Had 20 positions. Keeping my $SPYL (-0,07%) but will start to build $FWRG (-0,16%) going forward whilst adding to the others on dips.

SPDR S&P 500 ETF

Price

Discussão sobre SPYL

Postos

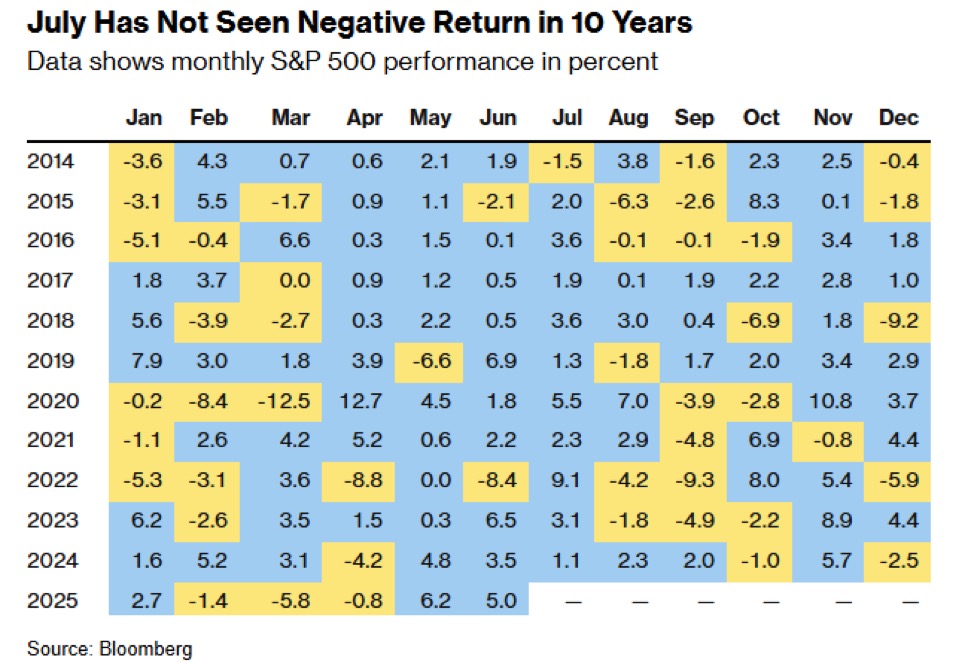

10Will we see further price rises in the S&P 500 in July?

$GS (+0,09%)

$CSPX (-0,27%)

$VUSA (-0,2%)

$VUAG (-0,21%)

$SPYL (-0,07%)

$SPYD (+0,25%)

$ISP6 (+0,38%)

$SPXS (-0,19%)

Goldman Sachs forecasts that the rally in the S& P 500 is likely to continue over the next few weeks before losing momentum in August. Historically, July is the strongest month for the S& P with an average gain of 1.67% since 1928, and the first two weeks are usually the best.

It remains exciting ✌️🚀

Portfolio Feedback | Long-Term Offensive Investor (28 y/o, €80k) 📈🚀

Hi everyone,

I’m 28 and planning to invest €80,000 with a long-term, offensive strategy. I’m aiming for broad global diversification, focused on both value and growth. I’m totally fine having 60–70% of my portfolio allocated to the U.S. and with exposure to emerging markets as well.

Here’s a rough outline of the allocation I have in mind:

30–40%

Nasdaq 100

$EQQQ (-0,18%)

$XNAS (-0,17%)

$CSNDX (-0,22%)

15–25%

S&P 500

$VUAG (-0,21%)

$CSPX (-0,27%)

$SPYL (-0,07%)

10%

World ex US

$WEXU (+0,37%)

$IE000R4ZNTN3 (-0,16%)

$EXUS (-0,18%)

10%

Small Cap US Value

$ZPRV (+0,48%)

5% Small Cap World $WSML (+0,88%)

$ZPRS (+0,72%)

5% Emerging Markets (EM)

$EIMI (-0,05%)

$XMME (-0,13%)

5%

EM Small Cap

$SPYX (-0,35%)

5–10%

India UCITS ETF

$FLXI (-0,62%)

$QDV5 (-0,37%)

Additionally (5-10%), I’m considering adding one or two of the following ETFs – would love your thoughts on which one(s) you’d choose and why (or not):

- $SMH (+0,07%) | VanEck Semiconductor UCITS ETF

- $RBOT (+1,42%) | iShares Automation & Robotics UCITS ETF

- $AIQG (-0,67%) | Global X Artificial Intelligence UCITS ETF USD Accumulating

- $XDWT (-0,47%) | Xtrackers MSCI World Information Technology UCITS ETF

Finally, I’m thinking of picking around 10 individual stocks as a satellite component. Any suggestions? 🚀

Curious to hear your feedback:

• What do you think of this ETF setup overall?

• Would you add or remove anything?

• Would you tweak the allocation? If yes, how and why?

I prefer accumulating ETFs only, and I plan to add €1,000–1,500 every month going forward.

Your thoughts are much appreciated! 🙏🏼😀

Change as of 01.04.

Hello,

I received a message in my TR mailbox the day before yesterday about an upcoming change to $SPYL (-0,07%) but I can't click on the link in the document. Does anyone know what this is? I can't find anything on the net either. Thank you.

Swap S&P 500 ETF?

Hello everyone,

I currently have the $CSPX (-0,27%) in my portfolio and I'm thinking about switching to the $SPYL (-0,07%) as the TER is more favorable. I could still do this without tax expenses as I am still at the beginning and there is still a lot of room for maneuver in the tax-free amount.

Is there anything I am overlooking that justifies staying in the $CSPX (-0,27%) other than the fund volume? Of course, the lower TER doesn't make much difference at the moment, but it could save a few euros in the future.

Ps I have a monthly savings plan on S&P 500.

70k goal achieved 🚀

Next year the goal is to achieve 100k.

Assuming that I need 30k in savings, I'll have to save 2500€ per month, for 12 months.

That will only be possible due to a mix of factors:

- 30% ruling tax benefit ( thank you NL 🇳🇱 )

- living with flatmates

- new higher paying job

My tactics for next year are

- 2000€ in $SPYL (-0,07%)

- 500€ in $NU (-1,95%)

$SPYL (-0,07%) there isn’t much to say. I believe in the American economy, so my chips will be there.

$NU (-1,95%) is a risky bet and I will DCA a bit more.

on a side note, I am curious about a future Klarna IPO 🇸🇪

we go by going 🚀 🚀🚀

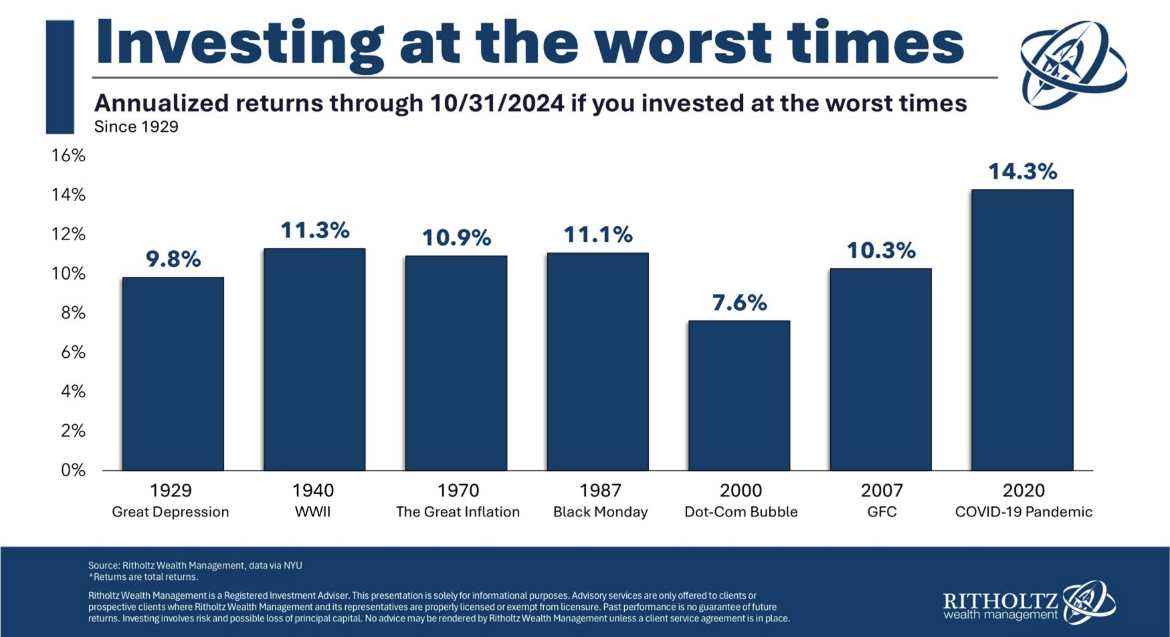

Investing at the worst times

These are the annualized returns for an investor who bought the day before Covid-19, or just before the Great Financial Crisis in 2007, or at the peak of the Dot Com bubble - not ideal, but not disastrous in hindsight.

The miracle of equities is that, despite your rotten luck, you still end up okay if you allow enough time to pass.

Hello community!

I'm quite new to the investments world, but I've studied a bit and I'd like to have an additional opinion about how to invest my money.

I have 20k euros to invest, and I plan to add 400 euros every month.

I plan to let this money grow for at least 20 years or even more.

I have decided to invest in I decided to invest in an All-World ETF and my choice fell on $VWCE (-0,28%) (I have also considered the $FWRG (-0,16%) which has lower TER, but also lower fund volume and higher spread).

But I'd like to add one or more (not to much) ETFs to boost up a little bit the performance and I was thinking about some ETFs on the Nasdaq100 or the S&P 500 indexes (like $SPYL (-0,07%)

$SPXD (-0,24%)

$VUAG (-0,21%)

$VUSA (-0,2%)

$EQQQ (-0,18%)

$UST (-0,17%) ).

What do you think about this idea? I have read that there is an overlap problem doing this but I'd like to have more opinions about it.

I think also that would be nice to have some money coming from dividends for everyday use, but I haven't searched nothing and it's not essential for me.

Have you got any suggestions?

Thank you in advance

Títulos em alta

Principais criadores desta semana