...and so I would also like to look back in conclusion...

...after many personal ups and downs this year, everything turned out well after all.

In addition to the idea of getting married, as many people already know, I was torn out of life by cancer in the middle of the year. A long operation, since then a constant fight back to life, always at the limit, but at the end of the year the certainty that things will continue to improve and that I will remain free of cancer.

It's just a shame that the surgery was exactly 2 weeks before my final IHK exam (tax law) on the way to becoming a financial accountant, but postponed is not canceled and so I will tackle this project again in 2026.

But I would like to thank you again for the kind wishes for recovery and encouragement before and after the surgery, you are just meeegggaaa 🫶

But let's move on to the final figures for 2025:

The 28 was then also cracked on the last meters of this year and so overall I am almost in the middle of my 2nd forecast increase 💪🏻

Even if the path to the first 100k still seems a long one, it is the right path and, as we all know, that is the constantly growing goal.

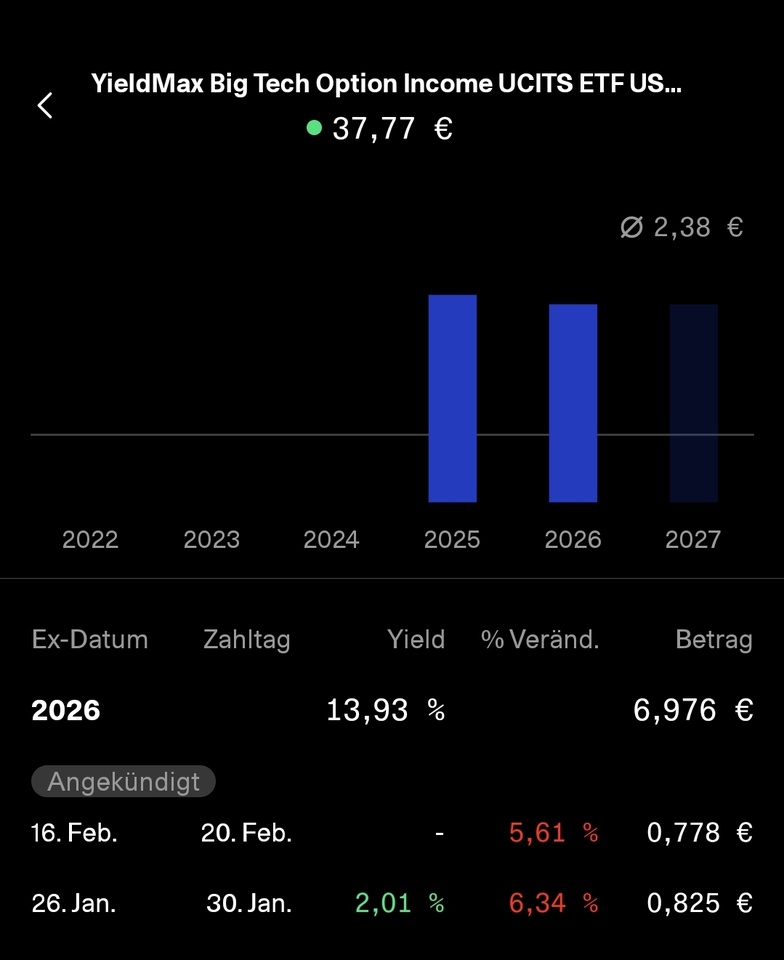

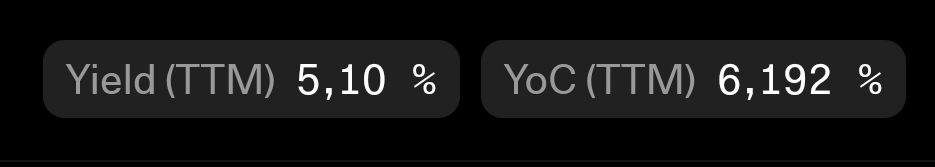

In terms of dividends, I was also right on target and it's hard to believe that these also help to generate further sustainable growth 🤫😅

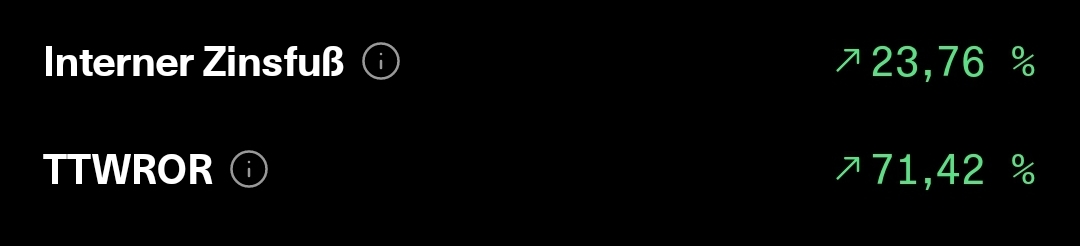

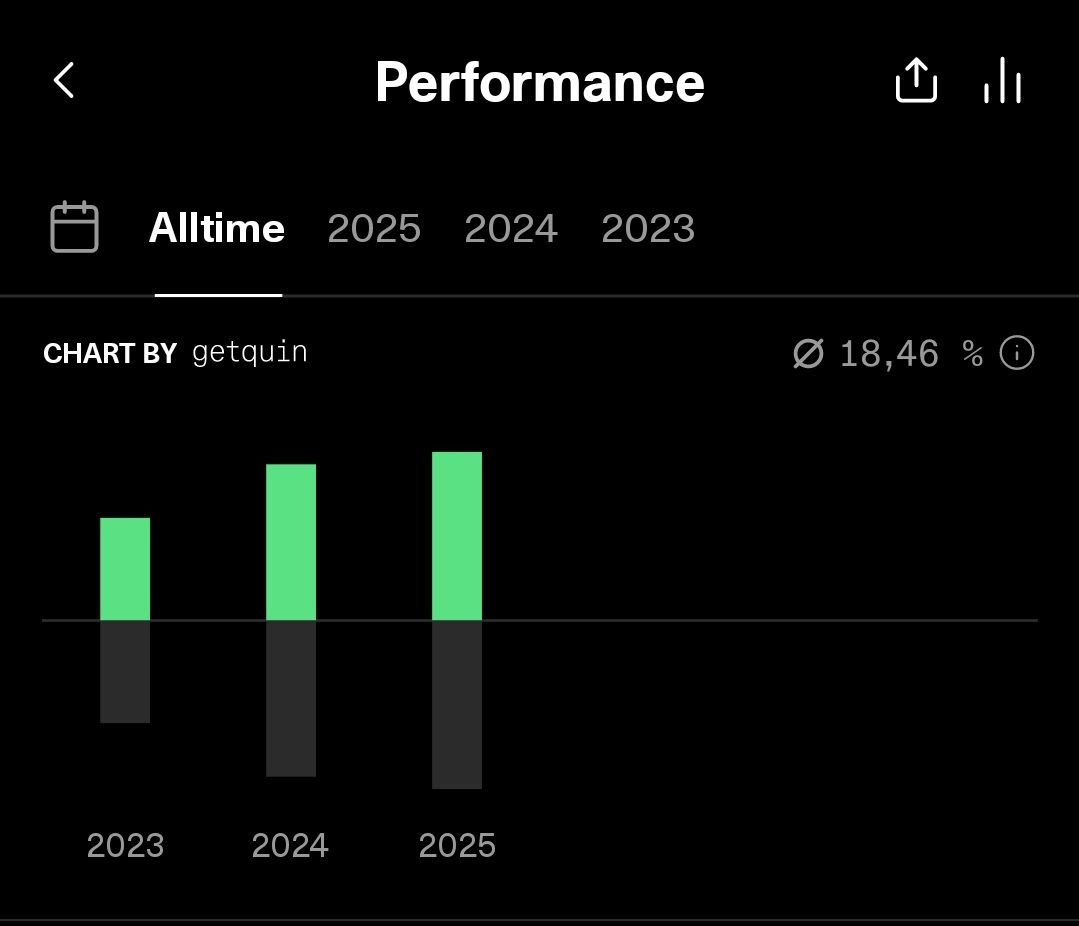

Now most people will be beating their hands over their heads and singing the performance song, but well, as you know, I approach things a little differently.

That's why I'm looking forward to breaking at least the 2k net dividend in 2026, despite my low volume 🥳

And despite this fact, I don't think the performance is bad at all 🤷🏻♂️🤗

》Top 5 of 14《

$3750 (-0,87%) +51,37% (+51,56%)

$HSBA (+1,43%) +35,01% (+39,07%)

$BATS (+2,33%) +34,53% (+91,90%)

$RIO (+0,67%) +20,55% (+28,69%)

$HAUTO (+0,56%) +15,83% (+26,19%)

》Flop 5 of 14《

$1211 (-0,75%) -11,51% (-11,49%)

$YYYY (+0,63%) -5,23% (+1,45%)

$ASWM (+1,83%) -2,36% (-2,36%)

$DTE (+0,29%) -1,70% (-1,70%)

$VAR (-0,19%) -0,80% (+2,65%)

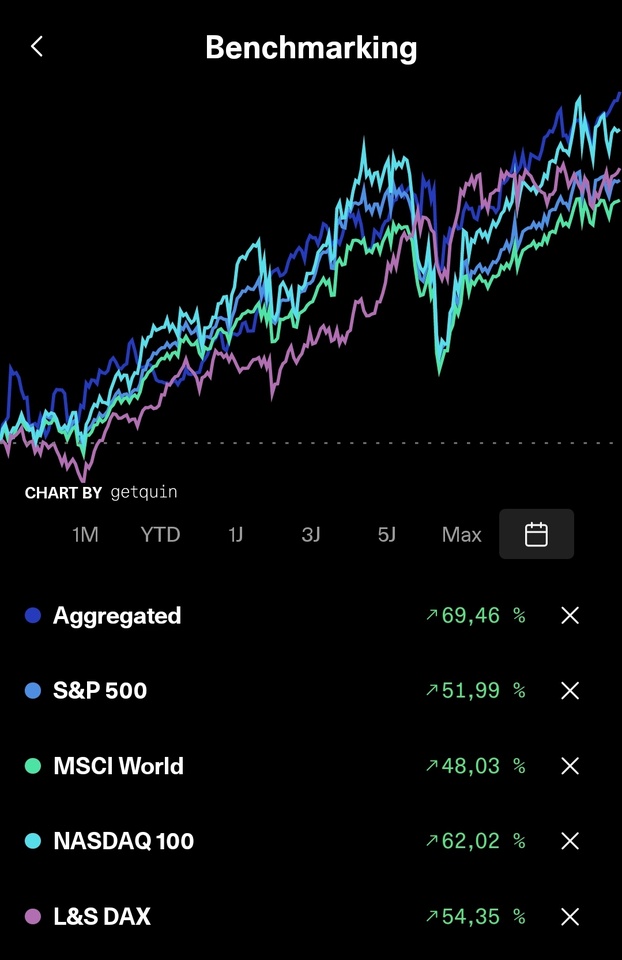

All in all, the long-term view also looks quite reasonable in my opinion...

...so I will continue to stick to my targets and strategy in 2026.

And so there's really nothing left for me to do but thank the entire Getquin team @kundenservice @christian and the entire community...you are simply MEGA 🫶

Wishing everyone a happy new year and everything priceless for 2026 💫🥳

Let's just pick up together in 2026 where we left off in 2025 👋🏻

#gemeinsammehrerreichen