In April 2024 I went on a holiday trip to Croatia. 🇭🇷First in the city of Osijek. After that week I traveled to the capital Zagreb to visited some of my friends. So in the first week I stayed in the city of Osijek. That’s where I first came across a Erste bank branch. Beside a cup of coffee ☕️ in a local bar in the city center I did some research. Later that year, I decided to open my first a position in the company. My first purchase was 20 stocks. Another couple months later. I bought in again on a lower price. Since then, the stock has only gone upwards. 📈

Now about Erste Group Bank:

Erste Group Bank AG/ $EBS (-3,24 %) an Austrian bank in the heart of europe. They rule as one of the largest providers in financial services in eastern europe. Serving above 16.000.000 clients in over 2000 braches in nine central and eastern european countries. Erste Bank is headquartered in the capital city of Austria, Wien/Vienna. 🇦🇹

Why is Erste Bank so interesting to me?

Well, at first. It is headquarted in the heart of europe. Which gives Erste Bank a widely spread of markets all around them. They are mostly active in the eastern part of europe. Which is often seen as the least developed part of the european continent. For me, that is a point of interest. Due to the fact that eastern europe is developing relatively fast in comparison with the western part of europe. Western europe is often seen as the most developing part of europe. But is that statement actually true? Or, is that statement on its way to retirement? Let’s find out. 🫱🏻🫲🏼

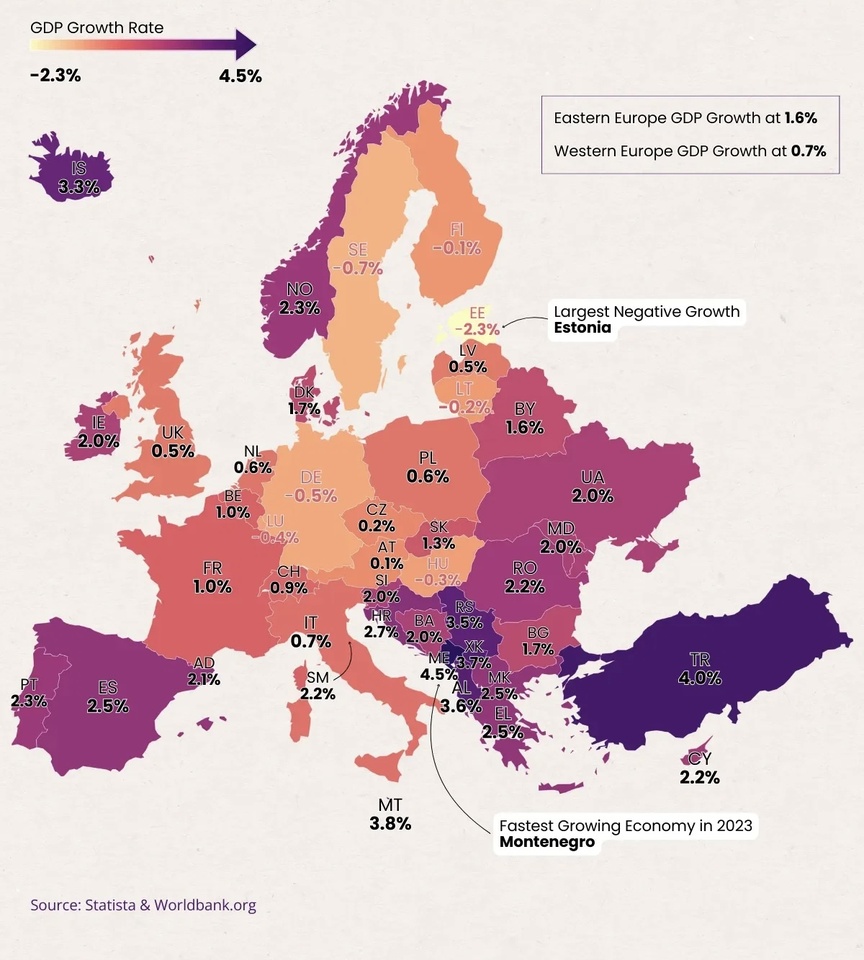

Let’s take a look at the next image about GDP growth rates in Europe (2023) 🇪🇺📉📈

Here we can see several things. First thing that you can notice is that as seen on the image. Western europe is growing on average +0,7% GDP . While eastern europe on average is growing +1.6% GDP. If you we would expres that difference in percentage. Than the diffenece would be 120%! Which means, eastern europe is growing on a 2,2x faster rate than “developed” western europe. All this is excluding the difference in inflation rates. Because the inflation rates are really close in western and eastern europe. Some are having a hard time, while others are back to the wanted +-2%.

As a western european myself, I could see this being shocking. On the otherhand, I believe there is a way to benefit from this.

Let’s make a summary for Erste Bank its markets. (GDP growth) Central and eastern.

For the central european markets:

Austria 🇦🇹 = + 0,1%

Czech Republic 🇨🇿 = + 0,2%

These growth rates could be concidered as low.

For the eastern european markets:

Hungary 🇭🇺 = - 0,3%

Slovakia 🇸🇰 = + 1,3%

Moldova 🇲🇩 = + 2,0%

Romania 🇷🇴 = + 2,2%

Croatia 🇭🇷 = + 2,7%

Serbia 🇷🇸 = +3,5%

And for the most stunning one, (eventhough it is a small country with a in comparison small economy.)

Montenegro🇲🇪 = +4,5%

Outside of Erste Bank its markets the best and least performing two countries are:

Türkiye 🇹🇷 = +4,0%

Estonia 🇪🇪 = -2,3%

This is something which I think is important to see. Because this image shows for Erste Bank. That they are in the right spot of the continent here. And I’m looking forward to the further development in the future. 📈🫱🏻🫲🏼

What is Erste Bank doing to expand its influence troughout the region and what are their main goals? 🇪🇺🏦

they have a couple main goals:

Market Leadership: The first main goal is to soldify their position as a leading bank in their core markets.

Sustainability: Integrate environmental, social, and governance (ESG) principles into their operations and promote sustainable and environmental development. 🌳✅

Loan Growth: Achieve robust loan growth, particularly in retail and corporate business. 💸

Customer Focus: Support customers in achieving their financial goals and ensure their financial well-being. 📈

Dividend and Shareholder Returns: Propose dividends and execute share buybacks. For example on 21 May 2025 when Erste Group Bank AG announced a framework programme for the purchase of its own shares, with plans to acquire up to 1,500,000 shares, or an equivalent of €42 million, between 27 May 2025 and 10 April 2026. 💰

And for their further expansions of influence they are constantly searching for new opportunities troughout the region. Erste Bank was for example not active in Poland 🇵🇱. But, Erste Bank is expanding its presence in Poland by acquiring a 49% stake in Santander Bank Polska, a deal valued at approximately €6.8 billion. This acquisition, along with a 50% stake in Santander's Polish asset management unit, makes Erste Group also a major player in the Polish banking sector and again solidifies its position as a leading bank in Central and Eastern Europe 🇵🇱🇪🇺💰

Why did they choose specificly for an expansion to Poland?🇵🇱🇪🇺

Because, Poland its strong economic growth and relatively underpenetrated financial markets make it an attractive market for expansion. 📈

I also made a post about a Polish bank. Feel free to check that one out if you are interested!🇵🇱📊

Ofcours, this all is just a fraction of the whole picture. And there is ofcours, much more to talk about. Erste Bank is a company of concistensy, sustainability and the constant willing to expand and develope more. And I think it deserves a look from all. For me, since when I bought the stock. I had no doubt of it being anything els but a success. And untill now, I think that is the case. And it has been my best purchace of last year. I’ve gained about +41% in that time range (excluding the recieved dividend). And I’m looking forward to Erste Bank its future. I think they are still, (eventhough the stock alltime high), very interesting. Take a look at it.

Tell me what you think about Erste Bank. Would you concider it a good company? Are you maybe already invested? And if that is the case, why did you decide to invest in Erste Bank? Feel free to to criticize or just to start a discussion. Thanks for reading, and let me know what you think about it. Thank you🇪🇺🫱🏻🫲🏼🇦🇹📈🩵