Over the past month, US stock markets have been on a strong climb, with the $CSPX (+0,58 %) S&P 500, $EXI2 (+0,74 %) Dow Jones, and $CSNDX (+0,8 %) NASDAQ reaching new record highs. This upward movement is largely due to solid corporate earnings reports that have surpassed expectations and a persistent belief among investors that the Federal Reserve will soon begin cutting interest rates. While recent inflation data has presented a mixed picture, leading to some daily market swings, the overall sentiment remains optimistic. The market seems to be betting on a "soft landing" for the economy, where inflation cools without causing a recession, boosting investor confidence.

iShares Dow Jones Global Titans 50

Price

Discussion sur EXI2

Postes

13BREAKING: UnitedHealth shares fall by over 8% in after-hours trading

$UNH (-0,11 %)

$IUSA (+0,6 %)

$CSINDU (+0,34 %)

$EXI2 (+0,74 %)

$XDWH (+0,02 %)

The UnitedHealth share price $UNH (-0,11 %) falls by over 8 % as the Department of Justice announces an investigation into possible Medicare fraud.

Funnily enough, this news comes right now and the investigation is likely to date back to last year? Let's see what follows today, whether there are any official reports, $UNH (-0,11 %) has issued a statement immediately, how do you react to this?

https://www.unitedhealthgroup.com/newsroom/2025/2025-05-14-response-may-14-wsj-article.html

The U.S. Justice Department is investigating UnitedHealth Group Inc (UNH) for possible criminal Medicare fraud, the Wall Street Journal reported citing people familiar with the matter.

The investigation is being led by the healthcare-fraud unit of the Justice Department's criminal division and has been ongoing since last summer.

Though specific allegations are unclear, the probe is focused on UnitedHealth's Medicare Advantage business practices, the report said.

The Journal noted that the investigation adds to other government inquiries into the company, including antitrust concerns and a civil review of its Medicare billing practices at its doctors' offices.

On Tuesday, UnitedHealth Group announced that its Chief Executive Officer Andrew Witty stepped down from the position due to personal reasons. Following this, the healthcare company appointed Stephen Hemsley as its new Chief Executive Officer, effective immediately. He was the company's Board chair in 2017.

Additionally, the company announced its decision to suspend its 2025 outlook, citing higher than expected medical expenditures. However, the company expects to return to growth in 2026.

performance and cracked the 50,000 mark for the first time.

Hello everyone,

With today's high, I have cracked my first target of €50,000 for the first time.

The next target is of course €100,000, hopefully by the end of 2026/beginning of 2027.

I would therefore like to present my portfolio to you and hope that you will have any suggestions for improvement and constructive ideas.

Basically, the focus is on buy and hold / growth. But a dividend is also nice.

I started thinking more intensively about the whole topic around the beginning/middle of 2023, at the age of 29. The aim is to possibly reach the millions after all, or in any case to have a more comfortable retirement later on.

Before that, it was more about trying things out or the "safe" investment that you get from your parents. In the meantime, we saved in stories such as DWS funds. I still have one of these "corpses", the DWS Vermögens... $HJUF (-0,16 %) .

However, this is also to be restructured in the near future.

I am currently working on increasing my ETF positions to get to a ratio of 50%/50%. I have not been so successful with this recently, as I have increased many individual stocks due to the low.

Actually, the iShares Core S&P 500 $CSPX (+0,58 %) and FTSE All-World $VWCE (+0,76 %) are in the foreground.

Yes, I am also saving here at the same time $VWRL (+0,63 %) for a few more dividends a year. You are welcome to give your opinion on whether this makes sense or whether you should only take one of the two.

My current monthly ETF savings plans at a glance,

Core S&P 500 $CSPX (+0,58 %) - 150€

All-World $VWCE (+0,76 %) - 70€

All-World $VWRL (+0,63 %) - 70€

MSCI World $IWDA (+0,57 %) - 40€

S&P 500 Information Tech $IUIT (+0,64 %) - 30€

All-World High Divid. $VHYL (+0,81 %) - 30€

VanEck Sustainable World Equal $TSWE (+1,14 %) - 30€

VanEck Developed $TDIV (+0,23 %) - 15€

iShare DJ Global Titan 50 $EXI2 (+0,74 %) - 15€

Here, too, a merger would be conceivable and also make sense.

For example, since I hold the DJ Global Titan 50 $EXI2 (+0,74 %) and the MSCI World $IWDA (+0,57 %) with a small amount for ages, I have not yet been able to part with them.

I still save the following shares weekly at €7 each on the side,

In addition to the above, I buy individual shares, ETFs or top up positions worth a further €500, depending on prices.

On average, my monthly savings rate is therefore around €1,000-1,500.

As already mentioned, I would like to ask the community for their opinion, any suggestions for improvement and constructive ideas.

Thank you very much, best regards and happy trading days.

BREAKING: states sue Trump in bid to block new tariffs

$CSPX (+0,58 %)

$CSNDX (+0,8 %)

$EXI2 (+0,74 %)

$IWDA (+0,57 %)

$EIMI (+1,48 %)

A dozen states filed suit against President Donald Trump and his administration on Wednesday, seeking an injunction declaring the new tariffs on foreign imports illegal.

- The president does not have the power to raise taxes on a whim, but that's exactly what President Trump has been doing with these tariffs," New York Attorney General Letitia James said in a statement on the lawsuit.

- The suit was filed in the U.S. Court of International Trade.

- Since taking office, Trump has issued a series of executive orders imposing a range of tariffs on foreign imports, including a 145% tariff on products made in China.

https://arktimes.com/arkansas-blog/2025/04/21/sanders-says-arkansas-in-dire-need-of-federal-assistance-but-trump-says-no

The beginning

Hello! I'm a software developer new in the investing world. Did my own little research and decided I wanted to start investing.

Since I don't want to spend too much time I'm going all with ETFs (no stock picking). I finally started my portfolio with 6 funds.

Let's see how it goes! Will appreciate any feedback or suggestions 😁😁

P.D. The weights are not correct yet. Is supposed to be:

• $VUAG (+0,59 %) : 50%

• $IS3Q (+1,12 %) : 20%

• $EXI2 (+0,74 %) : 20%

• $EXW1 (+1,32 %) : 5%

• $IEMA (+2,2 %) : 5%

• $ZPRG (+0,92 %) : 10% (as an extra)

Good in the long term?

Would it make sense with a

long-term investment period of 20 - 40 years the Dow Jones Titans 50 Etf $$EXI2 (+0,74 %) as the only Etf core in the portfolio via a savings plan?

What is your opinion on this?

👇👇👇

It's basically a blue-chip momentum ETF. The benchmark is the $VWRL, with which you can certainly sleep more soundly. But you can find good reasons for both 🙂

Analyst warns against investor ignorance

Have you heard about the current risks for the stock market? Despite the ongoing positive trend, many investors seem to be ignoring the looming dangers. Analyst Cam Hui points out that factors such as the DeepSeek crisis and tariff announcements are serious threats.

According to Hui, the latest consumer price index shows that inflation was higher than expected. This dampens hopes of interest rate cuts by the US Federal Reserve. However, the major indices, such as the Dow Jones $EXI2 (+0,74 %) and the S&P 500 $CSPX (+0,58 %)have fallen only minimally, while the NASDAQ Composite $FNCMX remained stable.

This ignorance on the part of investors could be problematic in the long term. It is important to keep a close eye on developments, as the stock market can turn quickly. How do you assess the current situation? Are you optimistic or do you also see risks on the horizon? 📈

Part I

---------------------------------------------------------------------------------------------------------

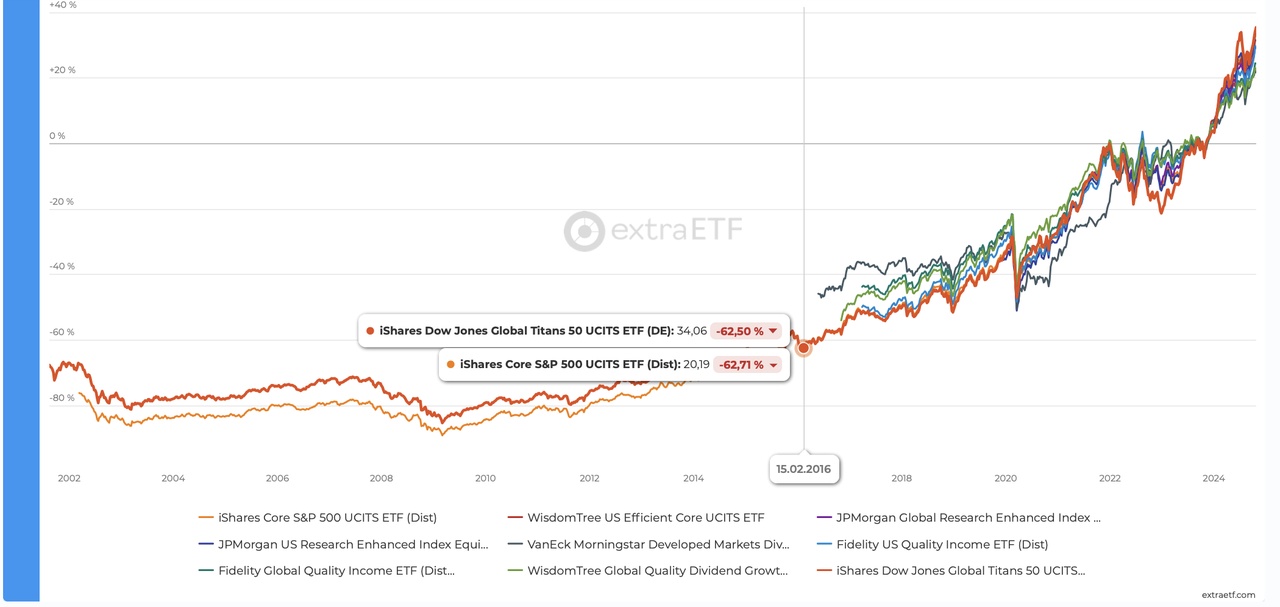

So far, the core of my portfolio has consisted of the MSCI World $HMWO (+0,73 %) and has brought me around 26% price gains and a few distributions. However, comparisons and back tests have shown that the MSCI World is not the best choice for the portfolio.

---------------------------------------------------------------------------------------------------------

The satellites consisted mainly of shares in well-known, large and often safe companies. I have gradually changed this over the last few weeks and you could say that the portfolio is changing in the direction of growth stocks with significantly higher risk and return potential. Whether and how successful I will be here is not too important in principle, as I still have a solid core, but it is precisely this core that is in the dock today.

---------------------------------------------------------------------------------------------------------

After spending the last few weeks looking at my portfolio and getting a lot of positive input, information and tips here on Getquin.

I have found the following ETFs that could perhaps form a better core for my portfolio.

A) The best known first, the S&P 500 $IUSA (+0,6 %) . If I were to start investing again today and did not know the following ETFs, I would opt for this one instead of the MSCI World.

B) The ETF mentioned by @Epi mentioned ETF, $WTEF (+0,34 %) . A portfolio concept consisting of 60 % US equities + 40 % bonds. Almost like the ARERO 😜 $LU0360863863 (+0,14 %) only much better. Because the performance so far has been very close to that of the S&P500. And I think that in turbulent stock market years, bonds will provide stability and returns. However, the fund is only one year old and so there is still little data available.

C) Then we have my favorites so far, 2 actively managed ETFs from JP Morgan.

One is the global variant $JRDG (+0,78 %) including emerging markets. Here, undervalued companies are overweighted according to fundamental data. Since its launch in September 2021, this fund has returned 11.88% p.a.

And then the counterpart to the S&P500 $JRUD (+0,55 %) the aim of this ETF is to outperform the S&P500 and to this end it also includes US equities that are not included in the index.

Since launch, December 2019, 16.5% p.a. has been achieved.

D) Then we have four dividend growth stocks. These have also beaten the MSCI World at times: $TDIV (+0,23 %)

$FUSD (+0,19 %)

$FGEQ (+0,23 %)

$GGRP (+0,53 %)

The $FUSD (+0,19 %) with a return of 13.66% p.a. since its launch in March 2017.

E) The iShares Dow Jones Global Titans 50 $EXI2 (+0,74 %) which has outperformed the S&P500 for many years and has realized 17.38% p.a. over the last 5 years, for example.

---------------------------------------------------------------------------------------------------------

I did some back testing to see how you could build a portfolio with these ETFs. However, most ETFs have not been around long enough to provide meaningful data. I also find the backtest very tedious as no perfect allocation is calculated or suggested, instead I have to work my way forward percentage by percentage. In short, I was not successful in backtesting.

I used these websites for the tests and comparison:

https://www.portfoliovisualizer.com/backtest-portfolio#analysisResults

---------------------------------------------------------------------------------------------------------

I would prefer to take them all and only buy the ones that are doing badly at the moment. But that wouldn't work because these ETFs overlap a lot and the correlation is therefore very high. ☹️

Perhaps the most dispensable would be the "dividend ETFs", $TDIV (+0,23 %) and $GGRP (+0,53 %) . These have some of the highest fees and the weakest performance. However, these are precisely the ETFs that overlap the least with the others. $TDIV (+0,23 %) could pass as Europe (55%) share of the portfolio. If you want to take Europe into account. It would be interesting for me if one region is doing well and the other is doing badly, because I could then make counter-cyclical purchases.

If overlaps and correlations are very high and costs are similar. Then it wouldn't matter whether I have them all in small chunks or large shares of one or a few ETFs. The difference should then be marginal. 😅

---------------------------------------------------------------------------------------------------------

Should I really only choose one or a few? What am I missing out on? How do you find the right one(s)? Has anyone built a portfolio from these ETFs? How do you make the right decision?

---------------------------------------------------------------------------------------------------------

Part II

Two thoughts on this:

1. for backtesting, it is essential to define what your goal is. Only then will you be able to search for an optimal allocation. What is your goal? Max CAGR, max Sharpe ratio, min max drawdown etc? But not every target is suitable for a core, because its function is stability, right? You would also have to define this and possibly even quantify it in order to make a meaningful search.

2. meaningful backtests are work! Such a backtest should go back AT LEAST the time you plan to invest in the future. So it has to be up to 2000 if you want to invest for another 25 years. Anything else gives you no relevant information and is blatantly subject to recency bias. The fact that the current ETFs have only been in existence for 3 years does not prevent the backtest. Portfoliovisualizer is a powerful tool and I don't know how deep you have dived into it. For example, you can search the Fund Screener for funds with comparable assets that are older. Or you can rebuild the respective strategy of an ETF manually and then test it. For example, you can easily test the Efficient Core ETF as a portfolio backtest 60% S&P500 + 40% US bonds with 50% leverage against a simple S&P500. You can put together your own MSCIWorld portfolio from various funds. As I said: a lot is possible, but it's work 😉

$EXI2 (+0,74 %) is cluster risk in the broadest sense. We have done well with this in recent months / years.

What is the attitude?

Move some of the profits (possibly after the recovery in late fall) into an equally weighted S&P ETF? Or take a dividend ETF? Or do you believe that the AI wave will continue to drive share prices and remain invested?

What do you think of the $EXI2 (+0,74 %) vs. $VWRL (+0,63 %) ??

I personally think the Global Titans 50 is really good.

Which one would you choose?

Titres populaires

Meilleurs créateurs cette semaine