Price decline

OPEC+ countries

Brent futures curve

Oil supply

Kazakhstan

tariff war

Price target

Link: https://shorturl.at/asfT7

$SHEL (+1,04%)

$TTE (+0,47%)

$CVX (+0,29%)

$XOM (+0,17%)

$BP. (-0,04%)

$OXY (+0,25%)

$SLB (+0,46%)

$2222

$ENI (+0,08%)

Messaggi

9Price decline

OPEC+ countries

Brent futures curve

Oil supply

Kazakhstan

tariff war

Price target

Link: https://shorturl.at/asfT7

$SHEL (+1,04%)

$TTE (+0,47%)

$CVX (+0,29%)

$XOM (+0,17%)

$BP. (-0,04%)

$OXY (+0,25%)

$SLB (+0,46%)

$2222

$ENI (+0,08%)

European defense stocks rise after Selensky-Trump dispute

Shares in the defense industry experienced a strong upswing on Monday, and there are good reasons for this. The trigger was the scandal between Ukrainian President Volodymyr Selenskyj and US President Donald Trump, which brought talks on a raw materials agreement and security guarantees to a standstill. This uncertainty has prompted investors to bet on defense stocks in the expectation that defense spending in Europe will increase.

Rheinmetall $RHM (+0,97%) reached a new record high in the DAX and closed with an impressive gain of 13.71% at EUR 1,144.50. This means that the share has already gained 80 percent since the beginning of the year. HENSOLDT $HAG also benefited from the general euphoria and closed up 22.25 percent at 64.00 euros. Shares in thyssenkrupp $TKA (-3,73%) rose by 10.57 percent to 8.41 euros, while RENK $ABBV (+0,46%) rose by 18.90 percent to 35.52 euros.

Analysts agree that geopolitical tensions and uncertainty over US policy will boost defense spending in Europe. Jürgen Molnar from RoboMarkets emphasizes that the world has changed after the scandal and that Europe can no longer count on the USA as a reliable partner. JPMorgan analyst David Perry points out that many NATO countries will increase their defense spending in the near future, which could further boost demand for defense stocks.

Forecast: Aramco expects results

Saudi Aramco $2222 is about to announce results for the quarter ending December 31, 2024. Analysts estimate that earnings per share will come in at 9.3 cents, down from 11 cents in the same quarter last year.

For sales, analysts expect a decline to an average of EUR 103 billion, which corresponds to a decrease of 11.69 percent compared to the previous year. Last year, Aramco recorded sales of EUR 117 billion. For the past fiscal year, analysts expect earnings of EUR 0.42 per share, compared with EUR 0.48 per share in the previous year. Total sales are estimated at EUR 450 billion, which also represents a decline compared to last year.

Sources:

Let's move on!

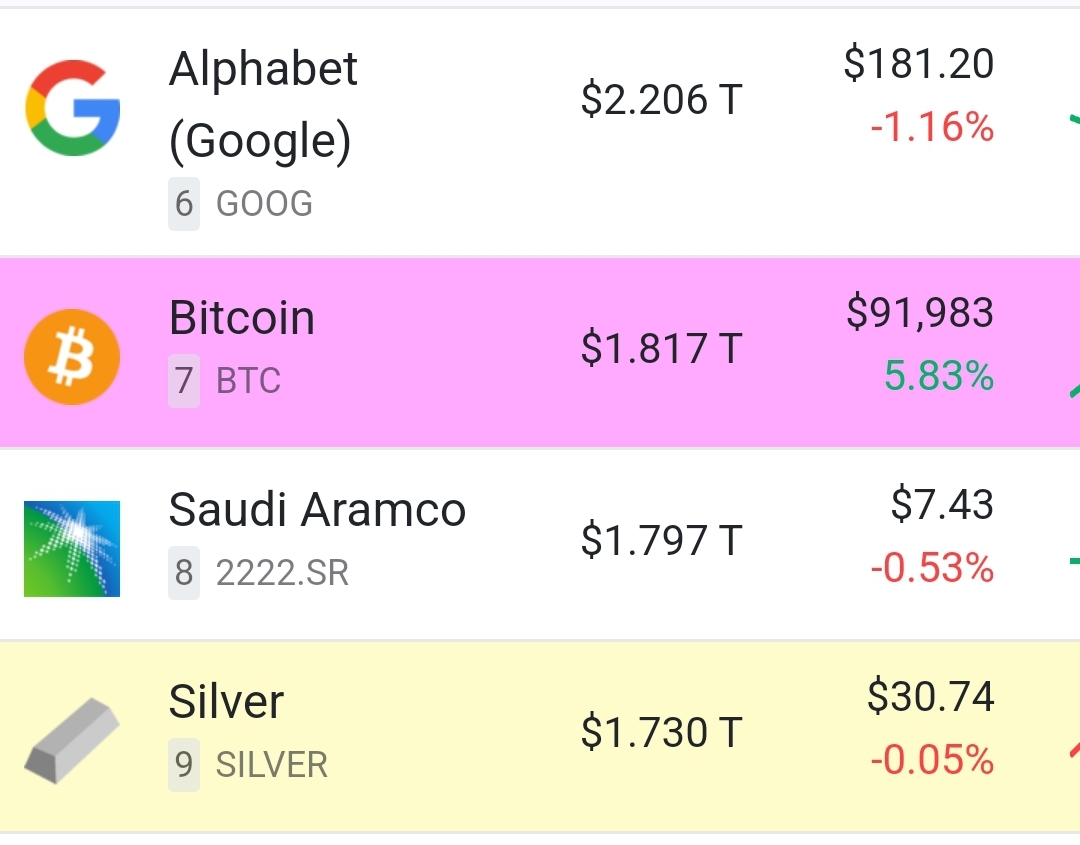

$BTC (-2,91%)

has now also $2222

flipped🚀

Next comes $GOOGL (+0,02%) 😁

BTW: have I ever mentioned that I love the push messages from Strike?😂

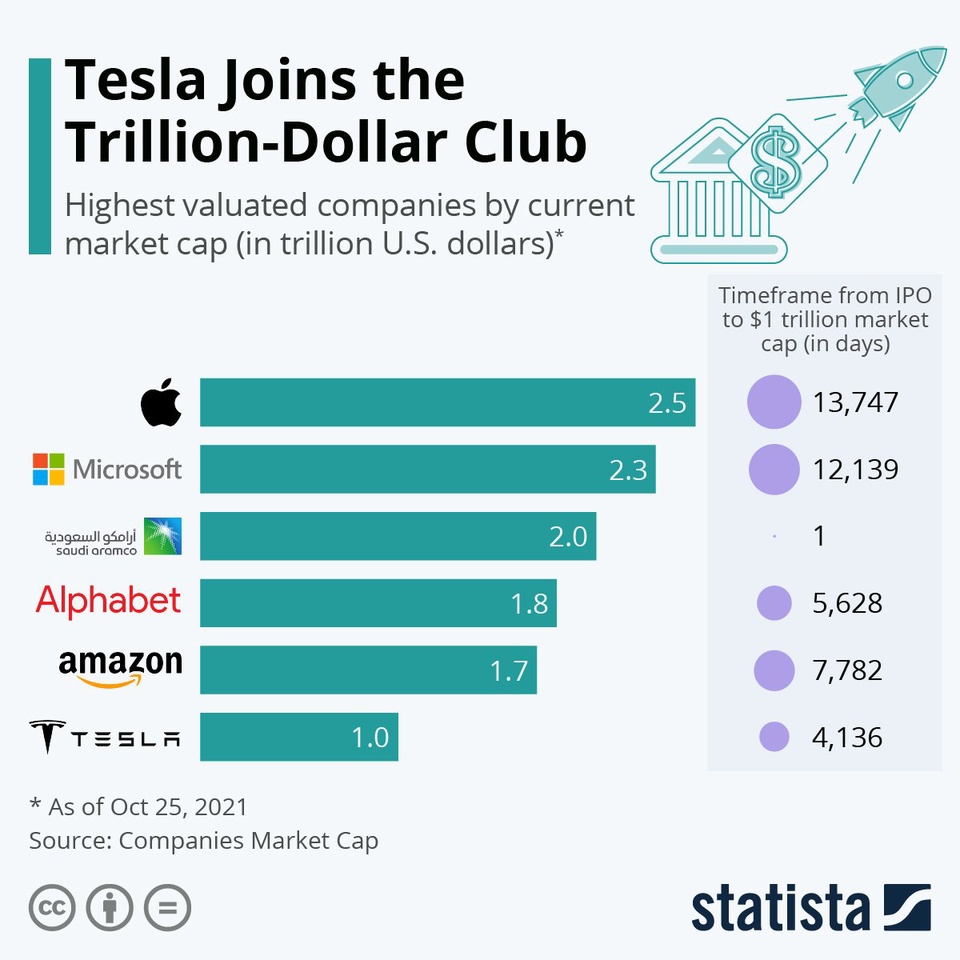

On this day in 2021 $TSLA (-0,16%)

joined the 1 trillion market capitalization club for the first time

Companies with trillion dollar valuations:

Apple: $3.5 trillion - $AAPL (+0,45%)

Nvidia: $3.1 trillion - $NVDA (-0,59%)

Microsoft: $3 trillion - $MSFT (+0,44%)

Alphabet: $2 trillion - $GOOGL (+0,02%)

Amazon: $1.8 trillion - $AMZN (+0,38%)

Saudi Aramco: $1.7 trillion - $2222

Meta: $1.3 trillion - $META (-0,38%)

Berkshire Hathaway: $1 trillion $BRK.B (+0,13%)

Source: Jon Erlichman

The bear is dancing! 🐻 - 5 Bearish Scenarios for Western Oil Stocks.

The oil industry has been battling massive media headwinds in the public eye since as early as the 1980s. Nevertheless, the saying proves true: "Those who are believed dead live longer!" proves true again and again.

In the following, I have listed some points that could indeed trigger bearish scenarios in the Western oil and gas sector. The probabilities for it are quite given, although these are now realistic, I am not able to judge with the contribution.

1. decoupling of the world markets

Many of you must have heard about it in the news. China is currently mediating in the dispute between the oil powers Saudi Arabia and Iran. It is said to amount to reconciliation and a new alliance is to be forged.

Oil trade, explicitly between Saudi Arabia and China, is then to be traded via the yuan (the Chinese currency).

What does this mean? Currencies have no material value. They are printed numbers with a sometimes fancy design intended to facilitate trade in a country or currency union. Behind this piece of paper, however, is always the respective person's imagination of the economic power of the respective nation. Almost all international trade is in U.S. dollars.

Saudi Arabia owns about 13% of the world's oil reserves (according to OPEC statistics). Not for nothing is Saudi Aramco $2222 has at times been the most valuable company in the world. China, on the other hand, is one of the largest buyers of oil. If one now transacts this trade in yuan, one suffers a relatively high loss of value in the dollar. The prices of WTI or Brent, which are tradable for us, would inevitably lose value as well, as demand collapses accordingly. (Long-term view)

In addition, we should continue to monitor China's activities with regard to Iran. After all, Iran also has huge oil reserves that cannot participate in the market at the moment due to the nuclear dispute and the resulting embargo.

2. persistently high prices

Persistently high prices could also spell doom for our oil industry. At present, it is true that money is being made strongly and shareholders can enjoy dizzying records. Nevertheless, the search for alternatives is becoming more attractive. The high demand from the industry may topple as soon as the high prices cannot be passed on to the end consumer, as this would again lead to demand deficits and increased supply. This leads to production cuts and ultimately to demand problems for oil.

The search for alternatives becomes more attractive, as high oil prices make one attractive to the overall market. This does not necessarily spur renewable energy sources. Relatively low coal and gas prices also lead to a reorientation on the energy markets. This can be read particularly clearly from the prices of the respective commodities from 2022. With the difference that the scenario was true for gas.

3. political environment

The following scenario is itself very unlikely, since the lobby in the EU can enjoy quite a lot of influence. Nevertheless, one is quite capable of surprises.

Suppose political environment in a large economic area changes rapidly. This can mean various legalities.

As an example, I take the decoupling of alternatives from oil and gas products. Biofuels could be fully more competitive, or a tax break, as in the 2000s could be a consequence. As a result, demand for oil fell just as sharply, and the federal government consequently rescinded the tax break and passed the Fuel Quota Act to compensate.

4. speculative bubbles in emissions trading

Many may not be familiar with it. In the EU, emitters are obliged to compensate for their emissions. In this case, the responsible companies have to buy certificates for this purpose. However, every emitter participates in this market. Accordingly, it can lead to speculation bubbles forming here as well. The corporations pass these costs on to the consumer. Accordingly, the respective economic good naturally becomes more expensive.

However, this emissions trading system is not limited to the EU. China and other countries also have such trading systems, although the prices there are rather symbolic in comparison.

In addition, there are of course national emissions trading systems, such as the one we have in Germany with the so-called CO2 pricing.

5. overthrow in own rebuilding

The petroleum companies on the European continent in particular are almost outdoing each other with their sustainability goals.

While Total $TTE (+0,47%) has nevertheless been able to solidly claim the gas market in the LNG sector for itself, Shell hardly plays a significant role in it. $SHEL (+1,04%) hardly plays a significant role in it. Overall, in the liquefied natural gas market, US brands such as. $LNG (-0,17%) , $CVX (+0,29%) and $COP (+0,19%) have established themselves.

Please note that this is the fossil market. In the renewables sector, Shell, in turn, already plays a quite considerable role.

BP $BP. (-0,04%) on the other hand, is rather cautious and timid in this respect. Rightly so?

Of course, this cannot be said across the board, since no one can reliably predict the future, especially the general conditions for the future. Nevertheless, the restructuring of the petroleum companies costs an enormous amount of capital and destroys their original business model. It is therefore necessary to venture into new and uncertain sectors, into markets that are already dominated by other well-known companies. The risk of losing market share both in the oil industry and in the so-called "future industries" is therefore very high.

getquin Daily Summary 10.10.2022

Hello getquin,

have a nice monday to all of you.

Europe🌍:

1. alliance expects inflation to rise further

Ahead of the release of the latest consumer price index this week, Mohamed El-Erian, Allianz's chief inflation advisor, said he expects headline inflation "probably to come down to around 8%" but core inflation "still rising."

Read more: https://cnb.cx/3Cm1tcb

🟩 $ALV (-0,73%) 165,32€ (🔼🔽 +0,62%)

America🌏:

2nd Rivian Automotive recalls almost all vehicles

The vehicles of Tesla, competitor Rivian, probably have a steering problem, which the automaker now wants to fix. To do so, Rivian is recalling about 13,000 cars built from 2021 through this September. Rivian is one of Tesla's larger competitors, with Amazon and Jeff Bezos also among its owners.

Read more: https://on.wsj.com/3rGHXCr

🟥 $RIVN (+0,39%) 31,10$ (🔽 -8,38%)

Asia🌏:

3. Saudi Aramco delivers fully to North Asia despite OPEC restriction

Saudi Aramco has told at least five customers in North Asia that they will receive the full contracted amount of crude oil in November, several sources familiar with the matter said Monday. The full supply allocation comes despite the decision by OPEC+, including Russia, to cut its production target by 2 million barrels per day. By lowering output, OPEC+ countries intend to further fuel oil prices. U.S. Treasury Secretary Yellen sees this as a major threat and thinks this development could trigger a global recession.

Read more: https://cnb.cx/3CLARTl

🟥 $2222 9,80€ (🔽 -0,69%)

Stocks of the day:

🟩 TOP $1COV (+0,02%) 33,50€ (🔼 +8,98%)

👍 postitive estimates of quarterly results boost share price

🟥 FLOP $F (+0,03%) 12,06€ (🔽 -5,00%)

👎 Analysts expect Ford and all other U.S. automakers to see profits slump by approx. 50%

🟥 Most searched $MSFT (+0,44%) 236,40€ (🔽 -1,59%)

🟩 Most traded $TSLA (-0,16%) , 228,45€ (🔼 +0,10%)

🟥 S&P500, 3,615.50 (🔽 -0.66%)

🟩 DAX, 12,317.20 (🔼 +0.36%)

🟥 bitcoin ₿, 19,889.25€ (🔽 -0.41%)

Time: 17:10 CEST

What are the largest companies in the world?

Here, most people think of the well-known tech giants, such as Apple $AAPL (+0,45%) or Microsoft $MSFT. (+0,44%)

However, companies can be valued not only by their market capitalization, but also by other factors.

Forbes, for example, ranks companies (equally weighted) according to the following criteria:

Suddenly you get a completely different picture than via the ranking according to pure market capitalization and you don't find a single(!) tech company among the top 5:

Here you can see again what power and weight e.g. a JP Morgan has in the global economy.

Do you primarily only look at market capitalization or do such rankings also play a role for you?

And does this make you look differently at companies/shares of e.g. JP Morgan or Berkshire Hathaway?

I migliori creatori della settimana