Today I read in the Deutsche Bank newsletter (Perspectives in the morning), which makes me believe that the US and tech will continue to outperform.

1. massive investments:

The Magnificent 7 alone are planning investments in research and development of 500 billion dollars!

Even if this will certainly not all flow into AI investments, it is safe to assume that it will be one of the main areas of investment.

To put this into perspective: Instead of investing in research and development, the Magnificent 7 could use this money to buy the entire Volkswagen Group about 10 times over.

Alternatively, they could also buy Mercedes, BMW, Adidas, BASF, Allianz, Munich Re, Deutsche Börse, Deutsche Bank, DHL and e.on!

The main beneficiary will certainly continue to be NVIDIA

$NVDA (+1,27%) but also Broadcom

$AVGO (-2,42%) and TSMC

$TSM (-0,2%) will certainly benefit, as will many other companies in the sector.

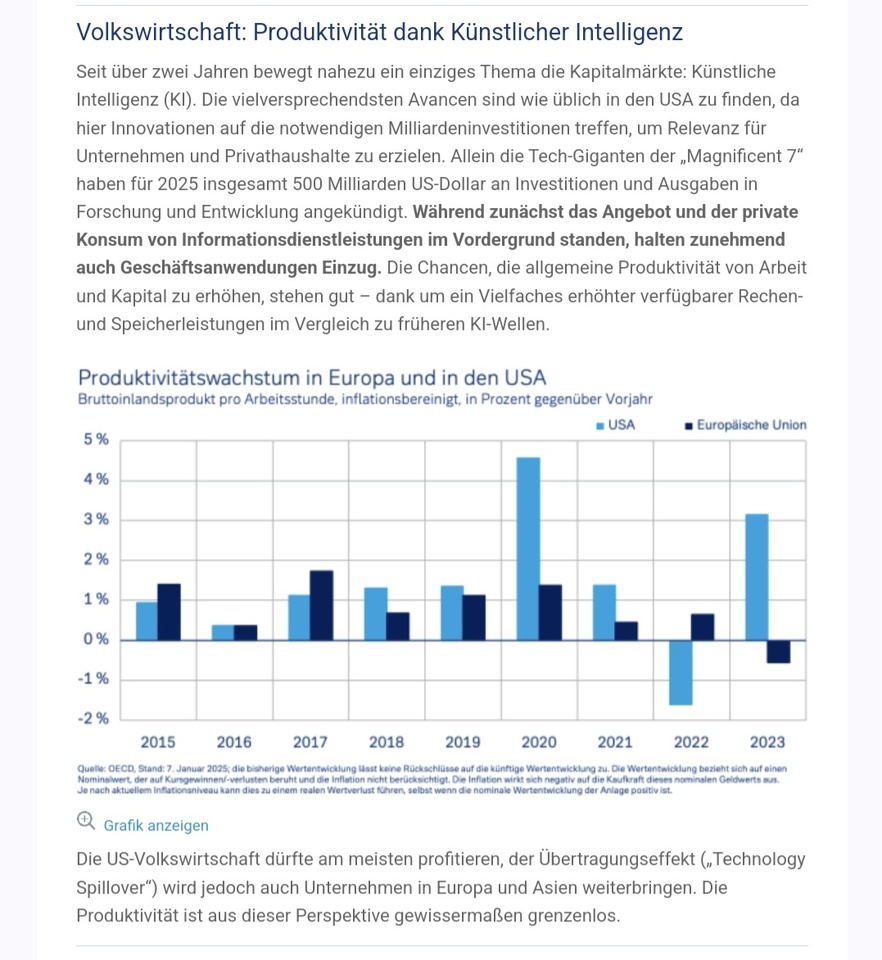

2. productivity increases

Deutsche Bank assumes that the many investments of the last two years will slowly have an impact on the productivity of the economy as a whole.

In recent years, NVIDIA in particular has benefited from the massive investments made by the Magnificent 7. Based on this, they have developed AI applications that can now be used by the economy as a whole and thus increase productivity in the wider economy. can lead to productivity gains in the wider economy.

This in turn leads to rising margins and cash flows, which in turn can drive the markets.

3 Trump and a friendly economic policy

I continue to believe that the US economy will remain strong thanks to a very pro-business America First policy under the incoming Trump administration. Europe and Asia could certainly suffer from this, but I don't see any major risks for the US there

4. high valuation / Isn't all this already priced in?

The high valuation is often cited as a counter-argument. However, it is worth taking a closer look here:

PE Ration:

- NVIDIA $NVDA (+1,27%) : 55

- Microsoft $MSFT (-0,37%) : 35

- Alphabet $GOOG (-0,51%) : 26

- Meta $META (+0,09%) : 29

Forward PE Ratio:

- NVIDIA: 32

- Microsoft: 28

- Alphabet: 21

- Meta: 24

A few other classic stocks for comparison:

- Coca-Cola

$KO (+0,95%) : 25 (Forward: 20) - McDonalds

$MCD (+0,33%) : 25 (Forward: 23) - Procter & Gamble

$PG (+0,68%) : 28 (Forward: 22)

If you look at the forward PE for 2 years from now, many Big Tech companies are valued more favorably than the stocks mentioned above.

But isn't that already priced in? Of course, Big Tech is expected to continue to deliver and if the forecasts do not materialize, there will certainly be a major downside.

However, this would also weigh on the indices as a whole, dragging all other stocks down with them. Furthermore, some of the big tech stocks are not necessarily more expensive on a current basis.

An Alphabet share is cheaper than Procter & Gamble from a pure P/E perspective and about the same price as a Coca-Cola or McDonald's.

I won't go into more detail on stocks like Palantir

$PLTR (+1,49%) which currently have a P/E ratio of over 300 and a forward P/E ratio of 150.

This does not mean that I am assuming that the share price will fall sharply, I have simply not done enough research on the company and have focused more on Big Tech

What does this mean for Europe?

An ASML

$ASML (+0,31%) will certainly also benefit from these developments. And European companies will also purchase AI applications to increase their productivity.

However, on the one hand, the investment money in the USA will end up with the big tech companies, and on the other hand, there will certainly be much stricter regulations, which will restrict or at least delay the growth in productivity.

What do you think? Do you also believe in a further tech & USA outperformance?