Last year, there was a distinct lack of snow in December. Instead, the portfolio did really well and I made progress with my crypto sell-off strategy. A small cold in the fall, despite taking good precautions, set me back in terms of ice bathing and hiking, but fortunately I was healthy again by Christmas. Unfortunately, that wasn't all... Time for a look back.

I present the following points for the past month of December 2024:

➡️ SHARES

➡️ ETFS

➡️ DISTRIBUTIONS

➡️ CASHBACK

➡️ AFTER-PURCHASES

➡️ P2P CREDITS

➡️ CRYPTO

➡️ WHAT IS REALLY IMPORTANT

➡️ OUTLOOK

➡️ Shares

$AVGO (-1,74%) is back on the tube. Wow, at +276%, the stock is now up for me. After the share cooled down a little, it went to the moon again in December.

$NFLX (-0,83%) and $SAP (+0,17%) are on a par with the previous month in terms of performance and are still in 3rd and 4th place in terms of volume. $WMT (-0,76%) . The retail chain will soon become a doubler for me.

The red lanterns will once again go to the usual suspects $NKE (-0,97%) , $DHR (-1,35%) and $CPB (+0,07%) . In terms of performance, all three stocks are down between -30% and -20%. They are the smallest positions in my main share portfolio with the $DHL (-0,77%) However, across all portfolios, the smallest positions are the new additions $SHEL (-0,89%) and $HSBA (-1,27%) .

➡️ ETFs

The ETFs are doing their thing as usual. This month, I immediately invested a refund from the previous year's utility bill in the $GGRP (-0,66%) and $JEGP (-0,49%) invested. I'm always expanding this asset class in particular with cash inflows. I don't care about timing. The money should go into the assets so that the stream of distributions keeps growing. I buy income and want cash flow.

➡️ Distributions

I received 34 distributions on 14 payout days in December. I am grateful for this additional income stream. My minimum target has been met anyway in this high-distribution month. The snowball rolling down the slope is getting bigger and bigger.

I already donated part of the dividend at the beginning of the month. This is based on the conviction that you can (and should) give something back, no matter how small, if you have the opportunity to do so.

➡️ Cashback

In November, I received €6 from redeemed Payback points, the equivalent of which I transferred from my grocery account to my settlement account. As already mentioned, there was also a credit from the utility bill. REWE and Penny have now separated from Payback, while Edeka, Netto Markendiscount and Marktkauf have joined. All three new stores are not in my immediate vicinity, which is why I will earn fewer Payback points in future. I will most likely collect the points mainly at DM. REWE and Penny now have their own bonus programs. REWE's will be exciting, as I can also save up credit with my purchases. I will deduct this discount from my grocery account and invest it in the same way as before. I'll see over the year whether it pays off more than Payback did back then.

➡️ Subsequent purchases

As already mentioned, there were additional purchases at $JEGP (-0,49%) , $GGRP (-0,66%) and $SPYD (-0,58%) . I always invest every little return or leftover money to further increase my portfolio. This buys me freedom.

➡️ P2P loans

I was finally able to get rid of Peerberry. Now only Mintos is hanging on my leg like a log. A mid-double-digit amount, which has long since defaulted, is still waiting to be refunded or written off.

This asset class will soon be history for me.

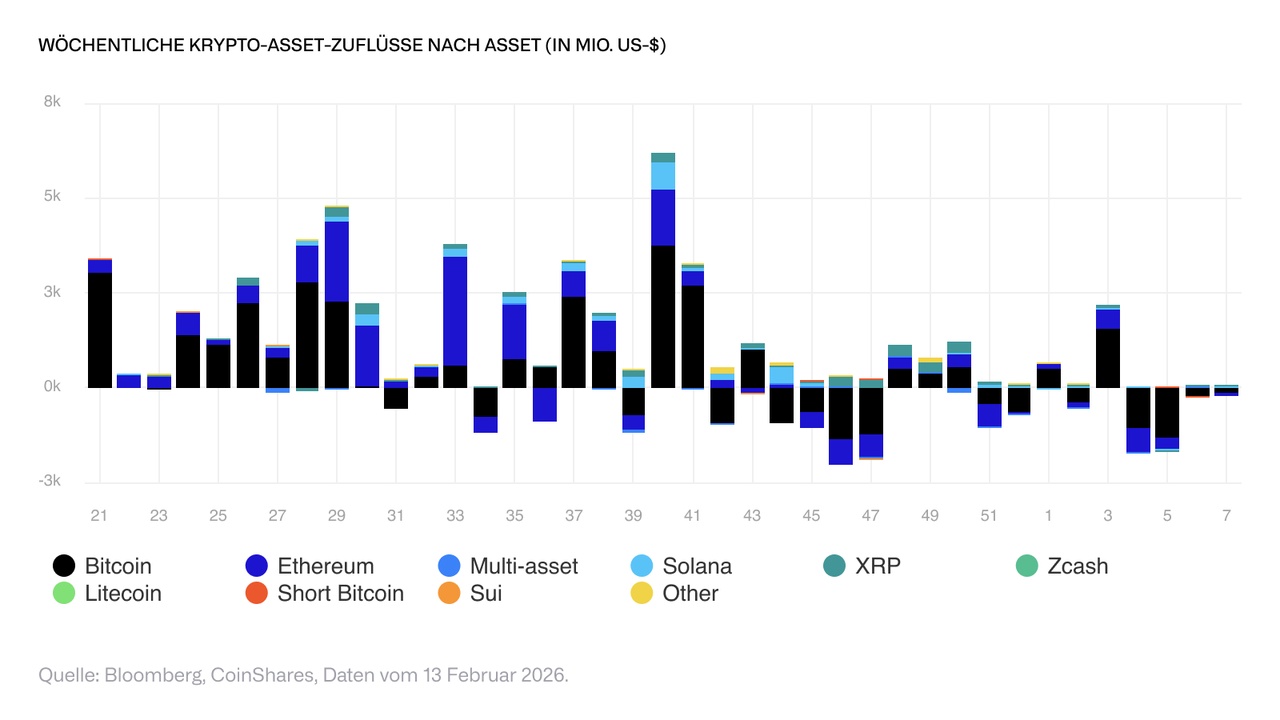

➡️ Crypto

All in all, December was another exciting month for crypto investors. Limit orders were triggered again for me. The last tranches $LINK (-4,26%) have left me, as has a first tranche $UNI (-3,74%) and a first tranche $BTC (-3,06%) . I have invested the proceeds in $HSBA (-1,27%) and $SHEL (-0,89%) invested in the separate portfolio. I have already explained my underlying strategy in detail, which you can read about in my articles. Recently, the crypto market has been in a sideways phase again. I'm hoping for another breakout in January to trigger further limit orders, as I still need to buy a security so that the separate portfolio pays me a return each month. So far, only two out of three quarterly months are covered. The two new stocks have even performed well in this short period of time, gaining around +3.6% within a month. The last purchase will perhaps be an ETF. You will see more about this in the coming reviews. I am already looking forward to collecting again in the coming bear market and will then certainly write an extra post with the levels at which I will gradually enter again.

➡️ What is really important

I remember December as a good month in financial terms, but unfortunately Christmas was overshadowed by tragic events this time.

After recovering from my cold at the beginning of the month a few days before Christmas Eve and getting back to my daily routine (consisting of work, running, ice swimming, hiking and my love of finance), I received the terrible news from Magdeburg. I am simply stunned and ask myself "why?". I am not affected, I am not one of the bereaved and I don't know any of the victims, the wounded or the bereaved personally, yet this event brought me down on the evenings around the Christmas holidays. Loyal readers know that I am working on a closer relationship with my ex's kids. Even though my blood doesn't run through their veins, questions ran through my mind about what if they were affected by the horrific act, or me? It could have happened anywhere. At least in the event of my untimely demise, I also made appropriate arrangements in the last few days of the year to ensure that what I leave behind ends up where I want it to be. I spent the turn of the year with the kids and the time I spent with them was the best end to the year imaginable. It's nice when connections continue to exist and you remain part of the life of the Kampfzwerge and can continue to accompany them through life.

➡️ Outlook

New year, new luck. I'll be surprised what the new year will bring. There will be a separate post for the evaluation of 2024 as a whole. I'm particularly happy because I exceeded an important goal despite a few expenses.

Links:

Social media links can be found in my profile, you can also check out the Instagram version of my review.