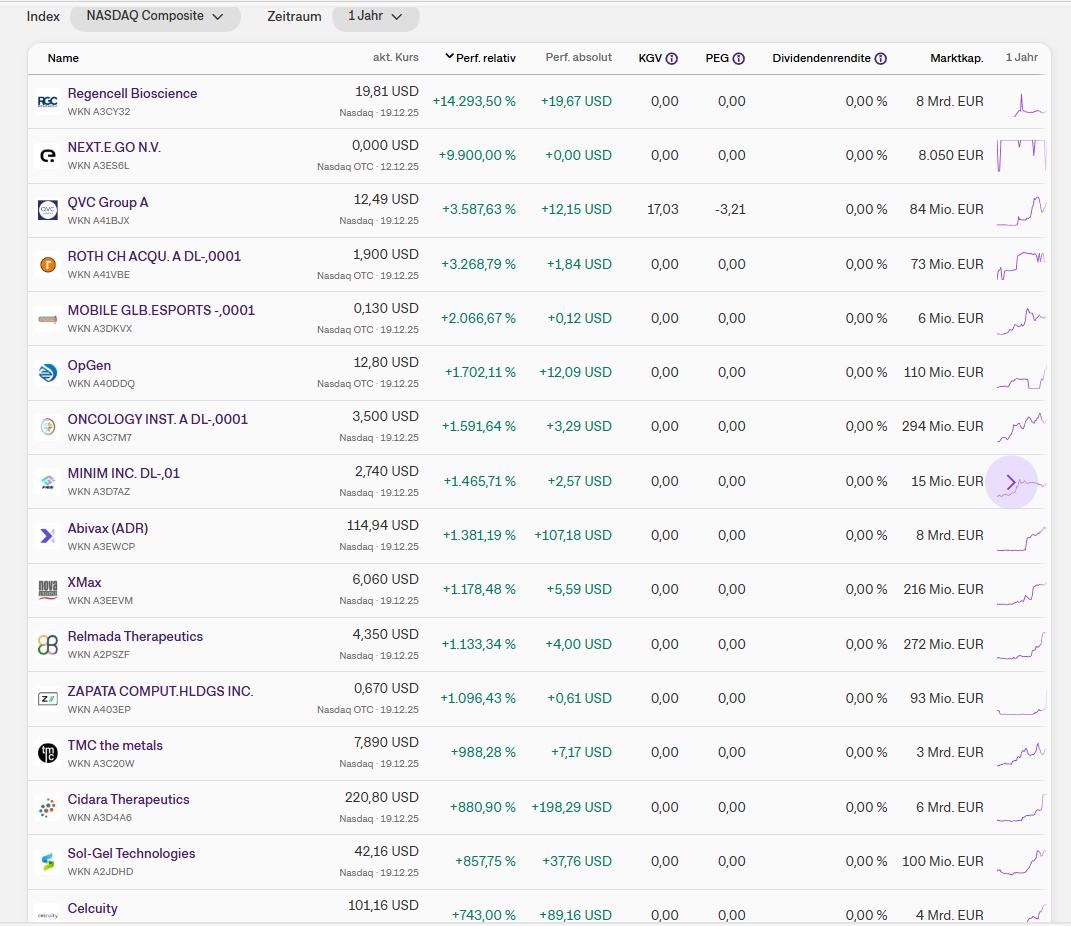

When looking at the TOPs from the indices, I keep noticing which pearls in the NASDAQ Composite are hidden.

My TOPs from this index are in the upper midfield.

It takes a lot of courage and risk to be among the best stocks here. Because as you can see, almost all of these stocks have no P/E ratio. That means they are not profitable.

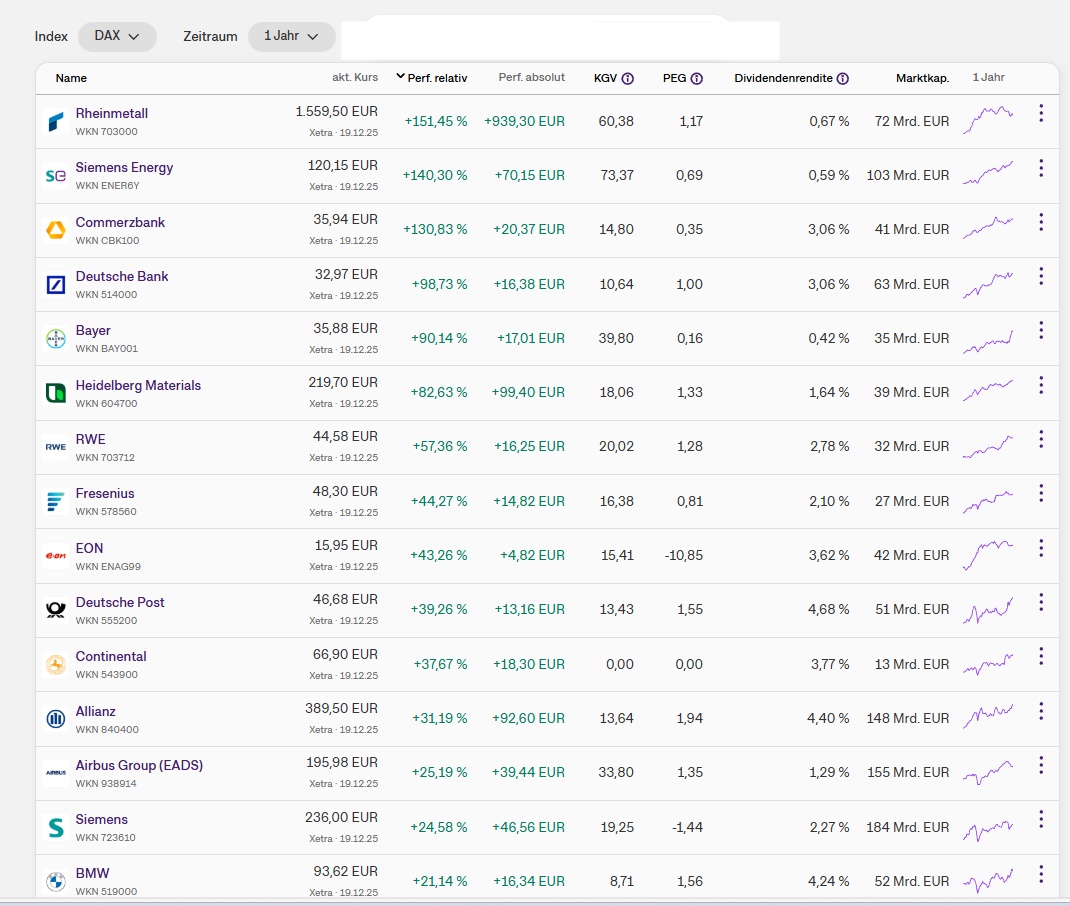

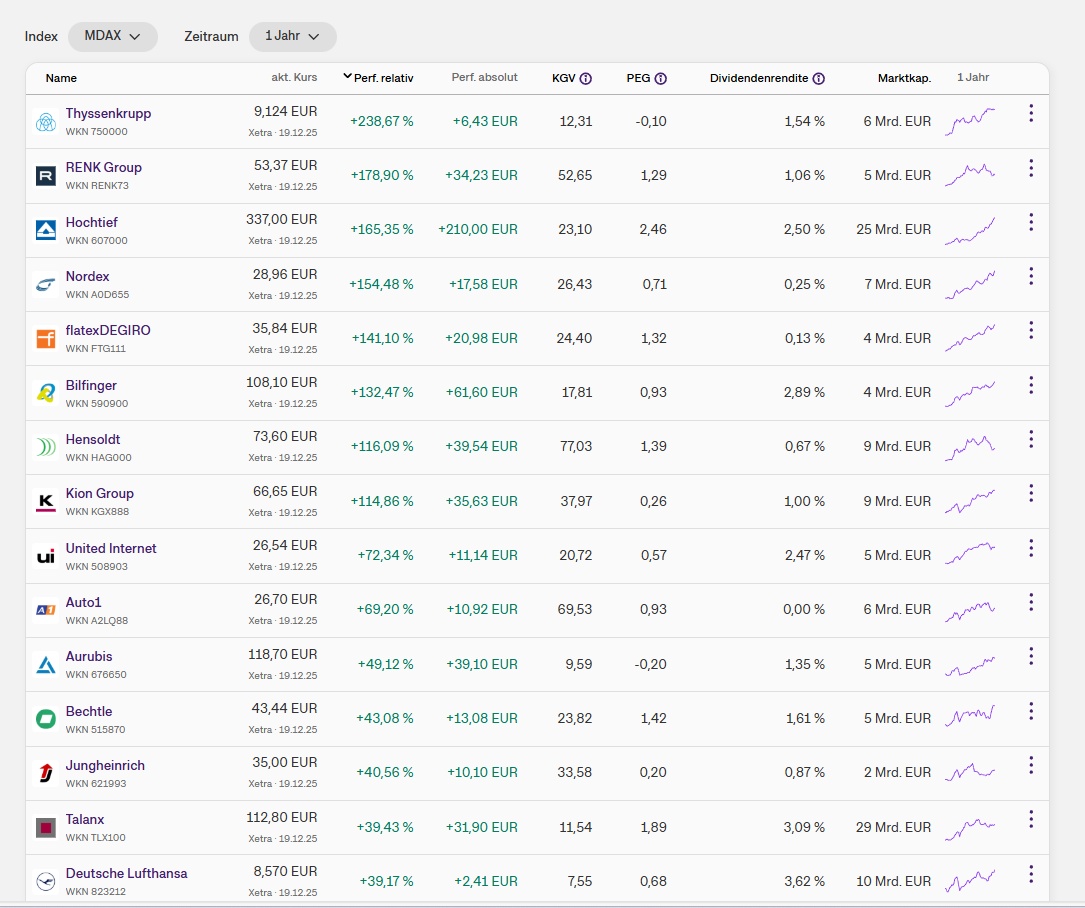

But there are also these gems in the S and M DAX, and perhaps it is worth taking a closer look here. Even if we like to talk Germany down.

There are also a few surprises, so I wouldn't have bet a flower pot on SMA Solar and Nordex. Even a Tenbagger is off the mark 😂🙈. Or who of you would have expected these stocks to be at the top?

Which value is a surprise for you, and which values do you still see at the top?

After all, a turn of the year shouldn't put an end to momentum.

I am at least pleased to be among the winners in some indices. 😘

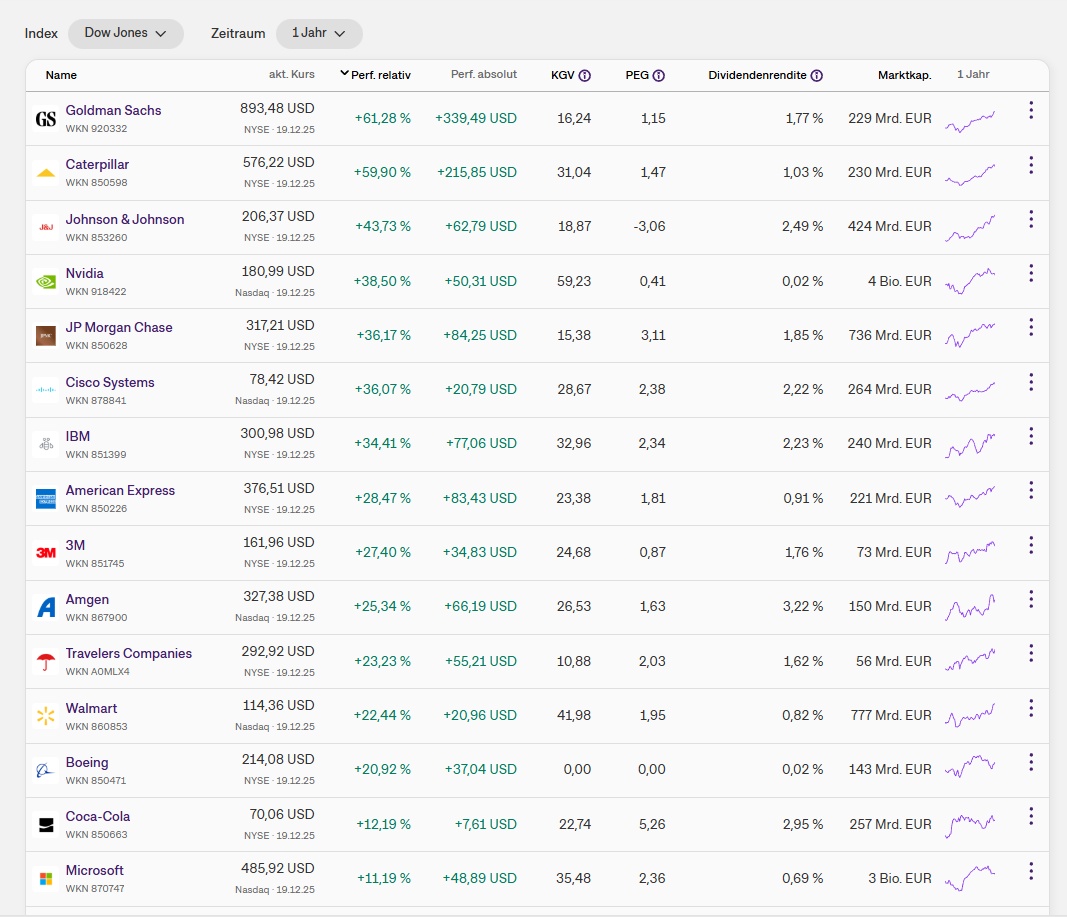

My TOPs from the stock market indices:

NASDAQ $MU (+2,55%) Micron 205.34 %

$APP (-5,89%) AppLovin 126.32 %

$GOOGL (+3,81%) Alphabet 62.94 %

DAX$SIE (+1,82%) Siemens 24.58 %

$ENR (+0,35%) Siemens Energy 140.30 %

Dow Jones$NVDA (+1%) NVIDIA 38.50 %

$MSFT (-0,3%) Microsoft 11.19 %

M DAX - - - - -

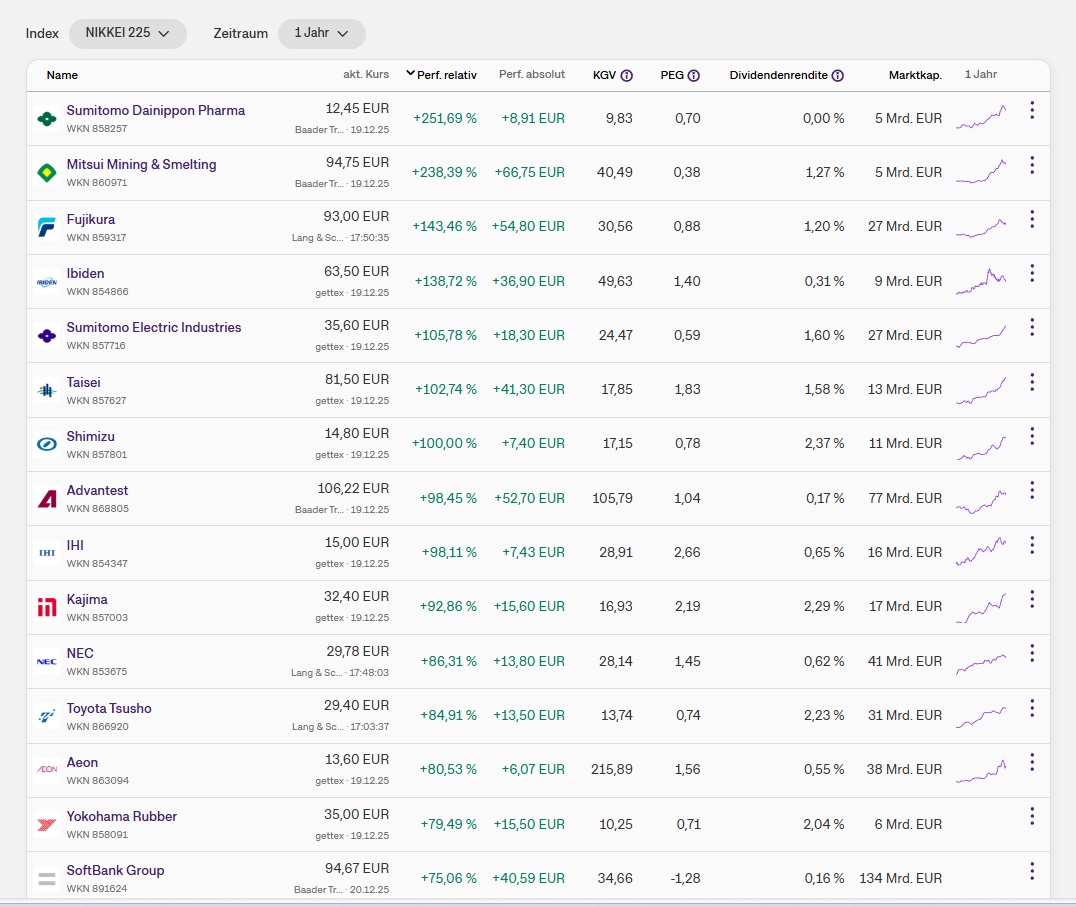

NIKKEI$6857 (+1,2%) Advantest 98.45 %

TecDAX$AIXA (-0,54%) Aixtron 17.87 %

SDAX -------

NASDAQ Composite

$FEIM (-3,96%) Frequency Electronics 159 %

$GILT (-1,57%)

Gilat Satellite Networks 102 %

$IESC (+2,56%)

IES Holdings 92,5 %

NASDAQ

DAX

Dow Jones

M DAX

NIKKEI

TecDAX

SDAX

NASDAQ Composite