Another strong year with a lot of profit. After a return of around 40% in 2024, I was able to achieve another strong return of 26% in 2025. I was able to realize a large part of the profit with my two Tenbagger shares $RGTI (+2,24 %) and $PLTR (+4,49 %) but the rest also performed quite well.

Due to the high gains in the two individual stocks, the weighting in my portfolio shifted massively and I took this as an opportunity to really tidy things up.

Portfolio realignment 2026

I would like to share the strategy I am pursuing with you. I have not yet reached the desired weighting, but I am slowly getting closer again.

The strategy is based on 3 different pillars and looks as follows:

CORE: ALL WORLD AND SWITZERLAND(40%)

The core consists of the broadly diversified world ETF $VWRL (-1,46 %) (approx. 30%) and with approx. 10% $CHSPI (+0,02 %) as an overweight of the home market

GROWTH AND QUALITY (35%)

The second part consists of some quality stocks with solid growth or dividends such as $SREN (-1,43 %)

$ROG (-2,88 %)

$BION (-1,53 %)

$MSFT (+0,04 %)

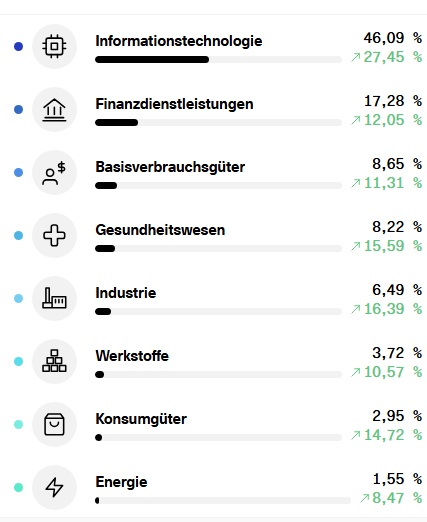

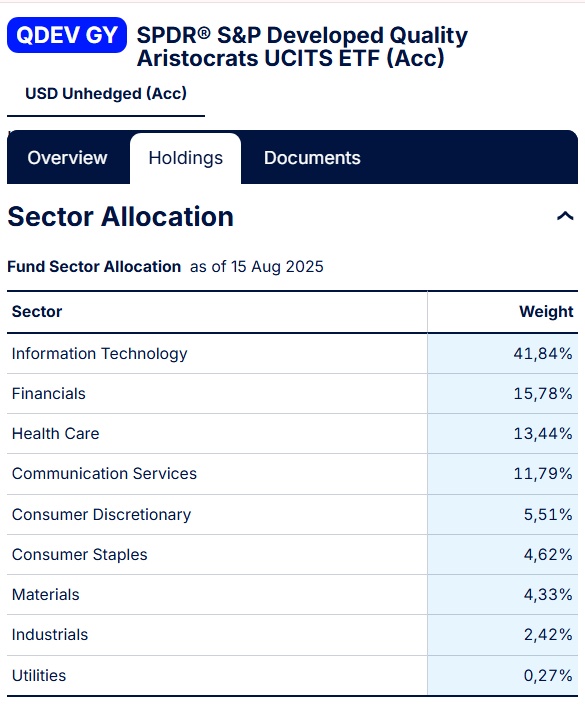

$SIE (-1,03 %) and the two trend tech ETFs $SMH (-1,49 %)

$XAIX (-0,43 %)

TENBAGGER SATS (20%)

Here I look for promising companies that have the potential to multiply and invest small amounts (currently max. CHF 1000). This is of course a high-risk investment, but I try to outperform with these stocks. By selling some of my tenbaggers, I was able to add new candidates to my portfolio.

These are all my potential price rockets:

$PLTR (+4,49 %) : my first Tenbagger. Here I have already realized around ten times my investment through partial sales. The rest will remain in the long term.

$RGTI (+2,24 %) : my second Tenbagger. I have realized approx. 8.5 times the stake through partial sales. The remainder is also left lying around.

$TER (-7,18 %) Chip testing, benefits massively from the AI chip boom.

$CELH Fitness energy drinks with strong growth and expansion into the mass market.

$CRSP (-3,02 %) Gene editing with huge health potential.

$MIPS (+1,79 %) : Safety systems for helmets. The technology is licensed to numerous helmet manufacturers in the sports and industrial sectors.

$RKLB (+6,28 %) : Rocket launches and satellites and established SpaceX chaser.

$JOBY (+0,3 %) Pioneer in urban mobility with air cabs and vertical take-offs.

$NU (-1,79 %) Digital neobank with enormous scaling potential in underserved markets such as Brazil, Mexico, etc.

$RBRK (+2,08 %) Cybersecurity

$IONQ (+3,09 %) Quantum computing. Highly speculative moonshot potential for computing power beyond classical computers.

I also hold approx. 5% in Bitcoin