Hello everyone,

Since a lot has happened in the last few days and weeks, I would like to give you an insight into how far my portfolio has changed in terms of growth and returns. First of all, the FTSE All World has been thrown out completely, as have the stable value stocks such as Airbus and Telekom. My "new" portfolio has so far included the following:

Position (weighting in the portfolio in %) Return to date in %

$BTC (+0,53%) (13%)

Return to date +-0

$IREN (+2,18%) (11,2%)

Return so far approx. +30

$RKLB (+2,37%) (9,46%)

Yield yesterday still at +15% today at just under +4% 🤪

$PNG (-0,3%) (9,4%)

Yield so far +15%

$TTR1 (-12,18%) (8,67%)

Yield to date +-0

$IOS (-0,94%) (8,55%)

Return so far approx +5%

$ASTS (+2,08%) (8,54%)

Return to date approx +5%

$ZAL (-0,14%) (7,35%)

Return so far approx +11%

$IPX (-0,07%) (7,27%)

Return so far -5%

Warrants (only for those who are interested)

(sorted by weighting)

Long on Hensoldt MM2TXJ (+16%)

Long on silver MK81Z6 (+84%)

Short on Puma DU1SAE (+6%)

Inline OS on Zalando UG71Z8 (+93%)

Inline OS on Thyssenkrupp UG81HF (+80%)

Inline OS on Telekom (since today) PJ711H (-1%)

Discount Tut on Palantir VK38YE (-34%)

In addition, I now have a savings plan with 200 euros per month on Bitcoin $SOFI (-1,45%) Tech, as well as 100 euros each on $VSAT (+0,51%) and $BNTX (+2,26%) (for the next pandemic, cancer therapy, and because of the thick cash cushion).

I think I've covered the areas of data centers and digitalization, as well as space and outer space. What I'm still missing is a convincing stock in the critical commodities sector (I have Iperionx, but I'm still looking for a candidate that convinces me)...

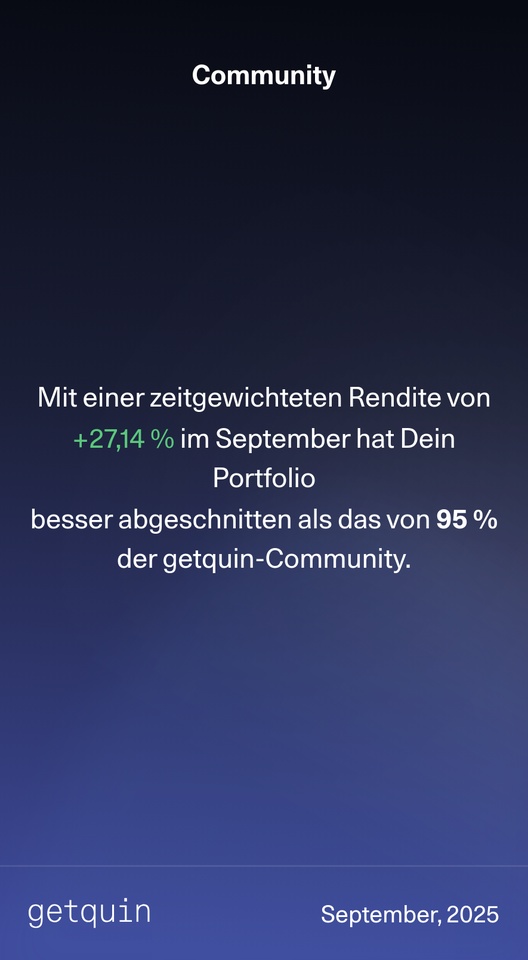

I'm up about 8% for the week and see this as a very small confirmation of the transformation in the portfolio, even though I know that these stocks are naturally more susceptible to a bear market xD

I'm not sure whether I'll be able to keep up the savings rates because I have to take my driver's license exams soon and I'm still doing my A-levels. And as I only work on a part-time basis, I don't have that much money available yet. My deposit is currently around 9900 euros and my short-term goal is to have enough money by the end of 2026 or early 2027 to buy my dream car, a Golf 7. 🙈

Please let me know what you think and whether you would do the same as me...

And if anyone else has a stock that would fit into my portfolio strategy, I would of course also be delighted...

HG Small investors ✌️🤝