Added more ASR to my portfolio 🛒 Now holding 97,80 shares, which should give me roughly €411,00 in growing dividends every year.

ASR Nederland

Price

Discussão sobre ASRNL

Postos

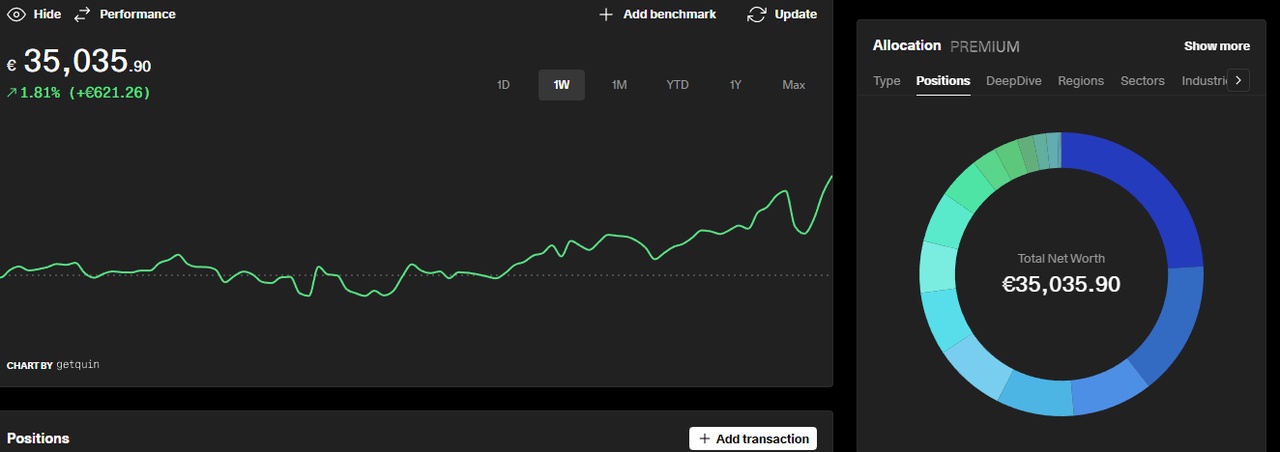

19Milestone reached

On the 4th of februari 2026 at 13:10, I reached the 20k mark. Almost exactly one year after I reached the 10k. Something I didn't expected to reach that fast.

After my graduation on november the 4th 2025, I am working my student job for the time being. Since januari i'm fully job hunting and hoping to increase my income for further investments.

I'm happy with my current investments. My core: $NL0013689110 and $NL0015000PW1 (indexfund) at 50% is widely spread and a solid core.

My other investements are solid dividend stocks. Some bigger, some smaller but all helping reaching my goal. $JNJ (-0,2%)

$NN (-0,35%)

$ASRNL (-0,06%)

$PEP (+2,03%)

$AD (+2,08%)

$KO (+1,15%)

$CMCSA (+0,96%)

$ARCAD (-5,15%)

$AGN (-2,02%)

$HEIJM (-1,86%)

$BAMNB (-0,44%)

$SO (+0,36%)

Only $LIGHT (-0,64%) and $AXS (-0,42%) are on my sell list.

Have a great day!

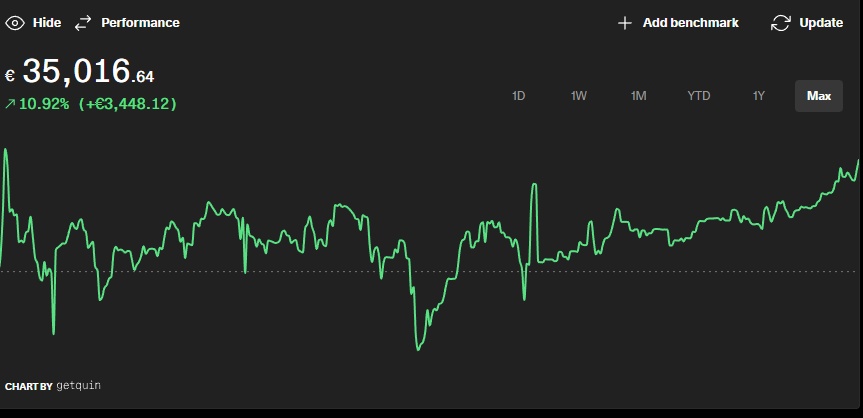

All time high 35k

Impressed by my performance in these turbulent times.

Which dividend stock do you think is a bargain right now? Long term.

$TDIV (+0,44%)

$PG

$O (+0,68%)

$ASRNL (-0,06%)

$JNJ (-0,2%)

$JEGP$AD (+2,08%)

$VPK (-2,69%)

$NOVO B (-16,01%)

$ULVR (+1,52%)

$WINC (-0,1%)

$VHYL (+0,01%)

Feedback wanted on new investment strategy for 2026

Hi dear community!

ith 2026 just starting and a great 2025 investment wise, this year I want to change my investment strategy slightly compared to last year.

1. Goal & Strategy

The primary goal for 2026 is to structurally outperform the World Index (FTSE All-World / VWCE) over a multi-year horizon. This is pursued by deliberately accepting a higher risk profile than the market, provided that this risk is taken in areas with a structurally higher expected return.

The chosen approach is a core–satellite strategy:

- The core ensures global market participation and stability.

- The satellites aim to generate alpha through thematic ETFs and a limited number of carefully selected individual stocks.

The focus is on long-term structural growth trends (AI, semiconductors, cybersecurity), rather than cyclical or opportunistic themes.

2. Portfolio Allocation

Core (±50%)

$VWCE (-0,74%) – ±30%

- Global diversification and the foundation of the portfolio.

$VUSA (-0,97%) – ±20%

- Additional exposure to the US as the primary engine of earnings

growth and innovation.

Thematic ETFs (±35%)

$SMH (+0,04%) - Semiconductors ETF – ±17,5%

- Structural growth driven by AI, cloud computing, automation, and industrial applications.

$LOCK (-3,61%) - Cybersecurity ETF – ±12,5%

- A defensive growth sector with high margins and recurring revenues.

Individual Stocks (±20%)

$CRWD (-9,76%) - CrowdStrike – ±5%

- Core holding within the cybersecurity segment.

$AMD (-1,74%) - AMD – ±5%

- Exposure to AI and data centres, with a deliberately limited weight due to overlap.

$RKLB (-1,24%) - Rocket Lab – ±5%

- An asymmetric growth play with a long investment horizon.

$ASRNL (-0,06%) - ASR Nederland – ±4%

- A defensive stabiliser within the equity allocation.

$IREN (+5,07%) - IREN – ±1%

A speculative satellite position focused on optional upside.

$AIR (-3,24%) and $ASWC (-2,43%) will be fully sold.

3. Investment Plan

- Monthly contribution: €500

- Execution: transactions every two months (€1,000 per cycle)

Approach:

- Core positions remain largely unchanged

- New capital is primarily allocated to thematic ETFs and selected stocks

Reallocations (AMD, NATO, Airbus) are executed gradually.

Cost control: limited number of trades per cycle with a fixed structure

The plan prioritises consistent capital deployment, not market timing.

4. Risk Assessment

- Market risk: heavy exposure to growth and US equities leads to higher volatility.

- Sector concentration risk: semiconductors and cybersecurity carry significant weight

- Stock-specific risk: individual holdings may temporarily underperform materially

- Speculative risk: IREN and Rocket Lab can experience severe drawdowns

- Behavioural risk: temptation to react to volatility, mitigated through predefined rules

Drawdowns of −30% to −45% during market stress are explicitly accepted.

5. Expectations

Expected average annual return: approximately 12–15%, based on historical data and allocation

- Outperformance objective: beat the World Index over multiple years, not necessarily every calendar year

- Volatility: higher than VWCE, but with superior long-term return potential

Performance is evaluated over a full market cycle rather than short-term intervals.

6. Mental Rules

- No new positions without a clear structural investment thesis

- No impulsive trades outside the scheduled execution moments

- ETFs provide structure; individual stocks provide conviction

- Positions with significant overlap are intentionally capped

- Speculative holdings remain small and controlled

- Time in the market matters more than timing the market

€1,700 shares purchased

The stock market went down and I took advantage of that by $ASRNL (-0,06%) and $VWRL (-0,49%) buying. See the video Mr. Wealth on Youtube and subscribe.

Weekly buy - ASR NL

After reaching its all-time high in August, ASR’s share price has pulled back by about 10%. At this level, I see it as an excellent buying opportunity, given the company’s solid fundamentals and strong financial position. ASR has consistently delivered value to its investors, and I believe it is well-positioned to continue doing so in the long run.

I recently took advantage of this dip by adding 10 more shares to my position, bringing my total holdings to 35. I’m confident that patience will be rewarded as the company continues to generate stable growth and reliable returns.

My Biggest Portfolio Gain Ever

Portfolio keeps rising and I bought a stock. We are over half way through my Road To 100K. Subscribe and follow my Road.

$CVX (+0,4%)

$VWRL (-0,49%)

$ASML (+0,95%)

$NN (-0,35%)

$ASRNL (-0,06%)

$VHYL (+0,01%)

Saving money for a year

I hesitate to hold DCA, or build up more cash. The doubt because I want to have more cash on hand for a crash on certain stocks.

Indeed, I see that I have missed out on some returns since April. Still, I can't complain.

I want to receive the last 1000 euros from dividends in the coming year to reach 30k.

I have already come this far!

What would you guys do?

Títulos em alta

Principais criadores desta semana