ABN Amro

Price

Discussione su ABN

Messaggi

8Invest in banking stocks with the aim to be acquired

After having invested before in $1COV (-0,1%) with the aim to be acquired by Adnoc/XRG and another investment in $ILTY Illimity Bank in Italy giving access to $IF (+1,02%) Banca IFIS with a 10% discount.

I'm now thinking to invest in further banking consolidation. Since there seems to be a wave of banking consolidations coming up both cross boarder and within individual European countries.

Italy shows:

$UCG (+1,16%) Unicredit stakebuilding in both $ALPHA (+0,34%) Alphabank & $CBK (+1,34%) Commerzbank and a failled attempt to acquire $BAMI (+4,23%) Banco BPM. We saw $BMPS (+3,62%) Monte dei Pachi acquire $MB (+3,18%) Mediobanca. $BPE (+4,11%) Bper Banca merge with $BPSO (+3,98%) and rumored to be on the wishlist of Unicredit.

Denmark is consolidating but could be still more ongoing:

A recent merger of $SYDB (+1,13%) Sydbank, Arbejdernes Landsbank & $VJBA Vestjysk Bank.

In Spain

We've seen a major but failed attempt to forget about the Spanish attempt of $BBVA (+1,8%) Banco Bilbao of $SAB (+2,77%) Banco Sabadell.

The Netherlands:

$ING (+2,43%) ING taking a substantial stake in $VLK (+1,1%) Van Lanschot Kempen.

$ABN (+0,33%) Doing several take overs in Germany and buying the trading app Bux and rumored to be bought themselves.

When thinking this through I see a potential for take over but, if it won't happen there is still good dividends to be earned. Therefore there is less of a need of a quick turn around.

I'm now looking for a "smaller" bank that traded and a likely take over candidate.

Where would you invest?

$BPE (+4,11%) - Bper Banca - Italy

$BAMI (+4,23%) - Banca BPM - Italy

$ABN (+0,33%) - ABN Amro Bank - Netherlands

$ALPHA (+0,34%) - Alpha Bank - Greece

$JYSK (+1,42%) - Jyske Bank - Denmark

$ALR (+0,07%) - Ailor Bank - Poland

Any other alternatives, or opinions about this idea, I'm happy to read!

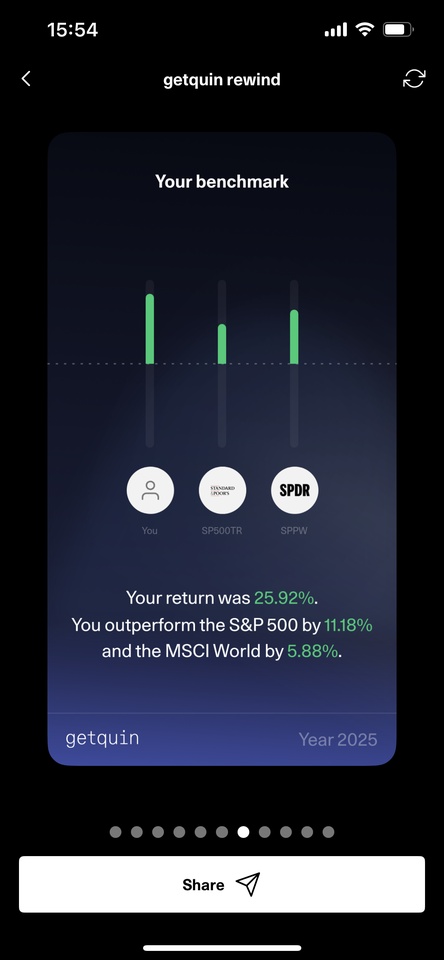

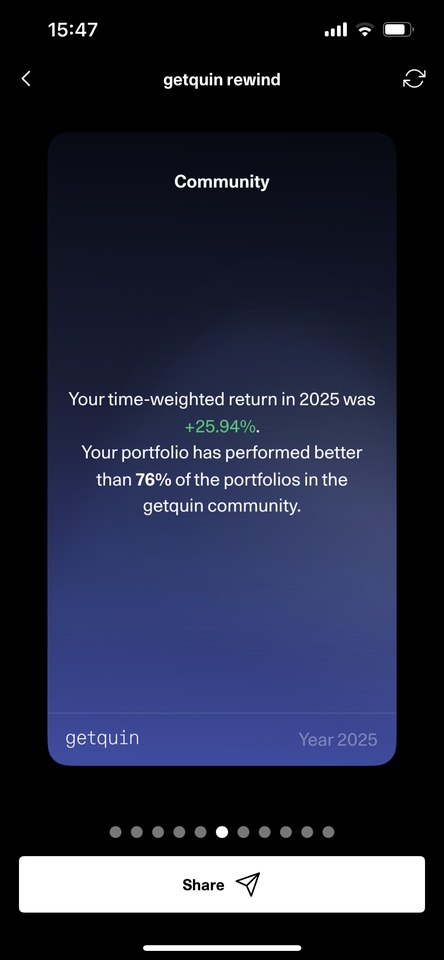

Building my dividend portfolio, which one would you pick?

I have been building my portfolio this year and it is doing quite well. Currently my focus is diversifying my portfolio. I have some nice performers in my portfolio like $BESI (+7,79%) , $ABN (+0,33%) , $EVO (-1,15%) , $VLK (+1,1%) . A few others are still underperforming for now but are known stable companies like $ALV (+1,65%) and $TTE (-0,18%) . My focus now is also a bit towards US stocks due to dollar diversification since I am mainly invested in Europe, Switserland and Scandinavia. I am always looking for companies with strong balance sheets, low debt ratio's compared to their peers, growth, dividend and maybe undervalued. One great example is $EVO (-1,15%) which I expect to launch🚀 in the coming year.

I'm looking at three dividend stocks right now: $PFE (-0,75%), $AEP (+0%) and $ENEL (+1,57%). They each have different profiles, and I'm trying to figure out which could be the most attractive at this point.

$PFE (-0,75%) seems undervalued. The stock is still well below its pre-COVID levels, the balance sheet is strong, and the dividend is over 5 percent. The real question is whether the company can return to solid growth with its pipeline.

$AEP (+0%) is a US utility with stable cash flow, a solid dividend track record, and relatively low debt. It doesn’t move fast, but it offers a good level of reliability and income, especially if rates come down.

$ENEL (+1,57%) is more of a question mark. The dividend is growing by nearly 9 percent a year and paid in multiple installments, which I like. But the stock is already up over 20 percent this year. Debt is quite high, and revenue growth is limited. I like the exposure to renewables, but I'm not sure if this is the right entry point.

- What do you think of these names?

- Any clear favourites? Or red flags?

Also curious: what are your expectations for the USD-EUR exchange rate in the second half of the year? I'm considering the FX angle too, since two of these names are US-listed.

#DividendInvesting

#Pfizer

#AEP

#Enel

#StockIdeas

#USD

#InvestingEurope

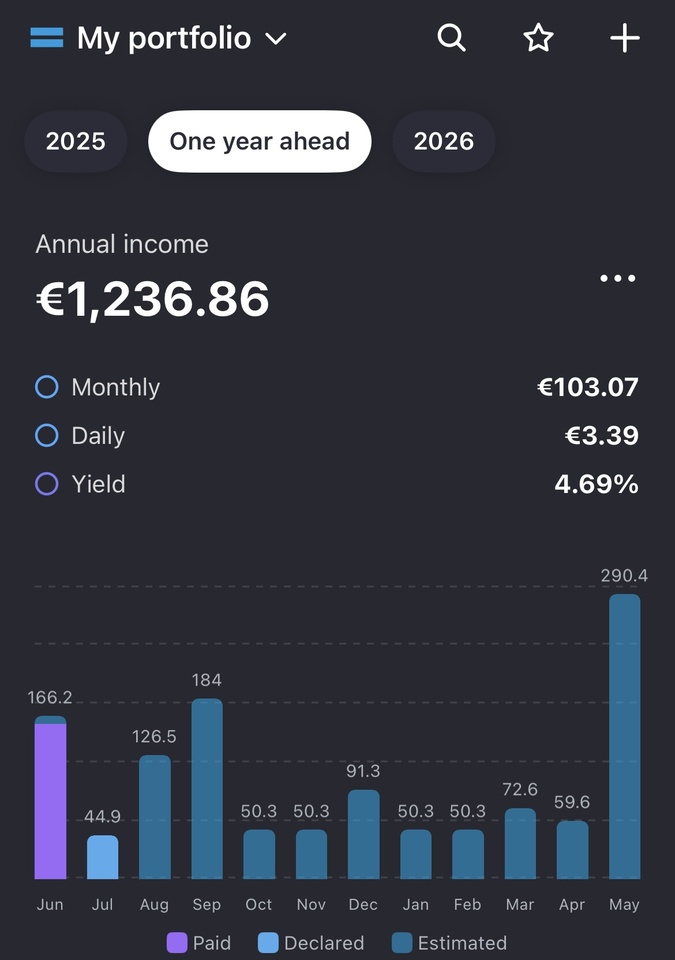

Dividend growth portfolio

I try to build a portfolio with combinations of growth and dividends:

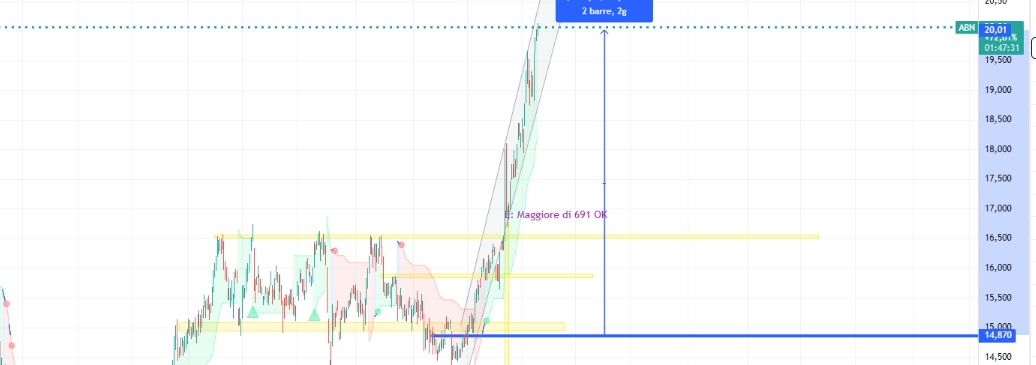

ABN

got to 20 today, beyond my wildest expectations...let's see how long it lasts# $ABN (+0,33%) old analisys https://getqu.in/qNFJ7w/

#dividends

#stockanalysis

#abn#idea

$ABN (+0,33%)

Salve Gente ,

Credo sia un buon momento per mettere in watchlist ABN e aspettare che arrivi ai 14Euro per pensare di comprarne qualche pezzo in modo da mettere da parte dei dividendi a lungo termine o in ogni caso per speculare un pò puntando ad un target di medio termine di circa il 17% intorno ai 16,3 Euro , che ne pensate?

Capitalizzazione oltre 12Miliardi(di Euro), c'è di meglio ma anche di peggio :)

Utili in Aumento dal 2020

Debito stabile

Dividendo del 10,25%

P\E 4,85 di poco più alto dell'anno scorso

Target degli analisti accreditati a 17Euro $ABN (+0,33%)

Titoli di tendenza

I migliori creatori della settimana