$WYFI the next Arista or Nebius? Let’s see. Added small position to my portfolio.

WhiteFiber, Inc.

Price

Discussion sur WYFI

Postes

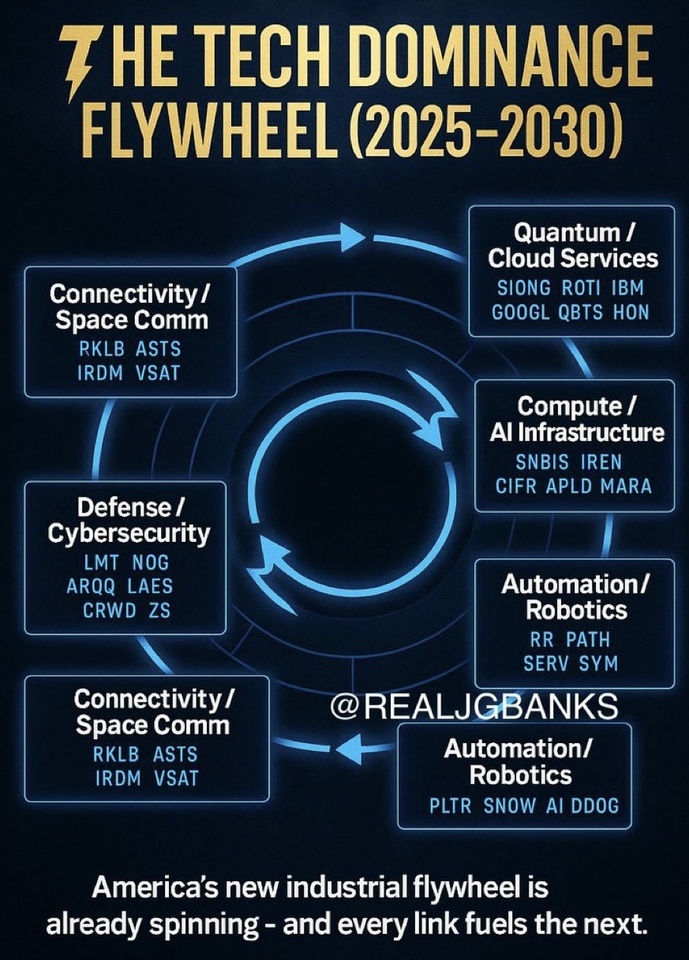

4A selection of possible TEN BAGGER 🚀

For all those interested, here is a list of possible upcoming TEN BAGGER or half or similar or future bankruptcies 🔮 📣🔊

🔸 Hims & Hers $HIMS (-0,67 %)

🔸 Palantir $PLTR (+0,16 %)

🔸 ExlService Holdings $EXLS (-1,12 %)

🔸 IES Holdings $IESC (+2,56 %)

🔸 Jabil $JBL (+3,68 %)

🔸 RadNet $RDNT (-0,83 %)

🔸 Robinhood $HOOD (+1,08 %)

🔸 RocketLab $RKLB (-6,56 %)

🔸 Toast $TOST (-2,42 %)

🔸 Whitefiber $WYFI

🔸 Figure Technology $FIGR

🔸 Circus SE $CA1 (-2,93 %)

🔸 Voyager Technologies $VYGR (+2,07 %)

🔸 Perpetua Resources $PPTA (+1,59 %)

🔸 Lightbridge Corp. $LTBR (-4,21 %)

🔸 Oklo $OKLO

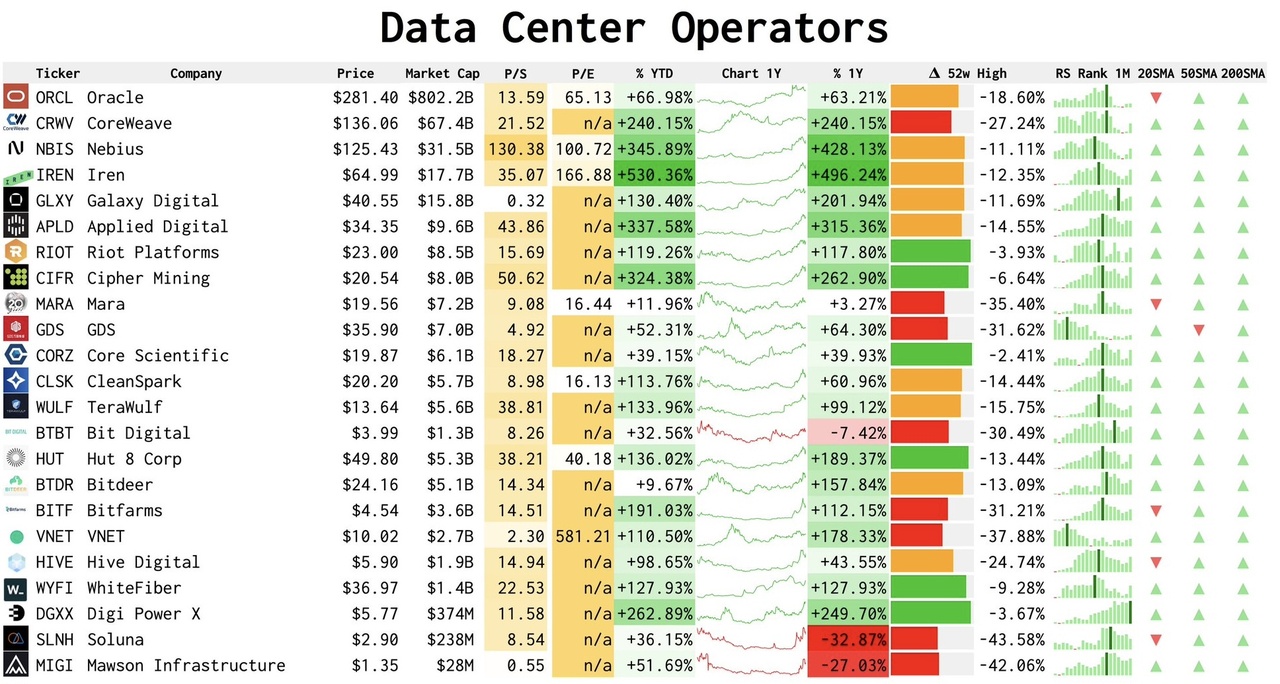

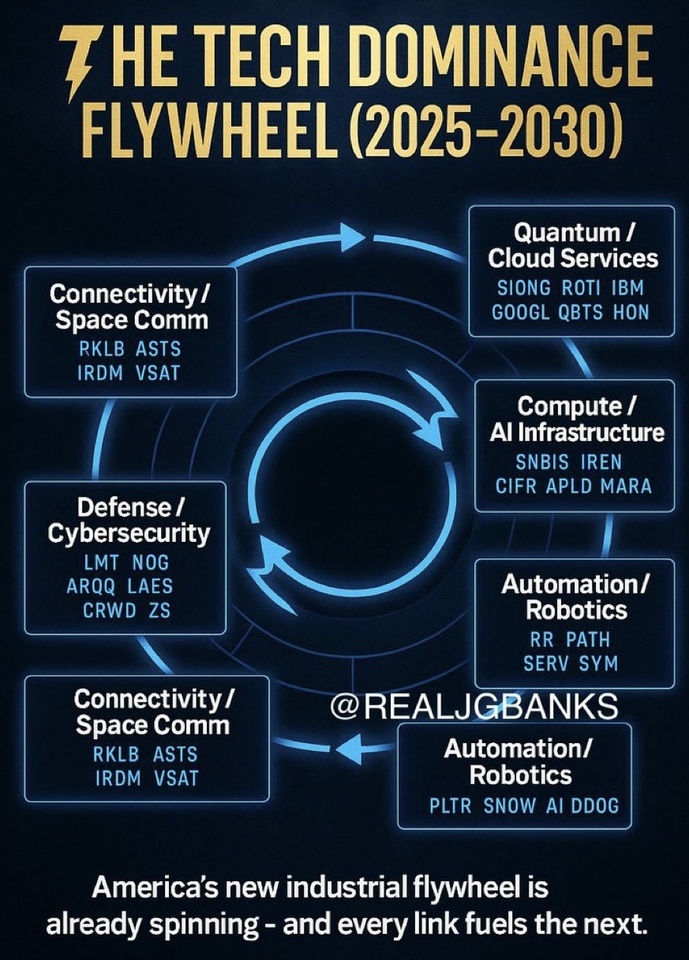

List of data center operators 🫡

$IREN (-6,41 %)

$CIFR (-6,57 %)

$NBIS (-9,32 %)

Maybe one or the other exciting value for you?

I am in $IREN (-6,41 %) , $CIFR (-6,57 %) but $NBIS (-9,32 %) I also find it exciting in the long term. 👌

$ORCL (-5,5 %) Oracle

$CRWV (-9,31 %) CoreWeave

$NBIS (-9,32 %) Nebius

$IREN (-6,41 %) Irish

$GLXY (-2,18 %) Galaxy Digital

$APLD (-7,5 %) Applied Digital

$RIOT (-3,62 %) Riot Platforms

$CIFR (-6,57 %) Cipher Mining

$MARA (+0,14 %) Mara

$GDS (+0 %) GDS

$CORZ (-3,77 %) Core Scientific

$CLSK (-1,33 %) CleanSpark

$WULF (-2,68 %) TeraWulf

$BTBT (+0 %) Bit Digital

$HUT (-2,47 %) Hat 8

$BTDR (+0 %) Bitdeer

$BITF (-1,14 %) Bitfarms

$VNET (-3,83 %) VNET

$HIVE (-1,63 %) Hive Digital

$WYFI WhiteFiber

$DGX (+1,48 %) Digi Power X

$SLNH Soluna

$MIGI Mawson Infrastructure

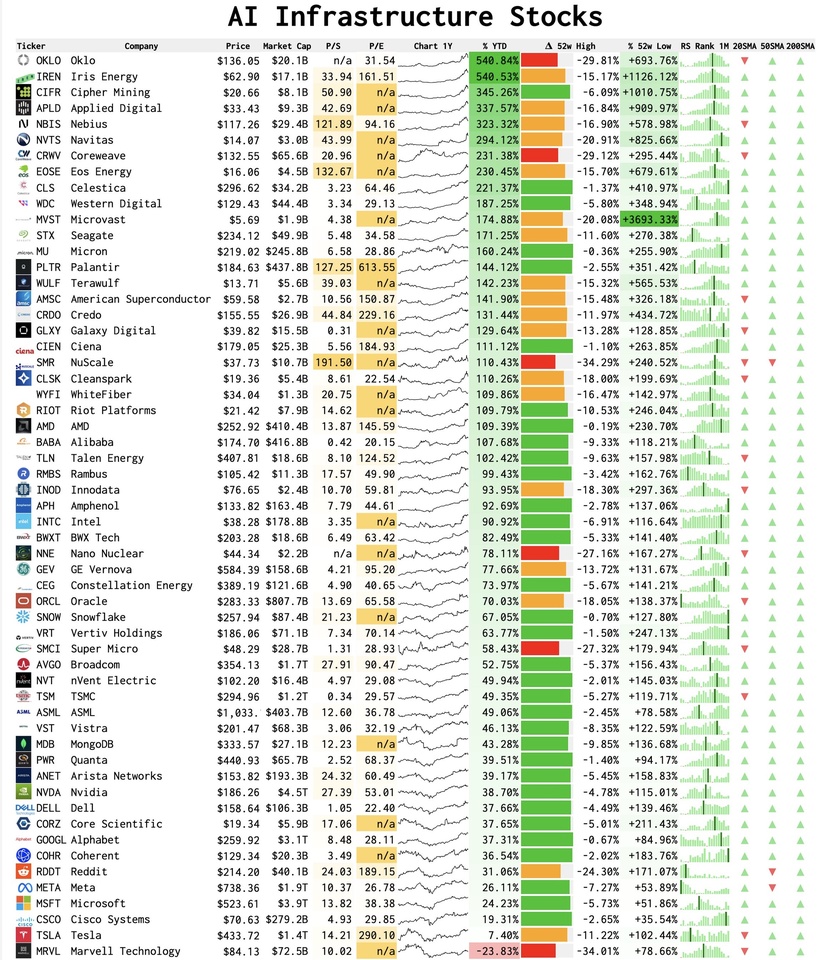

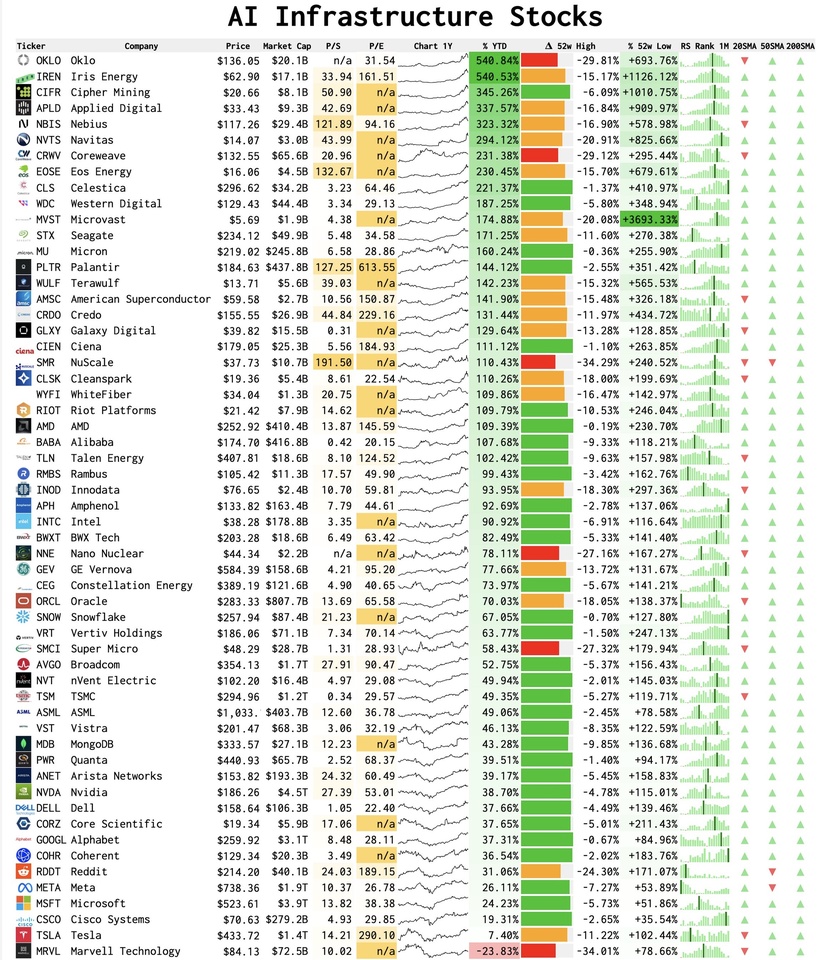

AI infrastructure continues to be one of the most exciting investment themes

$IREN (-6,41 %)

$CIFR (-6,57 %)

$BTC (-4,42 %)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (-6,41 %) and $CIFR (-6,57 %) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (-6,57 %) probably add a little more and perhaps pick up one or two other companies.

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+3,81 %)

$MSFT (-0,3 %)

$AMZN (+2,51 %)

$ORCL (-5,5 %)

$BABA (+0 %)

Neocloud: $NBIS (-9,32 %)

$IREN (-6,41 %)

$CRWV (-9,31 %)

$APLD (-7,5 %)

$GLXY (-2,18 %)

$WYFI

Memory: $SNDK

$STX (+0,37 %)

$MU (+2,55 %)

$WDC (-0,04 %)

$PSTG (+0,82 %)

Semiconductor: $NVDA (+1 %)

$AVGO (-0,41 %)

$AMD (-1,53 %)

$TSM (+2,62 %)

$ASML (+0,76 %)

$ARM (-0,93 %)

$KLAC (+1,83 %)

$INTC (-1,11 %)

Networking: $CIEN (+5,02 %)

$CLS (+0,4 %)

$CRDO

$RMBS (-1,39 %)

$ANET (-3,29 %)

$APH (+0 %)

$COHR (+7,63 %)

Servers: $VRT (+0,21 %)

$DELL (+2,6 %)

$HPE (-0,22 %)

Data: $INOD (-1,3 %)

$PLTR (+0,16 %)

$SNOW (-3,7 %)

$DDOG (-4,15 %)

$MDB (-3,21 %)

Energy: $LEU (-2,75 %)

$CEG

$OKLO

$TLNE

$GEV (-0,49 %)

$NXT (+0 %)

Batteries: $EOSE

$QS (-3,72 %)

$TSLA (-0,19 %)

$MVST (-5 %)

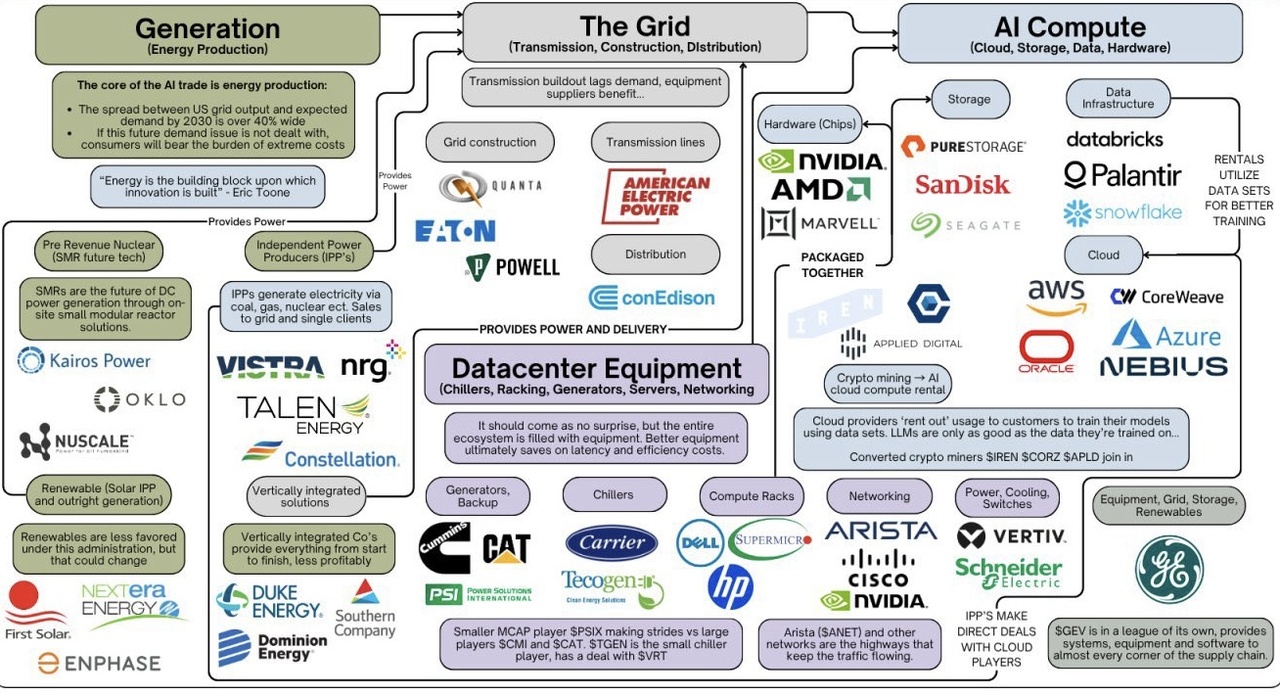

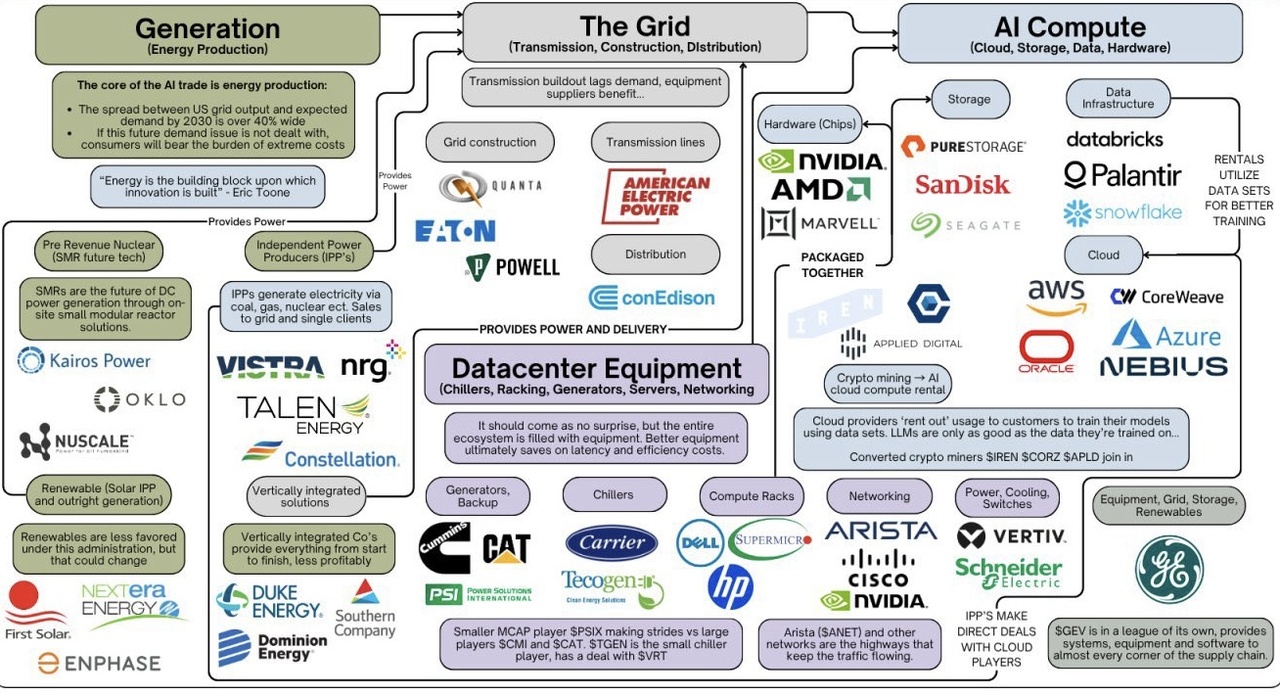

Every AI Value Chain explained:

AI infrastructure continues to be one of the most exciting investment themes

$IREN (-6,41 %)

$CIFR (-6,57 %)

$BTC (-4,42 %)

Maybe some exciting companies for you ✌️

I am currently only in $IREN (-6,41 %) and $CIFR (-6,57 %) which are the most promising for me in terms of the opportunity/return ratio. In the event of a further setback, I would $CIFR (-6,57 %) probably add a little more and perhaps pick up one or two other companies.

AI stocks, sorted by YTD performance:

Hyperscalers: $GOOGL (+3,81 %)

$MSFT (-0,3 %)

$AMZN (+2,51 %)

$ORCL (-5,5 %)

$BABA (+0 %)

Neocloud: $NBIS (-9,32 %)

$IREN (-6,41 %)

$CRWV (-9,31 %)

$APLD (-7,5 %)

$GLXY (-2,18 %)

$WYFI

Memory: $SNDK

$STX (+0,37 %)

$MU (+2,55 %)

$WDC (-0,04 %)

$PSTG (+0,82 %)

Semiconductor: $NVDA (+1 %)

$AVGO (-0,41 %)

$AMD (-1,53 %)

$TSM (+2,62 %)

$ASML (+0,76 %)

$ARM (-0,93 %)

$KLAC (+1,83 %)

$INTC (-1,11 %)

Networking: $CIEN (+5,02 %)

$CLS (+0,4 %)

$CRDO

$RMBS (-1,39 %)

$ANET (-3,29 %)

$APH (+0 %)

$COHR (+7,63 %)

Servers: $VRT (+0,21 %)

$DELL (+2,6 %)

$HPE (-0,22 %)

Data: $INOD (-1,3 %)

$PLTR (+0,16 %)

$SNOW (-3,7 %)

$DDOG (-4,15 %)

$MDB (-3,21 %)

Energy: $LEU (-2,75 %)

$CEG

$OKLO

$TLNE

$GEV (-0,49 %)

$NXT (+0 %)

Batteries: $EOSE

$QS (-3,72 %)

$TSLA (-0,19 %)

$MVST (-5 %)

Every AI Value Chain explained:

In addition to $IREN and $CIFR also $GLXY, $INOD, $NVDA and $DDOG.

Plus $GOOGL, $AMZN and $BABA

So I'm pretty broadly positioned in this area when I look at it like this 😉😎

Others would say there is a cluster risk. However, the strategy of focusing on the highest possible returns means investing in the booming sectors, which at the moment are AI and commodities.

Titres populaires

Meilleurs créateurs cette semaine