As you probably know, the profitability of banks depends heavily on the prime rate. As it is to be expected that this will fall again in the next few years, bank profits should also fall again. What is your opinion? Sell or hold? For information: Hold at present $BG (-4,49 %) and $RBI (-6,12 %)

BAWAG Group

Price

Discussion sur BG

Postes

23Trading Part4 - Deepdive indicators 📈📉☕

As always, first the link to the first post, where you will also find the links to all the other parts https://getqu.in/cbIOkg/

Today there are a few more details on the indicators from part 3 https://getqu.in/9XGYtO/

As described in part 3, I start my analysis with the SMA 200 / 50 / 5 daysto get an overview of the trend.

Example $UBER (-1,41 %)

For me, an important setting for the SMA is that I always use the SMA regardless of my chart setting always on a daily basis. daily basis. This means that even if I have set the chart to weekly or 4h, it always shows me the SMA on a daily basis.

Example $UBER (-1,41 %) 1h hour chart - but the SMA are still on a daily basis, not like the default setting, which always refers to the chart - then the SMAs would be calculated on a 200 / 50 / 5 hour basis!

Next, I'll get the VRVP to see the volumes. I have set the chart to the range since Uber has been in an overarching sideways phase.

I can see the price area with the highest volume and the distribution where 68% of the volume has taken place.

My VRVP settings are as follows, I adjust the line size depending on the visible range - the larger the range, the larger the number of lines.

So, I now have a good overview of the trend after a few minutes.

Now it's time to continue with the VWAP. My anchored VWAP I place it in a prominent position for me. In this case the last low before the start of the sideways phase. This is how I see the "DNA" of Uber - How does Uber behave in the statistical areas of the volume-weighted average price.

For my short-term trades, I zoom into the close range, but the anchored VWAP remains. I only switch to the 1 hour chart and the last few months.

The white circles then show potential entries and exits for me. The orange circles at the bottom show the earnings, there's always a lot of movement😁

Of course, I also look in detail at the price action, i.e. the candles per time unit.

In principle, this describes my main procedure for determining the buy/sell point.

That's it 🤷♂️ has been working for me for a long time with the outcome as described in part 2 https://getqu.in/TVNdpR/

Because of the overview, I have hidden the VRVP in the VWAP views, but I always leave it on for my analysis.

Example anchored VWAP with VRVP and SMA5 for the short-term trend

Example anchored VWAP with VRVP and VWAP on a weekly basisI can see where the VWAP of the current week has moved. It's also nice to see how and where the big volumes of the week have positioned themselves 😁

So, that's a bit more detail on my setup. As you can see, with a little practice and routing, you can analyze a stock in a short time. For me, such an analysis usually takes no longer than 10 minutes and I know whether a trade makes sense for me and where to place my buy and sell orders.

PS: I have found a clever script on TradingView for some of my stock screener filters. You can always display some criteria live - in the chart at the bottom right

You can find it under the indicators: Ticker Dashboard For Better Stock Selection

$ADYEN (-3,46 %)

$MMK (-4,29 %)

$MRK (+0,19 %)

$KTN (-3,07 %)

$BRBY (-3,87 %)

$OMV (-2,57 %)

$VER (-2,4 %)

$BG (-4,49 %)

$VOE (-6,27 %)

$ZAL (-3,15 %)

$VRTX (+0,16 %)

$RDC (-0,8 %)

+ 6

It reads very well. 💪🏼

OGH: Loan processing fees at BAWAG inadmissible

Source: https://aktien-portal.at/

Following a complaint by the Chamber of Labor, the Supreme Court (OGH) has declared the processing fees of 1.5 percent charged by BAWAG $BG (-4,49 %) for processing fees of 1.5 percent on consumer loans. According to the Consumer Protection Association (VSV), the bank must now pay back the collected fees, while the banking representatives of the Austrian Federal Economic Chamber (WKÖ) take a different view. BAWAG still wants to examine the concrete effects of the ruling, the bank said in response to an APA inquiry.

The clause is grossly disadvantageous, the Supreme Court stated in its decision. The court sees problems with the way the fees are calculated depending on the amount of the loan, but credit processing fees are not fundamentally inadmissible. However, it is not comprehensible why, for example, the granting of a mortgage loan of 440,000 euros should cause more expense than a loan of 220,000 euros, writes the Court.

BAWAG $BG (-4,49 %) G examines the effects of the ruling

"BAWAG $BG (-4,49 %) takes note of the Supreme Court's decision and is examining the concrete effects of the ruling," the bank said. It has been given a period of six months to do so.

The Federal Banking and Insurance Division of the Austrian Federal Economic Chamber (WKÖ) emphasized in a press release on Monday that the proceedings were "abstract association proceedings" in which abstract clauses were assessed, but no statement was made on the legal consequences in individual cases, according to a press release on Monday. The Supreme Court ruling therefore "does not automatically trigger repayment", said Franz Rudorfer, Managing Director of the division. This would require a case-by-case assessment.

VSV also wants to bring an action for an injunction

The consumer protectors take a different view. According to VSV, the bank must now pay back the fees. "The banks have made exorbitant excess profits, so it is only right and proper that unjustly obtained fees are paid back to customers quickly and without complications," said Daniela Holzinger-Vogtenhuber from VSV according to the press release. The Chamber of Labor (AK), which had filed a lawsuit against BAWAG and Santander Consumer Bank, now also wants to look for a solution so that affected customers "can get back their wrongly paid credit processing fees in a simple and uncomplicated manner," it said in a press release.

For VSV, the Supreme Court ruling alone is not enough. In the coming days, VSV intends to file an injunction - initially against BAWAG and later against all other major banks. This should ensure that consumers' claims for repayment do not become time-barred. The VSV is also planning remedial action should BAWAG $BG (-4,49 %) refuses to make repayments.

World Economic Forum 2025

January 20-24, 2025, Davos, Switzerland

The World Economic Forum (WEF) is an international organization founded by Klaus Schwab in Switzerland in 1971. It promotes cooperation between business, politics, science & civil society. The Annual Meeting takes place in Davos. The motto for this year:

"Cooperation in the age of intelligence"

The World Economic Forum 2025 is dedicated to a wide range of topics, including geopolitical tensions, economic growth and the transition to clean energy. At the same time, tech, AI, quantum computing & biotech also play an important role.

As always, there will be posts on all relevant topics from @HennRes & @Michael-official will be published. Under the #wef2025 you will be able to view all posts in chronological order.

Main topics:

- Rethinking growth: How can we tap into new sources of economic growth?

- How can companies respond to tech and geopolitical upheaval?

- What measures promote education, health & human capital?

- How can innovative partnerships & techs drive climate protection?

- How can cooperation be strengthened to overcome social divisions?

Participants from politics & business.

Over 350 government representatives, including 60 heads of state & government, 1600 people from the private sector, including 900 CEOs and over 170 people from NGOs, trade unions, academia and indigenous peoples are also present.

The key figures from politics are:

- 🇺🇸 Donald J. Trump(soon to be) President of the USA (via video link)

- 🇪🇺 Ursula von der Leyen, President of the European Commission

- 🇨🇳 Ding XuexiangVice Prime Minister of the People's Republic of China

- 🇦🇷 Javier MileiPresident of Argentina

- 🇩🇪 Olaf Scholz, Chancellor of Germany

- 🇿🇦 Cyril Ramaphosa, President of South Africa

- 🇪🇸 Pedro Sánchez, Prime Minister of Spain

- 🇨🇭 Karin Keller-Sutter, President of the Swiss Confederation 2025

- 🇺🇦 Volodymyr Zelenskyy, President of Ukraine

Executives from the private sector (who are expected/ not offical)

Technology sector

- 🇺🇸 $MSFT (-1,02 %) (Microsoft) - Satya Nadella, CEO

- 🇺🇸 $AMZN (-1,79 %) (Amazon) - Andy Jassy, CEO

- 🇺🇸 $IBM (-1,32 %) (IBM) - Arvind Krishna, CEO

- 🇺🇸 $MSFT (-1,02 %) (Microsoft) - Bill Gates, co-founder and head of the Bill and Melinda Gates Foundation

- 🌎 Cohere - Aidan Gomez, CEO

- 🌎 $META (-1,29 %) (Meta) - Yann LeCun, AI scientist

- 🌎 OpenAI - Sam Altman, CEO

- 🇺🇸 $TSLA (-1,91 %) (Tesla) - Elon Musk, CEO

Financial sector

- 🇪🇺 ECB - Christine Lagarde, President of the European Central Bank

- 🇫🇷 ECB - Francois Villeroy de Galhau, President of the French Central Bank

- 🇩🇪 German Bundesbank- Joachim Nagel, President

- 🇺🇸 $BLK (BlackRock) - Martin Lück, Chief Investment Strategist

- 🇳🇱 $ING (-5,39 %) (ING) - Carsten Brzeski, Chief Economist at ING Germany

Banking sector

- 🇺🇸 $JPM (-1,16 %) (JPMorgan Chase) - Jamie Dimon, CEO

- 🇨🇭 $UBSG (-4,44 %) (UBS) - Sergio Ermotti, Group CEO

- 🇨🇭 $UBSG (-4,44 %) (UBS) - Colm Kelleher, President

- 🇩🇪 $DBK (-5,12 %) (Deutsche Bank) - Christian Sewing, CEO

- 🇺🇸 $GS (-1,42 %) (Goldman Sachs) - David Solomon, Chairman and CEO

- 🇺🇸 $BAC (-1,07 %) (Bank of America) - Brian Moynihan, CEO

- 🇺🇸 $C (-2,08 %) (Citigroup) - Jane Fraser, CEO

- 🇬🇧 $HSBA (-4,32 %) (HSBC) - Mark Tucker, Group Chairman

- 🇬🇧 $HSBA (-4,32 %) (HSBC) - Michael Roberts, CEO of HSBC Bank

- 🇺🇸 $MS (-1,23 %) (Morgan Stanley) - Ted Pick, CEO

- 🇬🇧 $BARC (-3,2 %) (Barclays) - C.S. Venkatakrishnan, CEO

- 🇫🇷 $GLE (-5,45 %) (Société Générale) - Slawomir Krupa, CEO

- 🇮🇹 $UCG (-5,02 %) (UniCredit) - Andrea Orcel, CEO

- 🇦🇹 $BG (-4,49 %) (BAWAG Group) - Anja E. M. W. Schreiber, CEO

- 🇦🇹 $EBS (-3,44 %) (Erste Group) - Andreas Treichl, CEO

Industry sector

- 🇩🇪 $BAYN (-4,15 %) (Bayer) - Bill Anderson, CEO

- 🇨🇭 $NESNE (Nestlé) - Mark Schneider, CEO

- 🇬🇧 $ULVR (-2,24 %) (Unilever) - Hein Schumacher, CEO

- 🇨🇳 SHEIN - Donald Tang, Vice Chairman

- 🇮🇳 ADANIENT (Adani Enterprises) - Gautam Adani, Chairman

... and many more from the Tech, Banking, AI, Biotech, Pharma, Industrial, etc. sectors.

$BG (-4,49 %) Discussed in Wallstreet-Online's Dividend Radar: https://www.wallstreet-online.de/nachricht/18248681-passives-einkommen-top-rendite-finanzkonzern-bawag-glaenzt-zweistelliger-dividendenquote

$BG (-4,49 %)

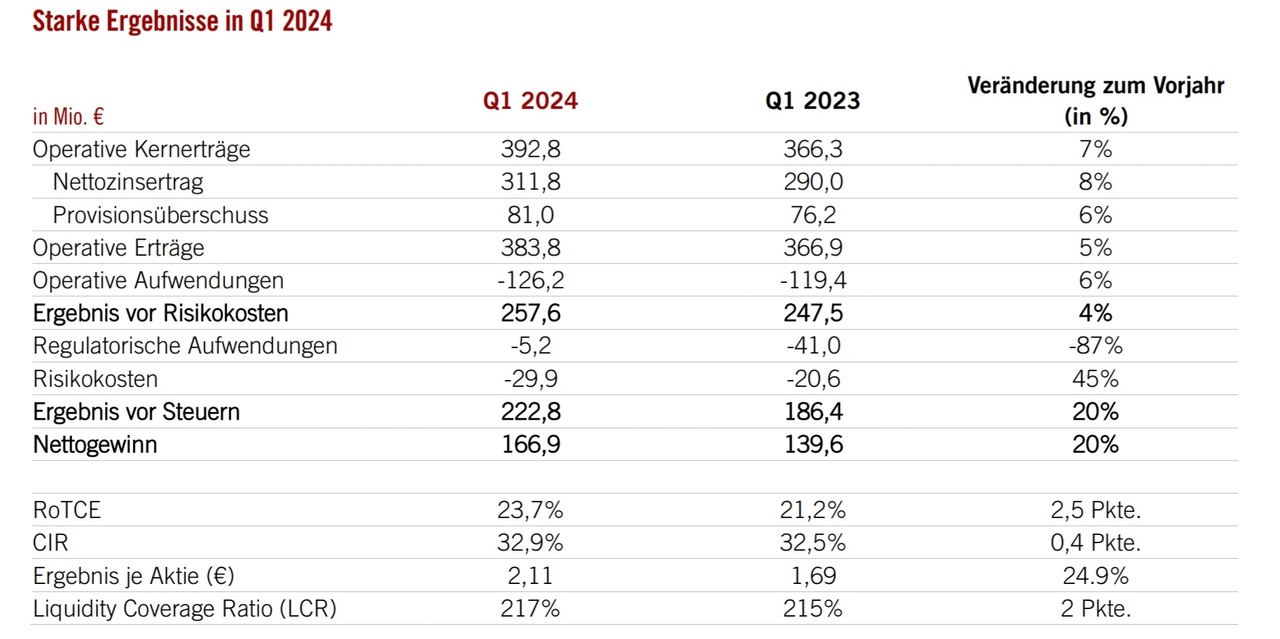

BAWAG GROUP quarterly figures

- Q1 '24 net profit of € 167 million, EPS of € 2.11 and RoTCE of 23.7%

- Customer deposits +1% and customer loans stable compared to Q4'23 (both on average)

- Profit before risk costs of € 258 million (+4% compared to the previous year) and cost/income ratio of 32.9%

- Risk cost ratio of 28 basis points ... NPL ratio at 1%

- CET1 ratio of 15.6% after deduction of the deferred dividend of € 92 million for Q1'24

- 2024 targets confirmedEarnings before taxes > € 920 million, RoTCE > 20% and CIR < 34%

Anas Abuzaakouk, CEO, commented on the financial results as follows: "In the first quarter, we delivered strong results with a net profit of €167 million and a RoTCE of 24%. We generated a significant amount of capital during the quarter, increasing our CET1 ratio by 90 basis points to 15.6% and our excess capital to € 623 million. This already takes into account the deduction of the deferred dividend of € 92 million for the first quarter of 2024. We have earmarked our excess capital for the acquisition of Knab Bank, which we signed earlier this year, as well as for further M&A, which is at an advanced stage. These strategic opportunities not only offer us high added value in terms of earnings, but will also allow us to further expand both our Retail & SME business and our presence in the DACH/NL region. Today, I am more excited than ever about our future growth opportunities."

The BAWAG Group AG is

the listed holding company headquartered in Vienna, Austria, and serves 2.1 million private, SME, corporate and public sector customers in Austria, Germany, Switzerland, the Netherlands, Western Europe and the USA. The Group offers a wide range of savings, payment, credit, leasing and investment products as well as building society savings and insurance under various brands and via different sales channels. The provision of simple, transparent and first-class products and services that meet the needs of customers is at the heart of its strategy in all business areas.

Titres populaires

Meilleurs créateurs cette semaine