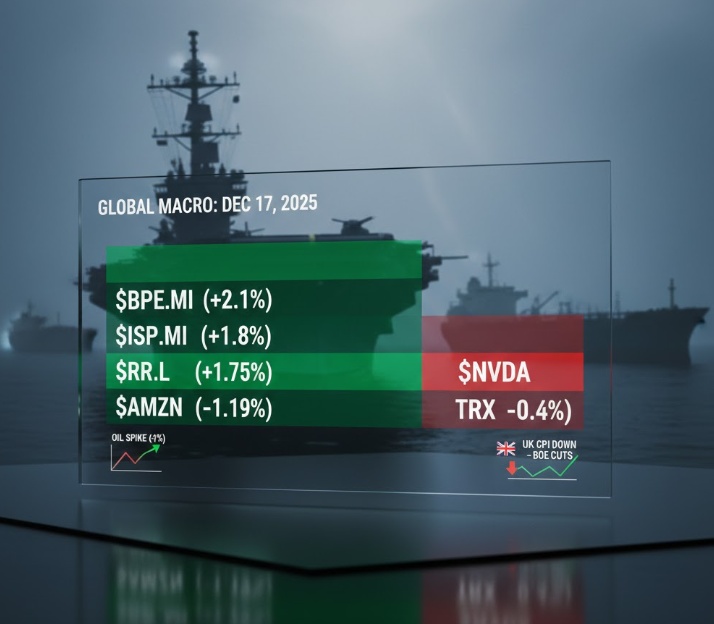

The week kicks off with a strong, but highly selective, risk-on rally. Markets are piling into quality Tech and European Financials, while simultaneously selling off Chinese retail and speculative growth names.

🇺🇸 US Equities (Pre-market/Early Trading)

$SPX500 — Trading solidly higher, driven by strong performance in Tech and Financials.

$DJ30 — Moving up, following the broad positive sentiment.

$NSDQ100 — Leading the gains, as major tech components are firmly in the green.

💻 Tech & Growth Snapshot

$NVDA (+1 %) — Advancing higher, leading the AI and semiconductor space.

$GOOGL (+3,81 %) — Moving up, showing solid strength in the mega-cap tech space.

$AVGO (-0,41 %) — Up moderately, participating in the semiconductor rally.

$META (+1,59 %) — Showing strong gains, continuing its upward momentum.

$MSFT (-0,3 %) — Up slightly, tracking the positive tech trend.

$TSM (+2,62 %) — Up slightly, showing resilience in the chip sector.

$RR. (+1,31 %) — Up moderately, the industrial/aerospace stock shows strength.

$RKLB (-6,56 %) — Down slightly, underperforming as speculative growth faces pressure.

$RGTI (-4,09 %) — Down sharply, quantum stocks are experiencing significant selling.

🛍️ Retail & Commerce

$AMZN (+2,51 %) — Up moderately, participating in the mega-cap rally.

$BABA (+0 %) — Falling sharply, the main source of weakness in the market today, dragging down the retail sector.

$CVNA (+1,39 %) — Up moderately, recovering some ground.

$SHOP (+2,19 %) — Down moderately, likely pulled down by the negative sentiment from $BABA$.

⚕️ Health & Pharmaceutical

$LLY (-1,18 %) — Likely flat or slightly down, as investors rotate out of defensive pharma names.

$HIMS (-0,67 %) — Holding steady, showing no significant price change.

$INSM (+3,7 %) — Flat, the biotech sector remains cautious.

🇪🇺 Europe & Industrials

STOXX 600 — Trading higher, led by a strong rally in the banking sector.

GER40 — Trading cautiously higher, reflecting the positive sentiment.

$LDO (+0,24 %) — Up strongly, the defense sector is showing significant strength.

$IBE (+0,92 %) — Down slightly, utilities lag as investors move away from defensive assets.

$OKLO — Holding steady, the nuclear tech stock is flat.

$CS (+1,79 %) — Up moderately, joining the rally in European financials.

🏦 Banking & Finance

$UCG (+1,16 %) — Advancing higher, part of the strong European banking rally.

$ISP (+1,92 %) — Up strongly, showing clear outperformance.

$BPE (+4,11 %) — Surging higher, continuing its massive rally and leading the Italian banks.

$CE (+1,02 %) — Up strongly, another standout performer in the Italian banking sector.

$BBVA (+1,8 %) — Up strongly, the Spanish bank is showing significant gains.

$AXP (+0,94 %) — Up moderately, the payments sector is positive.

$V (+0,55 %) — Down slightly, counter-trending the financial sector's strength.

🌏 Asia

$JPN225 / $KOSPI / $HK50 / $CHINA50$ — Likely closed mixed to negative, heavily impacted by the sharp sell-off in $BABA$.

_p_ Forex

$DXY — The Dollar Index is trading loweras risk appetite favors other currencies.

$EURUSD — Moving higheragainst a weaker Dollar.

$USDJPY — Drifting loweras the Yen gains some ground.

💎 Commodities & Precious Metals

$GLD (+0,05 %) — Holding steady, gold is flat as investors move into equities rather than safe havens.

$CDE (+1,9 %) — Flat, mirroring gold's lack of direction.

$BRENT / $WTI — Likely trading higheron risk-onsentiment and a weaker Dollar.

💰 Crypto

$BTC (-0,38 %) / $ETH (-0,45 %) — Likely moving higher, following the Nasdaq and the risk-onmood.

$TRX (-0,32 %) — Down slightly, underperforming the broader crypto sentiment.

$CRO (-0,64 %) — Not shown, likely tracking the positive risk-ontrend.

📈 Benchmark ETFs

$VOO (+0,05 %) / $VGT (+0,06 %) / $CNDX — Holding steady (from image), but the underlying components signal they are trading higher.

$BND (+0,04 %) — Flat, as bond yields likely rise (prices fall) in a risk-onmove.

🔎 Deep Dive: The "Quality Growth" Rally

Today is a "flight to quality growth." The market is not buying everything; it is highly selective. There is clear strength in established Tech ($NVDA, $GOOGL) and a massive rally in European Banks ($BPE.MI, $BBVA.MC). However, there is clear weakness in Chinese Retail ($BABA, $SHOP) and speculative Tech ($RGTI, $RKLB). This divergence signals that investors are willing to take risks, but only on assets with strong fundamentals or clear momentum, while dumping assets exposed to Chinese macro or high speculation.

Follow the Analysis:

For daily real-time market insights, deep dives, and trading discussions, follow me on X: https://x.com/ThomasVioli

To copy my portfolio, strategies, and complete trade insights, you can follow me on eToro: https://www.eToro.com/people/farlys

⚠️ Disclaimer:Past performance is not indicative of future results. Investing involves risks, including the loss of capital.