ABN Amro

Price

Discussion about ABN

Posts

8Invest in banking stocks with the aim to be acquired

After having invested before in $1COV (+0.02%) with the aim to be acquired by Adnoc/XRG and another investment in $ILTY Illimity Bank in Italy giving access to $IF (-0.69%) Banca IFIS with a 10% discount.

I'm now thinking to invest in further banking consolidation. Since there seems to be a wave of banking consolidations coming up both cross boarder and within individual European countries.

Italy shows:

$UCG (-1.8%) Unicredit stakebuilding in both $ALPHA (-2.85%) Alphabank & $CBK (-0.04%) Commerzbank and a failled attempt to acquire $BAMI (-2.94%) Banco BPM. We saw $BMPS (-3.39%) Monte dei Pachi acquire $MB (-2.17%) Mediobanca. $BPE (-3.68%) Bper Banca merge with $BPSO (-4.2%) and rumored to be on the wishlist of Unicredit.

Denmark is consolidating but could be still more ongoing:

A recent merger of $SYDB (-1.85%) Sydbank, Arbejdernes Landsbank & $VJBA Vestjysk Bank.

In Spain

We've seen a major but failed attempt to forget about the Spanish attempt of $BBVA (-1%) Banco Bilbao of $SAB (-3.19%) Banco Sabadell.

The Netherlands:

$ING (-1.61%) ING taking a substantial stake in $VLK (-1.29%) Van Lanschot Kempen.

$ABN (-3.36%) Doing several take overs in Germany and buying the trading app Bux and rumored to be bought themselves.

When thinking this through I see a potential for take over but, if it won't happen there is still good dividends to be earned. Therefore there is less of a need of a quick turn around.

I'm now looking for a "smaller" bank that traded and a likely take over candidate.

Where would you invest?

$BPE (-3.68%) - Bper Banca - Italy

$BAMI (-2.94%) - Banca BPM - Italy

$ABN (-3.36%) - ABN Amro Bank - Netherlands

$ALPHA (-2.85%) - Alpha Bank - Greece

$JYSK (-1.75%) - Jyske Bank - Denmark

$ALR (-2.38%) - Ailor Bank - Poland

Any other alternatives, or opinions about this idea, I'm happy to read!

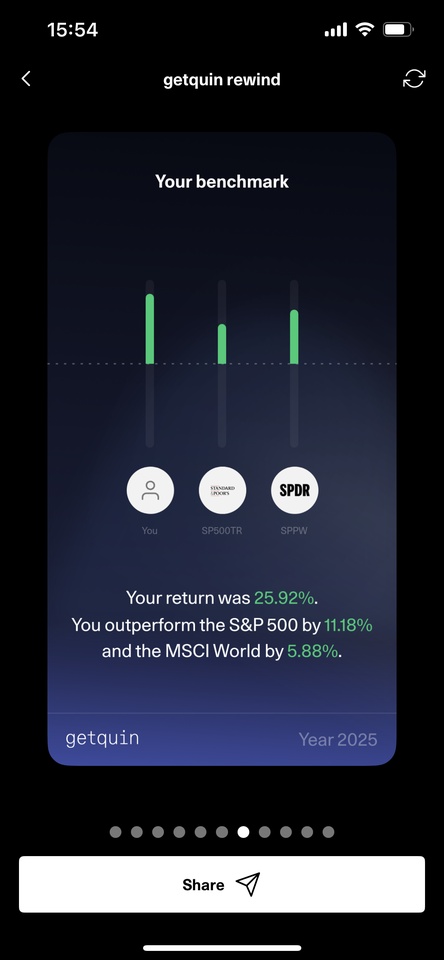

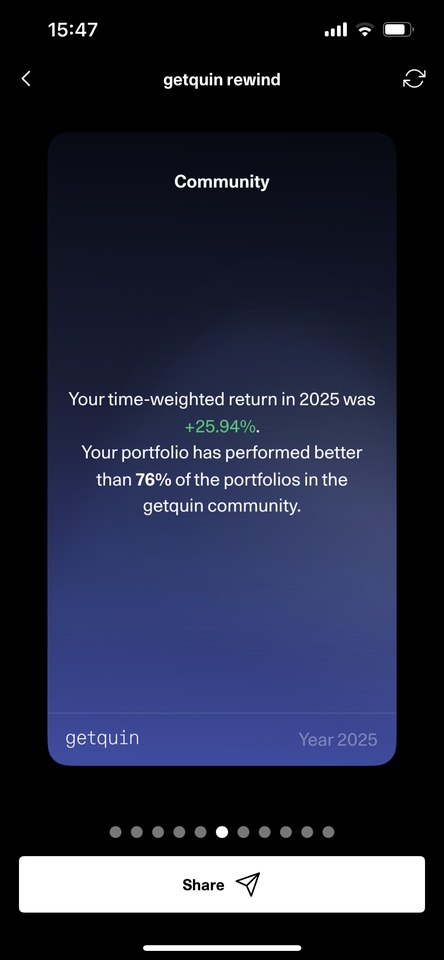

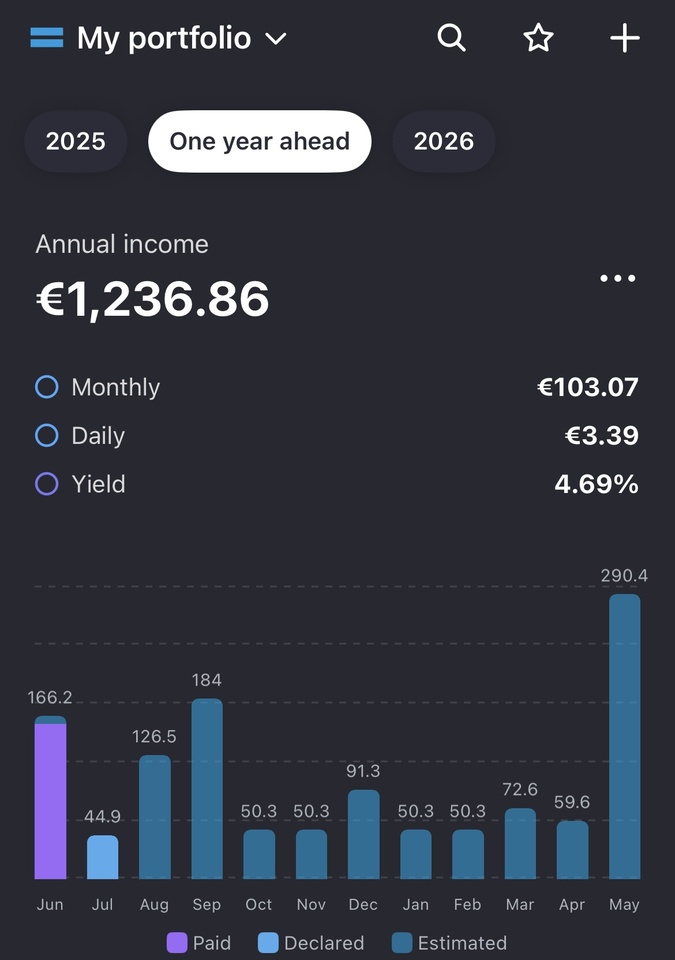

Building my dividend portfolio, which one would you pick?

I have been building my portfolio this year and it is doing quite well. Currently my focus is diversifying my portfolio. I have some nice performers in my portfolio like $BESI (+1.68%) , $ABN (-3.36%) , $EVO (+1.83%) , $VLK (-1.29%) . A few others are still underperforming for now but are known stable companies like $ALV (-0.58%) and $TTE (+1.04%) . My focus now is also a bit towards US stocks due to dollar diversification since I am mainly invested in Europe, Switserland and Scandinavia. I am always looking for companies with strong balance sheets, low debt ratio's compared to their peers, growth, dividend and maybe undervalued. One great example is $EVO (+1.83%) which I expect to launch🚀 in the coming year.

I'm looking at three dividend stocks right now: $PFE (+1.19%), $AEP (-0.45%) and $ENEL (+1.44%). They each have different profiles, and I'm trying to figure out which could be the most attractive at this point.

$PFE (+1.19%) seems undervalued. The stock is still well below its pre-COVID levels, the balance sheet is strong, and the dividend is over 5 percent. The real question is whether the company can return to solid growth with its pipeline.

$AEP (-0.45%) is a US utility with stable cash flow, a solid dividend track record, and relatively low debt. It doesn’t move fast, but it offers a good level of reliability and income, especially if rates come down.

$ENEL (+1.44%) is more of a question mark. The dividend is growing by nearly 9 percent a year and paid in multiple installments, which I like. But the stock is already up over 20 percent this year. Debt is quite high, and revenue growth is limited. I like the exposure to renewables, but I'm not sure if this is the right entry point.

- What do you think of these names?

- Any clear favourites? Or red flags?

Also curious: what are your expectations for the USD-EUR exchange rate in the second half of the year? I'm considering the FX angle too, since two of these names are US-listed.

#DividendInvesting

#Pfizer

#AEP

#Enel

#StockIdeas

#USD

#InvestingEurope

Dividend growth portfolio

I try to build a portfolio with combinations of growth and dividends:

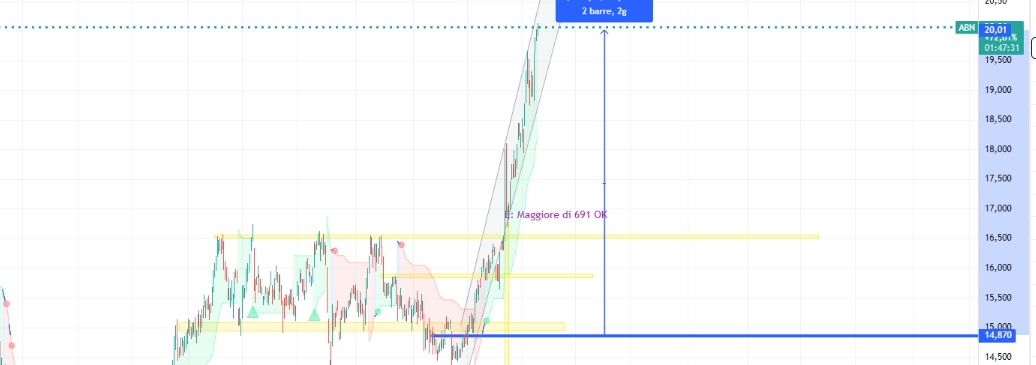

ABN

got to 20 today, beyond my wildest expectations...let's see how long it lasts# $ABN (-3.36%) old analisys https://getqu.in/qNFJ7w/

#dividends

#stockanalysis

#abn#idea

$ABN (-3.36%)

Hi Folks ,

I think it's a good time to put ABN on watchlist and wait for it to get to 14Euros to think about buying a few pieces in order to put aside some long term dividends or in any case to speculate a bit aiming at a medium term target of about 17% around 16.3 Euro , what do you think?

Capitalization over 12Billion(Euro), there is better but also worse :)

Increasing profits from 2020

Stable Debt

Dividend of 10.25%

P\E 4.85 slightly higher than last year

Analysts' target accredited to 17Euros $ABN (-3.36%)

Trending Securities

Top creators this week