- $OHB (-2,12%) sold

Discussão sobre OHB

Postos

17Rheinmetall plans Starlink alternative

Hello my dears,

I have already introduced OHB to you, but unfortunately I have not invested myself. Did any of you invest after my presentation?

According to insiders, the defense group Rheinmetall is in negotiations with the space and technology group OHB for a Starlink competitor.

26.01.2026 at 09:39

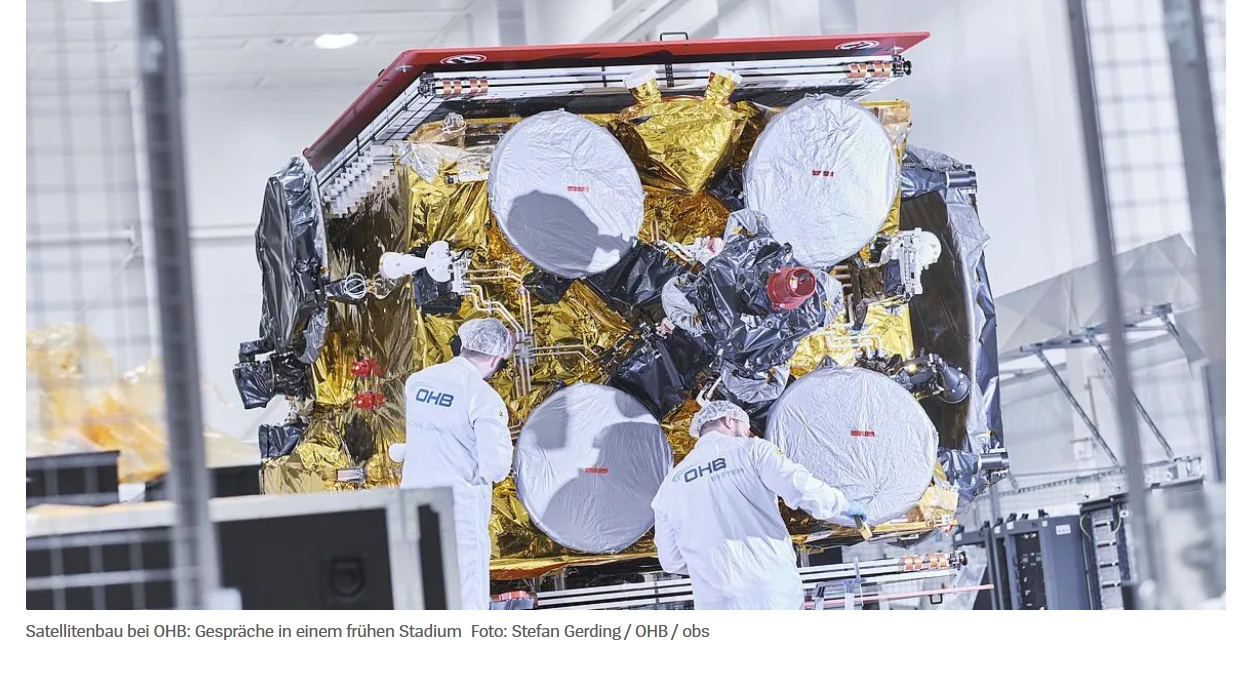

The armaments group Rheinmetall and Bremen-based space and technology group OHB are discussing plans for the joint construction of a satellite system comparable to Starlink for the Bundeswehr. The two companies are in talks about the project, a person familiar with the matter said on Monday, confirming reports in the "Financial Times" and the "Handelsblatt" newspaper.

The talks are at an early stage, according to the FT. However, Rheinmetall and OHB wanted to jointly bid for the establishment of a Elon Musks Starlink comparable communication system for the German Armed Forces. The contract could be worth around ten billion euros. Rheinmetall did not comment on the information. No comment was initially available from OHB.

The Düsseldorf-based company sees the satellite business as a market of the future. Eight to ten billion euros in sales are to come from the digitalization business, which also includes satellites, the Group announced. The Düsseldorf-based company is already working with the Finnish satellite manufacturer Iceye in this area. (Reuters)

Aufrüstung im Weltall: Rheinmetall will mit OHB deutsches Starlink bauen - DER SPIEGEL

Internetabschaltung im Iran betrifft auch Starlink-Verbindungen – DiePresse.com

OHB - from a small workshop to a space company

The unlikely story of a family business that once repaired hydraulic jacks and now manufactures satellites. In the middle of it all: Christa Fuchs and her family.

Thomas Jahn

14.01.2026 -

Bremen. At the beginning of the 1980s, Christa Fuchs was an "empty nester", as we would say today. Her two children had moved out and her husband was fully occupied with his job as an engineer. So the then 42-year-old looked for something to do to escape the empty family home.

An ordinary story so far, but one that continued in a more than unusual way. In 1981, Fuchs took over a small company that repaired hydraulic jacks for the German army and installed parking heaters in military vehicles. Entrepreneurship ran in the family: her father had a locksmith's shop in Pinneberg. Before her marriage, she had learned the commercial side of the business in the steel trade at Klöckner in Hamburg.

But the purchase of OHB was a "suicide mission", as Christa Fuchs once told a local newspaper. In fact, she took over "Otto Hydraulik Bremen" without any management experience or knowledge of the industry. Her days were suddenly more than full: Talking to customers, giving instructions to the then five employees, working through orders - with the help of an experienced foreman and lots of help from all sides, Fuchs managed to solve all the problems.

The now 87-year-old ran the company for two decades, first alone and later with her husband, amateur pilot and aerospace engineer Manfred Fuchs. Her son Marco Fuchs joined her in the mid-nineties. Together they built up one of the most important aerospace companies in Germany.

A high-tech group in Bremen

What a change, what a story. And right in the middle of it all, the former housewife and part-time employee of a coffee shop, who made a company big as a company boss - which wasn't always easy: "If you're worried about how you're going to pay the salaries at the end of the month, then you don't sleep well anymore," she replies in writing to questions from Handelsblatt. An interview was not possible; she is very open about her stroke, which makes it difficult for her to speak.

The sleepless nights were worth it: with a turnover of 1.3 billion euros, OHB is no longer a small workshop, but a high-tech group based in Bremen. With around 3,300 employees, OHB builds high-tech satellites, for example for the German Federal Armed Forces, and develops an asteroid defense system for the European Space Agency Esa - which uses a probe to divert such small astronomical bodies from their course towards Earth if necessary.

Esa CEO Josef Aschbacher told Handelsblatt: "OHB has enjoyed a long and successful collaboration with Esa." The cooperation ranges from Galileo navigation satellites and the third-generation Meteosat weather satellites to the exploration of exoplanets, the measurement of gravitational waves and future European launch vehicles. "This family-led commitment with a clear vision for the future strengthens Europe's space sector and industry and is greatly appreciated by Esa."

The signs are pointing to growth: the German Armed Forces want to invest 35 billion euros in space defense by 2030, while Germany is providing more money for Esa over the next three years than any other country in Europe with 5.4 billion euros.

"There were no funny remarks"

However, today's OHB would almost never have existed. When Christa Fuchs was looking for a job in 1981, she was offered a job in a wool store in the Roland shopping center. Back then, knitting and crocheting were a new and promising trend.

Rather by chance, Christa Fuchs got talking to the Otto family at an event, who were unable to find a successor for their repair workshop. The rest is history. The decision was also the right one on a personal level: "I always felt I was treated pretty well there," Fuchs recalls. "They also taught me a lot, and although I was suddenly the new boss as a young woman without a lot of experience, there were no funny comments."

At the time, her husband Manfred Fuchs worked at Erno Raumfahrttechnik, a German aerospace company - which is now part of Airbus. The aerospace engineer also flirted with self-employment: he came from a family of entrepreneurs with distilleries, sawmills and a wine trade in South Tyrol. The Forst brewery in Merano is still family-owned today - and is still the largest family-run brewery in Italy.

The time of the space shuttle

In 1985, four years after the purchase of OHB, Manfred Fuchs resigned from Erno and also took the plunge into self-employment. He saw business opportunities: "At that time, there was an initial space boom in Germany. There were more and more European projects, and there were also orders from the USA. In collaboration with NASA, Europe built the reusable space laboratory "Spacelab", which was used a total of 22 times with the space shuttle in the 1980s and 1990s. Back then, Ulf Merbold was the first West German astronaut and non-US citizen to fly in a space shuttle to look after the Spacelab.

OHB manufactured so-called drop capsules for Erno: the company launched the "Mikroba" into the sky with a high-altitude balloon in order to achieve weightlessness for a short time during the fall. Later, the company also built a "drop tower". This was based on an idea that emerged with the construction of the International Space Station (ISS) and is still in vogue today: to use "microgravity" in space for industrial products such as semiconductors or medicines or for scientific experiments.

With the fall of the Berlin Wall, however, much changed in space travel. The Cold War was over and many military and civilian projects such as the space shuttle were discontinued. OHB had to react - and entered the satellite business. In 1994, OHB launched its first satellite, the "Bremsat", into orbit for the University of Bremen. Today, the 60-kilogram high-tech piece adorns OHB's reception hall.

From lawyer to space manager

The collaboration was groundbreaking. The project manager was a certain Hans Königsmann, whom Elon Musk recruited as the fourth employee for SpaceX in 2002. The German aerospace engineer spent almost two decades shaping the SpaceX space program, which is now the most valuable private company in the world at 800 billion dollars. Königsmann left SpaceX in 2021 and was elected to the Supervisory Board of OHB a year later.

There was another important change in the mid-nineties: Marco Fuchs came on board - rather reluctantly. The then 33-year-old worked for the American law firm Jones Day in New York, enjoying the "glamor" of the cosmopolitan city, as he recalls today. But that came to an end in the fall of 1994 when he was transferred to Frankfurt. Due to the time difference, he also had to work almost around the clock for the American law firm. "They expect you to be there for them until one o'clock in the morning," he said.

So Marco Fuchs resigned - and set up a law firm in Hamburg. He also started at OHB, but only part-time, putting two thirds of his time into the law firm. But it soon became clear: "As a lawyer, you always work for others, you only ever pursue the dreams of others."

At that time, OHB was still a small company with 40 employees and a turnover of around ten million marks. The lawyer was familiar with space travel from an early age. As a lawyer, he said he was able to contribute a lot: "That's where you learn to think in a structured and strategic way," recalled Marco Fuchs, who has been managing OHB's fortunes as CEO since 2000. He was responsible for a number of acquisitions, such as that of MT Aerospace in Augsburg in 2005: "I basically built up the Group's development outside of space systems such as satellites."

The dynamics of a family trio

How the transformation succeeded is down to a lot of work, technological enthusiasm and a management trio that is mainly found in family businesses. "My father was the business developer, my mother was the CFO, and I basically changed and expanded the structure of the company," says Marco Fuchs.

According to the 63-year-old, a system of mutual control developed: "It was usually the case that my mother argued against my father and me." Christa Fuchs remembers this all too well: "They had ideas day and night, all of which were expensive and you didn't really know whether they could be implemented at all - and if so, whether anyone would want to buy them." Her conclusion: "If you just let engineers get on with it, it quickly becomes a bottomless pit." She was excited about every rocket launch - and also thought about the money her satellite had cost on board.

That may have "killed a good idea at times, but it kept us economically stable," says Christa Fuchs. "That applies to every company, whether you're in space travel or jacking cars: you have to have a solid foundation and manage your business well and wisely, otherwise customers will lose confidence."

An IPO and American raiders

Almost a quarter of a century ago, OHB experienced a turning point. In 2001, as part of the euphoria surrounding the Neuer Markt, the company floated parts of the company on the stock exchange. To this day, however, the family still holds a 65 percent majority stake in the Group. At that time, Marco Fuchs raised capital for expansion into new business areas such as the digital sector or, in 2005, for the acquisition of MT Aerospace in Augsburg.

With the IPO, Christa Fuchs withdrew from the operational business. She moved to the Supervisory Board, which she chaired until 2018. At that time, US investor Guy Wyser-Pratte bought a stake in OHB. He criticized the fact that the CEO was controlled by his mother. Marco Fuchs found that time "strange", he recalls: "That was the only phase in which we were really harshly criticized by shareholders." However, the American was partly right in his criticism. Wyser-Pratte later exited at a profit.

To this day, the stock market and America have shaped OHB. "The stock market has been good for us because it disciplines you," says Marco Fuchs. You have to structure the company in order to meet corporate governance requirements, for example. "Many companies that grow often have the problem that their structures somehow get mixed up."

Cooperation with KKR

OHB is still listed on the stock exchange today, although only a six percent share is still listed. With the help of US private equity giant KKR, the company submitted a takeover bid for EUR 44 per share in 2023. This valued OHB at a total of EUR 768 million. Since then, KKR has owned around 28 percent of OHB. Not a bad deal, as the space boom in Germany is inspiring investors and the market capitalization is now more than two billion euros.

The Fuchs family placed their shares in a family foundation in 2022. Marco Fuchs is interviewed by his son Konstantin, who studied aerospace engineering in Munich and worked for a time at a Berlin satellite start-up. He is currently considering joining the company. Marco Fuchs' sister, Romana Fuchs Mayrhofer, is also on the Supervisory Board. The lawyer has been running her own law firm in Munich since 1993.

The future is full of opportunities. According to Marco Fuchs, now CEO of OHB, the family business is on the verge of a boost: "If we don't grow now with the boom, when will we?" OHB currently has incoming orders worth three billion euros, so "our turnover should also rise to three billion euros in the next few years".

Germany is becoming a space nation

The focus is on the German Federal Armed Forces, which wants to build its own satellite constellations. As a German space company, OHB is the natural partner. "We already know the Bundeswehr very well and have gained experience with several satellite contracts," says Sabine von der Recke, who is responsible for "customers in politics and space-related institutions" on OHB's Management Board. "But no one in Europe has ever done such large constellations before. It will be a big change." However, the Management Board member, who has been working at OHB since 2014, is confident: "To be honest, I have never experienced OHB saying that we can sit back and relax, nothing new is going to happen."

OHB is also investing in New Space in Germany. For example, the company owns around half of Rocket Factory Augsburg (RFA), which was founded in 2018. Alongside Isar Aerospace from Munich, RFA is one of two German start-ups that have been shortlisted for Esa's 2025 rocket competition. RFA and Isar Aerospace are currently engaged in a duel: who will launch the first private German rocket into space?

In any case, Christa Fuchs is not worried about the future of the company: "I don't know what will be in demand in space travel in ten years' time, but it will certainly be possible to order it from OHB."

AKTIE IM FOKUS: MTU attempts chart breakout - UBS raises hopes

My dears, now that $OHB (-2,12%) the 🚀 has already started. The investors seem to have realized today. That MTU is a supplier to OHB. And therefore also gets a slice of the cake from Dorothee Bär (Federal Minister for Research, Technology and Space).

Pistorius: 35 billion for space armament - a share takes off

FRANKFURT (dpa-AFX) - MTU shares on Tuesday showed signs of breaking out of the correction trend that has been intact since the July record. Up 3.4 percent to 386.50 euros, the shares of the engine manufacturer headed back towards their high of almost 396 euros.

In his outlook for the quarterly report on October 23, UBS expert Ian Douglas-Pennant gave investors hope that MTU will then surprise them with an increase in the targets it has set itself for the year. He is very confident of this, but the market is not yet expecting it. Investors are too focused on a normalization of the replacement turbine quota and have failed to recognize the general strength of the secondary market.

Douglas-Pennant's forecast for the operating result (EBIT) on an adjusted basis for the quarter is around 15 percent above consensus./ag/jha/

© 2025 dpa-AFX

35 billion euros from the federal government for space projects

$OHB (-2,12%)

$AIR (+0,87%)

$KKR (+0,32%) (@Simpson ). $MTX (+1,02%)

The new German government has brought space travel more into focus. Until a few months ago, the industry was more or less working away in the shadows, but now it has powerful political advocates. Walther Pelzer sits on the board of the German Aerospace Center and is beaming from ear to ear. The new German government has raised the topic of space travel "to a political level that was previously only found in Italy, France, Japan and the USA".

One area is becoming increasingly important: security and defense in and from space. After all, today's conflicts are no longer only fought on Earth. A few months ago, NATO Secretary General Rutte expressed concern that Russia could station weapons in space to combat satellites. Space is a crucial part of critical infrastructure. A satellite failure could have fatal consequences in modern life, from cell phone outages to plane crashes and non-functioning bank transfers.

Defense Minister Boris Pistorius (SPD) remarked in his speech at the congress: "39 Chinese and Russian reconnaissance satellites are flying over us as I speak to you here alone". And for the first time, he mentions a concrete figure that the industry has been waiting a long time for: the German government is planning to spend 35 billion euros on space projects by 2030. It's about "networked satellites for military reconnaissance, it's about tracking missiles". "We are investing in spacecraft, which sounds like science fiction to many people out there," says Pistorius.

My dear OHB has a good chance of taking a slice of the cake.

(With a P/E ratio of 29, it's no longer quite so cheap, but compared to Rheinmetall etc. perhaps still rather undiscovered. And due to the new growth, there is certainly still potential)

Feel free to write your opinion in the comments.

Just a few meters away at the "Space Congress" of the Federation of German Industries (BDI) is the stand of an established traditional company. OHB is one of the largest space companies in Europe, a medium-sized family business headquartered in Bremen. OHB is 44 years old these days and builds everything from satellite systems and small rockets to security technology, explains Sabine von der Recke. She is a member of the Management Board of OHB-System AG.

She describes the many new start-ups such as The Exploration Company, Isar Aerospace and Rocket Factory Augsburg as "innovation providers", while she sees her own company as a "start-up of the 80s". OHB would also know what the small companies are going through, which is why it promotes and supports the newcomers.

At the end of the day, however, it is not enough just to have a good idea, says von der Recke. "You also have to run a company that is economically viable." Some of the smaller companies will certainly manage this very well, others will have a dry spell and a few may not make it, predicts the OHB board member. But she believes that a broad-based network is important for the space industry in Germany and Europe.

Airbus and OHB are regarded as important German companies involved in the space and satellite industry. Other well-known companies are MT Aerospace AG, Jena-Optronik and Tesat-Spacecom, which focus on specific technologies such as satellite systems, optics and rocket development. Growth in the field of small satellites and micro-launchers is being driven by companies such as Isar Aerospace and Rocket Factory Augsburg.

$MTX (+1,02%) (I am invested here myself)

MTU Aero Engines develops and manufactures key components for rockets and spacecraft, often as part of international partnerships.

MTU Aero Engines works closely with other companies such as MT Aerospace, a subsidiary of OHB SE, and international partners to further develop its activities in the space sector.

@EpsEra Are you also involved or invested in this sector?

The jump in the share price is primarily due to the low free float of around six percent. The US financial investor KKR took over the Bremen-based space company as part of a public takeover bid in summer 2024. The Fuchs family, which previously held a majority stake in OHB, remained the majority shareholder with a good 65 percent, while KKR holds around 28.6 percent of the shares as a strategic partner.

https://www.tagesschau.de/wirtschaft/technologie/raumfahrt-branche-weltraum-astronauten-100.html

How about you?

Under the radar?

Years ago I was at a space fair with my nephew in Bremen and also visited a stand of $OHB (-2,12%) stand. Exciting, I thought, you have to keep an eye on that. Well, I completely forgot about it and looked in yesterday after ages and wow, what a great development of the share! Of course, the feeling of a missed opportunity also resonates a little 😄.

Now I've had a look at the data and news on $OHB (-2,12%) and the stock seems to be rock solid with good growth opportunities thanks to the good order situation.

But it also shows how blinded you are by the US stocks that you can no longer see the opportunities on your own doorstep 🙈

Asteroid 2024 YR4: OHB plans defense mission against potential impact

MUNICH (IT BOLTWISE) - The German space company OHB has begun planning a possible defense mission against the asteroid 2024 YR4, which could collide with Earth in 2032.

The asteroid 2024 YR4, which was discovered at the end of December, is currently the focus of the international space community. With a size of between 40 and 90 meters and an impact probability of 2.6 percent according to NASA and 2.4 percent according to ESA, it is considered one of the most dangerous celestial bodies currently known. This assessment has prompted the German space company OHB to examine a possible defense mission to prevent a potential impact in 2032.

OHB, which has already gained experience with asteroid missions, sees 2028 as the ideal time to launch such a mission. The Group has developed the Hera probe for ESA, which is currently on its way to the asteroid moon Dimorphos. This mission builds on the findings of NASA's Dart probe, which successfully changed the orbit of an asteroid. A similar concept could also be applied to 2024 YR4 to divert it from a possible collision course with Earth.

The Turin Scale, which classifies the danger of asteroids, places 2024 YR4 in class 3. This means that it is not only of astronomical interest, but also deserves the attention of the public and official bodies. In the past, only the asteroid Apophis has achieved a higher classification, but it is now considered harmless. The possibility that 2024 YR4 could cause major local or regional destruction in the event of an impact makes the development of defensive measures all the more urgent.

International organizations such as the NASA-coordinated International Asteroid Warning Network and the ESA's Space Mission Planning Advisory Group have already begun their work. They are continuously monitoring the asteroid and discussing possible countermeasures. However, concrete proposals have not yet been drawn up, as more precise data on the size and orbit of the asteroid is awaited. The James Webb space telescope should soon provide more precise information.

The development of defense strategies against potentially dangerous asteroids is an important step in planetary defense. Experience from previous missions such as Hera and Dart shows that it is possible to change the orbit of an asteroid in a targeted manner. This could also be the case with 2024 YR4, provided the mission is launched on time. International cooperation and the exchange of data and technologies are crucial in order to protect the Earth from potential threats from space.

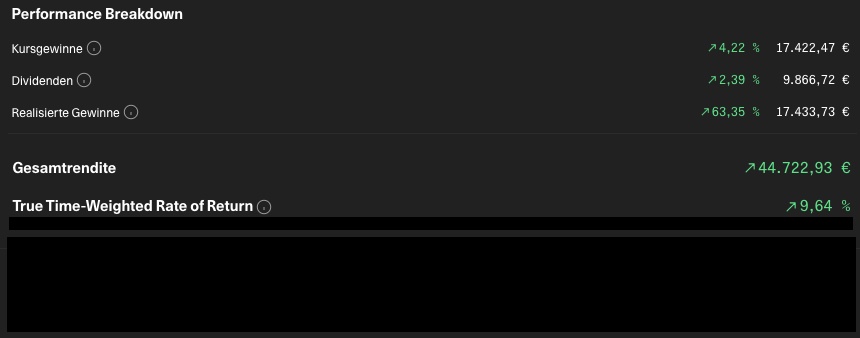

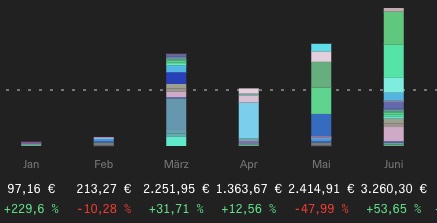

The first half of the year is already over, so here's a quick look at my portfolio:

The overall performance doesn't look too bad for 1HY, with realized gains already accounting for a large part. The delisting of $OHB (-2,12%) and thus the sale of my position is most noticeable. Nice $OHB (-2,12%) profits over time, I would have liked to have kept them. But who knows, at some point they might come back like $Renk, for example

Net dividends are at last year's level. Many dividends were reduced in May (e.g. $SIX2 (-1,09%) without special dividend, $KNIN (+1,03%) adjustment) or, as in the case of OHB or $Baywa, no longer paid due to sales. Some payments were also simply postponed to June. Over the year as a whole, an increase of 9-10% should be possible.

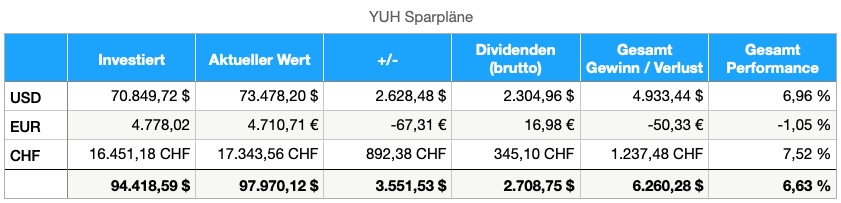

The savings plans I started in 04/2022 are still running. Some positions are full and others have been added over time. My target here is 5000tsd $/€/CHF per individual position, with the exception of ETFs which are still running. The overall performance here is ok, it has been significantly better in the past. The dividends of the equivalent of 2700$ in two years are of course great and ensure additional purchases. Conclusion: in future I will save less in individual stocks, but with higher amounts (currently 150, then more like 300-500 depending on the situation) I want to remain a little more flexible and prefer to buy in good times.

At the moment, CHF 2750 a month is invested in fixed savings plans and CHF 400 goes into an employee share scheme with my employer. It will stay that way and then we'll see where we stand at the end of the year.

Happy weekend!

So, my $OHB (-2,12%) shares that I put up for sale were booked out at the limit today. It is somehow not foreseeable how long KKR will need for the regulatory stuff. And as the shares will not rise any further and there will be no more dividends, I have sold them. I should have done it straight away, I've already given away some performance elsewhere ... Well, I could have.

This freed up just under €22,000 (500 OHB shares sold at €43.8, making +506% and +€2200 net dividends)

A portion was directly reinvested.

5Tsd € $ISPA (+0,76%)

5Tsd € $VAPX (+2,1%) (new in the securities account)

5Tsd € $XD5E (+1,18%)

2Tsd € $WLD (+0,75%)

For the rest, I'll go back through my watchlist and continue to add to ETFs.

Just listened to episode 651 of the OMR Podcast with Marco Fuchs (head of $OHB (-2,12%) Bremen). It's about space travel in general and why it might not work on the stock market, Elon's SpaceX, the KKR investment and how it started and continues with OHB.

It's worth a listen!

Títulos em alta

Principais criadores desta semana