depot significantly simplified.

Savings are now only $VWCE (+0,8%) and $VHYL (+0,36%)

Messaggi

289depot significantly simplified.

Savings are now only $VWCE (+0,8%) and $VHYL (+0,36%)

Our puppy has been walking by our side for almost a whole moon cycle now - a little companion who brings light, chaos and new paths into our lives 🐾🌙.

As my B.Sc. in Economics draws to a close, the lines of my investment strategy are also beginning to shift...

as if the stars themselves had changed their constellation ✨🔭.

At Scalable Capital, I'm erecting a protective shield for upcoming vet costs - a silver wall to protect us from life's unpredictable storms 🛡️🌫️.

Pet health insurance isn't worth it yet, so my own reserve is growing there, guarded like a treasure in an old chest.

Plus two faithful companions:

$VHYL (+0,36%) , the global dividend earner 🌍💸,

and $O (-0,55%) , the moon priest of monthly distributions 🌕🕯️.

My goal: €5,000, anchored in the ground like a rune stone that won't break even in winter 🪨❄️.

My "nest egg deposit" rests at Trade Republic - a silent guardian that only wakes up in real crises ⚔️🌑.

There flow $VWRL (+0,66%) and again $O (-0,55%) reinforced by the 2% interest that seeps into the reserve like drops of pure mana 💧🔮.

And yes... the odd individual purchase has crept in there like a mischievous forest spirit at dawn 🧝♂️🌫️.

At my house bank, the $SPYY (+0,9%) as a core ETF - free of charge as long as I'm still under 31, like a gift from the old gods 🎁🌤️.

Soon to be joined by the $VHYL (+0,36%) which brings me global dividend streams, like a river that doesn't freeze even in the depths of winter 🌊❄️.

Some dividend stocks are to follow; the runes have not yet been interpreted.

But $DTE (-0,27%) calls out like a beacon in the fog with its tax-free dividend 📡🔥✨.

Despite possible criticism from the shadows, I have chosen two ESG funds from Union Investment for my godchildren.

Not every path is the same, and sometimes you follow the star that only shines for you ⭐🧭.

My long-term goal remains as clear as the North Star over a quiet winter's night:

That all these small but steadily growing savings plans will one day pay for themselves - through interest, dividends and the unstoppable force of time.

A cycle that feeds itself 🔄🌌.

A wheel that keeps turning 🛞✨.

A fortune that grows like an ancient world tree, deeply rooted and yet striving towards the sky 🌲🌠.

Your DividendWeiser

Today I increased my $VHYL (+0,36%) increased my position. What did you buy on this Friday the 13th?

I’m building a simple long-term ETF portfolio dividend

The idea is to combine growth with stable dividend income and reinvest everything for compounding.

Do you think this is a good balance? Would you change anything?

Hi everyone,

I'm currently facing a question that everyone probably likes to ask themselves, but I have around €10,000 to invest and I'm not sure where to put it at the moment.

I am saving both the $TDIV (+0,6%) as well as the $VHYL (+0,36%) as a dividend earner but also the $IWDA (+0,55%) as my core

My general goal is to have a good mix of dividend stocks ($KO, $SBMO (+4,1%) etc) and growth/tech stocks ($GOOGL (+2,31%) ). Overall, I want to continue this trend and therefore ask you for recommendations

First of all:

Thank you for the warm welcome to the getquin community!

Unfortunately, I did not read the HowTo:Portfolio feedback on GetQuin from @DonkeyInvestor

for a detailed presentation only later and this time I'm trying to write in more detail than the first time and to substantiate the decisions I made in order to possibly receive even more precise feedback from the community. 💛

My personal goal is to become completely debt-free and at the same time start steadily building up assets 📈to improve my private pension provision in 2026. I am expressly prepared to take a higher risk in the first year of my investment and am therefore trying out almost everything.

This year, I would like to operate according to the conscious principle of "set and forget" and consciously review my strategy at the end of 2026 between the holidays and adjust it if necessary.

Instead of "keep it simple", it's more likely to be "overenginerring."

I see your numerous tips as the reason for this, for which I would like to thank you again at

@Epi

@Gehebeltes-EFH

@Stullen-Portfolio

@Multibagger

@Sunrise-Mantis

@EisenEnte

@PositivePossum

@schlimmschlimm

and my general motto in life:

"Anyone can do simple!"

I think at this point in time, investing with "putting everything into the AllWorld ETF" would only be half as much fun for me and would rather bore me. Everything is still so new and unknown. 🤯

I'll then see whether the different investments were generally a good thumbs 👍🏻 or a very bad thumbs down 👎🏻Idee.

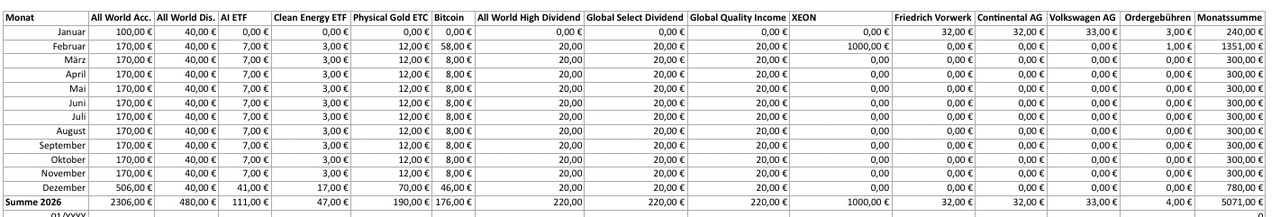

The sum of € 5,071.00 that I have already firmly capped and gradually planned to invest in this first year 2026 has already been completely written off in my mind as play money.

For the necessary diversification (ETF, ETC, individual shares and crypto) in my portfolio, I have taken further INCENTIVES and have switched from the initial €100 per month savings plan to an accumulating AllWorld ETF and have set up an additional savings plan of €40 per month on the same AllWorld ETF in distributing form in mid-January 2026.

In the meantime, I came up with the idea at the end of January 2026 and added the two existing savings plans $VWCE (+0,8%) and $VWGL additional savings plans ($AIQG (+0,79%)

$RENW (+1,09%)

$IGLN (-0,66%)

$BTC (+0,83%)

$VHYL (+0,36%)

$ISPA (+0,38%)

$FGEU (+0,31%) to a total of 9 savings plans with a monthly sum of €300.

Unfortunately, it was already too late to execute the savings plans by direct debit at Trade Republic at the beginning of 02/2026. Therefore, they will now only be executed in the middle of this month.

Yesterday I spontaneously decided to place a €50 single order in bitcoin. I just let myself be carried away by the postings. 🤑

The planned unscheduled repayment (€500 per month) for my car loan has now worked well for two months and will be prioritized in order to actually become debt-free more quickly.

The specific amounts and items invested to date and in the future can be seen in this Excel table.

Regarding the 6 suggestions from you @Epi (Yes, you'll get the promised feedback here), I've given the following thoughts in detail, from which my plan is then based.

Deka funds:

The two savings plans of €50 per month each were already suspended by me and were actively used to service the first savings plan of €100 per month.

In addition, I am now liquidating the two sub-custody accounts belonging to the savings plans one by one and selling €100 per month in order to achieve the best possible average value in the sale.

The €100 is then immediately reallocated in the form of five savings plans per month and reinvested as follows:

Core: 65%

Satellites: 35%

of which:

Clean Energy 10%

AI: 10%

Bitcoin: 10%

ETC Gold: 5%

VWL:

I will keep the monthly €40 VWL on the third sub-deposit with Deka until I develop the motivation to inform my employer of another contract. At the moment I have no need to be in contact with the HR department any more than necessary.

Nevertheless, I have set up an additional savings plan of €40 per month for the All World ETF distributing from February 2026.

I'm keeping the three individual shares plus the Xiaomi bonus share in my portfolio to develop a feel for shares.

No further individual stocks are currently planned. This fits quite well in this respect, as I have to hold the bonus share for a year before it can be sold.

Bonus savings contract:

The premium savings contract with a term of 99 years under the "old law" has an annual investment of €150 per month at €12.50 with a guaranteed premium of 50% plus interest and compound interest. After checking the terms and conditions of the contract, switching to 0 would result in an immediate loss of the premium. For this reason, I have decided to keep the contract.

Saving & winning without savings:

Just as I was about to decide whether to cancel the savings tickets, one of the tickets won €1,000 in January 2026. For this reason, I decided to keep my 10 tickets after all.

A key point of my savings lottery tickets is that I get €480 of the €600 back at the end of the year.

These will also be distributed by me to the 5 selected savings plans in December in the same weighting as for the reallocation from the Deka Depot.

The profit from the savings lots in the amount of €1,000 goes to$XEON (+0%) for "max. interest".

Nest egg:

My real nest egg, on the other hand, I keep completely in the call money account so that it is always immediately available to me.

To give me a feel for dividends, I've also picked out three dividend ETFs that I invest €20 a month in.

In combination, these three ETFs ensure that I receive a planned dividend every month. That sounds like a lot of dopamine, at least in theory, so I really like it.

What will actually still be there in 01/2027 from the €5,071 invested is already a 100% profit for me, because after I fell for the game "WOS" 🥶(who knows it?) almost a year ago and blew around 5k on digital crap in 3 months and above all to improve my stove 🔥🪵, this is clearly the better alternative to spend my money on dopamine boosts and pass the time. And being part of a community online at the same time. What more could you want?

So, I'm already looking forward to your feedback. Be honest, I can take it! 🤞🏻

VG

QW3RTY

PS: I could not share my portfolio. The function was grayed out.

The new year got off to a slow start for me. The turn of the year somehow passed me by this time. It wasn't until mid-January that I felt I had arrived in the new year.

But then things got moving: During the first of two hikes through wintry Saxon Switzerland, it occurred to me that there was still something on my to-do list. I just wanted to start making videos again. Whether reels, shorts or entire YouTube videos. That was on my list. And as I climbed the Lilienstein at 8 a.m. on a cold January Saturday, I simply picked up my cell phone and shared my thoughts. But one thing was not enough. During my tours over snow and icy paths and ascents from the Schrammsteine to the Bastei, there were more shots. I finally left my comfort zone again and started the next project on my list. I simply started imperfectly instead of continuing to put off perfection.

Everything continued to run automatically in the background, thanks to automation and savings plans. This time with a small strategic adjustment. Additional funds were not invested, but held back for the taxation of the advance lump sum. The tax-free amounts were just enough, so there will be plenty of additional investments next month.

And now enough preamble, time for a look back.

DISCLAIMER/RISK WARNING

Please remember that this article is for entertainment purposes only. At no point is it a buy or sell recommendation or professional legal, tax or investment advice. Don't just copy anything I do. I am merely describing what is happening in my portfolios, but in no way guarantee that it is up-to-date, correct or complete.

Investing in the capital market is always associated with risks such as loss of invested capital, price fluctuations, liquidation risks or market risks. In accordance with the current guidelines of ESMA and BaFin, I expressly point out that this review serves exclusively to document my personal investment strategy and does not constitute investment advice within the meaning of Section 2 (8) WpIG. The securities presented by me are expressly not to be understood as investment advicebut are merely components of my personal portfolio at the time of reporting.

Overall performance

We all know and appreciate the magic of automation in our portfolios. Except for one thing, the entire news cycle passed me by in January. I'll come back to that at the end.

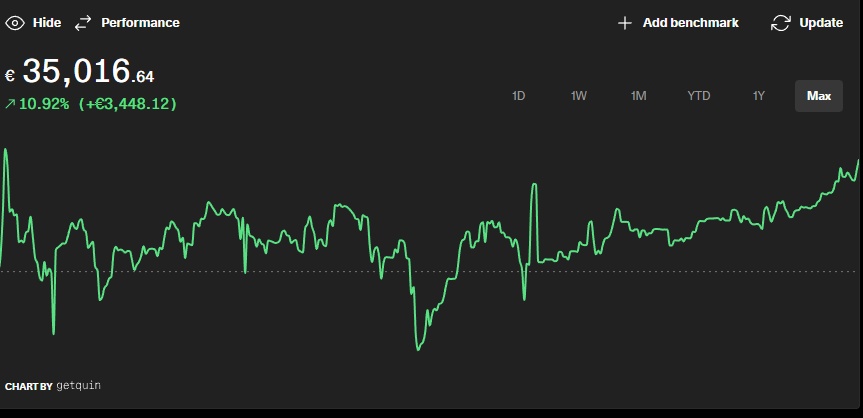

My key performance indicators for my overall portfolio at a glance:

Performance & Volume

My class leader $AVGO (+3,82%) continues to decline as a proportion of the portfolio volume and, as in the previous month $NFLX (-0,69%) with it. The latter even drops out of my top 5 largest individual positions. However, the tide is turning for the giant $GOOGL (+2,31%) . But this is not a recommendation to you! It's just what happened to me. The other positions in my top 5 ($WMT (+0,28%) , $BAC (-1,72%) and $FAST (+0,98%) are also not to be begged and continue to improve, also in terms of performance.

The five red lanterns naturally go to the same weakening candidates (in terms of performance). However, the minus points are finally getting smaller, particularly noticeable in the case of $NOVO B (+2,75%) . And also with $TGT (-0,77%) .

Largest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$AVGO (+3,82%) 2.56% (main share portfolio)

$WMT (+0,28%) 1.93% (main share portfolio)

$GOOGL (+2,31%) 1.55% (main share portfolio)

$FAST (+0,98%) 1.52% (main share portfolio)

$BAC (-1,72%) 1.45% (main share portfolio)

Smallest individual share positions by volume in the overall portfolio:

Share (%) of the total portfolio (and associated securities account):

$NOVO B (+2,75%) 0.45% (main share portfolio)

$BATS (+0,8%) 0.56% (main share portfolio)

$GIS (-1,78%) 0.56% (crypto follow-on deposit)

$MDLZ (-0,24%) 0.60% (main share portfolio)

$CPB (-1,18%) 0.61% (main share portfolio)

Top-performing individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$AVGO (+3,82%) : +294% (main share portfolio)

$GOOGL (+2,31%) +129% (main share portfolio)

$WMT (+0,28%) : +104% (main share portfolio)

$NFLX (-0,69%) : +77% (main share portfolio)

$BAC (-1,72%) +75% (main share portfolio)

Flop performer individual stocks

Shares with performance since initial purchase (%) (and the respective portfolio):

$GIS (-1,78%) : -35% (main stock portfolio)

$NKE (-0,96%) -34% (main share portfolio)

$CPB (-1,18%) : -30% (main share portfolio)

$TGT (-0,77%) -26% (main share portfolio)

$NOVO B (+2,75%) : -13% (main share portfolio)

Asset allocation

Equities and ETFs currently determine my asset allocation.

ETFs: 41.9%

Equities: 58.1%

Investments and additional purchases

I have invested the following sums in savings plans:

Planned savings plan amount from the fixed net salary: €1,040

Planned savings plan amount from the fixed net salary, incl. reinvested dividends according to plan size: € 1,060

Savings ratio of the savings plans to the fixed net salary: 50.07%

In addition, there were the following additional investments from returns, refunds, cashback, etc. as one-off savings plans/repurchases:

Subsequent purchases/one-off savings plans as cashback annuities from refunds: € 0.00

Subsequent purchases/one-off savings plans as cashback annuities from bonuses: € 0.00

Subsequent purchases from other surpluses: € 0.00

Automatically reinvested dividends by the broker: €3.54 (function is only activated for an old custody account, as I otherwise prefer to control the reinvestment myself)

In the month under review, only the fixed savings plans were executed.

Number of unscheduled additional purchases: 0

Passive income from dividends

I received € 172.72 in dividends (€ 98.60 in the same month last year). This corresponds to a change of +75.15% compared to the same month last year. The reason for the strong increase, in addition to normal dividend growth, is that the distributions from my three large Vanguard ETFs slipped over the turn of the year, which makes January look unusually strong. Adjusted for this effect, growth is in line with expectations.

Number of dividend payments: 24

Number of payment days: 12 days

Average dividend per payment: €7.20

average dividend per payday: € 14.39

The top three payers in the month under review were:

My passive income from dividends (and some interest) mathematically covered 17.32% of my expenses in the month under review. For a rather weak month with medium-high expenses by my standards (due to the first annual bills), this is acceptable.

Performance comparison: portfolio vs. benchmarks

A comparison of my portfolio with two important ETFs shows the TTWROR in the current month (and since the beginning):

My portfolio: +1.64% (since I started: +84.34%)

$VWRL (+0,66%) +1.52% (since my start: 66.12%)

$VUSA (+0,59%) -0.26% (since my start: 63.76%)

After underperforming the ETFs last month, the tide has turned for the first month of the new year. 🤗

Key risk figures

Here are my key risk figures for the month under review:

Maximum drawdown:

since inception: 17.17%

Month under review: 2.06%

Maximum drawdown duration:

since inception:702 days

Month under review: 16+ days

Volatility:

since inception: 28.29%

Month under review: 2.28%

Sharpe Ratio:

since inception: 0.42

in the month under review: 9.26

Semi-volatility:

since inception: 21.01

Month under review: 1.36

The maximum drawdown of 702 days since the beginning is still reminiscent of the tough phase of 2022-2023 before the recovery began. In January itself, the decline was minimal at 2.06%, so a quiet start to the year, showing that no major dislocations were imminent.

My Sharpe ratio shot up to 9.26 in the month under review. This is an upward outlier that reflects the positive performance with low volatility. Since the beginning, it has been a solid 0.42. This means that for every unit of risk, I am achieving just under half a unit of return above the risk-free interest rate. Volatility was extremely low in January at 2.28%, compared with 28.29% since the beginning. Semi-volatility was even as low as 1.36%. This means that although the portfolio fluctuates, the actual risk of loss remains low.

What remains? The confirmation of my strategy: think long-term, keep calm, invest automatically. So January got off to a solid and uneventful start. Just the way I like it!

Outlook

As already explained, I will make provisions for the taxation of the advance lump sum in the markets in the second half of February. This will be accompanied by any expected refunds. If you want to know what, be sure to check back next time. 😊

I'll also bring AI as an off-topic topic.

Gemini 3 is simply amazing. I've already used it to create in-depth research on any topic and use it to create podcasts and information material. NotebookLM is now also on the list of tools I'm going to explore. That's the forward momentum in me, to keep my finger on the pulse and get the most out of the new possibilities.

This time I won't end my review with a personal point, but with an event that has not passed me by.

I actually keep politics and world events out of my social media and internet presence, unless they affect our finances, economy or portfolios. What is happening in Iran is absolutely shocking for me. It is inconceivable that the people there, who are fighting for the same rights that we take for granted, are being cut down en masse like cattle by an inhuman regime and its criminal henchmen

Of course you could say: What's it to us? But if we take a look at our country, we realize that such circumstances can also threaten us if we do not stand up for our free, democratic and liberal values and show the clear edge to everything that stands against them. Our women in particular have fought for rights that must be defended. We men also have a duty to defend these achievements. We must understand that all of us who were born and grew up here in the Western world, from Europe to North America to Australia, New Zealand and Japan, have won the ovarian lottery. Not only in terms of poverty and wealth, but also in terms of human rights and freedoms. And that is precisely why there have been and continue to be posts on my Instagram channel that address and share the situation in Iran. Because they are cut off from the outside world and continue to be brutally oppressed, tortured and executed, it is important to give people their own voice and make them visible.

The courageous people who risk everything in the fight for freedom, who have been injured and the countless people who have been murdered, are the greatest heroes this world has seen in recent times.

I wish the people of Iran, who are now risking everything, that they will finally drive out this criminal Islamic regime and its disgusting henchmen and find their way to peace, freedom and self-determination. I wish them all the best and all the happiness in the world. 🍀

Thank you for reading. And now off to an icy February! ❄️

👉 You can also see my portfolio review for January on Instagram from 08.02.2026 (and budget review from 09.02.2026).

📲 In addition to the portfolio and budget review, there are currently three posts a week: @frugalfreisein. Instagram reels and YouTube shorts currently appear irregularly under channels of the same name; the same applies to videos.

!!! Please pay close attention to the spelling of my alias. Unfortunately, there are too many fake and phishing accounts on social media. I have already been "copied" several times. !!!

👉 How do you personally feel the stock market year has started? (No investment advice!)

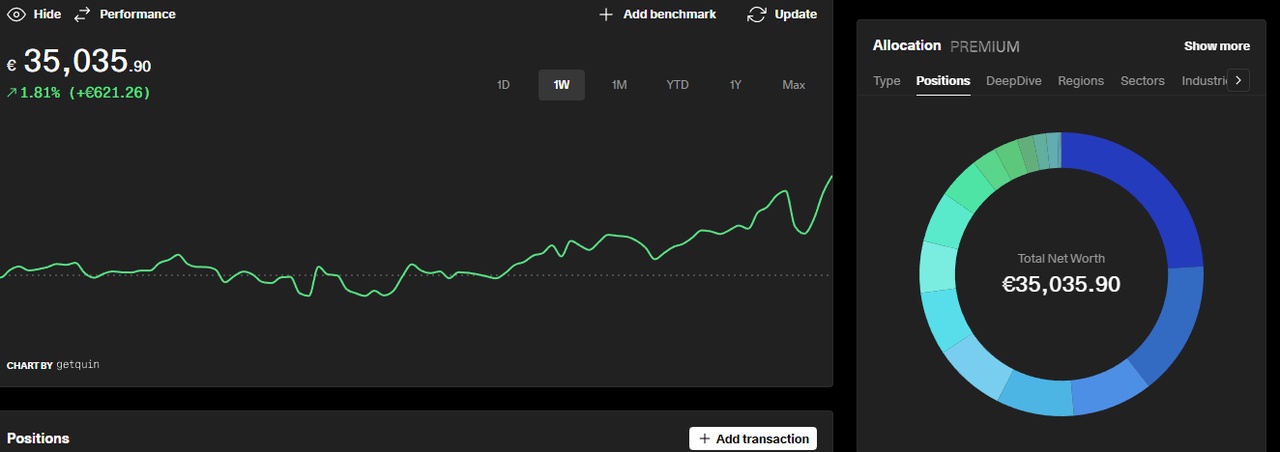

I know, I know. It's just a snapshot, but this figure has been a goal of mine for a long time. Now this figure has finally been reached.

I've been investing since 2022, initially only a little, CHF 200-300 per month. I've learned a lot and found my passion for dividends.

I turned 27 last week, had a difficult start 9 years ago in the adult world. Debts and 0 CHF in my bank account, at some point I managed to get out of it and am now very proud of it.

I still have a long way to go and hope I do the best daraus👌🏼

At the moment I am saving

$VWRL (+0,66%) 50CHF per week

$VHYL (+0,36%) : 50CHF per week

$SREN (+1,77%) : 100 CHF per month

$PEP (+2,24%) : 100 USD per month

$TTE (+0,62%) : 100 Euro per month

Impressed by my performance in these turbulent times.

Which dividend stock do you think is a bargain right now? Long term.

$TDIV (+0,6%)

$PG

$O (-0,55%)

$ASRNL (+0,28%)

$JNJ (+1,59%)

$JEGP$AD (+1,65%)

$VPK (+2,66%)

$NOVO B (+2,75%)

$ULVR (-0,73%)

$WINC (-0,01%)

$VHYL (+0,36%)

I migliori creatori della settimana