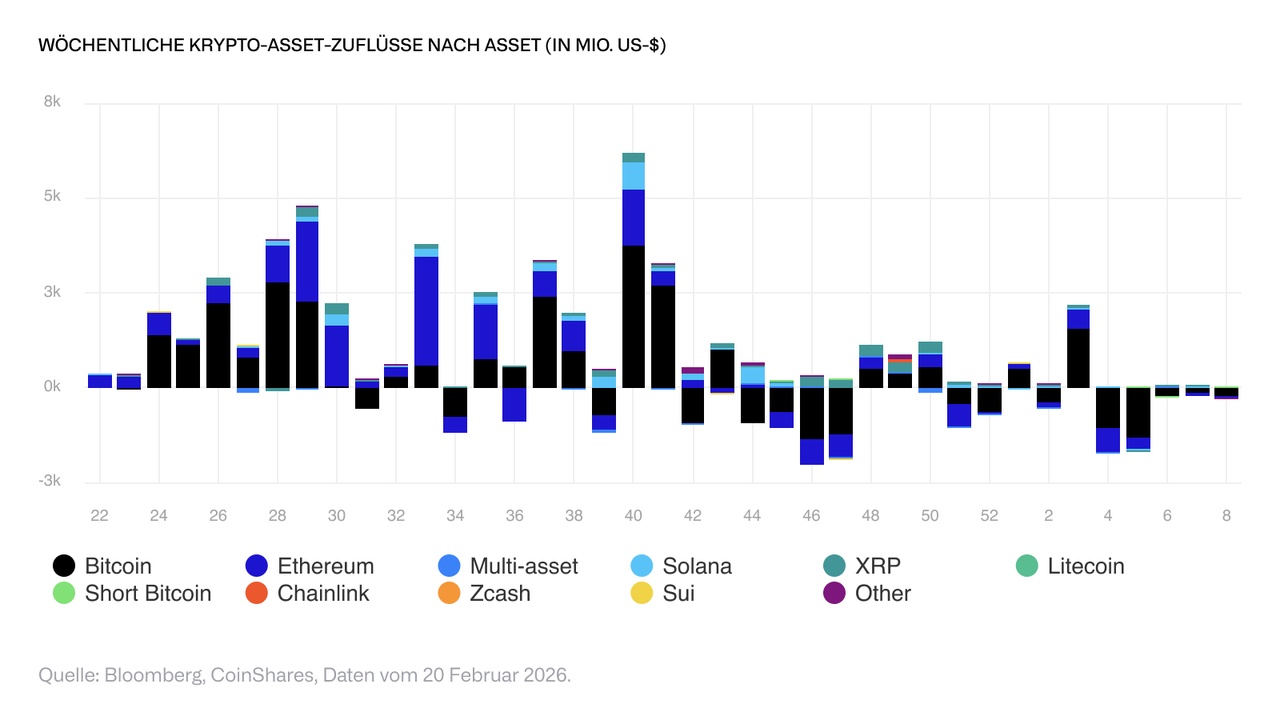

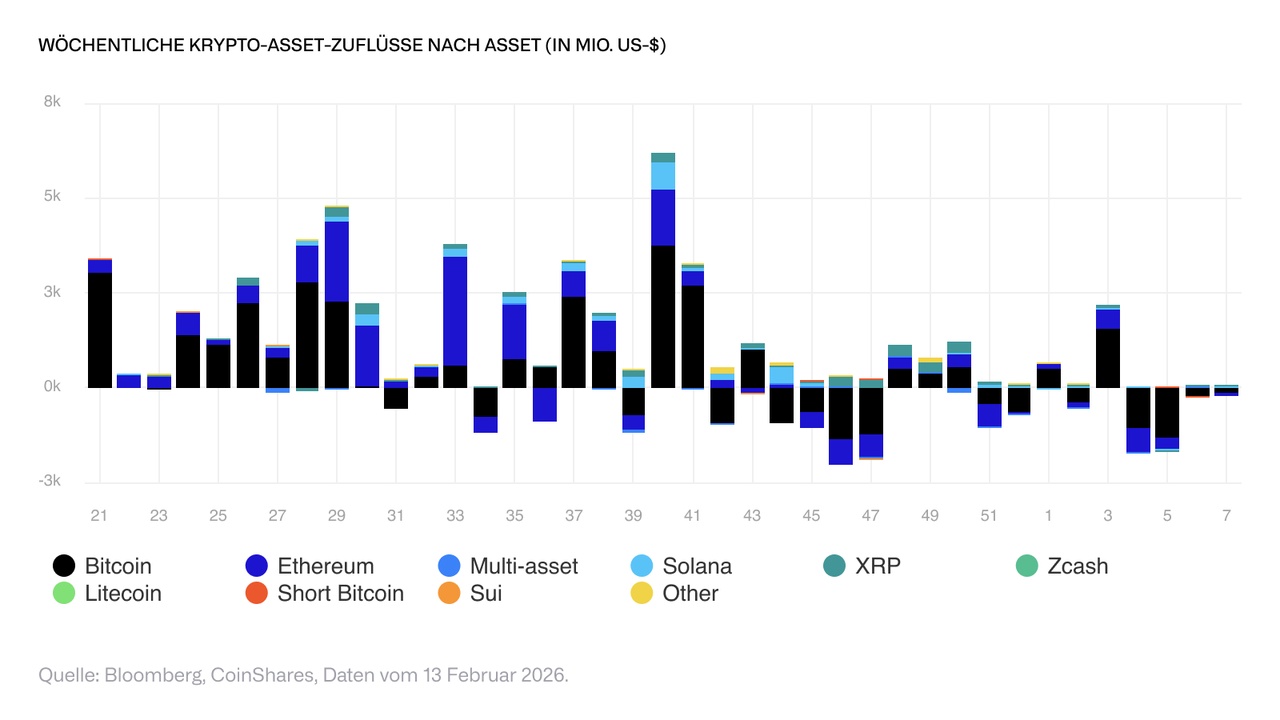

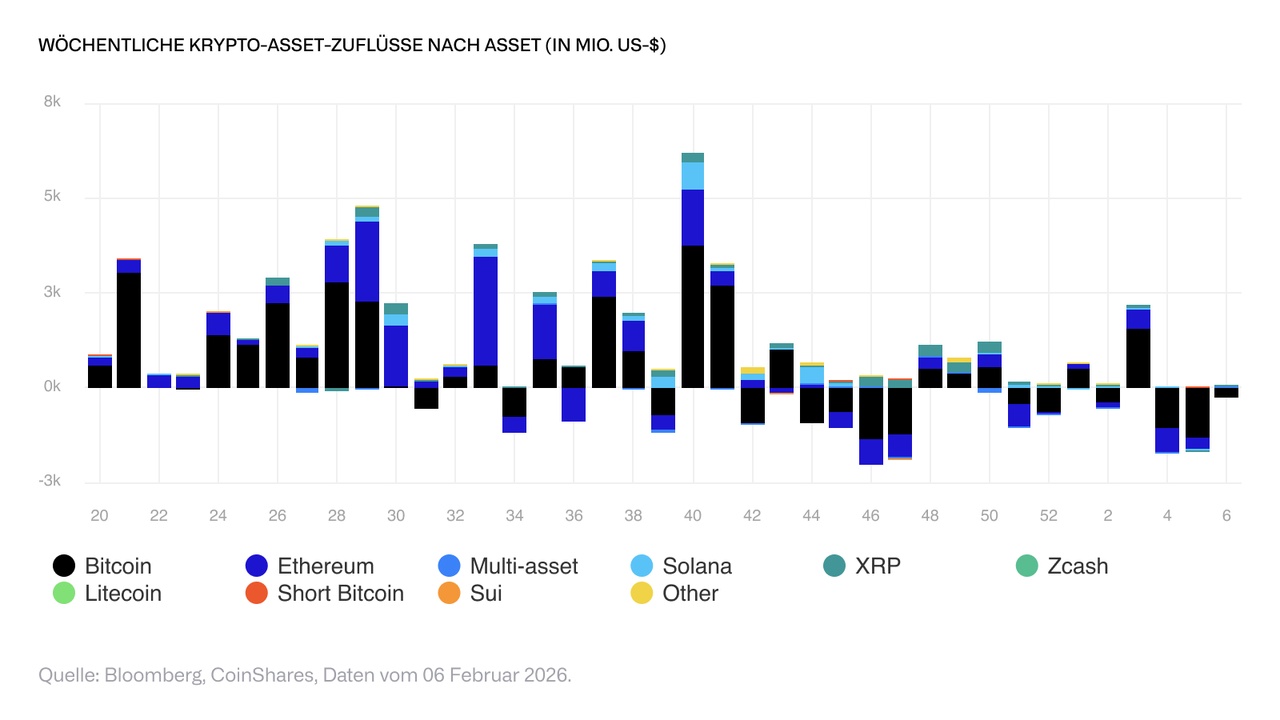

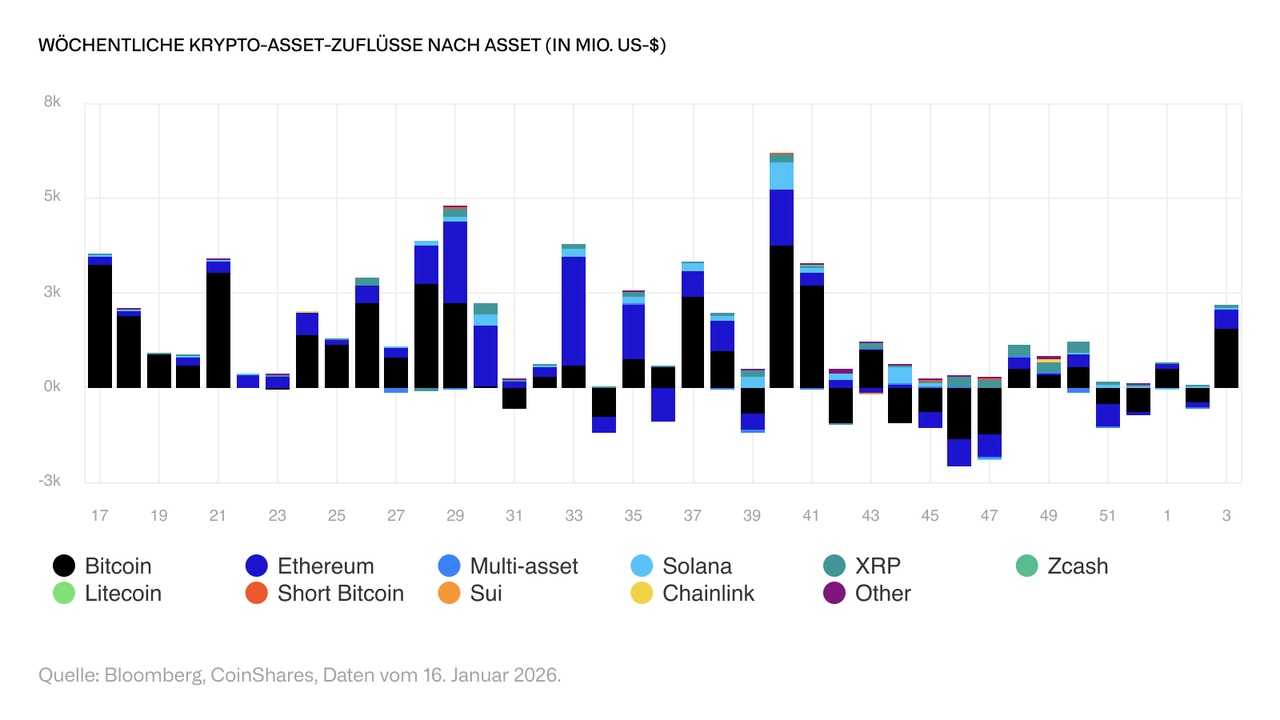

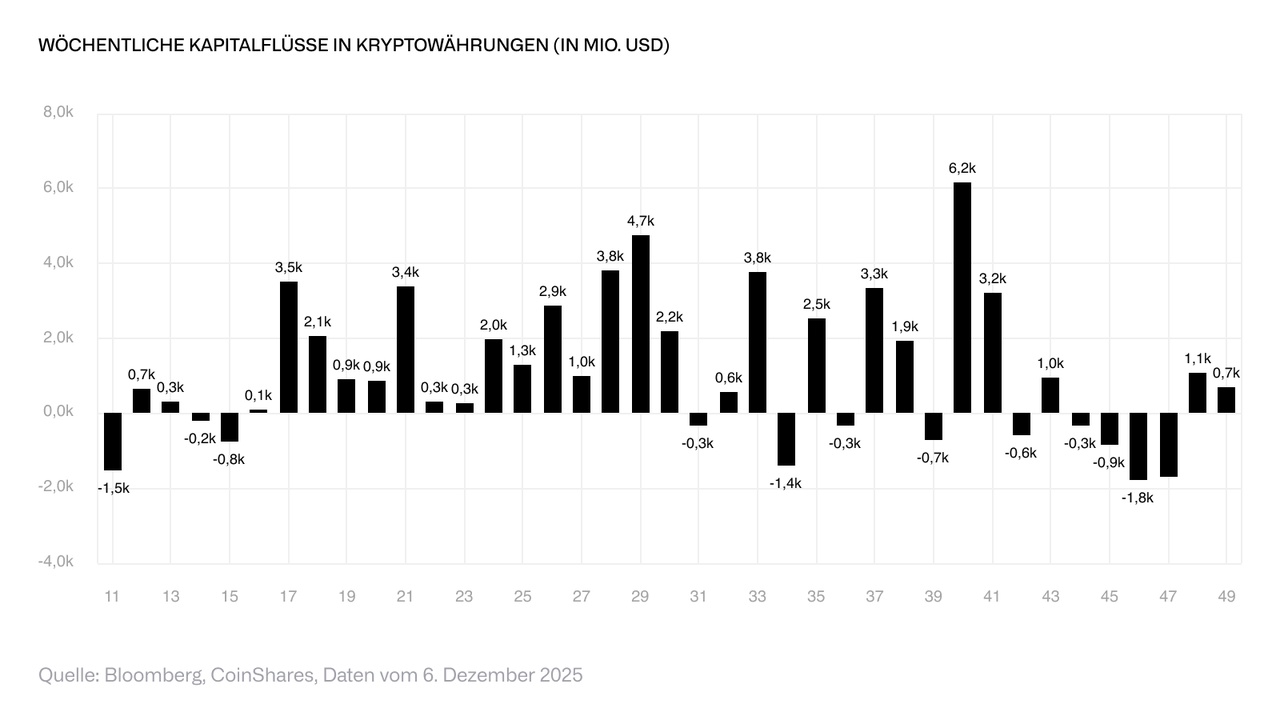

Investment products for digital assets recorded outflows of 288 million US dollars last week. This was the fifth consecutive week of net outflows, bringing the total to USD 4.0 billion - still below the USD 6 billion reached in the same period last year. After several weeks of record activity, trading volumes in ETPs slumped significantly to USD 17 billion, the lowest level since July 2025, indicating waning investor interest.

The regional picture is divergent: In the US, outflows totaled USD 347 million, while other regions saw inflows totaling USD 59 million. This was led by Switzerland with USD 19.5 million, Canada with USD 16.8 million and Germany with USD 16.2 million.

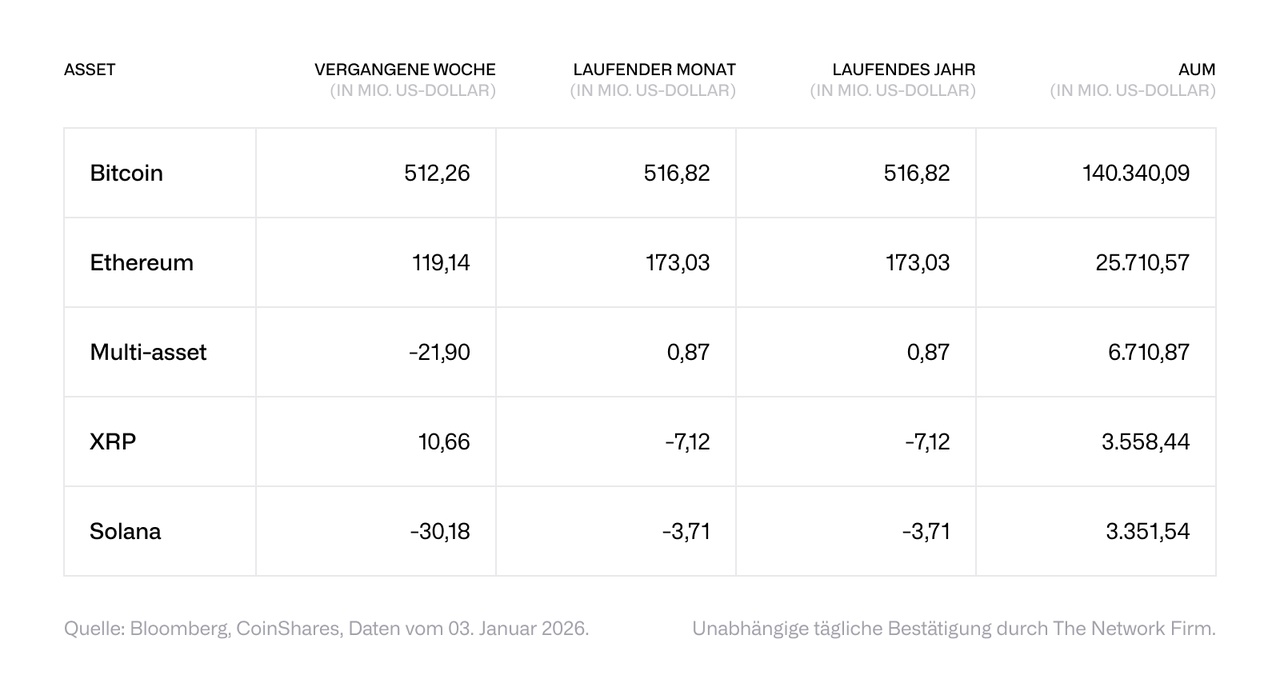

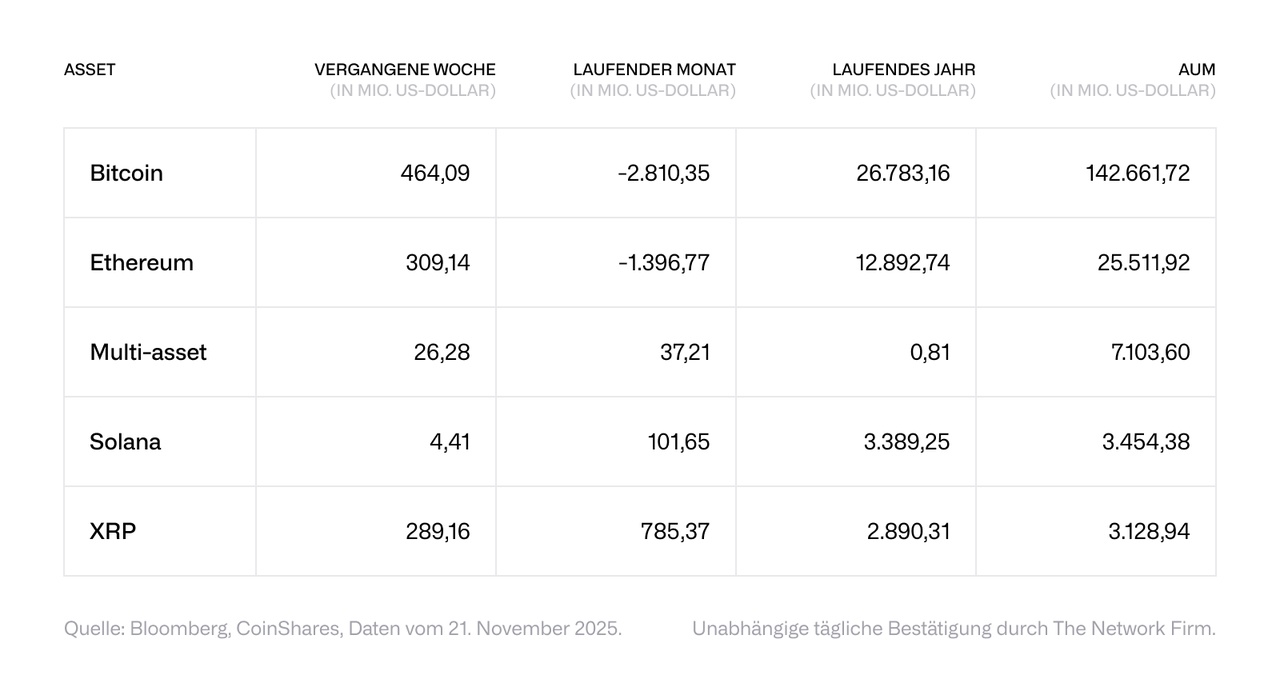

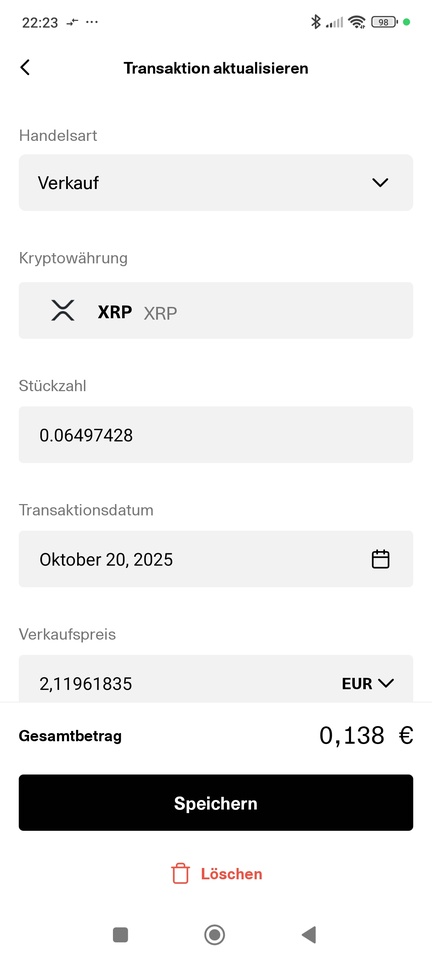

$BTC (-3,39%) The US dollar dominated the negative sentiment with outflows of USD 215 million, while short bitcoin products saw inflows of USD 5.5 million - the highest figure among all asset classes. $ETH (-4,11%) The short bitcoin fund recorded outflows of USD 36.5 million, followed by multi-asset products with USD 32.5 million and $TRX (-0,04%) (Tron) with 18.9 million US dollars. Low inflows were recorded for XRP (USD 3.5 million), $SOL (-4,14%) (3.3 million US dollars) and $LINK (-4%) (Chainlink) (USD 1.2 million), but not enough to offset the net outflows from altcoins.