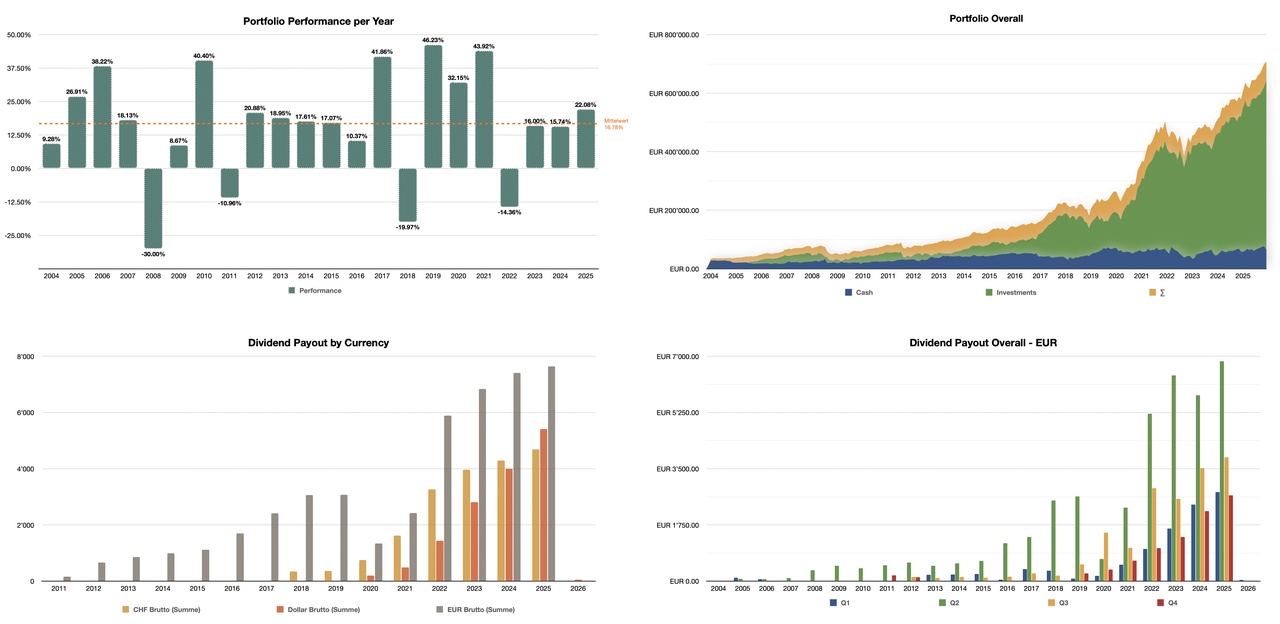

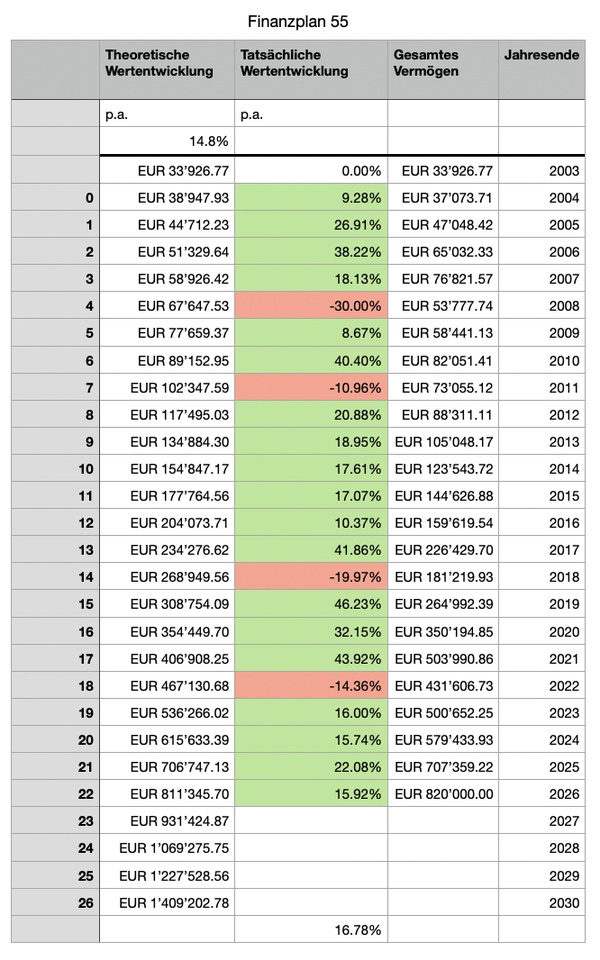

I have now also managed to update my good old tables and complete the year 2025. Small depot turbo at the end of the year and the first week 26 was already great again.

I would say that everything is still going in the right direction. What is striking is that dividends now make up a really big slice of the cake. My US dividends have overtaken the CHF dividends. In a total of 26 years on the stock market, around €100k gross has been added in dividends alone 🤓

I already stopped my savings plan at the end of 25 $SPY (+0,67 %) and for the time being am only saving in selected US individual stocks and the $VHYL (+0,8 %) . Currently running

$V (-0,18 %)

$UPS (-2,09 %)

$EIX (+0,5 %)

$AXP (+0,94 %)

$CMCSA (+3,26 %)

in savings plans. Individual purchases depending on the situation, currently e.g.

$KHC (-0,86 %)

$GIS (-2,32 %)

$PG (-0,98 %)

$MO (-1,23 %)

$VZ (+0,48 %)

New in the Swiss portfolio is $BCHN (+0,5 %)

$VZN (+4,71 %) and $SIKA (-0,25 %) in it. $NESN (-1,02 %) I will probably buy more in the short term.

The euro portfolio currently remains as it is, the euros are invested in ETFs.

$XD5E (+0,82 %)

$VAPX (+0,13 %)

$VFEM (+0,5 %)

I will try to increase my cash holdings again. The target for 26 has also been set, to increase total assets to 820Tsd. That would be another +16%, which is exactly my average for the last 21 years.

So here's to another one, keep going!