**Summary:**

I plan to draw down a building society loan of **€16,800** **without residential use** and invest specifically in **3 income-distributing ETFs**.

The aim is **cashflow-based repayment within approx. 24 months**, not buy & hold for 10 years.

---

## 🏦 Financing (fixed)

* Loan amount: **16.800 €**

* Debit interest rate: **2,15 %**

* Term (formal): **10 years**

* Special repayment: **possible monthly at any time**

* Monthly interest charge: **≈ 30 €**

* Strategy: **Dividend income + special repayment**

*My goal repaid after 24 months loan

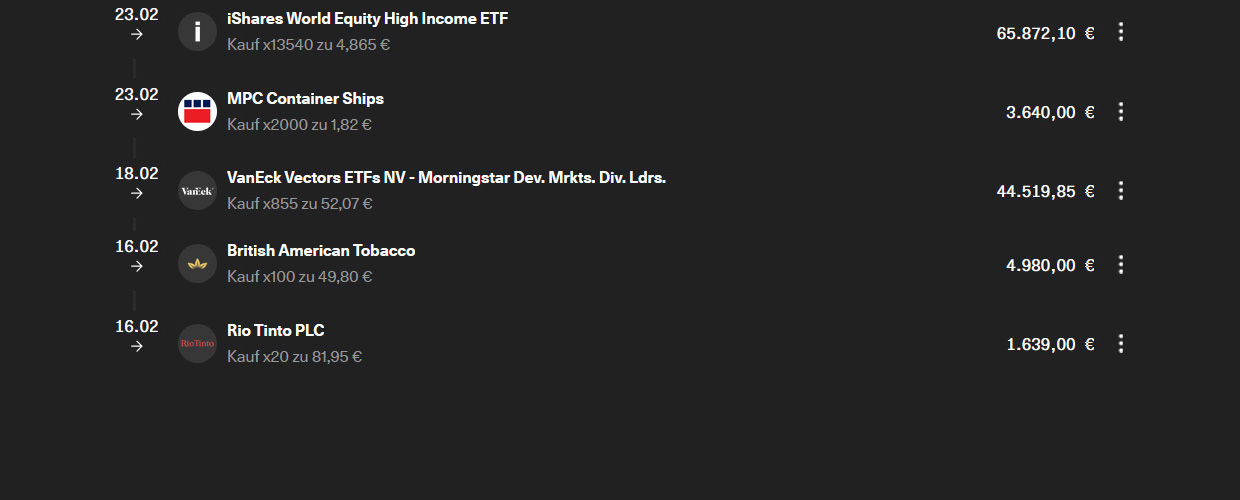

📊 Planned investment (debt capital)

**Equalized distribution: € 5,600 each**

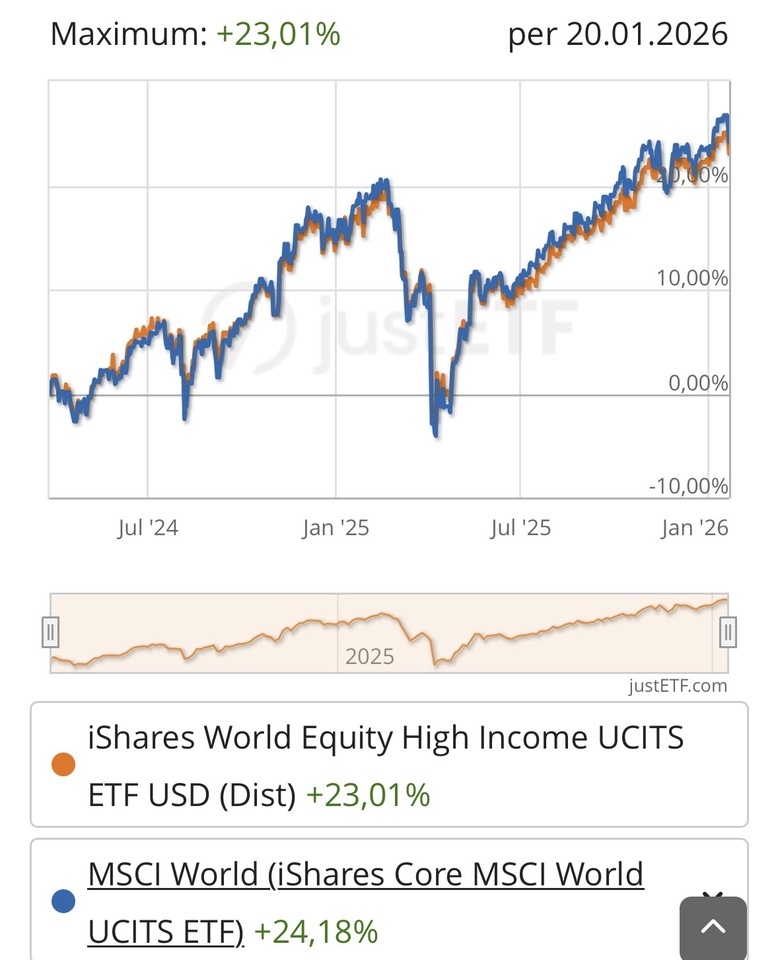

1️⃣ **iShares World Equity High Income Active UCITS ETF**

ISIN: IE000KJPDY61 $WINC (+0,29%)

→ Global equity income, high distribution (mainly quarterly)

2️⃣ **JPM Nasdaq Equity Premium Income Active UCITS ETF**

ISIN: IE000U9J8HX9 $JEPQ (+0,5%)

→ Nasdaq exposure + option premiums, **monthly distribution**

3️⃣ **JPM Global Equity Premium Income Active UCITS ETF**

ISIN: IE0003UVYC20 $JEGP (+0,03%)

→ Globally diversified + option strategy, **monthly distribution**

---

💸 Expected cash flow (conservative)

* Total net dividends: **≈ 90-108€ / month**

* Interest covered: **yes**

* Pure repayment portion from distributions: **≈ 60-78€ / month**

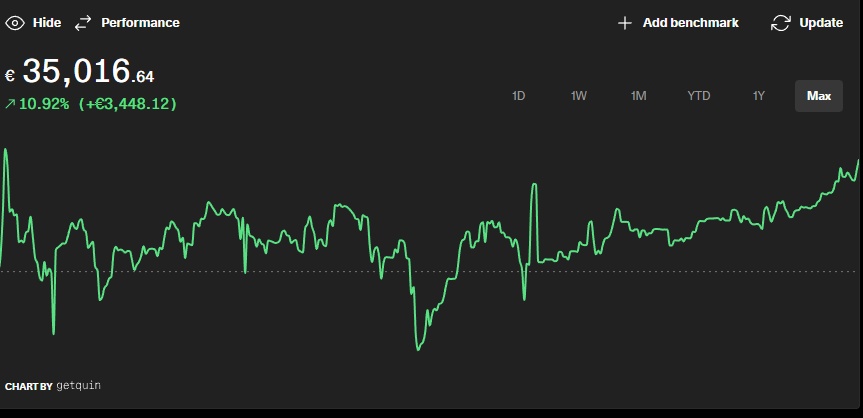

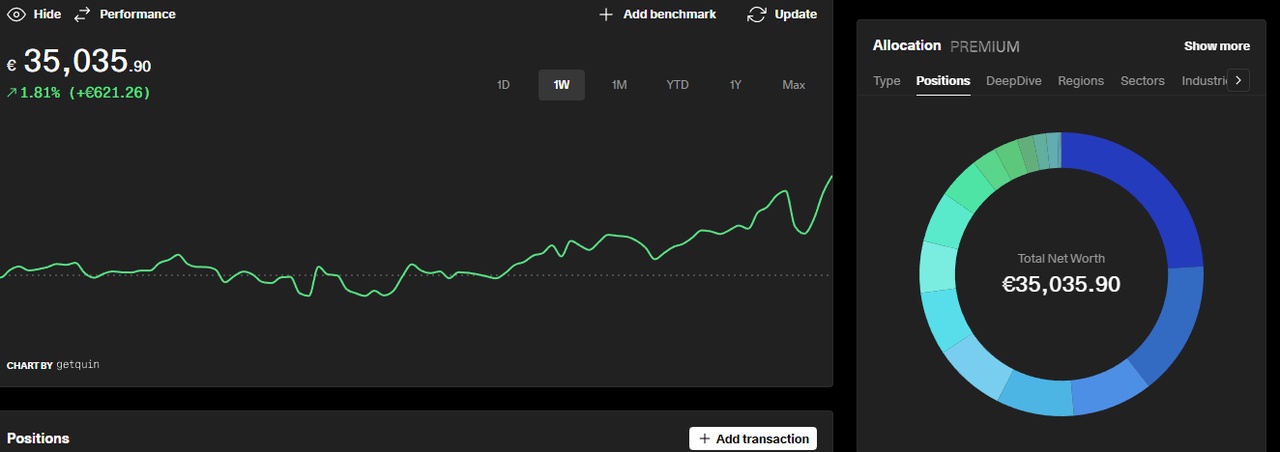

* Additional repayment planned from own funds (dividends from the existing portfolio are diverted to repayment)

➡️ **Target:** Full repayment in **~24 months**, then cash flow free.

🧠 Risk classification (deliberately chosen)

* No margin, no Lombard

* Fixed interest rate < expected cash flow

* Income ETFs → limited upside, but predictable return

* Main risks:

* Reduction in distributions

* Sideways/downwards markets

* Option strategies limit price gains

💸 Cash flow side (income ETFs)

Conservative net distribution yield of the ETF basket:

≈ 6.5-7.0% net p. a.

corresponds to 650-700 basis points

➡️ Spread (yield - interest rate):

+435 to +485 basis points

🧠 Interpretation (for the community)

No classic growth lever

No price momentum required

Leverage based purely on carry

Comparable with:

conservative credit spread

structured income overlay

Yes, a savings plan on the Msci world could be in the portfolio after 2 years with a higher book value, but after 2 years I have one the shares in the 3 ETFs and monthly cash flow free

---

## ❓ Open questions for the community

* How do you see the project?

* Is the **2.15% fixed interest rate** a justifiable "leverage" from your point of view?

* Would you set the weighting of the three ETFs differently?

* Am I overlooking a structural risk?

I am very happy to receive critical opinions.

The goal is not "get rich quick", but controlled cash flow with a quick payback