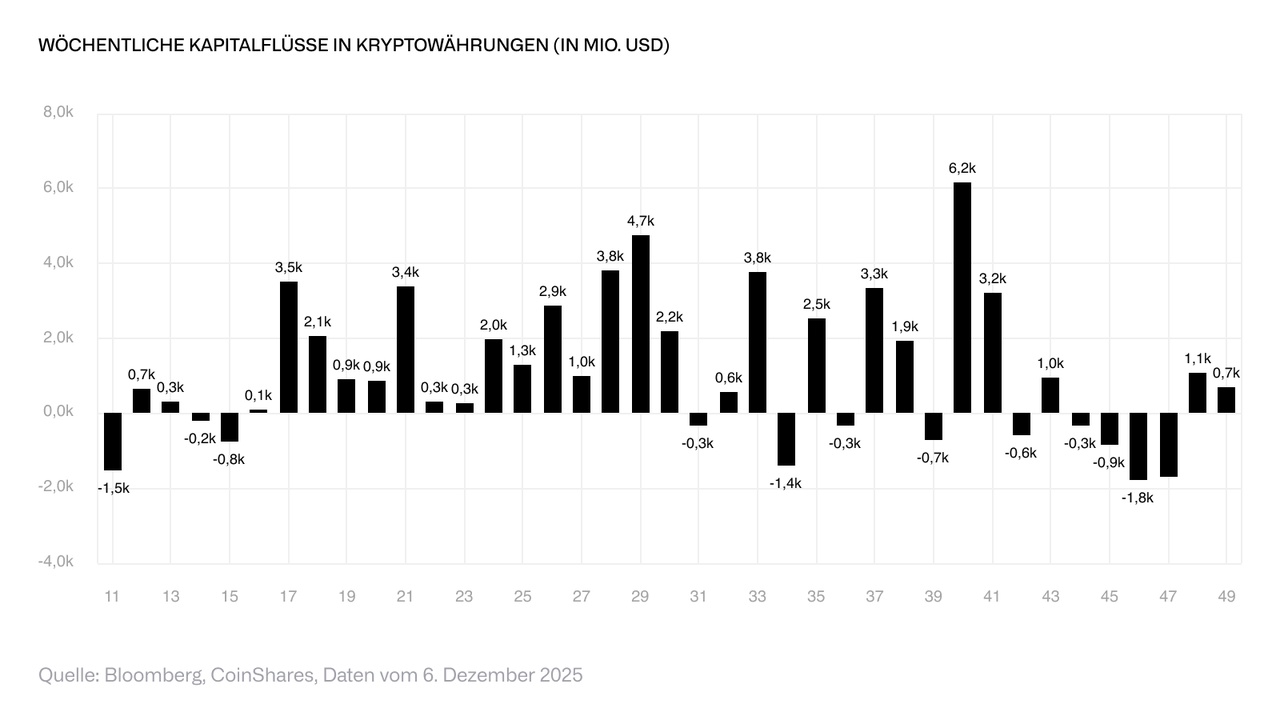

Digital asset investment products saw inflows of USD 716 million for the second week in a row as sentiment continued to improve. Daily data showed small outflows on Thursday and Friday, which we believe were a reaction to macroeconomic data from the United States indicating continued inflationary pressures. Total assets under management have increased by 7.9% to USD 180 billion since the November lows, but remain well below the record USD 264 billion.

#bitcoin was the main beneficiary, recording inflows of USD 352 million, bringing year-to-date inflows to USD 27.1 billion - well below the USD 41.6 billion reached in 2024. Short Bitcoin products saw outflows of USD 18.7 million, the largest since March 2025, when these outflows coincided with a similar price decline, suggesting that exchange-traded product investors believe the current period of negative sentiment may now have bottomed out.

#xrp continued to report strong inflows, totaling USD 245 million last week and bringing year-to-date inflows to USD 3.1 billion, easily surpassing the USD 608 million reported in 2024. Chainlink also received exceptionally high inflows totaling USD 52.8 million last week - the largest ever recorded - representing more than 54% of assets under management.