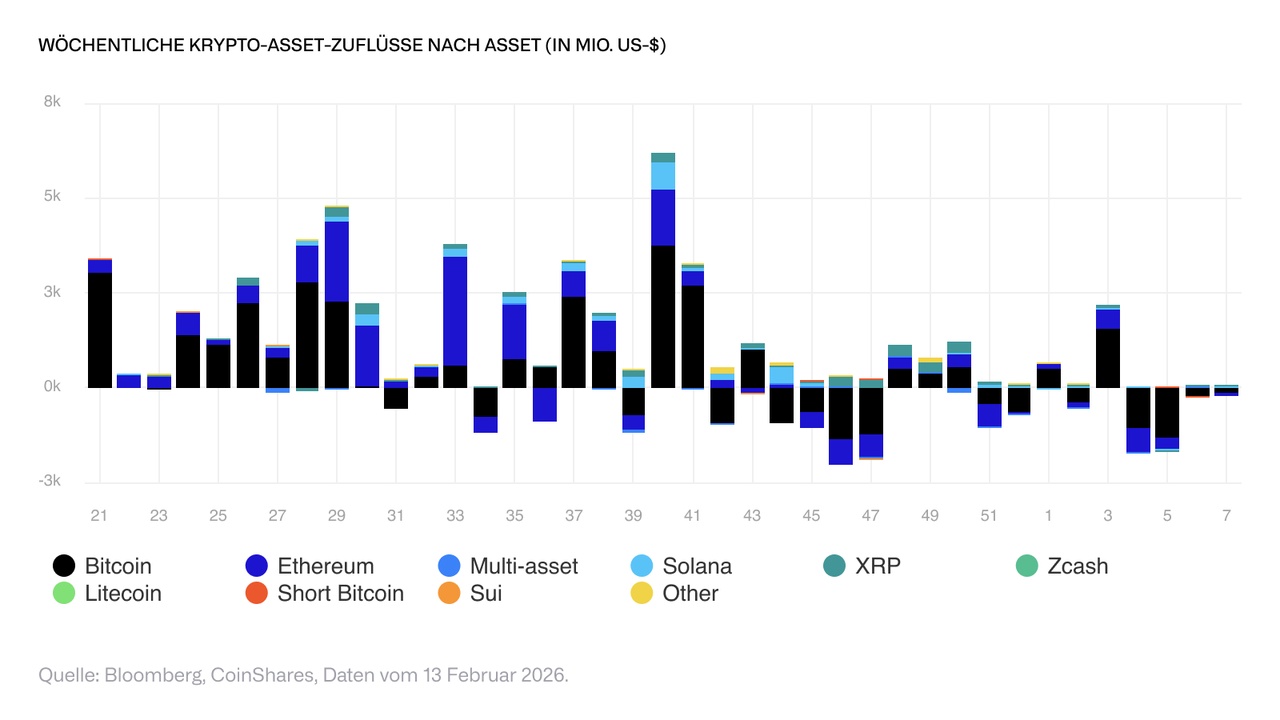

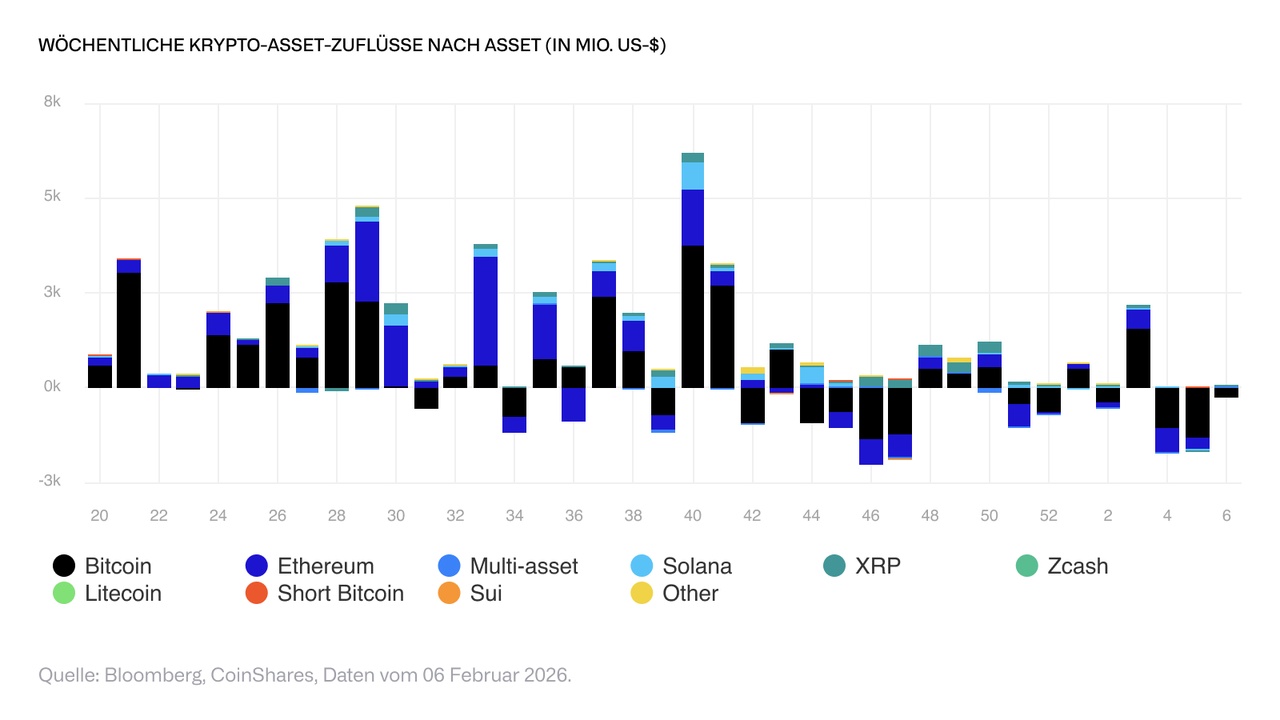

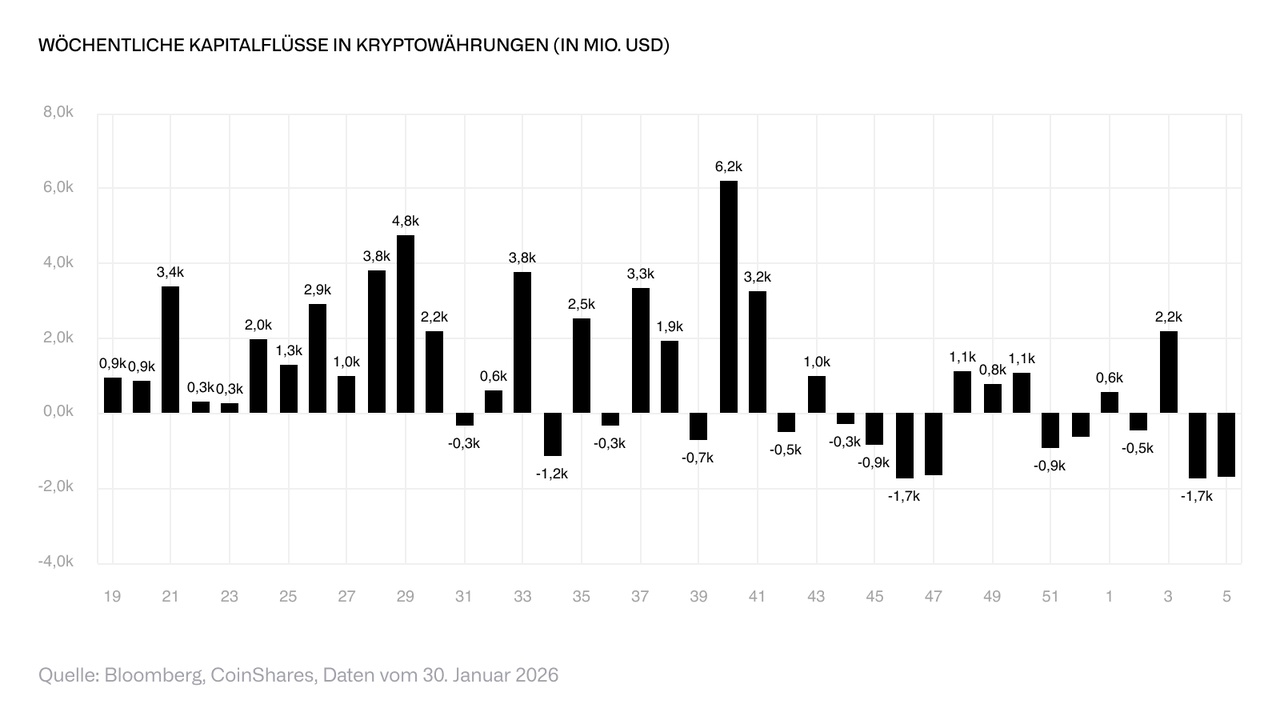

$BTC (-0,07 %) recorded the weakest investor sentiment last week. A total of USD 133 million flowed out of corresponding investment products. At the same time, there were also outflows from short Bitcoin products, totaling USD 15.4 million over the past two weeks - a pattern that has historically often been observed near local lows.

Also $ETH (-0,05 %) was also affected by outflows, with withdrawals totaling USD 85.1 million. $HYPE (+0,67 %) The US dollar market also saw outflows, albeit at a much lower level of USD 1 million.

In contrast, sentiment towards $XRP (-0,61 %), $SOL (-0,58 %) and $LINK (-0,52 %) remained constructive. These assets recorded inflows of USD 33.4 million, USD 31 million and USD 1.1 million respectively in the past week.

$XRRL (+0,75 %)

$SLNC (+2,78 %)

$CTEN (+1,72 %)

$GB00BMY36D37 (+1,53 %)