As a listener to Archer Aviation's conference call ($ACHR ) for the fourth quarter of 2024, I was able to gain important insights into the company's current stage of development.

Adam Goldstein, the founder and CEO of Archer, outlined his vision of a fundamental redesign of aviation. He emphasized that the aviation of the future must be ubiquitous, highly autonomous and electric to accommodate growing cities and populations. To achieve this, he said, aviation must be made accessible to the masses, autonomy must be increased through software-controlled systems and AI, and electric propulsion must be used more widely.

Goldstein believes Archer has a responsibility to lead this lead this transformation. The company focuses on three main areas:

- Design and manufacture of the electric air cab Midnight electric air taxi for use in cities.

- defense in partnership with Anduril to develop a hybrid vertical take-off aircraft for military and civilian purposes.

- Software to develop advanced flight control systems and optimize airspace through AI.

A central point was the presentation of the "Launch Edition" programprogram, which is intended to enable Archer to operate Midnight aircraft in selected markets worldwide before the FAA has granted type certification. Abu Dhabi Aviation was introduced as the first Launch Edition partner. These partnerships will not only generate revenue, but also serve as a "playbook" that can be scaled to other partners worldwide. In the U.S., Archer continues to work with United Airlines and Southwest to plan operations in key cities such as L.A., San Francisco, Miami and New York.

Goldstein also emphasized the importance of the defense business and emphasized the partnership with Anduril to develop a hybrid aircraft for vertical hybrid aircraft for vertical takeoffs. He sees an opportunity here for multi-billion dollar programs that do not require FAA approval. Similar to SpaceX, there would be synergies between the civil and military sectors, with the civil technology creating credibility and diversified revenue streams, while the role in the defense sector would establish eVTOL as a national priority.

Goldstein concluded by mentioning a capital increase of 300 million US dollarswhich provides Archer with over $1 billion in liquidity.

Thomas Muniz, Archer's Chief Technology Officer, then presented detailed insights into the company's technological progress. technological progress of the company. He emphasized that Midnight's core technology, the electric drive system and the flight control softwarecan be adapted for different applications. The company has conducted extensive testing, including Propeller endurance tests, ground vibration tests and fault injection tests. Muniz emphasized that there are no shortcuts in flight safety and that the thorough tests have strengthened confidence in the maturity of the aircraft design and systems.

An important design aspect of Midnight is its ability to conventional take-off and landing (CTOL) and for vertical take-off and landing (VTOL), which increases operational flexibility and safety. Muniz also mentioned the progress made with operational approvals FAA and the certification of the Part 141 Flight Training Academywhich enables Archer to train and certify Midnight pilots.

Internationally, Archer has continued its efforts in the UAE and works closely with the General Civil Aviation Authority together. A project-specific certification plan has been finalized and Archer has already started submitting compliance data. In the summer, the first manned Midnight aircraft will be delivered to Abu Dhabi for flight tests under hot conditions.

With regard to Archer Defense, the company is planning a VTOL aircraft with hybrid propulsion and low thermal and acoustic signature.

Priya Gupta, Archer's acting CFO, presented the company's financial results for the fourth quarter of 2024. She highlighted that Archer ended the year with 835 million US dollars in cash and cash equivalents, which is the which is the highest quarter-end cash balance ever achieved. Current liquidity is over $1 billion. Gupta also mentioned the possibility of an additional capital infusion from Stellantis of up to $400 million.

The Non-GAAP operating expenses for the fourth quarter totaled $98.3 million, while total GAAP operating expenses were GAAP operating expenses amounted to 124.2 million US dollars. For the full year 2024, non-GAAP operating expenses amounted to USD 380.6 million and GAAP operating expenses amounted to USD 509.7 million. The Cash flow from operating and investing activities for 2024 amounted to USD -450.6 million, but also included expenses for the construction of the ARC facility.

For the first quarter of 2025, Archer expects an adjusted EBITDA loss of 95 to 110 million US dollars.

In the question-and-answer section of the conference, Archer executives responded to questions from analysts:

FAA certification and commercializationGoldstein emphasized that there are two different paths: the "Launch Edition" path, which is independent of FAA certification, and the FAA-certified path for the US market. He was confident that the new government would help to speed up the processes.

Pilot flightMuniz stated that the Midnight aircraft is now fully assembled and at the flight test center in Salinas. He did not give an exact date for the first flight, but indicated that it should take place soon.

Launch Edition salesWhen asked about the sales expectations for the Launch Edition aircraft, Goldstein confirmed the target of several tens of millions of dollars in sales and a positive margin for these aircraft.

Production capacity: In terms of production capacity, Goldstein said that the company plans to produce "dozens of aircraft" in 2025 and 2026. "dozens of airplanes" and to scale up production from 2027.

SoftwareGoldstein mentioned that software is an important part of Archer's strategy, especially in terms of customer booking experiences, motion control, operational control and autonomy.

Compliant aircraftMuniz explained that Archer has a detailed plan for the parts of each test aircraft that must be compliant to support the intended flight test objectives.

Defense initiativesGoldstein stated that the timing is good to commit resources to the DoD initiatives because the Midnight aircraft is mature and engineers can be diverted from that program.

Financial planningGupta explained that spending in the first quarter is expected to be between $95 million and $110 million. She also mentioned that Archer is leveraging existing engineering resources as they transition from the Midnight program to the defense program.

Anduril Partnership: Muniz said that Archer is working to build the aircraft and can't share much right now given the sensitivity of the matter.

Abu Dhabi contract: Goldstein said the contracts will vary depending on the goals of the different countries and partners they are working with. The planes are expected to have a price tag of around 10 to 15 million dollars.

To summarize, Archer Aviation has made significant progress in the fourth quarter of 2024, both in terms of technology and liquidity. The company is pursuing an ambitious vision for the future of aviation and is focusing on a combination of civil and military applications to realize this vision.

The partnership with Abu Dhabi Aviation and the "Launch Edition" program are promising steps towards the commercialization of the Midnight aircraft, while the collaboration with Anduril opens up new growth opportunities in the defense sector.

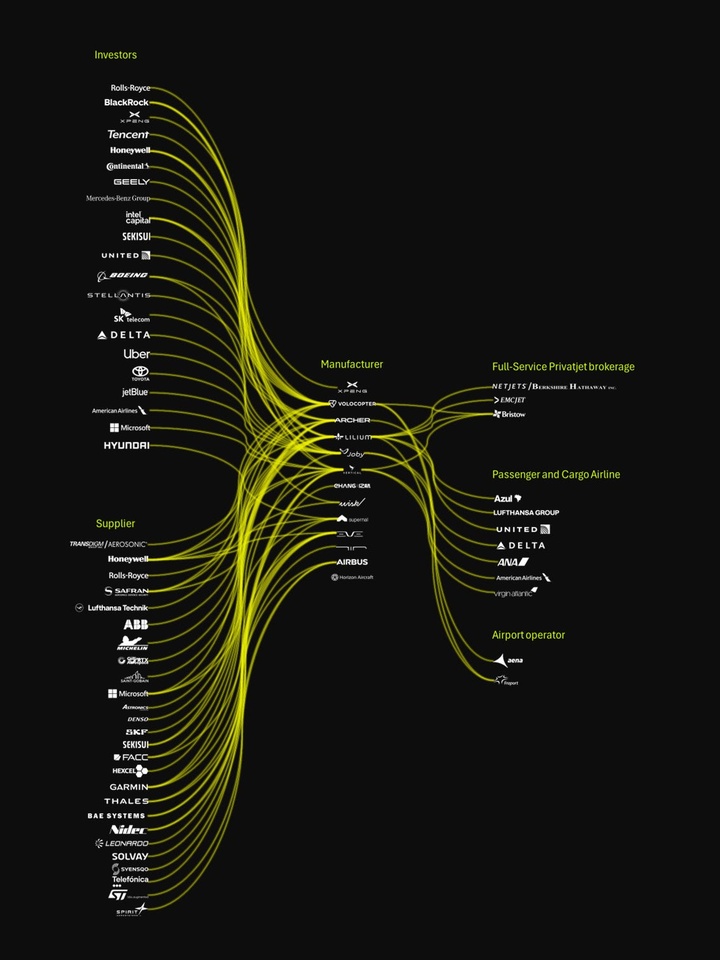

Other listed EVTOL manufacturers include Joby Aviation ($JOBY (+2,92 %) ), Lilium ($LILM (+0 %) ) and Eve Air ($EVEX )