ETFs that partly implement a CC strategy also underperform the market over the long term.

$QYLE (-0.58%)

$JEPI (-2.12%)

$JEGP (-0.32%)

$JEPQ (-0.66%)

$WINC (-0.71%)

$IE000MMRLY96 (-0.67%)

Posts

7ETFs that partly implement a CC strategy also underperform the market over the long term.

$QYLE (-0.58%)

$JEPI (-2.12%)

$JEGP (-0.32%)

$JEPQ (-0.66%)

$WINC (-0.71%)

$IE000MMRLY96 (-0.67%)

Then I'll do it:

... hereby announces the following dividends, for which the ex-dividend date is September 11, 2025. The record date is September 12, 2025 and the payment date is October 07, 2025:

JPM US Equity Premium Income Active UCITS ETF - USD (dist) $JEPI (-2.12%) 0.1169$

JPM Global Equity Premium Income Active UCITS ETF - USD (dist) $JEGP (-0.32%) 0.1471

JPM Nasdaq Equity Premium Income Active UCITS ETF - USD (dist) IE000U9J8HX9 $JEPQ (-0.66%) 0.1795$

Could have been more but also less

Today I bought the $JEGP (-0.32%) etf, 11 shares at an average price of €22,870 each (including transaction costs).

I currently own 199 shares, which currently yields +- €339 per year in dividends.

Hello everyone, I have opened a custody account with TR for my kids and am now saving the $VWCE (-0.86%)

Every now and then the kids get gifts of money. From their grandparents for their birthdays or from us every now and then.

I'm thinking of transferring some of these gifts of money to the custody account and investing them in a distributing ETF or share so that they can see that the money is working. Otherwise, of course, the money will be spent on the 1000th toy.

I am thinking, for example, of the $JEPI (-2.12%)

(I have the other two in my depot)

Do you have any ideas or suggestions? Thank you very much...

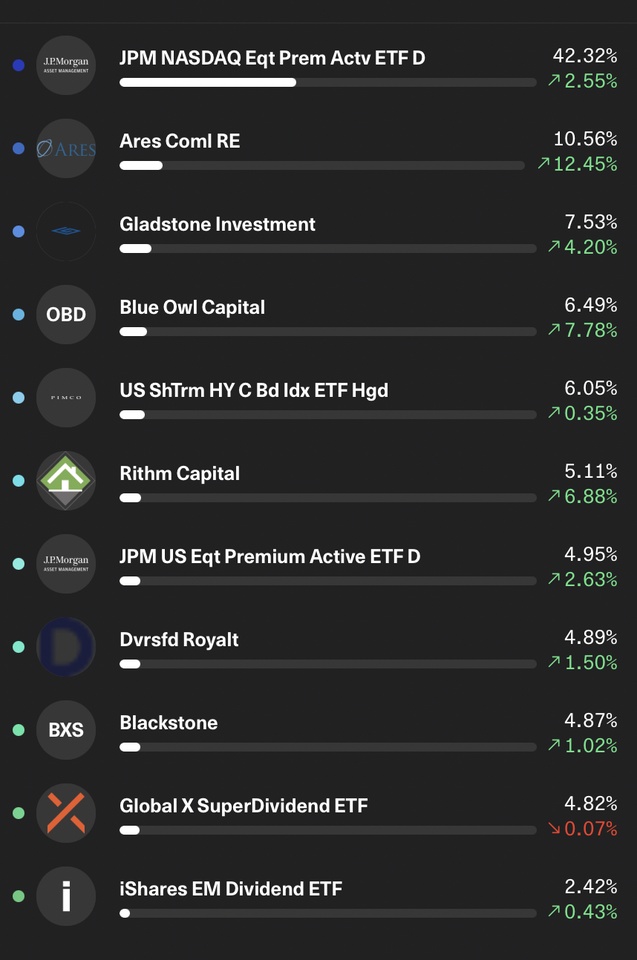

Update High Yield Income Portfolio

There were a few changes to the portfolio in December.

New additions:

Exchanged for:

I want to keep my div/dist yield at around 8-10% in the long term.

$IE000U9J8HX9 (-0.66%) I will only be saving with the distributions from the portfolio, so the weighting should slowly decrease for the time being, while I continue to save the other positions regularly.

Have you found any interesting stocks in the last month?

how much the Nasdaq Equity Premium Income$IE000U9J8HX9 (-0.66%) has gained in fund volume in the last few trading days.

There are already 391 million $ fund volume on the speedometer.

The Global Equity $JEGP (-0.32%) (on the market for almost a year) has raised $343 million

and where currently nothing is going at all US Equity Premium $IE000U5MJOZ6 (-2.12%) which is stuck at a fund volume of 20 million.

Top creators this week