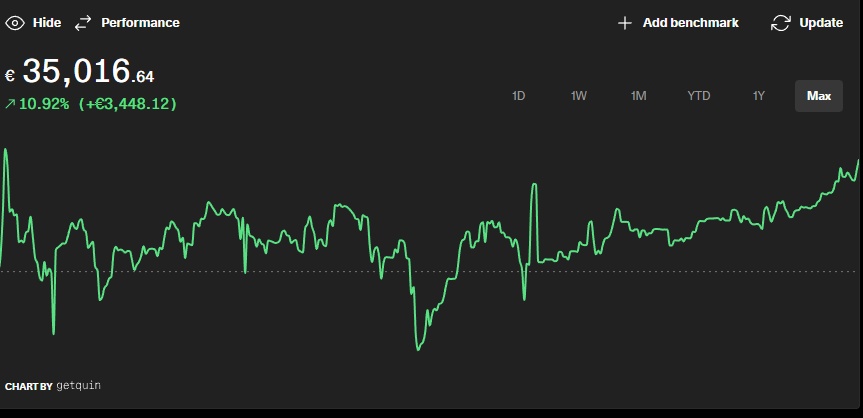

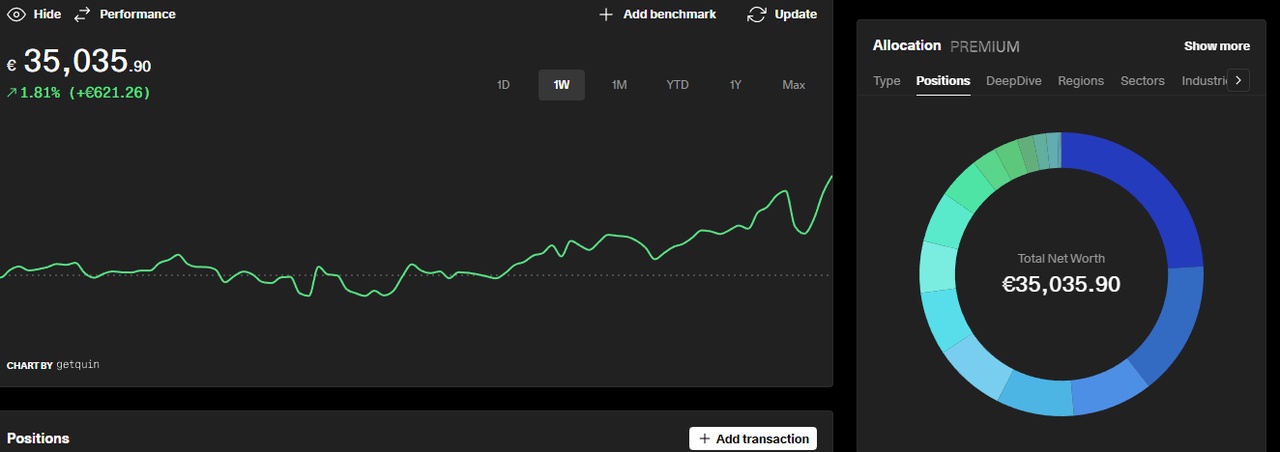

On the 4th of februari 2026 at 13:10, I reached the 20k mark. Almost exactly one year after I reached the 10k. Something I didn't expected to reach that fast.

After my graduation on november the 4th 2025, I am working my student job for the time being. Since januari i'm fully job hunting and hoping to increase my income for further investments.

I'm happy with my current investments. My core: $NL0013689110 and $NL0015000PW1 (indexfund) at 50% is widely spread and a solid core.

My other investements are solid dividend stocks. Some bigger, some smaller but all helping reaching my goal. $JNJ (+1,08 %)

$NN (+0,35 %)

$ASRNL (+1,46 %)

$PEP (+0,65 %)

$AD (+0,59 %)

$KO (-0,56 %)

$CMCSA (-0,63 %)

$ARCAD (-9,97 %)

$AGN (-5,6 %)

$HEIJM (+0,97 %)

$BAMNB (-1,63 %)

$SO (+4,98 %)

Only $LIGHT (+1,23 %) and $AXS (-1,95 %) are on my sell list.

Have a great day!