Jens Vollmar has not been in office as CEO of $IMPN (-1,39%) but still has ambitious goals for the construction group.

16.01.2026 16:00

300 days: that's how long Jens Vollmar will soon have been CEO of Implenia. "He has consistently pursued the strategy of his predecessor André Wyss since taking office at the beginning of April 2025 and accelerated it in parts," says Anja Felder, Senior Financial Analyst at St.Galler Kantonalbank (SGKB), summarizing his time in office so far.

Implenia impressed the market with its figures for the first half of 2025, in which it increased its operating profit and the corresponding margin. "The market was pleased with this development, which should have further strengthened investors' confidence in Jens Vollmar as the new CEO."

After 289 days, the CEO has now made a bold statement that should give investors further hope. "We can become twice as big!" said Vollmar at Immo26, the Swiss real estate fair for investors, on Wednesday. He gave this answer to the question "What do you want to achieve with Implenia?" in a "question fire" at the end of a 25-minute talk, i.e. short questions, quick answers.

Of course, such a statement should be treated with caution if no time horizon and no specific key figures are mentioned. However, he was probably referring to key figures that measure company growth - i.e. turnover, profit, market share or company size. The 41-year-old has been with Implenia for more than 10 years and, according to Swiss law, still has 24 years of employment ahead of him - plenty of time to achieve his ambitious goal.

The CEO's statement is not entirely far-fetched. After all, the share price has doubled since he took office from CHF 40.80 to CHF 82 in January - so the doubling target has already been achieved. In addition, the prospects for business activities are also good. In Switzerland in particular, falling interest rates are increasing the willingness to invest in the real estate market, and in Germany the 500 billion euro economic stimulus package is likely to have a positive effect.

"The decisive factor will now be the extent to which the German infrastructure program is actually reflected in future figures. We assume that noticeable effects will not be visible until 2027 at the earliest," emphasizes the SGKB expert. It is also crucial that the planned investments are actually implemented and that Implenia can successfully assert itself against the competition. The clear focus on profitable growth is the right strategic path.

On Thursday, the Group announced new orders in Germany and Norway worth 350 million euros. When the half-year figures were published, the order backlog had already grown by 9.8 percent to CHF 7.8 billion. Anja Felder of SGKB is optimistic: "In our view, Implenia will be able to further increase its operating profit in the future and achieve its medium-term target of a margin of over 4.5 percent." Expectations of Implenia and its CEO Jens Vollmar are correspondingly high.

Strong project pipeline

Prior to the Q&A, Vollmar was asked in more detail about his first few months as CEO. One of his highlights was the construction group's many exciting and varied projects, especially infrastructure projects. "Under Jens Vollmar, Implenia has succeeded in winning major projects, which should have a positive impact on order intake and the visibility of future sales," emphasizes Felder.

In particular, the German-born company boss is probably referring to the rail project between Zurich and Winterthur. The federal government is planning a double-track line through the Brüttener Tunnel as well as the expansion of the Dietlikon, Bassersdorf, Wallisellen and Winterthur Töss railroad stations.

At Immo26, the new CEO also spoke of the merger of the divisions from four to three as a highlight. According to him, this was probably relatively "simple". The fact that the majority of the companies were individual contributed to a smooth transition, as Vollmar emphasizes.

The Real Estate division and the Buildings division were combined to form the Buildings unit. In addition, there is the Civil Engineering division and the new Service Solutions division, which includes the real estate service provider Wincasa, for example.

With regard to the low margins in the construction business, Jens Vollmar replied: "The industry suffers structurally from the fact that construction companies can often only differentiate themselves through price. We deliberately don't want to go down this route." Instead, Implenia is focusing on greater differentiation through selected projects in specialized areas.

Aisha Gutknecht has been working as an editor for cash.ch since July 2024.

$IMPN (-1,39%)

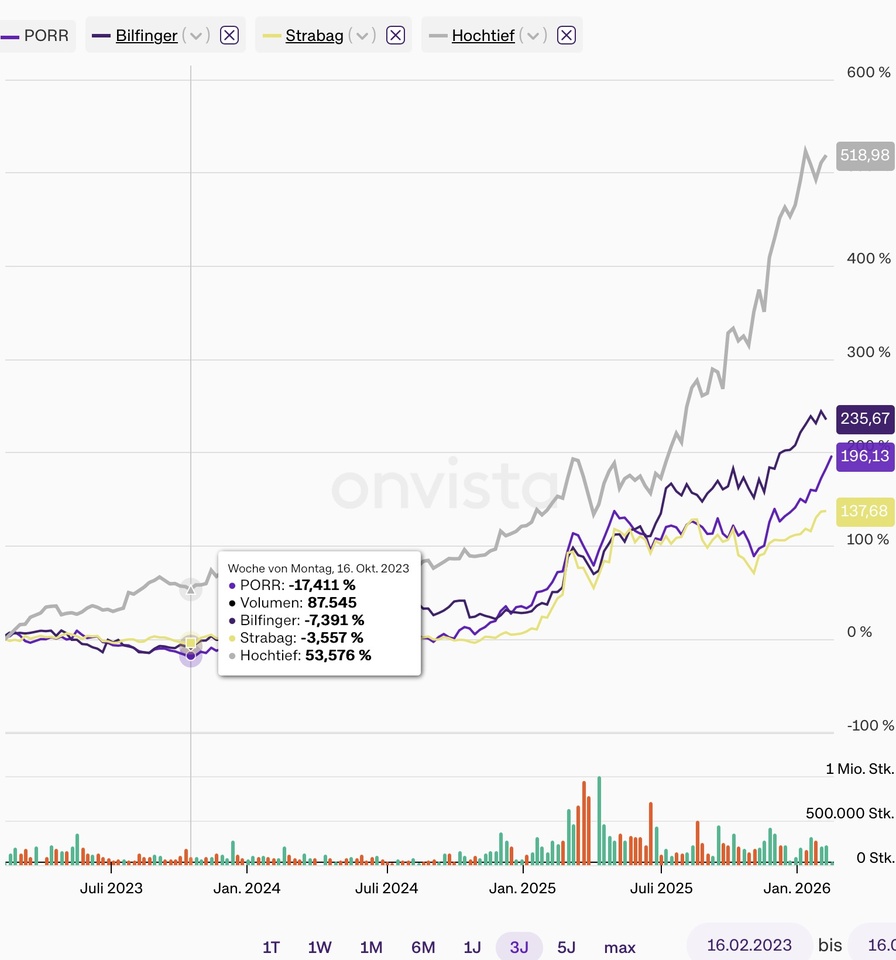

$STR (-1,17%)

$HOT (-2,45%)

$GBF (-1,86%)