Kevin Warsh: Favorite for US Treasury Secretary and his potential impact on the crypto market

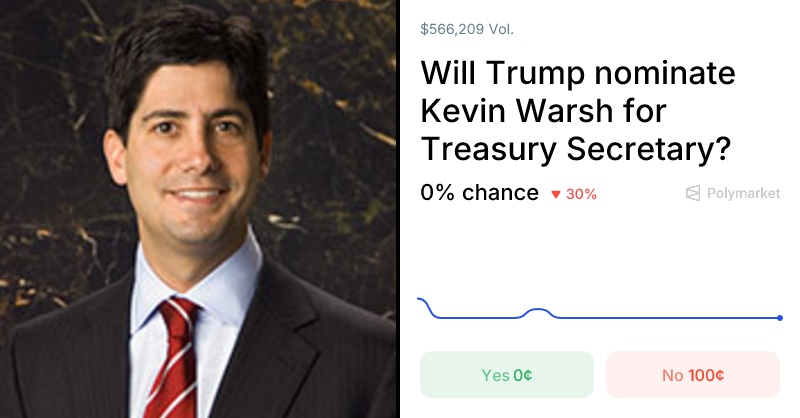

Kevin Warsh, former governor of the Federal Reserve and currently Senior Fellow at the Hoover Institution, is considered the 51% favorite to become US Treasury Secretary under the new Trump administration, according to Polymarket. His pragmatic stance on cryptocurrencies - from recognizing the potential of Bitcoin to supporting a digital US dollar - makes him a key figure who could have a decisive impact on the crypto market.

Who is Kevin Warsh?

Kevin Warsh was a member of the Federal Reserve Board from 2006 to 2011 and played a central role in stabilizing the markets during the 2008 financial crisis. He is known for his deep expertise in monetary policy and his ability to integrate technological innovations such as digital currencies into economic policy considerations. His views combine traditional market approaches with an openness to modern financial technologies.

What power does the US Secretary of the Treasury have?

The US Secretary of the Treasury is one of the most important economic policy makers in the government. The person in this office steers US fiscal policy, oversees the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN), and influences international financial relations. Particularly relevant for cryptocurrencies is the role of the Secretary of the Treasury in working with regulatory authorities such as the SEC, CFTC and the Federal Reserve. The Secretary of the Treasury can therefore directly influence the regulation and integration of cryptocurrencies and blockchain technology in the financial system.

How crypto-friendly is Kevin Warsh?

So far, Warsh has mainly commented on Bitcoin, describing it as the "new gold". His proposal to develop a digital US dollar (CBDC) shows that he takes the potential of blockchain technology seriously. However, his criticism of speculative tokens suggests that he does not have an unreservedly pro-crypto stance. His approach is probably balanced: Support for established cryptocurrencies and technologies, but with clear regulation to protect consumers and the financial system.

Warsh's statements and positions on cryptocurrencies:

1. support for a US digital dollar (CBDC)

As early as 2018, Warsh proposed the introduction of a "FedCoin", a central bank digital currency (CBDC) to secure the international leadership role of the US dollar. He stated: "The Federal Reserve should consider a 'FedCoin'." Warsh argued that a digital dollar could help compete with other countries such as China, which are already working on state-controlled digital currencies. The "FedCoin" could serve as a complement to traditional payment methods.

2 Bitcoin as digital gold

In an interview in 2021, Warsh described $BTC (+6,98 %) as a kind of "new $GOLD ". He explained: "If you're under 40, Bitcoin is your new gold." Warsh pointed out that Bitcoin is a way for younger generations to hedge against fiat currency risks. He emphasized that Bitcoin could become more important in an environment of expansionary monetary policy by the Federal Reserve.

3. skepticism towards speculative tokens

While Warsh recognizes the potential of established cryptocurrencies such as Bitcoin, he remains critical of speculative tokens with no clear benefit. He warned: "Such projects not only endanger investors, but also undermine confidence in the entire industry."

4 Blockchain as a transformative technology

Warsh sees blockchain technology as having the potential to make the financial infrastructure more efficient and transparent. He explained: "Bitcoin and the underlying technology could fundamentally change the financial world."

Conclusion

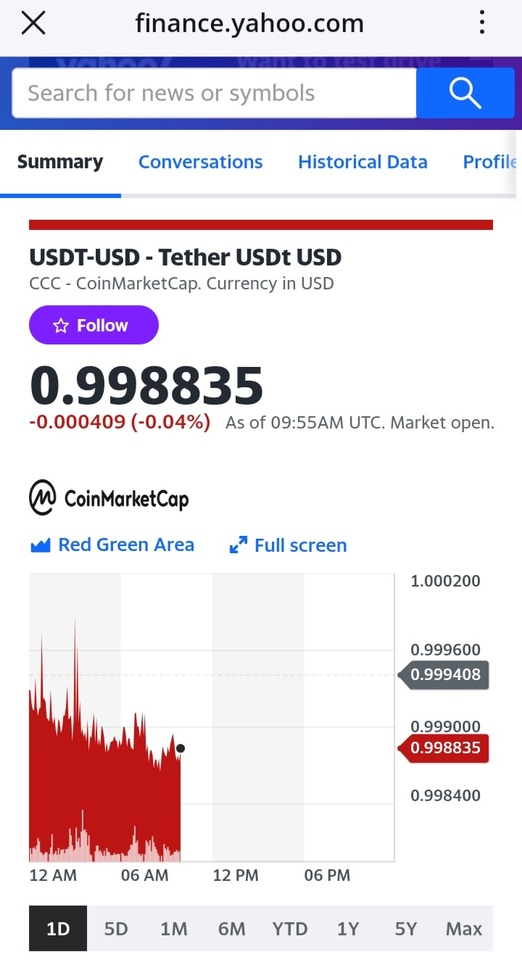

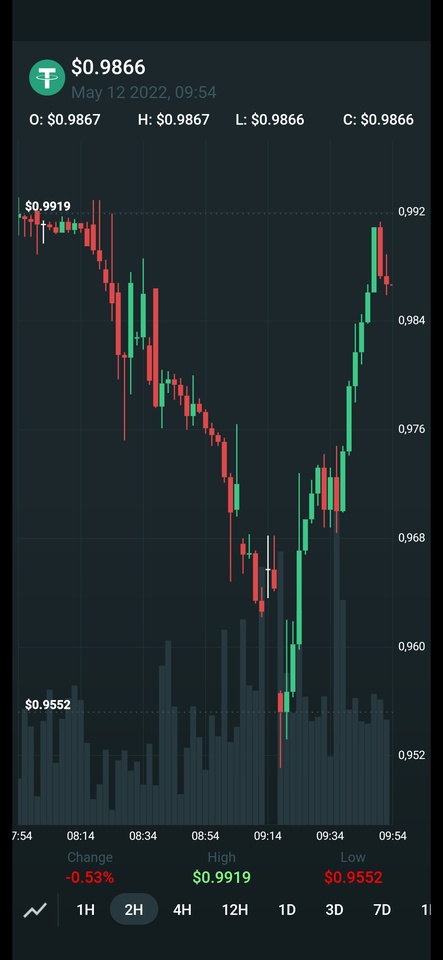

Kevin Warsh combines a pragmatic and forward-looking approach to cryptocurrencies. His appointment could lead to a balanced approach that encourages innovation in blockchain while introducing regulations to protect investors and the stability of the financial system. His potential support for a US digital dollar would reshape the global financial order and could support private stablecoins such as $USDT (+0,41 %) or $USDC (+0,43 %) under pressure. However, it remains to be seen whether Warsh will actually be nominated as Treasury Secretary, as the final decision has yet to be made.

Sources:

Polymarket Betting Market: https://polymarket.com/event/who-will-trump-nominate-for-treasury-secretary/will-trump-nominate-kevin-warsh-for-treasury-secretary?tid=1732035823612

Claims:

Cointelegraph: https://de.cointelegraph.com/news/former-us-federal-reserve-governor-says-federal-digital-currency-deserves-consideration

BeInCrypto: https://de.beincrypto.com/kevin-warsh-wenn-du-unter-40-bist-ist-bitcoin-dein-neues-gold/

Decrypt: https://decrypt.co/53378/federal-reserve-governor-bitcoin

Crypto News Flash: https://www.crypto-news-flash.com/de/bitcoin-ehemaliger-fed-gouverneur-erwartet-fortsetzung-des-bull-runs/