Hi all

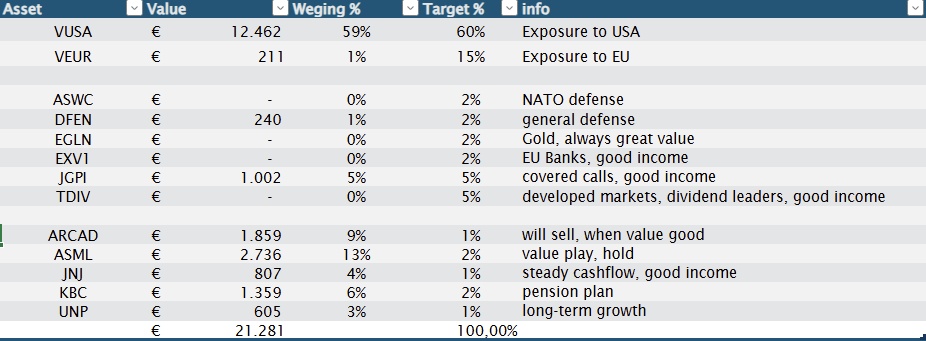

here's some info on my strategy, it's core-satellite method

ETF's is the biggest part with

Core:

$VUSA (+0,6%) & $VEUR (+0,96%)

Satellite:

$ASWC (-0,67%) & $DFEN (+0,12%) as Defense investing, due to EU pulling 5% of GDP with 2030 target

$IGLN (+1,13%) for the gold exposure, minimizing downtrend when markets drop

$JEGP (+0,2%) to make use of market volatility as source of income

$TDIV (+0,23%) past performance is great, dividends of 3-4% always nice income

Individual stocks: mostly dividend stocks as we can deduct €240-region of dividend income of those indidual stocks, sadly not of ETF's.

$$KBC (+0,62%) is marked as pension plan. I do work for KBC and once a yearn i can buy stocks and deduct some of it from my taxes, also buying on cheaper prices.

$UNP (+1,06%) will be a good long-term hold as america is still the biggest, and with trump it should have some long-term growth in it.

$ARCAD (-5,26%) is a value play, aiming to sell around €58, but in meantime, giving dividend to deduct taxes.

$JNJ: (-0,5%) always good to have this one, great long-term hold and steady source of dividends

$ASML (+0,76%) : love this stock, it's a monopoly and is growing strongly, keeping this as long as i like the progress