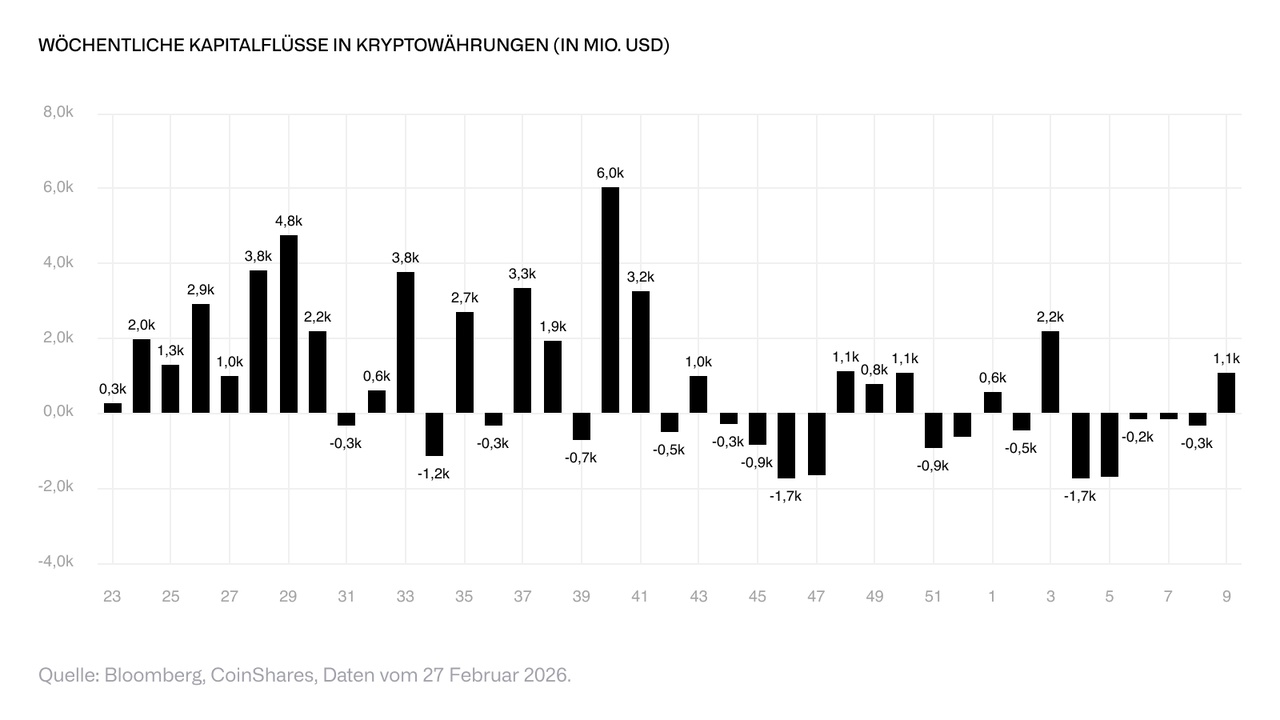

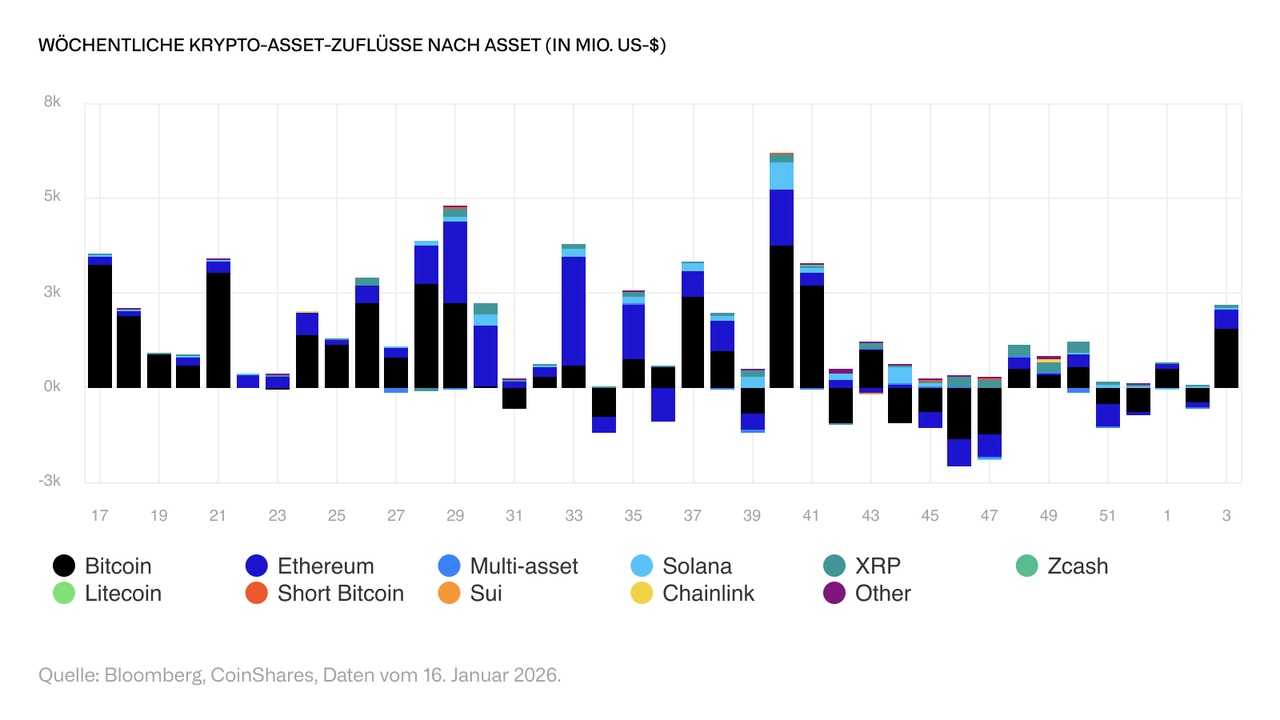

Investment products on digital assets recorded inflows of USD 1 billion last week, ending a five-week period of outflows that totaled USD 4 billion. From a macroeconomic perspective, it is difficult to attribute the change in sentiment to a single trigger. However, the previously weak price performance, the break of important technical support levels and renewed accumulation by large $BTC (-3,39%)-holders are likely to have contributed to the trend reversal. Anecdotally, it can also be observed that recent client discussions are almost exclusively about attractive entry levels and no longer about reducing the allocation to this asset class.

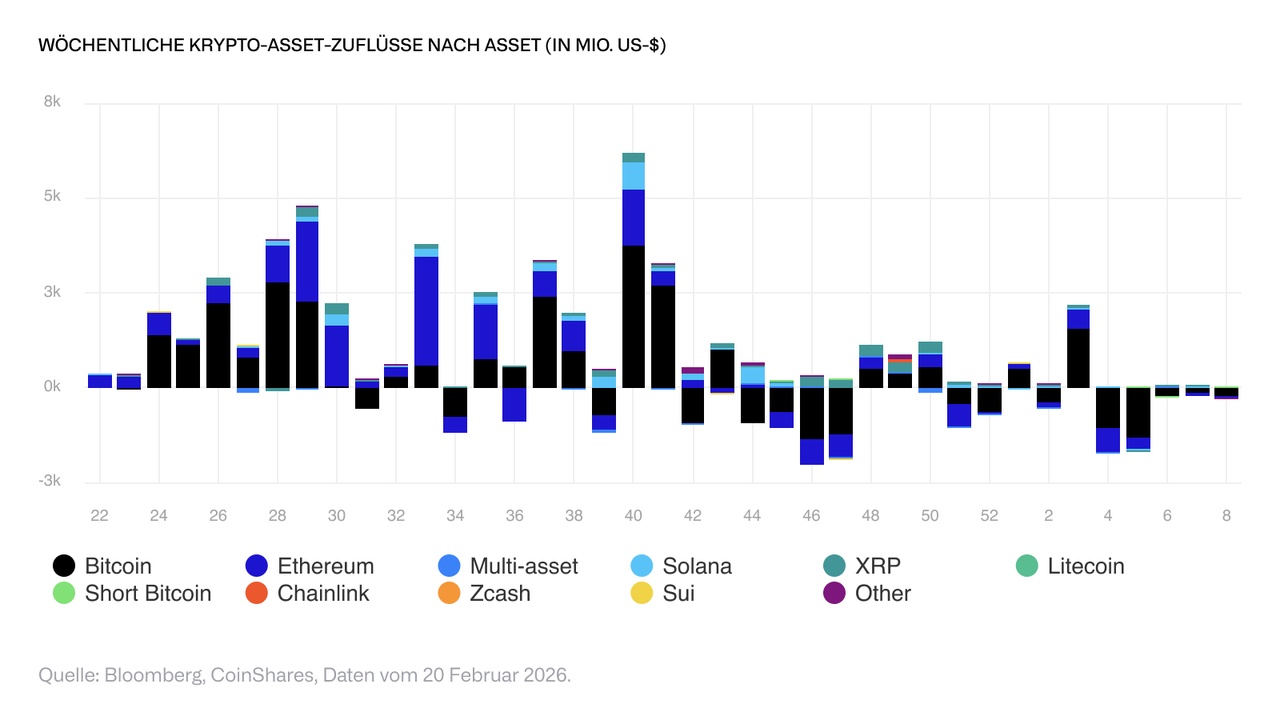

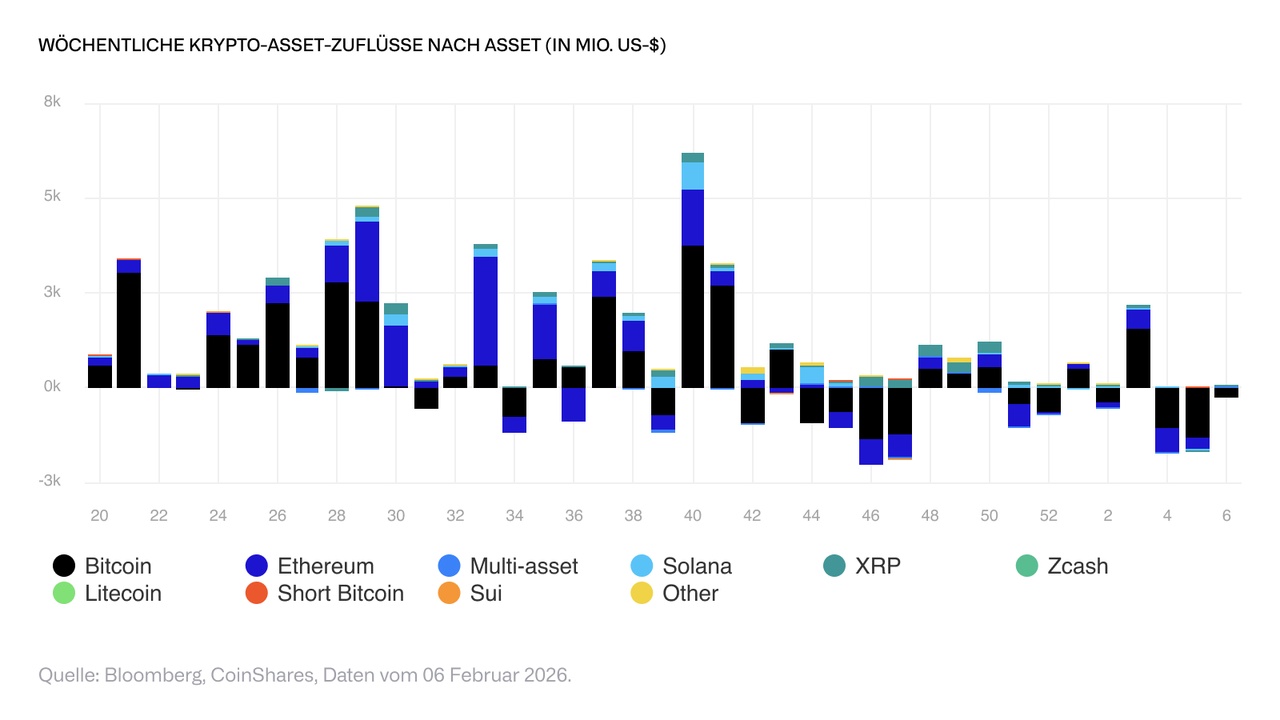

Bitcoin was the main beneficiary, attracting USD 881 million. At the same time, inflows into short Bitcoin products amounting to USD 3.7 million illustrate that opinions continue to diverge. Ethereum also saw inflows totaling USD 117 million - the highest since mid-January. Both $ETH (-4,09%) and #bitcoin are still net negative since the beginning of the year.

$SOL (-4,13%) In contrast, inflows of USD 53.8 million were recorded last week and total USD 156 million since the start of the year. At $LINK (-3,97%) (Chainlink) saw inflows of a moderate USD 3.4 million, while there were no significant outflows.

You can invest in Bitcoin, Ethereum, Solana and Chainlink via the following vehicles: