I'm not sure whether I should add the Value ETF to my portfolio in addition to the FTSE and Nasdaq 100 ETFs. $XDEV (+0.06%) to my portfolio. What do you think of the Value ETF at the moment?

- Markets

- ETFs

- Xtrackers MSCI World Value ETF

- Forum Discussion

Xtrackers MSCI World Value ETF

Price

Discussion about XDEV

Posts

14CAP update > active 375k passive 0k

This month I poured extra cash into the investment account effectively zeroing out the leverage exposure.

This is an issue I had not considered when I structured my accumulation plan . https://getqu.in/G2SujF/ .

I should probably increase pac purchases when I have extra income and not reduce the level of leverage implemented.... I have a few days before my next purchase and want to think about it. I would appreciate your views on this.

Anyway, today the broker entered orders again balancing the percentages of the ETFs in the plan:

- $IWDA (-0.23%) 31 shares at 106.665

- $XDEV (+0.06%) 11 shares at 47.387

The portfolio plotted by getquin reports a total amount of about 375k recording some deviation from the actual. i am not clear where the deviation comes from, perhaps from the miscalculation of double taxation on some dividends. I will try to solve it shortly.

#etfs

#dividends

#portfolio

#portafoglio

#fire

#retirement

#leverage

#pac

Here's my new 8k a month pac.

Today the first orders of my new automatic accumulation plan will be placed in the market. Each month, on the first and fifteenth days, my broker will place orders for 4,000 euros, automatically rebalancing the portfolio holdings of these instruments according to the following weights:

$IWDA (-0.23%) 50% | $XDEV (+0.06%) 37,5% | $IEMA (-0.93%) 12,5%

Why did I choose these ETFs?

◾ Right now my portfolio is 98% composed of distribution instruments. This all-accumulation PAC aims to correct this drift, at least partially.

◾To realign the portfolio to the market with a slight tilt value: I believe that some segments of the market are overvalued and will have lower returns in the coming years. At the same time, however, I believe in passive investing and do not want to deviate too much from the market with excessive tilts. Today this tilt in my portfolio already exists--think Nvidia weighs only 0.5 percent of my total exposure.

How do I finance my €8,000 per month plan?

It is not an inheritance, not a win-win, I do not sell courses or do scams. In the next post I will explain in detail my thoughts and misgivings about it.

How do you think about adding other factors?

Presentation of multifactor portfolio

estimated reading time: 4 minutes

Twenty years ago, the new market crash wiped out my first stock market money and my ego. I swore off the stock market, but my pension certificate showed me that ducking out has an expiry date.

So the first attempts to start again followed. Here on Getquin, I have learned from positive critical voices from e.g. @DonkeyInvestor and @Epi that there is more to it than "just picking something". Since my last post 6 months ago, this was followed by extreme late-night brooding, Excel monsters, AI research, reading Kommer and countless "new agains".

I have tried to read up on modern optimization models such as Mean-Variance, Black-Litterman and Fama-French etc. and implement them in the best possible way.

The result was this portfolio!

As thoroughly tested as you can in a private garage, and coupled with the insight that we only have to leave the uncontrollable to chance.

And one thing first. I am convinced of this and will not change it.

I just want to share my thoughts and ideas about the direction with you. It's difficult to really explain every detail here, I'm sure I could do it better in a conversation, but that's not possible here. I can assure you that the selection and combination definitely makes sense - at least for me and the construct. Among other things, it was important to me to be able to control individual regions separately. I think I have achieved that.

Global (30%)

- SPDR MSCI All Country World, $SPYY (-0.3%)

- L&G Global Equity UCITS ETF, $LGGG (-0.39%)

- iShares Edge MSCI World Momentum, $IS3R (-0.62%)

- Xtrackers MSCI World Value, $XDEV (+0.06%)

- Invesco Global Active ESG Equity, $IQSA (-0.34%)

- VanEck World Equal Weight Screened, $TSWE (-0.4%)

- VanEck Morningstar Developed Markets Dividend Leaders, $TDIV (+0.13%)

USA (31.5%)

- L&G US Equity, $LGUG (-0.27%)

- iShares MSCI USA Mid-Cap Equal Weight, $IUSF (+0.09%)

- JPMorgan BetaBuilders US Small Cap Equity, $BBCS (+0.21%)

- SPDR MSCI USA Small Cap Value Weighted, $ZPRV (+0.03%)

Europe (17.5%)

- HSBC EURO STOXX 50, $H50A (-0.28%)

- L&G Europe ex-UK Quality Dividends Equal Weight, $LDEG (+0.01%)

- SPDR MSCI Europe Small Cap Value Weighted, $ZPRX (-0.45%)

Emerging markets (19%)

- iShares Edge MSCI Emerging Markets Value Factor, $5MVL (-0.27%)

- UBS LFS MSCI Emerging Markets ETF, $EMMUSA (-0.73%)

- L&G Emerging Markets Quality Dividends Equal Weight, $LDME (-0.24%)

- SPDR MSCI Emerging Markets Small Cap, $SPYX (-0.35%)

Japan (2%)

- L&G Japan Equity UCITS ETF, $LGJG (+0.05%)

Ø TER = 0.25%

In summary, this gives the following breakdown

Regional breakdown

- USA (North America) ~ 48%

- Asia ~ 22%

- Europe ~ 22%

- UK ~ 3.6%

- Japan ~ 4.4%

Market capitalization

- Large Cap ~ 52%

- Mid Cap ~ 26%

- Small Cap ~ 22%

The portfolio deliberately allocates its capital to the regions and - where possible - to all capitalization classes. The world building blocks provide the global beta; value, momentum and quality satellites add factor premiums. In the USA, a complete large/mid/small stack provides a pronounced size bias, while Europe receives a value bias via quality and small value ETFs. The emerging layer combines large-cap value stocks, quality leaders and a small-cap module - a diversification anchor beyond the developed markets.

Due to the almost equal weighting of the 18 positions, the Herfindahl index of ETF weights falls to ~633; indirectly, the portfolio contains several thousand individual stocks. The weighted TER is ≈ 0.25 % p. a., spreads below 0.1 %. This means that, compared to a $GERD (-0.36%) a favorable multifactor portfolio myself.

The factor tilts (value 42 %, size 35 %, quality/div ≈ 12 %, momentum ≈ 8 %) increase the expected volatility moderately to 18-20 % p.a.; however, historical data on small and value indices indicate 1-2 percentage points additional return over long horizons. Large caps remain present at around 52 %, mid caps at 26 % and small caps at 22 % support the size premium .

With my "multi-factor all-cap portfolio", I combine global market coverage with five proven premiums, without cost or concentration ballast. Of course, I will have to endure additional fluctuations, but I believe that I have created a robust source of returns over the long term.

I have tried to consider everything and leave nothing to chance, except the uncontrollable.

Anyone who has made it this far. Thanks for reading.

I'm looking forward to your feedback.

PS:

YES, I have Bitcoin😉 and also two themed ETFs. They just stay like that.

- ARK AI & Robotics ETF, $AAKI (+0.02%)

- HanETF Future of Defense ETF, $ASWC (-0.68%)

- ETC GROUP CORE BITCOIN, $BTC1 (-0.85%)

---

no investment advice; DYOR

Thanks also to @VPT , @Mister_ultra , @Ph1l1pp , @ShrimpTheGimp , @MoneyISnotREAL , @Staatsmann and @Smudeo for commenting and providing approaches.

August Portfolio

Hello everyone. As a good novice investor, I am predisposed to read, learn from everyone and try to implement any suggestions for improvement.

After listening to you all, I have settled on a basic portfolio model that I intend to stick with over time.

My profile is moderate, trying to diversify geographically and using different types of investments.

I plan a modest plan of €250/month spread across different ETFs, stocks and cryptos, to see how it evolves.

My model is main core and satellite ETFs around it. The core remains stable, and the rest will be increasing contribution thanks to the investment plan.

Core: (Range 60-70%)

Satellites: (25-35% ETF)

$VECA (+0.12%) Bonds

$XDEV (+0.06%) World

$VHYG (-0.26%) High Dividend

$FYEM (-0.6%) Quality

$MVOL (+0.02%) Low Volat

Raw Materials: (5-10%)

$IGLN (-0.6%) Physical Gold

$SSLN (-1.93%) Physical Silver

As you can see, quite diversified and varied.

I appreciate your assessment and contributions.

It has been 3 months since I decided to make the switch to Trade Republik and three months since I followed your advice and restructured my portfolio.

This week it has surpassed the €1000 profit barrier. In three months, for a total investment of less than €30,000, this is a good figure.

The TTWROR has been in profit for the first time in three months, which gives me to understand that the path is adequate.

For this quarter, I will sell the platinum fund $SPLT and add two new ETFs, with a minimum investment of 5%, as a test bed.

$MVOL

$EMMV

These are two low volatility funds, reducing the potential volatility of platinum in the face of expected changes in US and EU interest rates.

The portfolio is as follows:

MSCI Core 70%

MSCI Value/ High Dividend 10%.

Bonds 13% Gold and Silver

Gold and Silver 5%.

Cryptos 2%

Pending the upcoming central bank meetings, I am leaving a defensive portfolio, with an MSCI core that provides value.

Presentation of portfolio logic - feedback welcome!

Hello dear community,

Recently my portfolio and its logic was presented in an article by Business Insider and analyzed by Konrad Kleinfeld from SPDR. There was some exciting feedback, but of course I would also like to activate your swarm intelligence and get your feedback 🙂

First of all: Although I am pursuing a core-satellite strategy, the "satellite" does not aim to outperform, but is simply for fun and offers room for investments that do not fit into the logic of the core. The satellite consists largely of ETFs (e.g. in commodities, real estate, private equity, REITs, etc.), but only accounts for <10% of the overall portfolio and is not included here.

My goal is broad diversification that goes beyond a pure market capitalization-based index as well as long-term returns.

In doing so, I rely on a rule-based approach and diversify along factors based on the selection criteria of the indices. As I deliberately do not want to make any sector or regional bets in the "core", but instead focus purely on the selection criteria of the indices, the relatively significant dividend block serves to reduce the US lump, as high-dividend companies are more frequently found in Europe.

Since the portfolio is quite granular, the portfolio overview function would be very confusing, so I hope it is easy to understand in text form:

1. MSCI World Block (40%):

$SPPW (-0.24%) MSCI World (10%)

$XDEM (-0.71%) MSCI World Momentum (10%)

$XDEQ (-0.15%) MSCI World Quality (10%)

$XDEV (+0.06%) MSCI World Value (5%)

$WSML (-0.14%) MSCI World Small Cap (5%)

Momentum, Quality and Size in the sense of the "normal", market-capitalized MSCI World are weighted slightly higher, as they have historically performed better and should logically perform better in a long-term positive market environment.

2. emerging markets block (20%):

$SPYM (-0.91%) MSCI Emerging Markets (6.67%)

$SPYX (-0.35%) MSCI Emerging Markets Small Cap (6.67%)

$5MVL (-0.27%) MSCI Emerging Markets Value (6.67%)

⚠ There are currently no ETFs on the MSCI EM Quality and MSCI EM Momentum indices that are available in UCITS form and tradable in Europe. Therefore, the logic of the EM block does not yet exactly reflect the structure of the World block. As soon as these ETFs are available, the block will be adjusted accordingly. Consequently, the "normal" MSCI EM as well as the value factor and small caps are currently equally weighted here.

3rd Dividend block (30%):

$VHYL (-0.23%) FTSE All-World High Dividend Yield (5%)

$TDIV (+0.13%) Developed Markets Dividend Leaders (10%)

$ISPA (+0.01%) Global Select Dividend 100 (10%)

$ZPRG (+0.2%) S&P Global Dividend Aristocrats (5%)

As mentioned, this block serves 1) to reduce the US lump, is also distributing and thus provides cash flow, which 2) is used for rebalancing at the end of the year (so I don't have to spend any additional capital on this, which has a psychological effect for me) and 3) the monthly distributions motivate me to continue investing intensively. In addition, 4) the tax-free allowance is utilized without having to actively sell shares in the other "blocks". The top 10 holdings of the individual ETFs differ greatly here despite the common denominator of "high yield". However, the financial sector is a large lump. The weighting here is derived from the high yield and diversification in the sense of complementing the other "blocks" (i.e. little tech and little US).

4. hedge bonds (10%):

$IBCI (+0.26%) Euro Inflation Linked Government Bond (10%)

My equity allocation is (roughly) based on the rule "120 minus age", so 10% is currently left for bonds. The purpose of a bond block in the portfolio is stabilization and further diversification. With shares, I give a company capital, i.e. I become a stakeholder in the company. Corporate bonds have the same logic, because here I am also giving capital to companies. That's why I opted for government bonds in the eurozone. TIPS have performed comparatively well here in the past and the logic of inflation-linked interest rates also appeals to me.

📈 Additional considerations:

1. i deliberately do without the "Low / Min Volatility" factor, as i assume a rising market in the long term and would like to participate more in the positive phases instead of reducing the vola.

2) I don't see overlaps between ETFs as a problem, but rather as a deliberate overweighting of companies that fulfill several criteria at the same time. Of course, many companies currently overlap in the classic MSCI World and the Quality and Momentum variants. However, the selection criteria are different and as soon as a company no longer meets the quality criteria, for example, it automatically drops out of the index and the weighting is reduced without me having to actively do anything about it.

3) I have actively decided not to invest in a multi-factor ETF because I want to have transparent control over the allocation of the individual factors and many of the factor ETFs available combine the selection criteria underlying the individual factors in such a way that the corresponding product would have performed well in the past, which of course represents a hindsight bias and does not necessarily correlate with future performance.

💡 To those of you who have read this far:

First of all, thank you for your time! The portfolio is intended to dynamically reflect a section of the market that could develop positively in a diversified manner based on the different selection criteria of the indices, without taking bets on specific sectors or regions. What do you think of the allocation and the strategy? Do you see any room for improvement or things you would do differently?

Thanks for reading, showing interest and thinking along. 😊

My Rewind 2024 - Getquin wrapped

Preface:

In the following, I would like to present how my portfolio has developed over the course of 2024.

This includes

1) my strategic orientation

2)Return on the portfolio.

The main topics are:

- Moving away from individual stocks

- Entry into gold and bitcoin

- Factor investing

Finally, I will give my own thoughts on how to proceed.

The main changes to my portfolio that have led

to my current strategy are presented below using a short timeline.

timeline:

My timeline

Beginning of 2024

At the beginning of the year, I pursued a 70/30 core satellite

strategy. The 70% ETF core again consisted of STOXX Europe.

MSCI World, Emerging Markets.

The 30% consisted of stocks such as: $CSIQ (-0.7%) , $O (+0.43%) ,$TSM (-2.64%)

$ADM (-0.35%)

$UMI (-4%)

$D05 (+0.29%)

$BMW (+1.03%)

$UKW (-0.9%)

$8031 (-2.01%)

$MUV2 (+1.16%)

February

Addition of gold to my portfolio. Target size 10%. Build-up in batches.

The remaining 70/30 strategy therefore only relates to the remaining

90%.

April-June:

Entry into Bitcoin via Trade Republic in several batches

at prices between 50k and 63k.

After exchange with @Epi to the fee schedule at Trade Republic

I sold them there in order to sell Bitcoin on a dedicated crypto exchange.

exchange.

June:

Thanks to @PowerWordChill I got to grips with factor investing. A Gerd Kommer book later, and after some internet research, I decided to

decided to transform my ETF strategy into a factor ETF strategy.

July-August 2024:

Sale of my shares. Concentration on the factor portfolio.

August - September 24:

Renewed build-up of Bitcoin with the aim of making Bitcoin a

a fixed component of the portfolio. Consideration is 5%-10%

of my portfolio.

The idea. Build up an initial position, then make regular

investments of €50 per week with the aim of growing to the target size

to grow to the target size. The rapid rise in October/November led me to

led me to leave it at €50 per week. And individual purchases in

larger tranches at an early stage with a portfolio size of 2.x%.

End of December 2024:

Position size of Bitcoin almost 5%.

I am not yet including Bitcoin in my gold/ETF quota. I'm still running it on the side.

I re-evaluated my factor weighting at the end of the year

and would like to fine-tune it a little. I will briefly present the result in the

following section.

In addition, I have decided to include a small

include a small proportion of real estate stocks. However, this will probably never

part of my strategy worth mentioning and contains - as of today - only

about 3% of my portfolio and only $O (+0.43%) ).

Overall breakdown of my portfolio:

As described above, I do not yet include Bitcoin in my overall strategy

part of my overall strategy so that rebalancing remains easier. This will

change when Bitcoin reaches its target size.

The rest is made up as follows:

ETFs:

$XDEM (-0.71%) 30.3% (MSCI World Momentum)

$XDEB (+0.06%) 10.1% (MSCI World Minimum Volatility)

$XDEV (+0.06%) 10.1% (MSCI World Value)

$ZPRV (+0.03%) 15% (MSCI USA Small Cap Value Weighted)

$ZPRX (-0.45%) 6.5% (MSCI Europe Small Cap Value Weighted)

$PEH (-0.54%) 4.5% (as a quality factor on emerging markets)

$5MVL (-0.27%) 4.5% (Edge MSCI EM Value)

$SPYX (-0.35%) 9% (MSCI EM Small Cap)

Gold

$EWG2 (-1.01%) 10% Gold ETC

Getquin Rewind and own data:

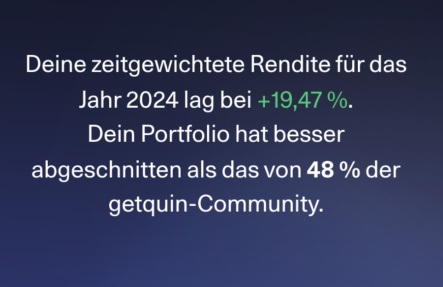

At the end of the post you will find my Getquin Rewind, as I was not able to embed the image in the text:

However, according to my own calculations, this cannot be correct.

My portfolio volume at the start of the year was around €103,500 with a return of €16,693. This would correspond to a total return of 19.2%. However, we are not yet talking about a time-weighted return, as my invested capital has roughly doubled over the course of the year. I therefore estimate my TTWROR to be higher.

My own thoughts and outlook:

I do not expect any major changes in strategy over the next few years. At some point, a strategy will have to be established. If necessary, I will make some adjustments to this strategy.

This includes the fact that I am dissatisfied with the costs of the emerging markets factor ETFs. So far, however, I intend to live with it. Should I

stumble across better products, I will consider switching. Especially as long as I stay within the tax allowance when switching.

I'll also have to decide how big my Bitcoin holding should ultimately be.

If you've been reading carefully, you'll notice that a lot of money has accumulated in the last year. Big profits, big investments. Due to personal circumstances, I will not maintain these rates in the same style, but will reduce them somewhat. I expect to be able to continue investing around 1.5-2k per month. This means that my financial goals are

with an expected return of 5% adjusted for inflation over many years.

I am half hoping for major setbacks in the near future and the associated favorable entries. However, in view of the impact that minor price jolts have had on society as a whole (thanks to populism), I don't really wish for them.

Do you have any suggestions, questions or comments? Is there anything that particularly interests you?

I am also happy to receive suggestions for improvement for future posts.

Best regards,

Your Smurf

PS: @DonkeyInvestor and me, that's love ❤. And now send me your coins! (So I can reward your next post appropriately).

PPS: I hope someone is interested.

Smart Beta ETF

Part 2 - Deep f***ing Value

Disclaimer: No investment advice or recommendation, this article is for information purposes only. Before you decide on an ETF, take a closer look at it in terms of positions, sampling, regions, etc. I can't describe everything here as it would go beyond the scope of this article

Part 1 (Definition, Categories & Z-Score and Quality Factor): https://getqu.in/RCSY4a/

💡 Value ETF

Focus on shares that are (undervalued) as attractive from a fundamental perspective. Valuation benchmarks here can be, for example, cash flow in relation to book value or P/E ratio, price to book value, etc. In contrast to momentum or growth ETFs, for example, they have a more fundamentally supported valuation. In theory, there should be a "value premium" for these shares, which is based on the study by Fama and French, according to which differences in returns between shares can also be explained by size and value factors in addition to the classic beta factor.

👉 Interest rate dependency

This also means that value stocks should tend to outperform growth stocks in times of sharp interest rate increases (or the expectation of such increases).

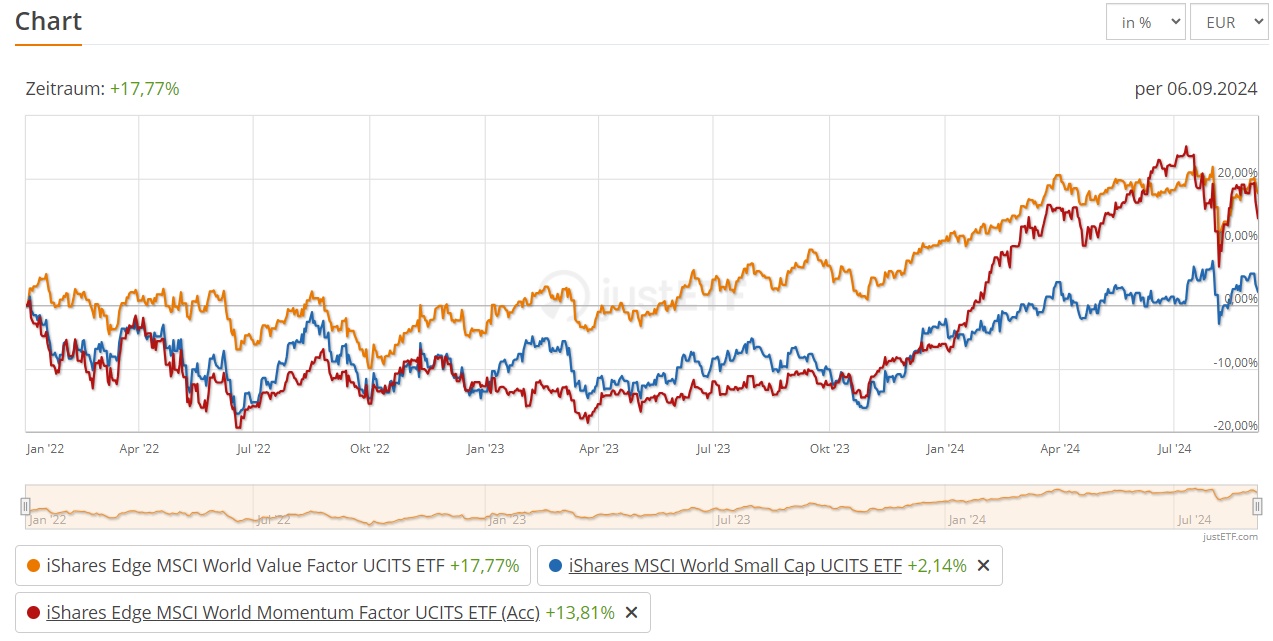

This can also be seen in a direct comparison of $IWVL, $WSML, $IS3R. In the period 2022-2023, the $IWVL outperformed the other two by 13% and 16% respectively. However, it can also be seen that in anticipation of an interest rate cut, Growth & Momentum strongly outperform the Value ETF (Fig. 1).

👉 Correlation/beta

The correlation of value ETFs to their "parent indices", i.e. World Value to Value, for example, is around 0.9. This means that, in simplified terms, the value ETF is only 90% as volatile as its parent index, i.e. it is less volatile. Weak market phases can therefore be easily mitigated

👉ETFs:

👉Z-Score MSCI Value ETF

There are 4 larger ETFs that are the same in terms of methodology but focus on different regions (TD = tracking difference):

- $IWVL (-0.09%) (World | TER 0.30 % | TD -0.02 % | 3.5 bn Investv. | 3Y Underperf. vs. World - 2,1 %.)

- $IUVF (+0.02%) (USA | TER 0.20 % | TD -0.24 % | 1.7 bn | 3Y Underperf. vs. S&P 500 - 19,5 %.)

- $XDEV (+0.06%) (World | TER 0.25 % | TD -0.09 % | 1.7 bn | 3Y Underperf. vs. world - 1,7 %.)

- $IEFV (+0.23%) (Europe | TER 0.25 % | TD -0.20 % | 1.4 bn | 3Y Outperf. vs. Eurostoxx 600 -+6,4 %).

💡 Index methodology:

- The ETFs are based on respective "parent indices", e.g. the MSCI World.

- In the first step, the variables are named for the value ETF:

- Expected earnings per share (price-earnings ratio)

- Price-to-book value (price-to-book value ratio)

- Equity value / cash flow from operations (unlevered equity / operating cash inflow)

- For each share, the Z-value (see first article) is determined for the individual key figures

- Extreme values are then eliminated

- The Z-values are then added together for each share

- The shares with the highest total Z-scores are included in the ETF

- Rebalancing takes place every six months (May & November)

👉 Ossiam Shiller Barclays CAPE

$216361 (+0.18%) (US | TER 0.65 % | TD 0.66 % | 2.5 bn | 3Y Underperf. vs. S&P 500 -3,35 %)- $CAPE (+0.28%) (Europe | TER 0.65 % | TD 0.64 | 0.2 bn | 3Y Outperf. vs. Eurostoxx 600 1,2 %)

💡 Index methodology:

- Based on the Cyclically Adjusted PE Ratio (CAPE Ratio) developed by Shiller

- The equity market, e.g. the US market, is divided into sectors (in this case 11) and the respective sector price earnings are determined. The inflation-adjusted (10-year) sector profits are used for this purpose

- A CAPE ratio is then calculated monthly for each sector and this is set in relation to the 20-year average for the sector.

- The 5 sectors with the lowest relative CAPE ratio are selected, as these are considered undervalued

- From these 5, the sector with the weakest 12-month price momentum is filtered out to avoid "value traps"

- The remaining 4 sectors are then weighted at 25%.

Conclusion Value:

The value premium was particularly evident in the 80-90s and after the dotcom bubble burst in the 2000s, but in the years that followed, growth stocks performed significantly better, so the value factor was more of a drag on returns. It is also questionable whether the value premium has come under pressure in the wake of changing business models. Instead of P/E ratios and P/B ratios, SAAS companies have their own KPIs such as Customer Acquisition Cost (CAC) or Annual Recurring Revenue (ARR), Daily Active Users (DAU) and many more.

However, if one follows the reversion to the mean approach that values tend to revert to the long-term mean, excessive differences in returns between value and growth stocks could be used to speculate on a convergence of these, in this case a resurgence of the value premium. The selection of these ETFs is therefore a bet that the value factor will prevail over growth companies in the future.

It is a pity that there is no value emerging markets ETF that I know of, as I believe it would be particularly important to pay special attention to the stability of equities here. There is a tendency for the European indices to outperform the benchmark index, which could be due to the fact that Europe is more value-oriented and does not have any large growth companies like the USA, for example. Anyone interested in the Shiller-Barclays-CAPE ETF (an exciting approach in my view) should in any case be aware of the high tracking differences.

Trending Securities

Top creators this week